TikTok Shop Opportunities Return to Sailing with Local Partnerships

Reviewing the value proposition offered by TikTok Shop and the opportunity to return to operations with local partnerships

Rumors of TikTok Shop returning to the e-markettrade Indonesia emerged last week, precisely since the Minister of Cooperatives and SMEs, Teten Masduki, revealed that the Chinese technology giant was negotiating with players. E-commerce local for consolidation. Tokopedia, Bukalapak, Blibli, Lazada and Shopee are the five players in question.

When confirmed, representatives of TikTok and the company E-commerce associated chose not to comment.

In Indonesia, TikTok as a social media platform has around 125 million users. Data Compass Market Insight said, in the period 1 September 2023 - 1 October 2023 (before it closed), TikTok Shop was able to record sales of FMCG products of up to IDR 1,33 trillion. It is estimated that the platform has impacted 7.000+ seller, 3900+ brand FMCG and 118.000+ product listings in the categories of beauty care, food and drink, mother and baby, health and home equipment.

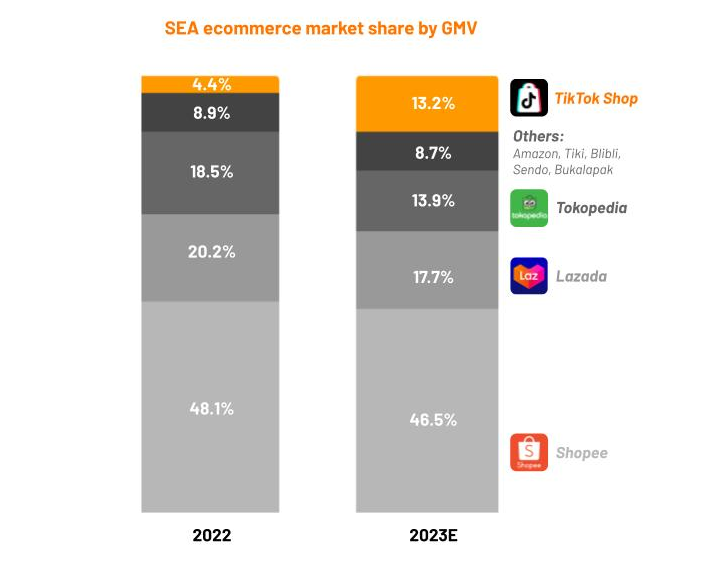

Research firm MomentumWorks in its publication, it is stated that by October 2023 the TikTok Shop service will be able to acquire 13,2% of the total GMV E-commerce in South East Asia. This is the third largest after Shopee (46,5%), Lazada (17,7%), and Tokopedia (13,9%).

This data is an indication of impressive achievements, especially in Indonesia itself, TikTok Shop has only been operating since Q2 2021. Efforts to return to this market are clearly being fought for. TikTok CEO Shou Zi Chew continues to strive for intense communication with the Indonesian government, in this case the Ministry of Trade and the Ministry of Cooperatives and Small and Medium Enterprises.

What makes TikTok Shop superior?

The exponential growth of TikTok Shop is not just luck. There is a mature strategy that has been formulated and has succeeded in presenting a value proposition that is appreciated by the market. Their retail business strategy is called "infinite loop". This approach focuses on bringing together consumers at various stages of the shopping journey/process (online). Through the power of personalized content, they drive more meaningful connections between brand and consumers.

This concept takes consumers to three important stages, as follows:

- TikTok impacts every stage of the retail journey—discovery, consideration, and purchase—more effectively.

- Post-purchase, TikTok maintains its influence through user-generated content such as videos unboxing and tutorials, which encourage brand loyalty and community engagement.

- TikTok stands out by creating positive experiences that resonate with users, encouraging them to associate joy and euphoria with their purchases.

This is based on an internal survey in 2021 which said that 49% of TikTok users used this media to discover new things, 35% to learn new things, and 29% to look for inspiration. According to the same study, TikTok users are 1,5x more likely to immediately purchase something they find on the platform compared to users of other platforms.

This can only be done when the sales platform is integrated with TikTok's – or so-called – content services social commerce. According to the latest regulations published in Indonesia, currently social media organizers such as TikTok or Meta are prohibited from selling directly using the same application – there must be separation between social media applications and buying and selling services.

