Momentum Works: GrabFood Leads the “Food Delivery” Market in Southeast Asia for 3 Consecutive Years

Estimated GMV of food delivery business in Southeast Asia reached $16,3 billion or grew only 5% from the previous year

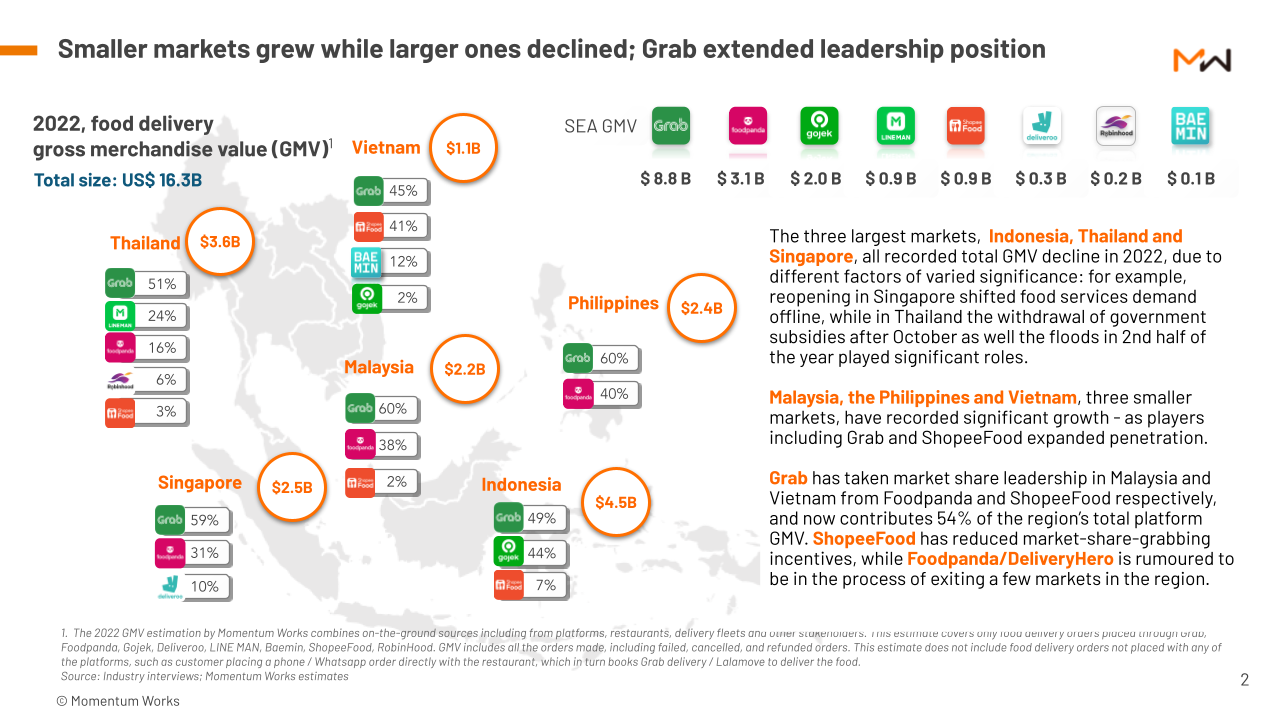

GrabFood, platforms food delivery belongs to Grab, said to lead the food delivery market in Southeast Asia for three consecutive years from 2020 to 2022, according to a Momentum Works report titled “Food delivery platforms in Southeast Asia (SEA) Jan 2023”.

“From a major regional player, Grab was the only one to maintain consecutive GMV growth for the last three years. Grab also has the best net cash position compared to its peers to sustain investment,” the report states.

"After the surge in food investment in 2021, Shopeehas scaled back to focus on making its core businessE-commerce profitable.Whereas, Gojek alreadystagnant for three years, a reflection of the dynamicsand competition in the Indonesian market.

Estimated GMV from GrabFood of $8.8 billion of the total GMV in Southeast Asia of $16,3 billion. Then, followed by DeliveryHero ($3,1 billion), GoFood ($2 billion), and ShopeeFood ($0,9 billion). Meanwhile, for market share GrabFood in Indonesia alone is 49%. Then followed by GoFood (44%) and ShopeeFood (7%).

The GMV in Indonesia reached $4,5 billion, still occupying the highest position after Thailand ($3,6 billion) and Singapore ($2.5 billion). “Grab has taken market share leadership in Malaysia and Vietnam from Foodpanda and ShopeeFood, and now its GMV accounts for 54% of the total in the region.”

