Cashlez Targets Business Growth Through Company Acquisition and Adds Online Merchant

Planning to raise funds through a rights issue in the first quarter of 2022 to support the inorganic strategy

PT Cashlez Worldwide Tbk (IDX: CASH) plans to acquire companies to encourage inorganic business growth in 2022. To support this plan, Cashlez will raise funds through the Pre-emptive Rights (HMETD) or rights issue in the first quarter of 2022.

It is delivered Cashlez during session media visits to the editorial team DailySocial.id virtually. This session was also attended by Chief Revenue Officer Djayanto Suseno and Corporate Secretary Hendrik Adrianto.

His party revealed that Cashlez will hold a rights issue the first stage with a value of $10 million or around Rp143,8 billion which will be used as working capital and product development. Then, Cashlez will do rights issue the second stage for acquisition needs.

According to Djayanto, the company is currently preparing The roadmap for the next five years covering organic and inorganic business strategies. Regarding the inorganic strategy, Cashlez opens the option to acquire the company. However, Djayanto could not provide further details about the business categories and companies to be acquired.

"That's why we want fundraiser Lewat rights issue. We are looking for investors who are ready to become standby buyers. There are outside investors who are interested, there are also internal investors. We have submitted everything to financial adviser us, namely Bahana [Sekuritas]," he said.

According to him, the company will continue to empower existing resources to encourage organic business development. However, that alone is considered insufficient considering that Cashlez wants to develop a larger digital payment ecosystem.

"For us at this time what is more appropriate is not what we will acquire, but the amount of funds raised. That way, we can know what we can buy," he added.

Cashlez was founded by Teddy Setiawan Tee in 2015 which offers financial solutions, namely payment gateways, payment aggregators, and mPOS solutions. In 2017, Cashlez obtained investments from Mandiri Capital Indonesia (MCI), and Sumitomo Corporation in 2019.

Aim online merchant

For information, Cashlez pocketed 18 billion transactions in total from 436 merchants in 2016. As of the end of 2021, the company has served 13.000 merchant in six cities connected to 7.000 EDC devices. Breaking down by merchant category, 30% of users come from the retail segment, 18% from restaurants, and 12% from fashion.

Cashlez recorded a total Gross Transaction Value (GTV) in 2020 of Rp5,9 trillion. Djayanto said that there will be a decline in GTV in 2021, which is around Rp. 4,3 trillion to Rp. 4,4 trillion. This decline occurred due to the closure of malls in a number of areas. This situation makes it difficult for merchants to sell.

To anticipate the decline, said Djayanto, Cashlez will continue to increase the number of merchants, but will focus on MSME merchants that serve online transactions. For comparison, the composition offline merchant in Cashlez by 90%, and the remaining 10% online. This year, Cashlez will significantly increase the portion of online [transactions from merchants].

"Until now, no fintech which has the ability to [serve transactions] on an O2O basis. Usually only strong in online just. So we're the only ones who have O2O capability at the moment," he said.

Social commerce

Trends in buying and selling products through social media aka social commerce growing significantly in Indonesia. Apart from the large population of social media users, the Covid-19 pandemic situation in Indonesia has actually triggered the emergence of small business actors who sell online.

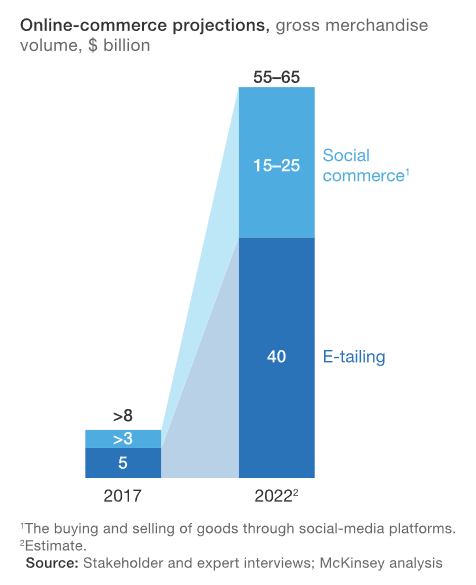

A number of reports project trends social commerce will continue considering there is potential in tier 2 and 3 cities that are starting to sample online transactions. According to McKinsey research, transactions social commerce in Indonesia is estimated to account for $25 billion of the total projected GMV E-commerce of $65 billion in 2022.

More Coverage:

While referring to the report Momentum Works, social commerce become one of the attractive options for MSME actors because the cost of customer acquisition is cheaper, and users are more flexible in exploring or finding the product they are looking for.

In the sampling, this trend is also predicted to provide a great opportunity for the needs of the payment system, considering that MSME actors do not have the access or ability to provide it.

Sign up for our

newsletter