Summarizing Digital Bank Efforts to Remain Relevant to Encourage Financial Inclusion

Most recently, Bank Jago synergized with GoPay to launch a savings product

PT Bank Jago Tbk (IDX: ARTO) is again expanding its synergy into the GoTo Group ecosystem. After Gojek, Bank Jago is now collaborating with financial business lines to provide GoPay Savings services on the Jago application.

This collaboration model may not yet exist in Indonesia considering that GoPay is known as a payment platform. Previously, the initial synergy was to present Bank Jago as a payment option in the application Gojek. GoRide, GoFood, or GoSend transactions will automatically deduct the balance at Bank Jago.

"GoPay Savings by Jago answers society's challenges unbanked. GoPay Savings by Jago is the first daily transaction account in Indonesia that combines electronic money services (e-money) something simple with the advantages of a bank," said President of GoTo's Financial Technology Business Unit Hans Patuwo in his official statement.

GoPay Savings can be used for transfers, saving money for daily transactions and applying for loans in one application. Via the GoPay application or Gojek, users can change their GoPay balance to GoPay Savings by Jago with a claim in two minutes.

This collaboration also makes remembering possible GoPay so far it is tied to the application Gojek. Post-spin-off a few months ago, GoPay was able to expand their services and was able to reach more people's needs.

Collaboration encourages inclusion

Since the emergence of digital banks several years ago, collaboration has continued to be intensified to encourage financial inclusion. The initial mission was to reach the community unbanked and underbanked who have limited access to finance. On average, this group does not have an account, is hampered by ATM locations that are far away, or does not have internet access.

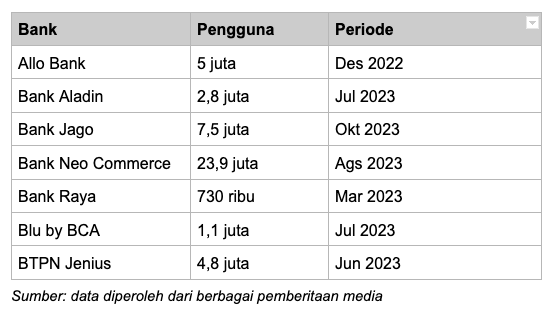

Digital banks take various different approaches, one of which is through collaboration with digital platforms, both e-commerce, ride-hailing, or e-wallets. This collaboration is also in line with the growth of digital behavior and transactions. According to data from Bank Indonesia (BI), the population unbanked in Indonesia it reaches 97,7 million people or 48% of the total population. Meanwhile, the transaction value digital banking in Indonesia reaching almost IDR 4,3 quadrillion as of April 2023.

This is different from the conventional banking model which still relies on branch offices for physical interaction with Plate When you want to create a new account, digital banks collaborate with digital platforms to make it easier to open accounts, payment transactions or loans. Some of the collaborations that have been established include:

- Jago Bank and Gojek Process Bank Jago is present in the application Gojek. Another synergy is connecting Pocket (Pocket) as a payment option in the application Gojek. Users can transact any service, from food, transportation, to bills.

- Standard Chartered and Bukalapak This strategic collaboration produces savings products OpenSavings, which allows users to withdraw funds via the Bukalapak Partner network.

- Aladin Bank and Alfamart Different from other digital banks, Bank Aladin believes that the offline ecosystem is key to embrace the segment unbanked and underbanked in Indonesia, especially those that touch daily activities. This thesis explains its strategic partnership with the owner of the national retail chain Alfamart.

Following strategies to ease the process , digital banking players continue to roll out features/services to make it easier for users to access their finances, such as payments via QRIS and cash deposits and withdrawals without an ATM card. Moreover, people are still used to banking services because they have a physical presence.

More Coverage:

Recently, Director of Strategy, Corp. Communication, and Investor Relations Bukalapak Carl Reading said that the current condition of society may not be ready to enjoy the full digital experience. This also makes Bukalapak's integration with its strategic financial partners progress slowly.

"We plan to use Mitra as a digital banking liaison between the digital world and rural communities to be able to make cash deposits and withdrawals," said Carl in Bukalapak's public presentation some time ago.

Regardless of the collaboration that is already underway, in fact the population unbanked recorded as still large. However, this condition opens up growth space for the banking, financial and digital ecosystem industries to explore partnership models beneficial for society, especially in the regions.

Sign up for our

newsletter