Shares Drop, Temporary Sentiment or GoTo Business Yellow Light?

Summary of GoTo's strategy and performance data in the last year to provide a comprehensive picture

The fall in GOTO shares in the last two weeks has made public sentiment towards public companies in the technology sector (which were previously startups) less favorable. The share price had dropped to the level of IDR 54 per share. Not without reason, investment passes private placement and the sale of 0,03% of the shares owned by William Tanuwijaya is considered to have led to this skewed sentiment.

GoTo's new CEO Patrick Walujo He even stepped in and spent around IDR 10 billion to buy up the company's shares. He also emphasized to the media that the sale of shares by founder does not show a loss of confidence in the company and its business prospects. It is a personal decision that depends on each individual's circumstances and is in no way related to GoTo's strategy, performance or commitment to shareholders.

The next question is of course whether this negative sentiment is only temporary because founder sell some of the shares? So what are the prospects for GoTo?

GoTo performance and plans

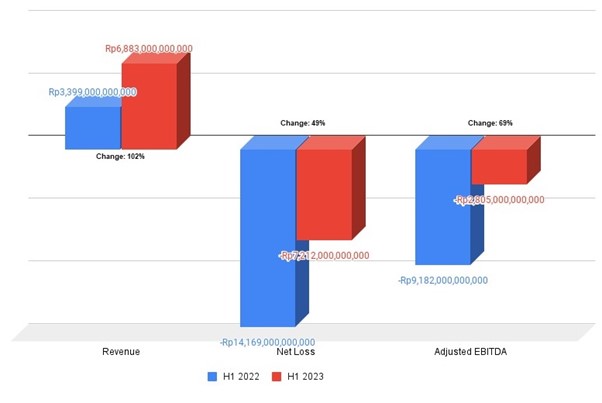

In the first semester of 2023, GoTo reported a decrease in net loss of 49% (YoY) to IDR 7,2 trillion. Net income increased 102% compared to the previous year, reaching IDR 6,8 trillion, driven by increased monetization across all business lines with take rate overall reached 4,1%, up 40 bps (YoY).

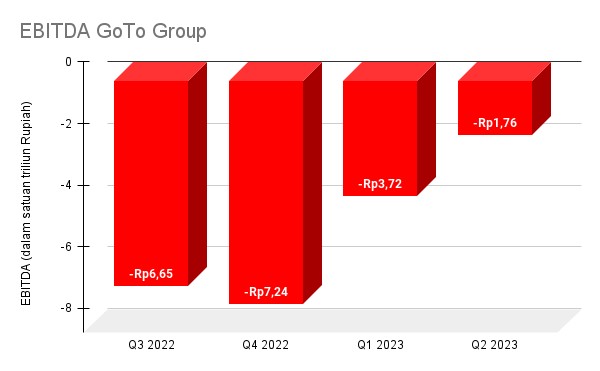

Though adjusted EBITDA shrank 69% to -Rp 2,8 trillion, GoTo remains optimistic about achieving profitability in the fourth quarter of 2023.

GoTo announced that it will release its 3Q 2023 report on October 30. From the first two quarters of the year, there was slight growth on the side revenue from IDR 3,33 trillion in Q1 to IDR 3,55 trillion in Q2. Meanwhile for net income also rose slightly from -Rp. 3.86 trillion to -Rp. 3,30 trillion. Compared to the quarter in the previous year, the ratio revenue and net income this year is considered better.

Strategy for realizing targets

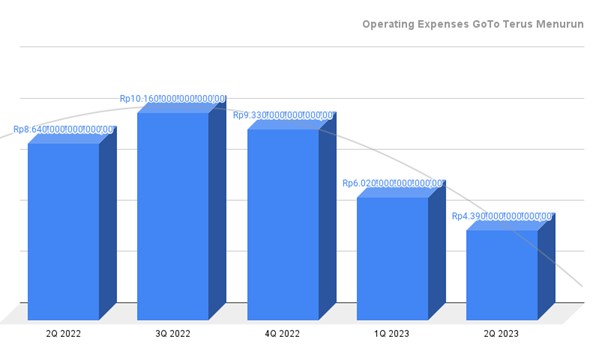

To realize the profitability target this year, GoTo is intensifying a number of strategies. Broadly speaking, the benchmark is based on three aspects: reducing transaction costs, tightening spending, and expanding into the lower middle segment. It is said that the first two points have been proven by the stable GTV and reduction in net loss in 2Q 2023.

According to analysts, the third strategy also has the potential to make GoTo move more efficiently in acquiring users. "Save mode" for the target audience can be maximized on the line on-demand owned, by utilizing technology (instead of money-burning promotions). Increasing this "budget" segment will also be realized in the e-trade by adding more product catalogues, with the hope of increasing the traction of financial services such as GoPaylater.

"Economy Mode products and services Gojek keeps printing new users, as well as bringing back inactive users. This move is in line with the business unit's core growth strategy on-demand "to expand the total potential market (TAM) by targeting consumers who prioritize price," wrote GoTo management in his official statement.

