E-commerce Outlook 2024: Will It Be the Year to Realize Profits?

The association is optimistic that e-commerce will soon reach the green light; observers highlight the competitive and regulatory potential of the GoTo-TikTok partnership

2023 seems to be the toughest year facing the industry E-commerce Indonesia. Different from before, when the perpetrator E-commerce still exploring services, features, and business models --- now they are focused on achieving profitability.

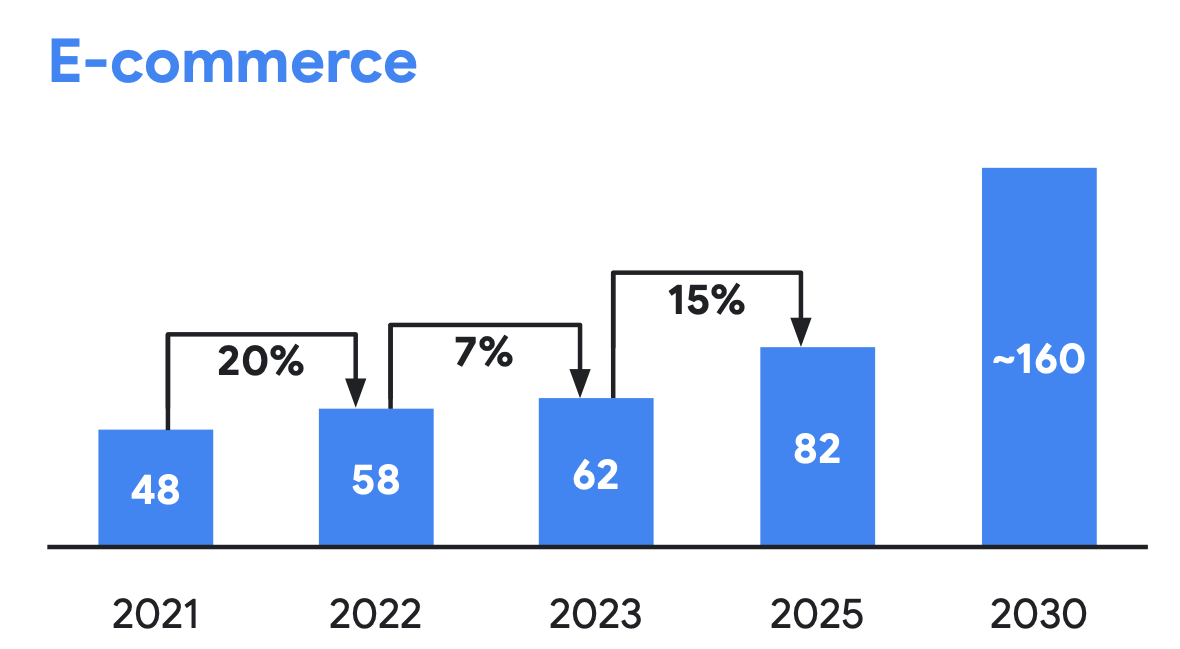

This year, sector E-commerce estimated to contribute Gross Merchandise Value (GMV) of $62 billion based on reports e-Conomy SEA 2023. In total, the GMV of Indonesia's digital economy is projected to reach $110 billion in 2025 with 75% still being paid by E-commerce. This clearly indicates that this sector is still the driving force of the digital economy in Indonesia.

General Chair of the Indonesian E-commerce Association (idEA) Bima Laga assesses that industry players are now consolidating their focus on services/products and appropriate business models. On a macro scale, the growth space is still very large considering penetration E-commerce It is estimated that only around 20%.

Increased penetration E-commerce in line with the increase in internet penetration in Indonesia which is projected to reach 70%-80%. Bima said there were still many areas outside tier 1 who has not been reached or has never shopped online. The 2021 SEA e-Conomy report noted that there were around 21 new internet users during the pandemic, 72% of whom came from outside big cities.

Dynamics in 2023

In its development for more than 10 years, the industry E-commerce have explored various approaches, ranging from B2C, B2B, or C2C. During that period, there were almost 10 platforms E-commerce went out of business because they were unable to compete in the long term, namely Blanja.com, Elevenia, and JD.id.

Now industry E-commerce leaving the top five players including Shopee, Tokopedia, Lazada, Blibli and Bukalapak with the main focus on strengthening their core business and achieving profits this year. Various efforts have been taken to encourage efficiency through employee restructuring and reducing cash burn on shopping promotions and postage subsidies.

Our highlights throughout 2023:

- GoTo Group cut nearly 2.000 employees over the past two years, continuing with spinoff GoPay application (financial unit) and divestment of GoPlay and GoTix (entertainment business unit).

- Since last year, Shopee pivot its strategy to focus on pursuing profitability over business growth; It also laid off more than 500 employees earlier this year.

- Bukalapak will carry out a second wave of layoffs at the end of July 2023; The Partner business line is still the main focus, while in the Marketplace line, the focus is on the products they have take rate and high margins, ie digital product (credit and games).

