Catalyst of Investment Trends in Digital Platforms

Rely on a practical and safe process, with a minimum of affordable investment costs

Based on the results of a national survey on financial literacy conducted OJK in 2019, the index of financial literacy and financial inclusion is increasing compared to a similar survey three years ago.

OJK acknowledged that the increase was supported by many factors, including the presence of a digital platform that makes it easier for the public to access financial services.

One of the highlights is the increase awareness investment services, something less grounded when compared to payment and financing services. In this concept, people must set aside some of their income for financial purposes in the future.

Digital gold as a catalyst

Digital investment platforms themselves have actually been around since the beginning of the decade. Stockbit's community services and stock buying and selling, for example, have been around since 2013. However, the concept of stock investment is still quite foreign compared to traditional investment concepts that are better known to the public, such as property and gold bullion.

Entering 2017, several startups are presenting digital gold investment applications. Consumers do not have to physically own gold and allow investments with very small nominal amounts, from 0,0001 gram. Jewelry buying and selling site Orori introduced an e-mas application in September 2017. Six months later, Tokopedia integrate gold investment services on its platform.

Being present in popular marketplaces immediately increases the traction of digital gold sales. Several other services have flocked to adopt a similar model to date. For example, Bukalapak and Koinworks collaborate with Indogold, Gojek and Dana collaborates with Pluang, Grab collaborating with Tamasia, and Tokopedia which has now chosen to partner with Pegadaian. Apart from these services there are also applications such as Treasury, Tanamduit, Sehatigold, and Lakuemas.

The Jakarta Futures Exchange (JFX) then made it official special committee of digital gold players.

For founder sees promising market potential, including in the current pandemic conditions. Dana CEO Vincent Iswara said, "We see that people are starting to reduce unnecessary expenses and choose to invest long term by buying gold. Through the DANA eMAS feature, users can start investing in gold directly online practically [..] The presence of this feature is also an ongoing effort to help educate the public about investment and accelerate financial inclusion."

| Platform | Minimum Investment |

| gold | IDR 100 |

| Indogold | IDR 500 |

| Lakugold | IDR 50.000 |

| Pawn shops | IDR 5.000 |

| Pluang | IDR 10.000 |

| Sehatigold | IDR 20.000 |

| Tamasia | IDR 10.000 |

| money | IDR 10.000 |

| Treasury | IDR 5.000 |

Potential market share

According to the projection data collected The report of Statista, this year there will be at least 191,6 million smartphone users in Indonesia. This is clearly an important target for digital gold investment platform developers.

Throughout 2019, according to data collected by Treasury.id and the China Gold Association, gold demand reached 54 tons, which means 0,2 grams of demand per capita with a value of $3,5 billion. It's still a far cry compared to India and China. However, based on existing trends, the market is quite optimistic that there will be an increase of up to 0,72 grams per capita in the coming year with a potential value of $12,6 billion.

Regarding future market potential, Pluang Co-Founder Claudia Kolonas when inaugurating his strategic collaboration with Gojek said, "We see that there is public awareness and interest in starting to invest for the future; and gold with a minimal and profitable risk profile is still the public's favorite investment choice. Through GoInvestasi we provide financial solutions for all Indonesian people. The partnership with GoPay opens up opportunities everyone can now invest."

As a digital giant in Indonesia, decacorn Gojek eager to participate in fighting for the digital gold market cake. Last September, through its venture unit Go-Ventures, Gojek lead funding Series A Pluang worth 42 billion Rupiah. Apart from deepening integration, this funding is expected to give birth to other investment instruments via the Pluang platform.

Apart from the cultural aspect, gold was chosen because it is seen as an instrument that has stability and is relatively less risky. This was also a consideration for GoPay Managing Director Budi Gandasoebrata when launching GoInvestasi. The company's internal data also points to potential trends in the sector.

"Based on GoPay data, investment is one of the increasing usage trends currently. Therefore, we believe that a transparent investment feature that can be done anytime, anywhere will meet user needs."