Samuel Securities as published Investor.id made a conservative projection that GoTo has the potential to record a positive contribution margin of IDR 2,1 trillion by the end of 2023. This is driven by an increase big and net take rate to 3,8% and 2,1% respectively. However, they lowered the GTV projection to IDR 614 trillion.

Previously one of the directors of GoTo, Catherine Hindra Sutjahyo, also said that as a technology company their business will continue to be boosted through technological innovation, product development and partner support. The efforts made will no longer be jor-rod promotions, but instead focus on establishing a sustainable business model. Technology optimization such as machine learning recommendations and personalization will continue to be deepened, so that it can produce more economical service offerings to consumers without having to pay a lot of discounts.

Catherine has been involved a lot in online servicesdemand transportation and delivery. This year, one of their priorities is improving mobility service connectivity, one of which is the expansion of GoTransit to make it easier for users to get access to multi-modal transportation services; as well as increasing the variety of transportation features such as GoCar Luxe, GoRide XL, and GoSend Car.

Business line analysis

Broadly speaking, there are 4 main business lines that the GoTo group is currently playing, including E-commerce, on-demand, finance and logistics. The company chose to focus on these priority areas, including by releasing other units that it felt were not closely related to its main business model. One of the results spin-off of entertainment service Goplay which is now an independent corporate entity.

e-linetrade

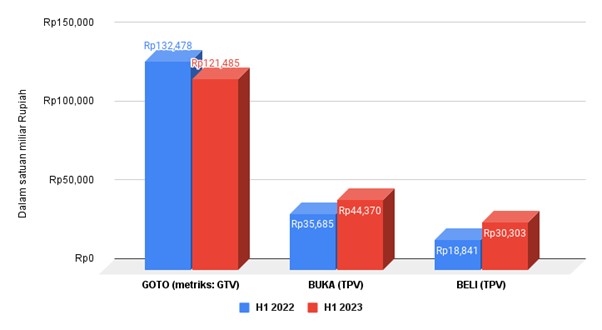

According to the e-Conomy SEA report, the GMV of the Indonesian e-commerce industry has reached $59 billion or equivalent to IDR 940,4 trillion in 2022. In the 1H 2023 report, the e-trade GoTo, led by Tokopedia, reportedly recorded GTV worth IDR 121,4 trillion. When compared with the GMV figure, GoTo's achievement is equivalent to 12,9% of the existing market share value.

Please note, there are different metrics in the report. As an illustration, GMV measures the total value of all transactions on the platform E-commerce, including those that do not generate revenue, while GTV only includes transactions that generate revenue.

Compared with local players who are the main challengers, namely Bukalapak and Blibli, Tokopedia's achievements are still above them.

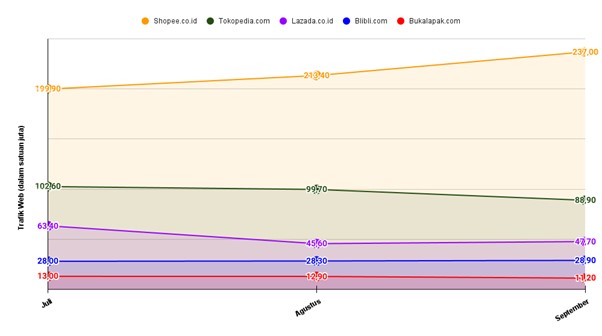

Nevertheless, industry E-commerce Local players are also enlivened by regional players. In the top five, based on web visit statistics, Shopee and Lazada are the main challengers. According to its parent company's report, Shopee's revenue (across its operational regions) increased 20% to $2.1 billion, and adjusted EBITDA from the Asian market turned a profit of $204.1 million.

To strengthen the line E-commerce, a number of strategies were launched. Most recently, GoTo is committed to sharpening “Partner” business model to optimize sales of digital products. This will be a strong opponent for Bukalapak Partners - who from the start will focus on optimizing this service. Based on Tokopedia Mitra data for the first quarter of this year, a number of digital products were recorded to experience rapid growth in the first quarter of 2023, such as education fees, internet and cable TV, and e-samsat. The average increase in transactions is almost 4x compared to the same period in 2022.

Others, Tokopedia also continues to develop infrastructure and products. On the infrastructure side, fulfillment centers also continue to be established at various strategic distribution points. Meanwhile, on the feature side, the Tokoscore service was also released to increase credit service penetration; also PLUS by GoTo to increase customer loyalty through a premium membership system.

Tokopedia and Gojek also started doing modeling cross-selling, since mid-2022 starting with the presence of GoFood in the application marketplace Tokopedia.

Lini on-demand

Service market on-demand in Indonesia projected to be worth $2,67 billion or equivalent to IDR 42,5 trillion in 2023 and will exceed $4,66 billion in 2028, with strong CAGR growth of 8,75% during that period. In 1H 2023, GoTo reports the line on-demand service initiated Gojek has succeeded in recording GTV reaching IDR 26,9 trillion – equivalent to 63,2% of the projected market share with more than 2,7 million driver partners throughout Indonesia.

