DailySocial and Populix Survey: The Most Popular Mutual Fund Investment in Indonesia

The respondent's most recommended gold investment for novice investors

OJK reported that the financial literacy index and financial inclusion index in Indonesia increased in 2019. Now the value reaches 38,03% for the financial literacy index, while the financial inclusion index reaches 76,19%.

Financial inclusion means something related to the number of users of financial services, while literacy means how to manage their money. The two are interconnected. A person with good financial literacy generally knows how to make the most of money.

Meanwhile, investment is a form of fund management in order to provide maximum results. It is part of financial literacy. Thanks to the rapid development of digital technology in the financial industry, various innovations were created to make it easier for people to start investing. Digital implementation plays a role in accelerating the process of financial literacy and inclusion.

Over the past five years, online investment application innovations have spread more rapidly. To see further awareness Indonesians towards investment applications, including during the pandemic, DailySocial do a survey together Populix.

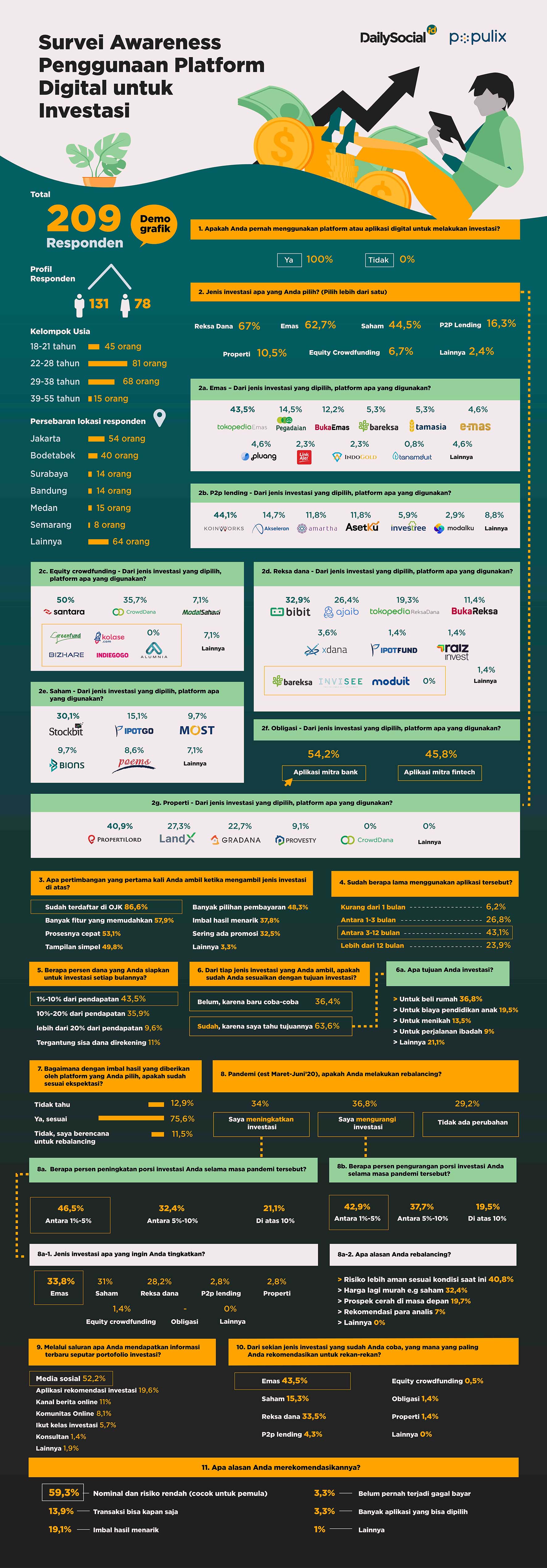

The survey was conducted at the end of June to 209 respondents, consisting of 131 men and 78 women. Its domicile is spread across Jabodetabek, Surabaya, Bandung, Medan, Semarang, and a number of other cities. All of these respondents answered in unison that they had all used digital platforms or applications to invest.

Explained further, the highest choice for the type of investment they choose is mutual funds (67%) and gold (62,7%). The percentages of male and female respondents who choose these two types of investment are not far apart.

Other types of investment that respondents chose sequentially were stocks (44,5%), P2P lending (16,3%), and bonds (11,5%). Regarding the consideration of choosing this type of investment, respondents answered that this was in accordance with their risk profile (48,8%), new to learning (24,4%), friend recommendation (10,4%), and most familiar (8,1%). ).

Most popular investment app

We also asked what applications were used to make it easier for respondents to invest. We asked one by one the type of investment to see how enthusiastic the respondents were.

For gold investment, the highest choice of respondents fell to Tokopedia Gold (43,5%). Next are Pegadaian (14,5%), Bukalapak's BukaEmas (12,2%), and Bareksa and Tamasia (5,3%). Meanwhile, for mutual fund investment, the most respondents' choices are: Seeds (32,9%), Wonderful (26,4%), Tokopedia (19,3%), BukaReksa (11,4%), and Xdana (3,6%).

The p2p lending applications that are chosen by many respondents are: CoinWorks(44,1%), Acceleration (14,7%), Amartha and Asetku (11,8%). Meanwhile, for the equity crowdfunding platform, the highest respondents' choices are Santra (50%) and Crowddana (35,7%).

For stock investment applications, the highest choice falls on stockbit (30,1%) and MOST Mobile Mandiri (22,6%). The next property investment application that gets the highest choice is PropertyLord (40,9%) and LandX (27,3%).

Finally, for bond purchase applications released by the government, such as the ORI and SBR series, respondents chose to buy from bank partner applications (54,2%) and fintech partner applications (45,8%).

User profile

The next question to the respondents is a consideration when choosing a platform to invest in. The highest answer is already registered with OJK (86,6%), many convenient features (57,9%), and simple / easy display (49,8%).

Respondents admitted that this application had been used between 3-12 months (43,1%), between 1-3 months (26,8%), and more than 12 months (23,9%).

Regarding investment habits, respondents admitted that they allocate 1%-10% of his income to invest (43,5%), 10%-20% of income (35,9%), and depending on the remaining funds in the account (11%).

The majority of respondents said that they understand that every investment that has been taken has adapted to the purpose (63,6%). However, there are also those who say they don't know the purpose because they are still trying (36,4%). Another investment objective of the respondents is to buy a house (36,8%) and the cost of children's education (19,5%).

In obtaining information about investment, respondents claimed to rely on sources obtained from social media (52,2%), investment recommendation applications (19,6%), and online news channels (11%).

We also asked respondents for recommendations for investment types to investors who are new to the investment world. Most answers are emas (43,5%) and mutual funds (33,5%). Their reason is that this breed has nominal and low risk (59,3%) and have attractive returns (19,1%).

Effects of the pandemic

The pandemic that has been going on since March is also a point that we will further examine, whether there is a change in the way of investing. For this reason, we asked whether the respondent did rebalancing investation.

The percentage comparison of the answers given is quite thin, between reducing investment (36,8%) and increasing investment (34%). Their reason rebalancing is a safer risk according to current conditions (40,8%), low prices (shares) (32,4%), and bright prospects in the future (19,7%).

For those who increase their investment, the percentage of funds prepared increases between 1%-5% (46,5%), between 5%-10% (32,4%), and above 10% (21,1%). The type of investment they want to increase is emas (33,8%), saham (31%), and mutual funds (28,2%).

For those who reduce investment, the percentage of funds that are ready to be transferred between 1%-5% (42,9%), between 5%-10% (37,7%), and above 10% (19,5%).

- Disclosure: This article is supported by a market research platform Populix.

Sign up for our

newsletter