Performance Exposure of Indonesian E-commerce Companies H1 2023

Summarizes the performance of the GOTO, BUY, and OPEN e-commerce business lines

Last year, the target transaction value E-commerce in Indonesia it is not achieved. Bank Indonesia (BI) recorded the realization of IDR 476 trillion from the initial projection of IDR 489 trillion. In 2023 and 2024, BI projects transaction value growth of no more than 20%, namely IDR 572 trillion and IDR 689 trillion respectively.

Menurut BI Deputy Governor Doni P. Joewono, industrial growth E-commerce slowed down due to a number of factors. First, people's mobility has returned to normal so they have started shopping offline. Second, consumers are starting to be attracted to transacting on the platform social commerce, like live-shopping in TikTok.

Other than that, Hypefast's latest research against 5000 brand Local also revealed that consumers now tend to be reluctant to shop online because of a number of platforms E-commerce started raising platform fees and reducing free shipping subsidies.

It is known, a number of platforms E-commerce is currently making cost savings in order to pursue profitability this year. Several major players recorded significant losses throughout 2022.

1H23 e-commerce performance

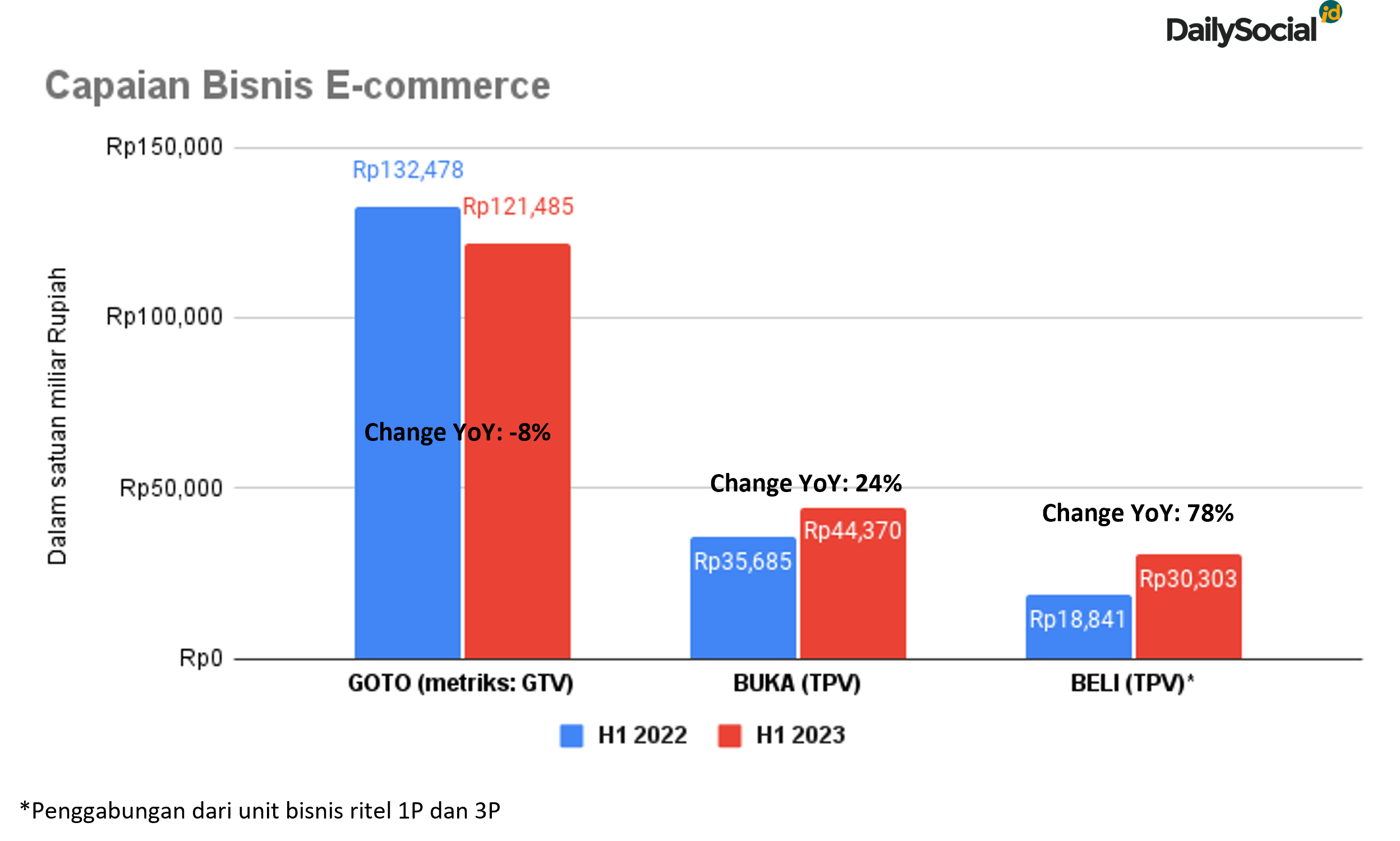

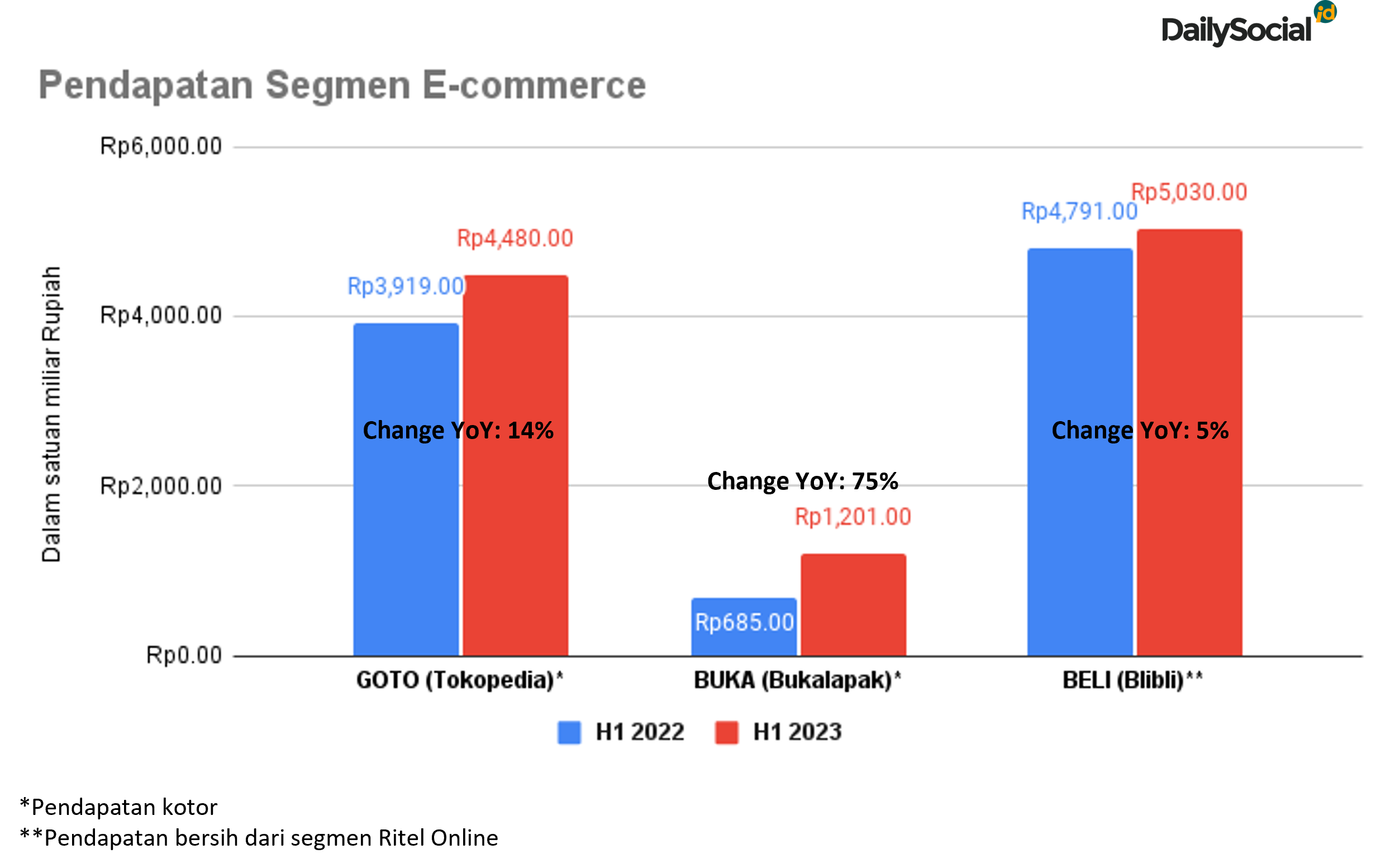

DailySocial.id summarizes the performance of PT GoTo Gojek Tokopedia Tbk (IDX: GOTO), PT Bukalapak.com Tbk (IDX: BUKA), PT Global Digital Niaga Tbk (IDX: BELI), and Sea Group (parent of Shopee) in the segment E-commerce in semester I 2023. As disclaimer, the following companies do not present the same performance metrics.

