Momentum Works: Shopee Leads E-commerce Transactions in Southeast Asia

Total GMV in Southeast Asia to reach $99,5 billion in 2022, 52% of which will be from Indonesia

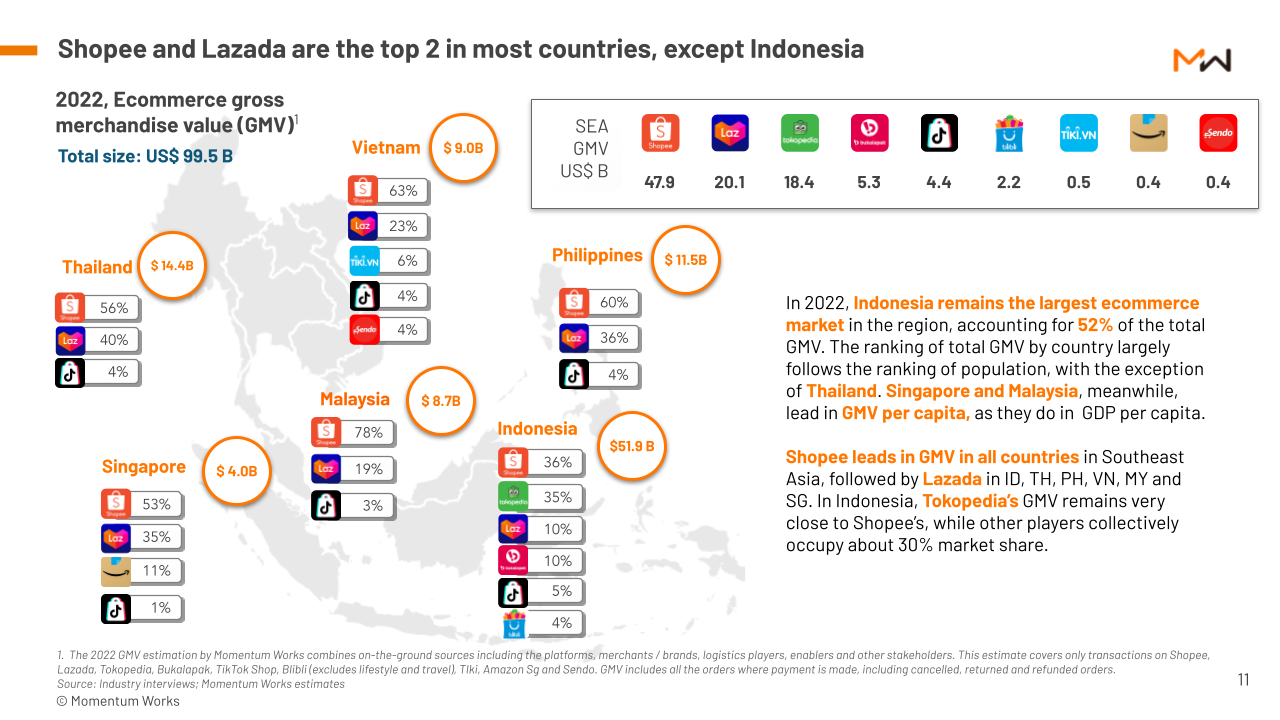

The e-commerce sector in Southeast Asia continues to show strong growth and competition despite various challenges in the digital industry. Shopee is recorded as leading the regional market with a Gross Merchandise Value (GMV) contribution of $47,9 billion, surpassing its competitors, such as Lazada, Tokopedia and TikTok Shop.

