Wealthtech Platform Increases Number of Beginner Investors

The ease of use of digital investment platforms has driven a massive increase in the number of novice investors

The trend of increasing the number of retail investors is predicted to continue, given that only 2% of the total productive age population in Indonesia accessing investment products in the capital market. The momentum is used by many players wealthtech, a term that is now used to describe platforms related to digital-based investments, to consolidate partnerships with each other so that more and more new investors join.

Quoting OJK, the number of SID (Single Investor Identification) reached 5,6 million investors as of June 2021, an increase of 44,2% on an annual basis. year-to-date (YTD) of 3,88 million investors. In further detail, the SID of stocks was 2,5 million investors (up 48,32% YTD), the SID of mutual funds was 4,9 million (up 55,27% YTD), and SID SBN was 538 thousand investors (up 17,03). % YTD). The improvements in crypto assets are far more fantastic. The Ministry of Trade noted that investors in this instrument reached 6,5 million people with a transaction value of IDR370 trillion until May 2021. Compared to the previous month, there were 4,8 million people with a transaction value of around IDR237,3 trillion.

This increase in the number of investors, apart from being supported by momentum, is also influenced by innovations made by players wealthtech. In notes DailySocial, the majority of players are still focused on only one investment instrument, for example in mutual funds, or only gold.

Later the players started collaborating with each other so that platformit gets richer and can attract more users from different risk profiles.

This trend, according to Indef Economist Nailul Huda, will continue because wealthtech in Indonesia is still very new. When referring to the non-linear graph, it is still in a period of accelerated growth along with other fintech industries.

In the fintech industry which is entering accelerated growth, investors will usually pay greater attention because the valuation value is getting higher. "A good opportunity for investors, that way there are usually more and more players in wealthtech," he said to DailySocial.

This has an impact on the market being formed towards monopolistic competition, where there is no dominant player. However, he highlighted the possibility that these platforms will develop their own ecosystems.

One way is to merge with fellow players wealthtech or with other fintech platforms such as fintech payments or digital banking. This method is relatively cheaper than developing your own ecosystem. "If this strategy is carried out, gradually a more oligopoly market will usually form."

On the other hand, partnering with many across industries wealthtech is actually a step in overcoming the different regulators that apply in Indonesia. Some are monitored by Bank Indonesia, OJK, and CoFTRA, giving the impression of being an obstacle for players to move more quickly.

"Cost This regulation can be circumvented by merger. "Maybe platform A already has OJK permission, platform B has Bappebti permission, they could merge to save costs."

The following are the types of investments presented by each wealthtech platform:

No | wealthtech app | Gold | Mutual Fund | Stocks or derivatives | Crypto assets | Securities crowdfunding |

| 1 | Bareksa | ✅ | ✅ | |||

| 2 | Pluang | ✅ | ✅ | ✅ | ✅ | |

| 3 | money | ✅ | ✅ | |||

| 4 | Raiz Invest | ✅ | ||||

| 5 | Gold | ✅ | ||||

| 6 | Lakugold | ✅ | ||||

| 7 | Treasury | ✅ | ✅ | |||

| 8 | Indogold | ✅ | ||||

| 9 | Tamasia | ✅ | ||||

| 10 | Seeds | ✅ | ||||

| 11 | Wonderful | ✅ | ✅ | |||

| 12 | IPOT | ✅ | ✅ | |||

| 13 | Invisee | ✅ | ||||

| 14 | XDana | ✅ | ||||

| 15 | stockbit | ✅ | ||||

| 16 | Halofina | ✅ | ||||

| 17 | Fundtastic | ✅ | ||||

| 18 | Santra | ✅ | ||||

| 19 | Bizshare | ✅ | ||||

| 20 | LandX | ✅ | ||||

| 21 | Crowdfunding | ✅ | ||||

| 22 | Indodax | ✅ | ||||

| 23 | tokocrypto | ✅ | ||||

| 24 | Pintu | ✅ | ||||

| 25 | Luno | ✅ |

Application wealthtech satu pintu

One of the players wealthtech which now has a more complete asset class is Pluang. From the beginning, when it was still using the EmasDigi brand, the company provided gold commodity investment products as its first product, now it has completed itself, starting from S&P 500 index, crypto assetsand mutual funds.

The development has been relatively short since rebrand in July 2019. The company partnered with players in related industries, even forming a subsidiary to obtain an APERD license called Pluang Grow (PT Sarana Santosa Sejati) so that it could partner with investment management companies.

Pluang Co-Founder Claudia Kolonas said rebrand is a step for the company to achieve its goal of providing a platform that makes it easier for users to invest.