Strongest rival Gojek Of course Grab. According to a report released in the first half of this year, Grab has posted GMV of $5,2 billion across its operational regions. This business also accommodates food delivery services. According to Momentum Works report, market share food delivery local as of 2022 led Grab Food (49%), GoFood (44%), and others (7%).

Apart from designing interoperability of transportation services via GoTransit, strategies Gojek to succeed onlinedemand also through regenerating the driver fleet to environmentally friendly vehicles. For electric vehicles, Gojek own a joint venture company producing electric motors Electrum; they also invested in Gogoro, a provider of electric motorbike battery infrastructure.

Financial line

In June 2023, the GTV line fintech under the auspices of GoTo worth IDR 182 billion. It is known that there are a number of financial products under it, including digital wallet services, paylater, p2p loans, and also digital banks. Industry fintech in Indonesia it is quite fragmented with many players in all lines. Innovation here is also quite intensive, considering the regulator's openness in accepting product innovation.

However, this line is important support system for all businesses under the GoTo group. Services such as GoPay, GoPaylater, and now Bank Jago have become the main infrastructure in their business transaction system.

In order to make this line more agile, in the middle of this year GoTo Financial announced the unit switch finance which houses the GoPay Later service. Previously platforms paylater was driven by PT Mapan Global Reksa (Findaya), then has now been taken over by PT Multifinance Anak Bangsa (MAB).

Head of Corporate Affairs GoTo Financial Audrey Petriny said, in November 2021 GoTo Financial officially acquired PT Rama Multi Finance, thenrebrand under the name PT Multifinance Anak Bangsa. The unit had previously held a license finance licensed and supervised by OJK.

The GoPay Later structure itself has been unique from the start. The BNPL platform has two products called GoPay Later and GoPaylater Cicil. Even though currently both are fully integrated and managed by MAB.

Fintech is indeed one of the business lines that GoTo continues to improve, including recently trying to expand Gopay's reach by releasing a special application that can be used separately from the service. Gojek -- even so, the Gopay feature can still be used through the application Gojek. Gopay is now integrated with Jago Bank, making it easier for users to convert their balances into savings assets.

Logistics line

Logistics is also a problem support system Mainly to support the GoTo business line. The GoTo Logistic unit as of 1H 2023 is claimed to have served around one fifth of deliveries on Tokopedia. It is claimed that increasing penetration of this service will reduce logistics costs even further. The shipping cost subsidy per order has decreased by around 15% since the beginning of 2023.

More Coverage:

In the future, GoTo Logistics will strive to continue to reduce delivery costs for consumers by improving delivery services in-house and service capacity fulfillment the company, as well as using allocation technology in-house to direct delivery to a third party delivery service if necessary.

GoTo earlier this year announced the investment of new shares in the context of the takeover of PT Swift Logistics Solutions (SLS). This transaction was carried out through GOTO's subsidiary, PT Paket Anak Bangsa (PAB) or GoSend, which purchased new shares worth IDR 583,12 billion. In disclosure, the company also stated that the reason behind this transaction was to reorganize and consolidate the group structure.

Leadership succession and profitability targets

In 2023, it has happened 2x leadership succession in the GoTo group. First, it was announced that in February 2023, Kevin Aluwi would step down from his position as commissioner, but remain as a shareholder with multiple voting rights in GoTo. Then, in June 2023, Patrick Walujo was appointed CEO of GoTo, replacing Andre Soelistyo who became Commissioner and Deputy Chairman.

The absence of the majority founder Gojek and Tokopedia in the executive ranks have attracted a lot of public attention. Even though Patrick is not a new name, this succession on the other hand gives the impression of a shaky leadership structure.

Ultimately, in the midst of a volatile technology industry, the market is now assessing businesses more conservatively. Without being overly ambitious, shareholders are demanding that GoTo be healthier in business terms. Since the beginning of the year, management has indeed conveyed targets realization of profitability this year with great optimism. Efficiencies have even been made by reducing personnel and focusing more on the main business model.

From the existing trends, GoTo from quarter to quarter shows a trend of improving financial performance pointing to positive EBITDA.

Leadership continues to be overhauled and strengthened. Business strategies continue to be formulated and finalized. Now it's just a matter of how these steps provide results on business performance. In the midst of this unfavorable sentiment, we think the only way for GoTo to restore public trust is to realize what has been targeted.

The fact is that the technology industry is gaining bad momentum. Moreover, in almost all of GoTo's main business lines, there is very fierce competition. Armed with a strong local team and extensive presence, Gojek, Tokopedia, and other business units within GoTo must be able to create neat consolidation so as to provide a better user experience.

GoTo (Gojek and Tokopedia) on the other hand are also important symbols of (public) technology companies in Indonesia. It could even be said to be one of the meccas of the startup ecosystem in Indonesia. The success/failure of GoTo provides a broad perception of the public's perspective on the potential of technology businesses (startups) in Indonesia in the future. Moreover, several large startups have also started planning to become public companies in the future.

Sign up for our

newsletter

Premium

Premium