GOTO decreased by 8% (YoY) to IDR 121 trillion in Gross Transaction Revenue (GTV) E-commerce in the first semester of 2023. However, its gross income rose 14% to IDR 4,4 trillion compared to the same period last year. Adjusted EBITDA in segments E-commerce also recorded improvement from minus IDR 3,6 trillion to minus IDR 752 billion.

BELI records net income from retail online increased by 5% to IDR 5 trillion driven by 3P Retail revenue growth of 710% to IDR 567 billion. 1P Retail Revenue decreased 6% to IDR 3,9 trillion. 1P retail are B2C transactions for products/services from first parties (1P), while 3P Retail are sales of products/services from third parties (3P); includes platforms E-commerce and travel agents online (OTA).

BUKA recorded revenue growth of 75% from marketplace with realization of IDR 1,2 trillion in the first six months of 2023. Total Processing Value (TPV) marketplace increased 24% (YoY) to IDR 44,3 trillion.

Meanwhile, SEA Group also reported that overall revenue from Shopee rose 20% to $2.1 billion. Shopee also recorded an increase in adjusted EBITDA. For contributions from the Asian market, adjusted EBITDA, which was at a loss, has now turned to a profit of $204.1 million in the first semester of 2023. From non-Asian markets, adjusted EBITDA loss improved from -$332 million to -$53.7 million.

Strategy

Instead of continuing to burn money to raise GMV, a number of platforms E-commerce Since last year there has been a big focus on reducing incentives (promotions, shipping costs, etc.) and taking new approaches to improve financial performance. Tokopedia and Shopee, for example, are increasing service fees for users to a range of IDR 1.000-IDR 3.000 per transaction in May 2023.

This incentive reduction had quite an impact on GOTO's performance, where GTV experienced a decline in the 2Q23 (YoY) period. It said that the reduction in incentives made transactions E-commerce from low quality users also decreases.

Train live-shopping which was intensified TikTok Shop began to overshadow the platforms E-commerce large, especially those that rely on product search-based models. With a large user base in Indonesia, it's easy for TikTok to attract new users through content, price subsidies, and streamlined transaction processes seamless pattern. Throughout 2022, the TikTok Shop pocketed transactions of $ 4,4 billion or quadrupled (YoY).

GOTO E-Commerce Director Melissa Siska Juminto said that currently there are two types e-commerce, namely (1) the traditional model with product search and (2) the content-based model via live streaming to attract transactions, especially transactions that are impulsive.

GOTO starts to navigate focus E-commerce to more affordable market segments (customer budgets) to encourage potential markets. One of them is improving product search on Tokopedia to further increase user interest. GOTO also seeks to encourage logistics utilization in-house for business E-commerce because the cost is lower.

"We continue to focus on strength core and our capabilities in traditional commerce. We are still building product proposition for more appeal make customer budgets," he said during a performance presentation some time ago.

Both OPEN and BUY also strengthen their strategies as do their positions in the market. BUKA since the last few years has been more focused on utilizing Partner business lines considering share marketplace now controlled by Tokopedia and Shopee. BUKA also actually made a profit last year, but that was also a profit from its investment in Allo Bank.

Meanwhile, BELI, which has just been listed on the stock exchange at the end of 2022, is still solid in executing its strategy omnichannel to accommodate market needs through various sales channels.

"The e-commerce market is still growing. We remain focused on building an o ecosystemmultichannel and maximizing synergies because the need for physical stores remains. This is also in line with our strategic partnerships with principal partners. "Expansion in physical stores further strengthens our position," said Blibli Co-Founder and CEO Kusumo Martanto during the Earning Call session some time ago.

Ecosystem omnichannel owned by BELI does not only present retail products/services, but also electronic products and Grocery. Despite the difficulty of encouraging penetration e-grocery, the company admits that it continues to evaluate product categories that have a better supply stock and cost structure to increase margins.

| Platform | Total Visits (June 2023 - Similar Web) |

| Shopee | 173,9 million per month |

| Tokopedia | 106 million per month |

| Lazada | 70,4 million per month |

| Blibli | 23,9 million per month |

| Bukalapak | 14 million per month |

Based on the 2022 SEA e-Conomy report, E-commerce still the main driving force of the digital economy in Indonesia with a total value of $77 billion in 2022. E-commerce is projected to contribute Gross Merchandise Value (GMV) of $95 billion in 2025.

Sign up for our

newsletter