“This development is in line with our goal of providing a platform that makes it easier for users to invest. "Through the name Pluang, it has become our new enthusiasm to continue developing other investment products on our platform," he said.

"Starting from changing the name, providing organic education to the public to finally the various new products that we launched, that's also what "release"Branding from just 1 finished asset to various investment assets," he continued.

With the position as one stop investment app, Pluang wants to embrace all potential users who come from various risk profiles. “For now, the majority user we still choose gold as their portfolio, for the S&P 500, crypto assets and mutual funds are arguably the new asset class. booming. "Pluang itself has just launched its mutual funds."

This condition is quite reflected in the user risk profile recorded by the company during KYC, namely that the majority are moderate. Although not detailed further, Claudia said that Pluang's business growth last year grew 20 times. He hopes that this performance trend can at least be maintained by the company this year.

“Pluang remains on a mission to provide customers with: access to diverse asset classes at affordable prices. In each asset class we will/already offer attractive products and distinctive in their respective classes."

Robo advisor technology trends

Before the player wealthtech present, industry wealth controlled by users who come from certain groups, namely High-Net-Worth-Individual (HNWI) and Ultra-High-Net-Worth-Individual (UNHWI). This group experiences personalized portfolio services exclusively from para wealth managers.

But this exclusivity can now be felt by users from all economic backgrounds thanks to technology robo-advisor developed by Para wealthtech. This technology analyzes data based on client questionnaire answers, then recommends investment solutions according to the client's goals and needs.

Compared to humans, robo-advisor can analyze thousands of variables simultaneously and efficiently. Some of the variables considered include demographics, time, historical trends, technical analysis, fundamental analysis, market sentiment, and others.

And what is no less important, the selling point that stands out from robo-advisor are low fees compared to traditional advisors who charge management fees of 2% – 3% of AUM, according to report from Bambu, a technology provider startup robo-advisor from Singapore.

This does not mean that human labor is no longer needed at this time. With data collected by robo-advisor, wealth managers are in a great position to understand their clients better – What their lifestyle is; Where is the trend going; What are their needs and goals? Then they can then strategize and find ways to organize investment decisions, risk management, and improve their advisor-client relationships.

Experts estimate the asset AUM of the industry robo-advisor This reached $1,4 trillion in 2020, growing 47% and 70,5 million new users globally. Utilization robo-advisor has reached the stage mature in developed countries, in the UK for example, the market value reaches $24 billion. Meanwhile, Singapore and Hong Kong recorded strong AUM growth of 400% over the last five years.

In Singapore, competition wealthtech increasingly fierce as incumbent financial firms begin to leverage technology robo-advisor. Quote from fintechnews, this competition will only increase as non-financial companies continue to enter the industry wealth.

One of them is UOB Asset Management (UOBMA) which is partnering with telecommunications company Singtel to launch the service robo-advisory in Singapore. The service will be integrated into Singtel's Dash mobile wallet and will allow Dash customers to invest in ETFs, managed funds, or other asset classes directly through the app.

Statista estimates that in 2020, AUM in Singapore for the segment robo-advisor reached $1,06 billion. Projected in 2024 to be $2,62 billion growing 25,3%. Users in this segment are expected to increase by more than 83% to 192.500 in 2024 from around 104.900 in 2020.

In Indonesia itself, technology robo-advisor It has started to be implemented by many players wealthtech. Seeds became one of its bearers, especially when they were first founded.

