Startups Reduce Money Burning, GMV of Indonesia's Digital Economy Estimated to Only Increase by 8%

Summary of the e-Conomy SEA 2023 report which also highlights monetization which is starting to tighten as startups shift focus towards profitability

The value of Indonesia's digital economy is estimated to only increase by 8% to $82 billion (around Rp. 1.307 trillion) this year from the previous growth of 20%. Growth in GMV transactions from the travel sector online grows the tallest, followed by E-commerce and online media, temporary ride hailing and food is estimated at minus.

According to the annual report “e-Conomy SEA 2023” compiled by Google, Bain & Company, and Temasek, submitted after mobility restrictions due to the pandemic were lifted at the end of 2022, there was a rebound in activity offline. Seen from travel services online also experienced promising increases, both from the perspective of domestic demand and business travel.

Sectors of the digital economy that previously experienced growth, such as food delivery and E-commerce growth will slow down, even though transportation online predicted to grow rapidly. On the one hand, all three have reduced the number of promotions and incentives they offer in order to balance growth and profitability.

The impact can be seen from slowing growth after price-sensitive consumers choose other options. "However, the number of loyal users is still quite large, thereby offsetting the decline in market growth with an increase in net income growth," the report wrote.

Following are the GMV estimates for each sector according to the report:

This report also highlights the direction of government policy, one of which is Minister of Trade Regulation Number 31 of 2023 which was issued on 27 September 2023. This regulation prohibits features E-commerce and social media in one application. TikTok also removed the TikTok Shop in Indonesia on October 4. Also, ban imports E-commerce under $100 per unit.

“Regulators greatly influence the direction of growth of key sectors of the digital economy. [..] import E-commerce under $100 to support local merchants could have a negative impact on the overall market.”

Another thing that is also being highlighted is GDP growth and inflation in Indonesia which are expected to gradually return to normal. With normalization, GDP growth will tend to return to moderate levels after high inflation in 2022. Fortunately inflation subsided more quickly than expected with falling input prices and the impact of government intervention felt.

"Indonesia's economic growth is still predicted to rise higher than the regional average and will be the main driver of digital economic growth."

Overall, the digital economy in Southeast Asia is estimated to reach $218 billion this year. Indonesia's digital economic value is the highest, but in terms of growth it is the lowest after Malaysia. Here are the details:

- The Philippines grew 13% to $24 billion

- Thailand grew 16% to $36 billion

- Malaysia grew 7% to $23 billion

- Singapore grew 12% to $22 billion

- Vietnam grew 19% to $30 billion

Highlight monetization

It was further explained about the monetization strategies currently being implemented by startups in Southeast Asia which are increasingly accelerating in their efforts to achieve profitability targets, and are starting to show success. They are taking steps to improve their efficiency, exploring new productivity drivers (such as AI) to achieve sustainable and profitable long-term growth.

