XL Axiata and Smartfren Reportedly Heading for a Merger Agreement

The two are reportedly carrying out a "non-binding agreement" to reach a deal worth $3,5 billion

The signal for the merger between PT XL Axiata Tbk and PT Smartfren Telecom Tbk is starting to come to light. Based on reports Bloomberg, Axiata Group Bhd and PT Sinar Mas Group, are currently doing so non-binding agreement to reach a deal worth $3,5 billion (around IDR 56,6 trillion).

According to internal sources, the two parent companies are operators mobile devices We are currently discussing further structures and transactions that include a combination of cash and shares. If consolidated into one business entity, this corporate action will combine customers with a total accumulation of 100 million.

"The clauses of this non-binding agreement are expected to reach a consensus point in the following month. That way, both parties can continue negotiating and continue due diligence," said the source.

Meanwhile, XL Axiata representatives revealed that this consolidation would benefit the industry, and they were open to exploring various options. Meanwhile, Smartfren President Director Merza Fachys was also reluctant to comment when asked for a response.

Rumors of a merger between XL and Smartfren have actually been circulating for a long time. In Bloomberg's initial report in September 2023, discussions between the two were difficult and did not reach an agreement. Meanwhile, the discussion included network consolidation and partnerships.

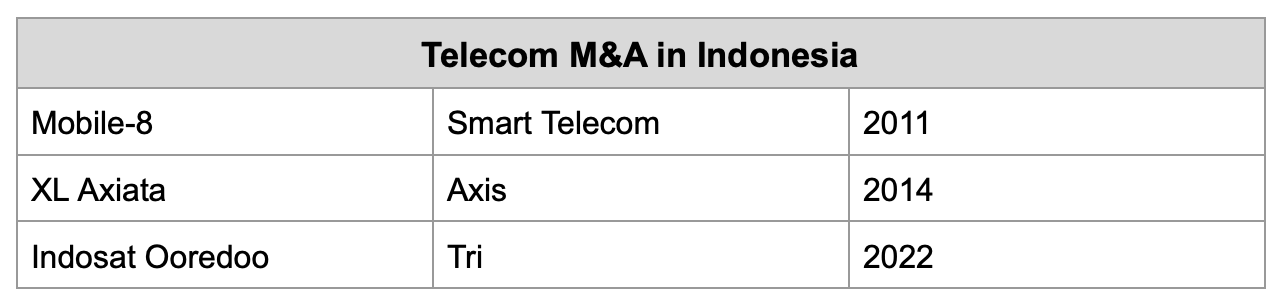

If this corporate action is realized, this will be the second XL Axiata merger. Previously, XL Axiata annexed operator PT Axis Telekom (Axis) for $865 million or around IDR 10 trillion in 2014.

For a long time, the Ministry of Communication and Information (Kominfo) has encouraged the telecommunications industry to consolidate. Apart from the fact that at that time there were too many operators in the country, this consolidation would make the industry more efficient amidst the onslaught of foreign OTT and high network costs.

More Coverage:

Kominfo said that ideally the number of cellular operators should only be four players. This means leaving Telkomsel which currently controls more than 50% of the mobile market share in Indonesia, followed Indosat Ooredoo which has merged with Hutchison 3 Indonesia (Tri) in 2022, XL Axiata, and Smartfren.

Operators are known to have done so portfolio restructuringo businesses such as releasing tower and data center assets, so they can focus on their core business and look for new sources of income. One of them is entering digital business.

Sign up for our

newsletter