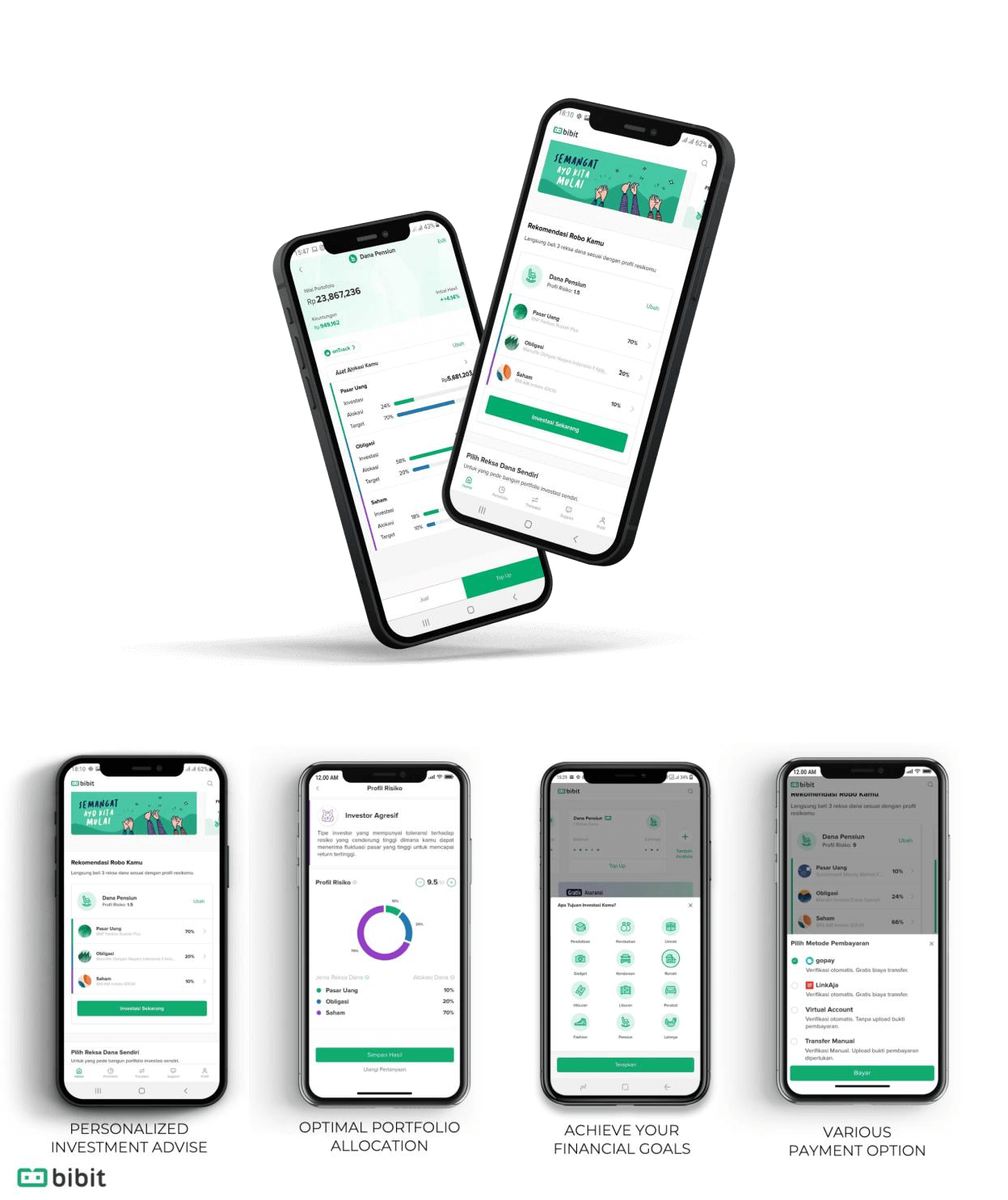

Bibit CEO Sigit Kouwagam explained, technology robo-advisor what they developed is scientifically proven to be able to map the risk profile of each user. Then, continue with portfolio diversification so that users can invest in various asset classes based on their risk profile, financial condition and financial goals.

"More than 50% of Bibit users invest for a period of more than 24 months and they continue to increase their investment," said Sigit.

Mentioned Seed users has reached more than one million people, 91% of whom are novice investors. The total AUM managed by Bibit reaches more than IDR 5 trillion. Over the past year, the growth of Bibit's new users jumped 10 times.

Sigit said not only robo-advisor To attract more new investors, the company has also made a number of adjustments, both in terms of lower transaction costs, cost and information transparency. “There are costs enemy biggest thing to get people on board before successful long-term investing.”

It is possible for Bibit to expand its asset class beyond mutual funds. Sigit said, apart from listening to users to provide a better experience, he also has a spirit of collaboration to provide connectivity in the digital ecosystem. sister company Seed, Stockbit, focuses on the stock asset class.

“We consistently monitor additional investment products for our users' long-term portfolios. "The point is that these products must be ensured to suit the user's risk profile, as well as clarity in regulations so that we can still protect all investors."

The educational journey is still long

Both Claudia and Sigit realize that education is a strategy that must be carried out continuously in an effort to develop wealthtech further. Pluang actively holds the Pluang Talks educational program in the form of webinars through various programs channel digitally on Clubhouse, Instagram Live, and Telegram Discussion.

"During this educational program, the participants showed enthusiasm with the many questions they asked."

Sigit added that knowledge about investment is an inseparable part of a user's investment experience. “We collaborate with fund managers and key opinion leaders to educate the public through various forums such as YouTube webinars, Telegram audio chat, and content strategy on social media channels. "We do this for free," he concluded.

- Header photo: Depositphotos.com

Sign up for our

newsletter

Premium

Premium