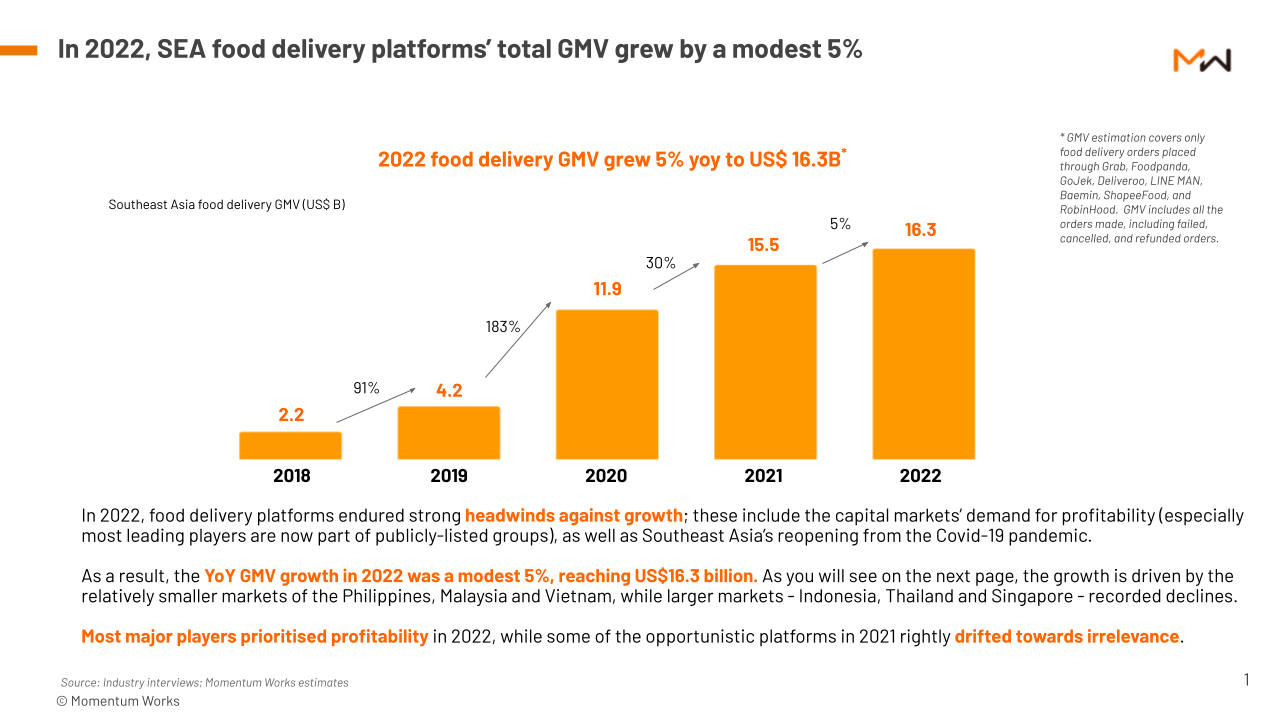

In the report, it is explained that by 2022, all food delivery platforms will experience strong obstacles in creating growth. This has to do with the capital market's demand for profitability, considering that most of the players have become public companies, and the return of community mobility after the pandemic.

Consequently, on a GMV basis for year-on-year only recorded a 5% growth to $16,3 billion. Growth was driven by the relatively smaller markets of the Philippines, Malaysia and Vietnam, while the larger markets - Indonesia, Thailand and Singapore - recorded declines due to a number of significant and varied factors.

For example, Singapore's reopening has taken demand for food services offline, while in Thailand the withdrawal of government subsidies after October as well as flooding in the second half of the year played a significant role.

“Growth in food shipments normalized to pre-pandemic levels after two years of significant growth. The post-covid reopening (return to eating out, reduced subsidies for delivery), and continued market rationalization, resulted in low growth.”

Food delivery macro trends

The report also highlights the next challenges in the food delivery industry based on macro trends, namely the fragmentation of F&B digitalization (as well as platform efforts to control POS), and the expansion of platforms into food delivery as a whole. The effort is intended as the platform wants to better leverage the offerings and increase the demand for food services.

For merchant culinary, the pandemic has accelerated adoption not only in terms of delivery, but also solutions that focus on the ecosystem chain. However, there is digitization that is fragmented and data, which ultimately makes merchant frustration.

Hence, it is very common to see F&B outlets using separate systems for Point-of-Sale (POS), menu ordering, payments, shift/workforce management, CRM/loyalty, marketing, inventory management, and delivery platform interfacing.

More Coverage:

“The question is – are we going to see a consolidation of the POS landscape in Southeast Asia, like what Meituan is doing in China? The leading food delivery platform Grab, Foodpanda, and LINEMAN Wongnai are already moving in this direction, by acquiring/partnering with restaurant technology companies.”

Furthermore, Momentum Works also saw a more strategic refinement of its platform strategy to achieve faster profitability, including scaling back, closing cloud kitchens, expanding revenue (ad solutions, subscriptions), as well as ongoing cost optimization (reducing incentives, increasing operational efficiency and focusing on payments). .

“We repeat the argument in the previous Food Delivery Platforms in Southeast Asia report on Southeast Asia: that profitability can be achieved with volume, density and operational efficiency. Most of the major platforms are publicly listed now, aside from the current operating metrics investors watch closely, Leadership, People, Organization and Product are critical factors for success (or failure),” concludes the report.

Sign up for our

newsletter