- Blibli is still pushing forward store expansion omnichannel to accommodate orders across various sales channels, including the addition of 14 outlets consumer electronics and New warehouse with AI support to save on packaging.

In its official statement, GoTo management revealed its change in strategy by focusing on segments budget consumers and reducing shipping cost incentives by utilizing its own logistics capabilities. This strategy was taken to maintain its market share, but had an impact on decreasing GTV E-commerce around 9% (YoY) in Q3 2023.

It is felt that this efficiency strategy has not been able to realize profits considering that Blibli, Bukalapak, and GoTo are still recording net losses and negative adjusted EBITDA, at least until Q3 2023.

| Platform | Adjusted EBITDA |

| Blibli | -Rp. 817 billion |

| Bukalapak | -Rp. 95 billion |

| Tokopedia | -Rp. 974 billion |

| Shopee (Asia) | -$306,2 million |

Source: Q3 2023 financial report

"In the past the industry was still exploring business models and features, now it is more focused on marketplace. Player E-commerce continue to focus on developing revenue channels which is right to increase its profitability, must focus on channel What. I see offline and online will go hand in hand, they must take advantage of all channels," said Bima when contacted DailySocial.id.

landscape E-commerce of 2024

Official GoTo and TikTok partnership to combine businesses E-commerce became one of the unexpected corporate actions towards the end of this year. This strategic partnership is the aftermath of TikTok's ban on facilitating buying and selling transactions on its social media platform.

How the Tokopedia-TikTok partnership can change the landscape and industry competition E-commerce in 2024?

Since the last few years, Shopee has continued to lead transactions which have also been boosted thanks to features live shopping. Based on reports Momentum Works in 2022, Shopee dominates GMV of $47,9 billion in Southeast Asia, followed by Lazada ($20,1 billion), Tokopedia ($18,4 billion), Bukalapak ($5,3 billion), TikTok Shop ($4,4 billion), and Blibli ( $2,2 billion).

TikTok is known to be trying to gain dominance in Southeast Asia through services e-commerce, Indonesia is the main market. Compass Market Insight noted that TikTok Shop recorded FMCG product sales of up to IDR 1,33 trillion in the period 1 September 2023-1 October 2023 (before closing). TikTok also has a large user base in Indonesia, namely around 125 million users.

Nailul Huda, Director of Digital Economy at the Center of Economic and Law Studies (CELIOS) highlighted two big points from the GoTo and TikTok strategic partnership. First, strategic steps this to beat Shopee which currently occupies the top share E-commerce in Indonesia. Second, efforts to restore the experience of social media as well as online shopping.

"[However], the impact for the industry, this [partnership] will create [gap] which is far from other competitors, such as Lazada, Blibli, especially Bukalapak. Competition will narrow down between Shopee and Tokopedia with their respective ecosystems. "Whoever has the most complete ecosystem and is liked by users, they will win the competition," he explained when contacted DailySocial.id.

TikTok's entry into E-commerce Local data directly indicates strong rivalry between global internet giant groups, namely ByteDance (China) and Sea Group (Singapore). Meanwhile, from GoTo's point of view, its collaboration with TikTok can encourage Tokopedia's business to balance segments traditional e-commerce and impulsive transactions.

From a consumer's perspective, this experience can increase the number and loyalty of users for their respective platforms. It's just a matter of how Tokopedia and TikTok synergize their features and services in one application. "So far, Tokopedia has a fairly complete and large ecosystem, from payments to logistics. However, one of the weaknesses in Tokopedia is the feature live-shopping"It's still inferior to Shopee," added Huda.

More Coverage:

Fenomena live-shopping It is popular in Indonesia because it is driven by virality and low prices. This trend was first popularized by Alibaba in 2016, which managed to attract more than 500 million viewers. McKinsey, in its report, records the GMV of live-shopping by brand and an influencer in the 2017-2020 period it grew up to 280% pa

Despite all that, Huda believes that the government needs to make adjustments to existing regulations, referring to Minister of Trade Regulation No. 31 of 2023 which was only published a few months ago. He is worried that an agreement between these two dominant players could trigger gap thick between other Electronic Trading Systems (PMSE) platforms.

He said, this adjustment is necessary to suppress potential predatory pricing so that it can protect MSMEs or offline traders. Rules regarding imported product categories and minimum prices have been contained in the new Minister of Trade Regulation, but need to be adjusted to tighten imports. For example, addition tagging products on all PMSE platforms, not just Tokopedia, TikTok, or Shopee.

"Innovation that is increasingly rapid will create business models that are always updated and reach directly to the public. Regulations that are too thick will make regulators confused about positioning platforms. Don't let Tiktok and Tokopedia's positions become problematic in the future. There needs to be regulatory adjustments, especially regarding licensing types. "

Sign up for our

newsletter

Premium

Premium