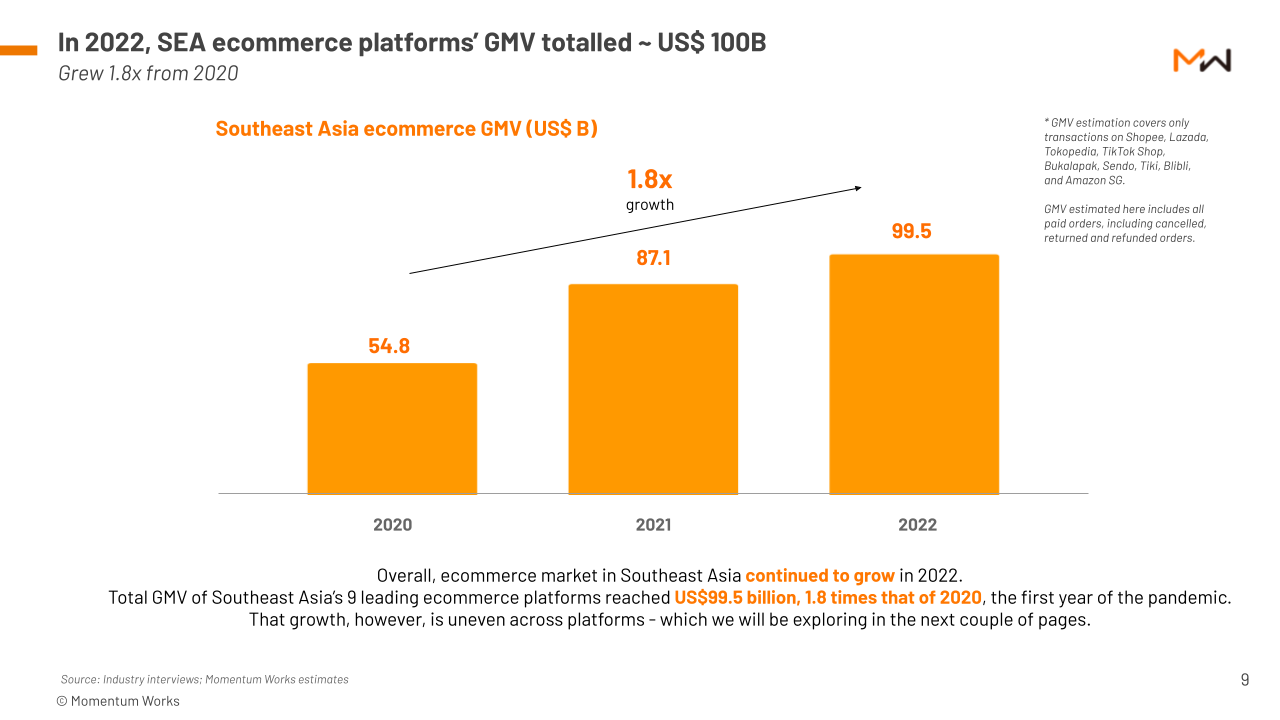

According to the latest report released Momentum Works titled "Ecommerce in Southeast Asia", the nine leading e-commerce platforms in Southeast Asia generated a total GMV of $99,5 billion in 2022, up 1,8 times from 2020, the first year of the pandemic.

Of the total GMV, 52% or $51,9 billion came from Indonesia, followed by Thailand ($14,4 billion). Meanwhile, Singapore and Malaysia occupy the top ranking based on GMV per capita.

Breaking down from the platform, Lazada scored a GMV of $20,1 billion, followed by Tokopedia ($18,4 billion), Bukalapak ($5,3 billion), TikTok Shop ($4,4 billion), and Blibli ($2,2 billion). After Shopee, Lazada occupies the second position in the same order in five countries, except for Indonesia.

In Indonesia, Tokopedia ranks second after Shopee, with a market share of 35% and 36%, respectively, followed by Lazada (10%), Bukalapak (10%), TikTok Shop (5%), and Blibli (4%).

Momentum Works projects Southeast Asia's total GMV to reach $175 billion by 2028 in a normal scenario, with a potential increase of up to $232 billion in a best-case scenario.

Regarding this report, Momentum Works Founder and CEO Jianggan Li said, the e-commerce business in Southeast Asia is likely to follow normal and healthy growth over the next few years. Shopee and Lazada will always share market share with one or two other global players.

"Players who focus on one country to survive, will switch to more omnichannel, where in 3PL logistics only 2-3 large and diversified regional players will survive. Brand owners will continue to work with warehouse supporters/distributors, with more emphasis on building their own loyalty," he said in an official statement.

Li continued, "the endgame may be not in a stable situation, but rather the result of the ever-changing currents, and how platforms can (or cannot) ride those flows."

Stretch TikTok Shop

The report also discusses the rapid development of the TikTok Shop in this region. As is known, last year TikTok's monthly active users (MAU) globally exceeded 1 billion, unlike Meta (Facebook) which made a number of half-hearted bets in the e-commerce business while focusing on advertising.

ByteDance, the parent of TikTok, is very determined to make both of them work globally. It should also be noted that TikTok (the Chinese version is called Douyin) is already making great inroads in e-commerce.

Following its aggressive push in Indonesia, TikTok Shop will expand into five countries in Southeast Asia in 2022, namely Thailand, Vietnam, Malaysia, the Philippines and Singapore. Reportedly, TikTok is targeting GMV growth to more than triple this year or $15 billion.

TikTok's e-commerce approach to users is different from traditional e-commerce players in the region. Some great initiatives, besides rely on video/live commerce, TikTok introduced a page marketplace specifically under the "Shop" tab.

The TikTok Shop initially focused on pushing product sales to the consumer's main view via live streaming and in-feed videos/ads. Then the feature was enhanced to be able to support and integrate multiple channels (such as product search and flash sales) to meet the shopping needs of different consumers.

More Coverage:

This makes it similar to a typical e-commerce platform and is able to encourage impulse buying and inculcate user habits of searching for products and shopping on TikTok.

Beyond that, the TikTok Shop still has a lot of homework. Among them, adding product categories with ticket sizes bigger one to jack up average order value (AOV), and most importantly how TikTok can strengthen its e-commerce ecosystem.

The reason is, so far TikTok has still relied on partnerships with logistics companies, which are the ecosystems most attached to e-commerce. Meanwhile, Shopee, Lazada and Tokopedia have built their ecosystems long ago. For example, Shopee Xpress has a network spread across 8000 points and is able to accept 35% -40% of orders.

Lazada Logistics has even bigger capacity to accommodate orders, around 50%-60% of the total and handled by more than 400 warehouse facilities, sorting places, and delivery points.

Sign up for our

newsletter