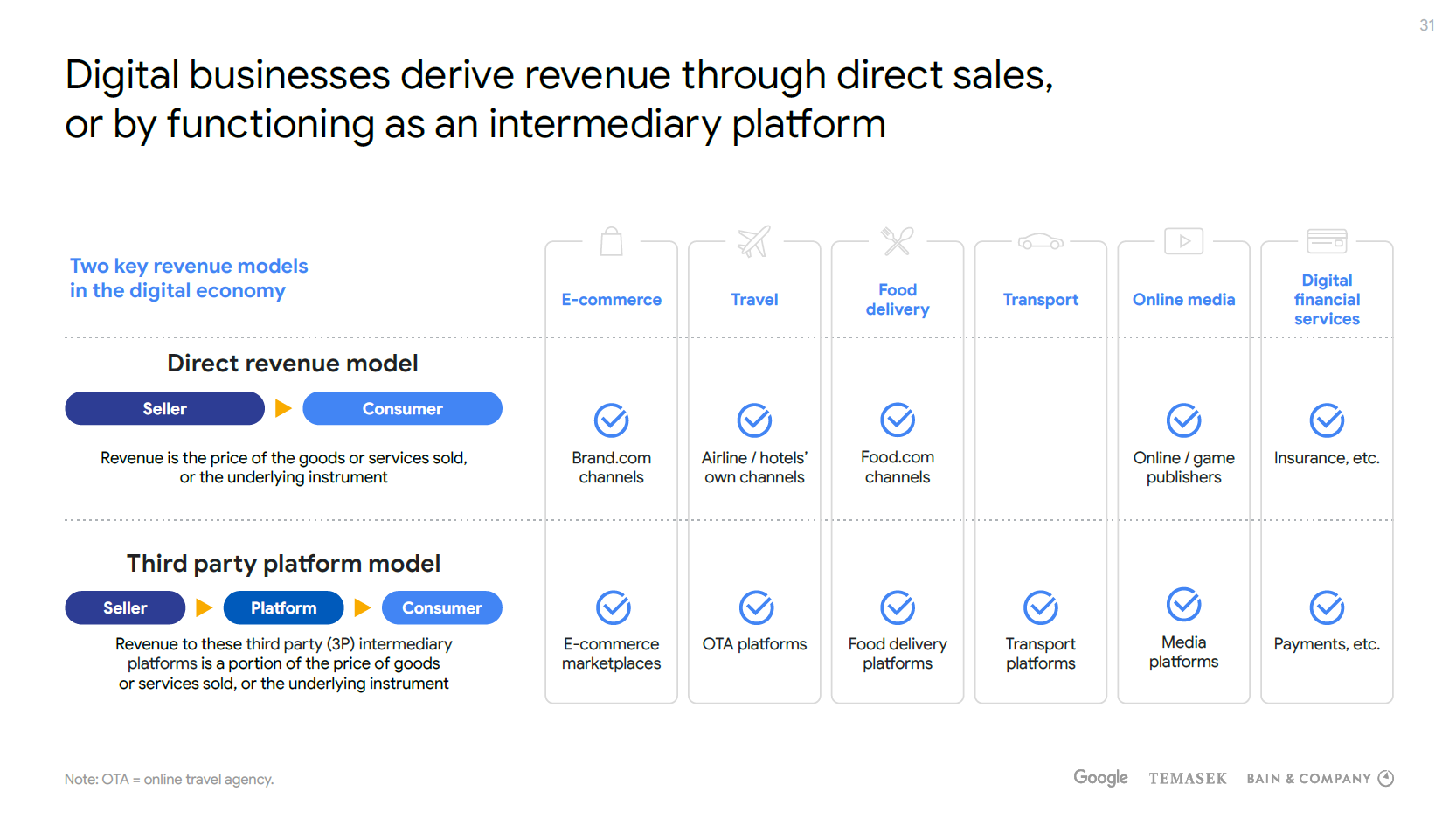

There are two business models commonly used in digital business: direct revenue model and third party platform model. Here are the details:

More Coverage:

“Revenue has grown faster than GMV as players increase take rates and expand into adjacent revenue streams (e.g. logistics, advertising, etc.). It is estimated that this trend will continue in the medium term.”

It continued, “Despite the focus on monetization, GMV will continue to grow even as market players reduce discounts and promotions to increase net take rates. Market leaders have expressed a willingness to start reinvesting profits to maintain their market share.”

One by one, the monetization strategies for these four sectors are detailed:

- Marketplace platform revenues increased due to higher commissions, ad sales, and logistics costs, in a bid to serve as a long-term growth engine. Selling additional services (e.g. advertising, delivery services, insurance, etc.) has become an increasingly common way to increase revenue per order and overall revenue growth.

- The largest OTA revenue is driven by hotel commissions because commissions from travel tickets are small (2%-5%), motivated by a consolidated airline market, competition between OTAs, direct sales channels from airlines. Hotel commissions can be high because OTAs are now moving from a broker-style model (handing the reservation) to a merchant model (managing the transaction) to increase commissions.

- The transportation and food sectors are starting to stabilize their monetization models. After years of focusing on user acquisition, players have shifted to improving unit economics, and are now generating positive net revenue by optimizing commissions and promotional spend – a first step towards sustainable long-term profitability. Consolidation is also underway, benefiting the largest players who have the clearest path to profitability.

- Media revenues are still dominated by advertising contributions, while streaming services drive market growth in the long term. Advertising continues to grow, even as brands are more careful about advertising spending while optimizing profitability. Meanwhile, short-form videos and marketplaces are the main growth drivers. AI continues to help improve targeting and personalization.

Sign up for our

newsletter