Another study states that, since its launch in 2021, TikTok Shop has reached 6 million sellers in Indonesia. In 2022 they will control around 5% of GMV e-trade nationally which reached $52 billion.

live commerce in local players

According to research results SEA Ahead Wave 5, most consumers in Southeast Asia access live stream via social media platforms (83%) such as Facebook Live, Instagram Live, and YouTube Live, platforms E-commerce (64%) including Shopee, Tokopedia, Lazada, and others, as well as platforms live stream or special applications for live streaming (11%) such as Twitch and Periscope.

In the Indonesian market, 78% of consumers have heard and know about shopping alternatives live streaming, 71% of whom have accessed it, and 56% admit to having purchased products through live streaming during the pandemic.

This trend encourages a number of platforms to strengthen features live commerce, by highlighting the feature in the app E-commerce each. In Tokopedia for example, in their main display "Feed" is one of the main menus. They even routinely present special promos via broadcast live which is conducted by seller – also by collaborating with national celebrities to also appear during sales sessions live.

Other players such as Shopee also do similar things. Shopee reportedly fought fiercely with TikTok Shop to lead the market live-shopping in Indonesia. A number of records have been broken, for example when Raffi Ahmad live on Shopee for 12 hours managed to achieve a sales turnover of IDR 7 billion.

From this it can be concluded that the concept of TikTok Shop has actually begun to be adopted by players E-commerce local. So the question is, if TikTok succeeds in consolidating with certain players, what kind of integration will be carried out?

TikTok consolidation opportunities

To be able to return to the market E-commerce locally, there are two choices that TikTok can take: (1) create a separate TikTok Shop application; (2) collaborate with other players.

With the exploratory rumors above, TikTok seems to be choosing the second option. This is quite a reasonable choice, considering when it comes to business E-commerce, the dependency is not only about the sales platform, but also related to supporting infrastructure such as fulfillment, logistics, payment, affiliates, to customer service.

Of course, the next challenge is how to integrate TikTok with potential partners so that it can be strategic infinity-loop this can still be done.

We think there are several scenarios that can be carried out, namely:

- Embedded Ecommerce; allows the shopping cart on TikTok to be active again, allowing users directly (without switching applications) to make purchase transactions. However, those whose role is to carry out transactions (in backend) is a service E-commerce who are partners. System E-commerce seamlessly connects into the TikTok service via a special API connection between systems.

- Integrated Affiliation; allows TikTok to become a more integrated promotional medium. Each product that is possible to purchase will have a sales link to a specific store. And when the store is visited, it will automatically redirect the user to the service E-commerce certain to complete the transaction.

- Acquisition; TikTok acquires units E-commerce specifically to turn it into the next generation TikTok Shop.

More Coverage:

For the record, this scenario is our estimate – not based on official statements from the relevant parties. The three scenarios above (if carried out) will at least comply with government regulations. Basically there are two business units that are run in two different entities, even though they have a close relationship with each other.

Impact on the market E-commerce local

Latest report e-Conomy SEA 2023 project sectors E-commerce in Indonesia will reach $62 billion this year and grow to $82 billion in 2025. Clearly this is not a small industry value, so all industry players continue to strive to be at the forefront.

TikTok's success consolidates with one of the players E-commerce local has the potential to change the competitive landscape. With the large user base it already has, TikTok can better drive purchasing decisions towards a product. The new habits offered through the TikTok Shop also have the potential to be revived to flow the taps that were previously stopped due to the cessation of TikTok Shop operations.

The excitement of TikTok Shop's closure last month also shows how significant the influence of TikTok Shop is on the buying and selling market online in Indonesia. Originally TikTok Shop (and platform social commerce others) are “accused” of being one of the main reasons why certain traditional retail sectors are quiet and open pintu for imported products (which have the potential to kill local MSMEs). In fact, after the closure, Tanah Abang is still the same few fans.

This issue is indeed sensitive, so next time TikTok Shop come back – under any scenario – it is hoped that they will prove that they are on the side of Indonesian MSMEs.

Technology has democratized Indonesia's retail sector. Simultaneously, he also succeeded in opening up various new opportunities to raise the economic status of many people throughout the archipelago. It is hoped that the presence of innovative services can accelerate economic turnaround, while providing inclusive services so that they can help equalize prosperity throughout the country.

Sign up for our

newsletter

Premium

Premium