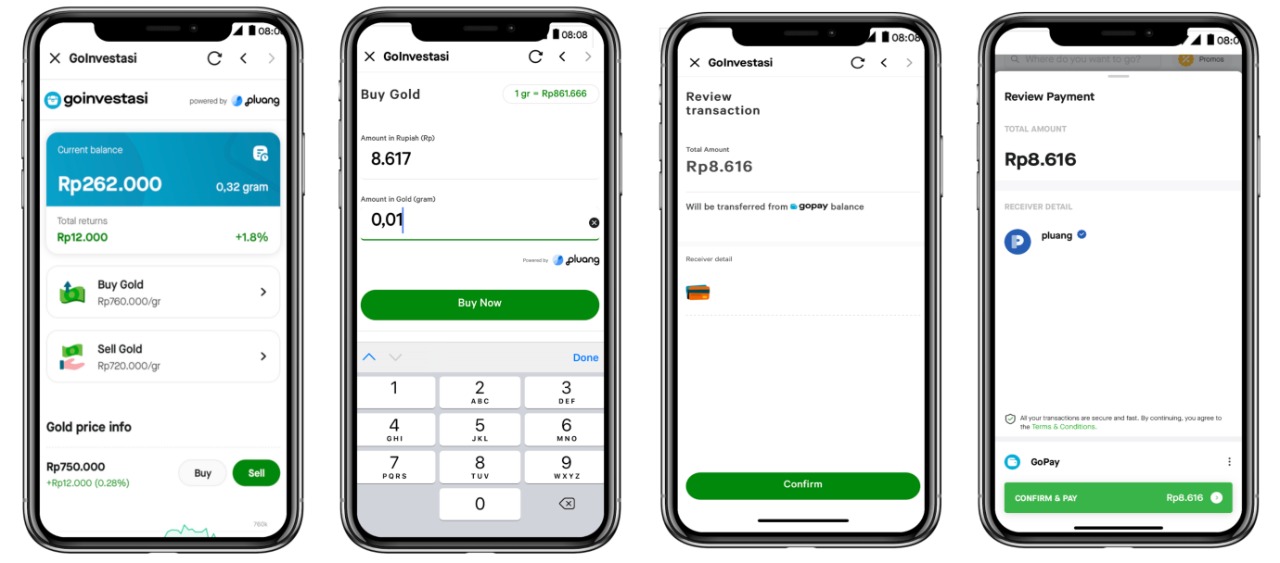

Display of the GoInvestasi features released by Gopay and Pluang / Pluang

Display of the GoInvestasi features released by Gopay and Pluang / PluangEncourage other investments

Continuously increasing financial literacy encourages investment interest. People are increasingly enthusiastic about exploring various other instruments. Last July 2020, DailySocial and Populix conducted a survey with respondents using investment applications, mostly young people (22-38 years). As a result, mutual funds (67%) are currently the most popular instruments. Below that is gold (62,7%) and stocks (44,5%). As many as 43,5% of respondents allocated 1-10% of their income for investment and 35,9% as much as 10-20%.

The trend on mutual fund platforms can also be said to be similar to gold. Many platforms are present standalone, such as Ajaib, Bareksa, Bibit, Moduit, Tanamduit, and Raiz Invest. Para unicorn also presents mutual fund services on its platform by collaborating with several partners. Initially Bukalapak used the same mechanism, but at the beginning of October 2020 they showed their seriousness by establishing it PT Opens Joint Investment who already has an APERD license.

“BukaReksa is our initial platform for understanding the best approach in presenting technology-based micro investment solutions. "In our journey, there are several important aspects that are our priority to continue to innovate and expand access, namely independence, improvements in terms of operations, security and regulatory supervision which are very important to increase investor satisfaction and comfort," explained AVP Investment Solution and Financing Bukalapak Dhinda Arisyiya.

Mutual funds also tend to be able to be started by anyone, because the minimum investment is more affordable. Almost all products can be obtained with a minimum investment of IDR 10.000. The disbursement process is also easy, like selling gold. More technically, mutual funds that consist of a collection of many investors allow for effective portfolio diversification, resulting in risks that tend to be minimal. This is an exploratory way for novice investors to get to know the capital market.

Next wave

On average, investment platforms that have emerged recently are targeting young investors (beginners). This was acknowledged by Ajaib Group Co-Founder & CEO Anderson Sumarli. Apart from mutual funds, they have just matured stock investment services. "In the first two months since the launch of the stock service on Ajaib, we have recorded tens of thousands of new users, most of whom are from the millennial generation."

The increasingly strong investment activity among these circles also encourages other players to present new products. Pluang is considered brave enough to launch the Micro E-mini S&P 500 Index Futures futures investment product to expand access for millennials to reach investment products in United States public company stock indexes that are affordable, practical and safe.

Claudia explained that the company is looking at this investment instrument because it wants to provide Indonesian investors with the opportunity to diversify their investment portfolio, considering that this alternative is still unfamiliar to most Indonesians. He admitted that he did not yet have an industry-wide idea of how many investors were interested in investing offshore (abroad).

The futures index product offered by Pluang is transacted on the largest derivatives exchange in the world, the Chicago Mercantile Exchange. Companies interested in choosing S&P 500 index because this index has superior performance with growth of 325,54% in the last 10 years as of December 31 2019.

- Header Image: Depositphotos.com

Sign up for our

newsletter

Premium

Premium