OLXmobbi Consolidation, Astra's Step to Compete in the Used Car O2O Market

Sales of Astra four-wheelers were recorded to have fallen 23% (YoY) to 40.438 units as of March 2024

The used car market is still very popular with Indonesian consumers. Throughout 2023, the sales volume of new cars is estimated to be around 1 million units, while used car sales are expected to exceed that figure.

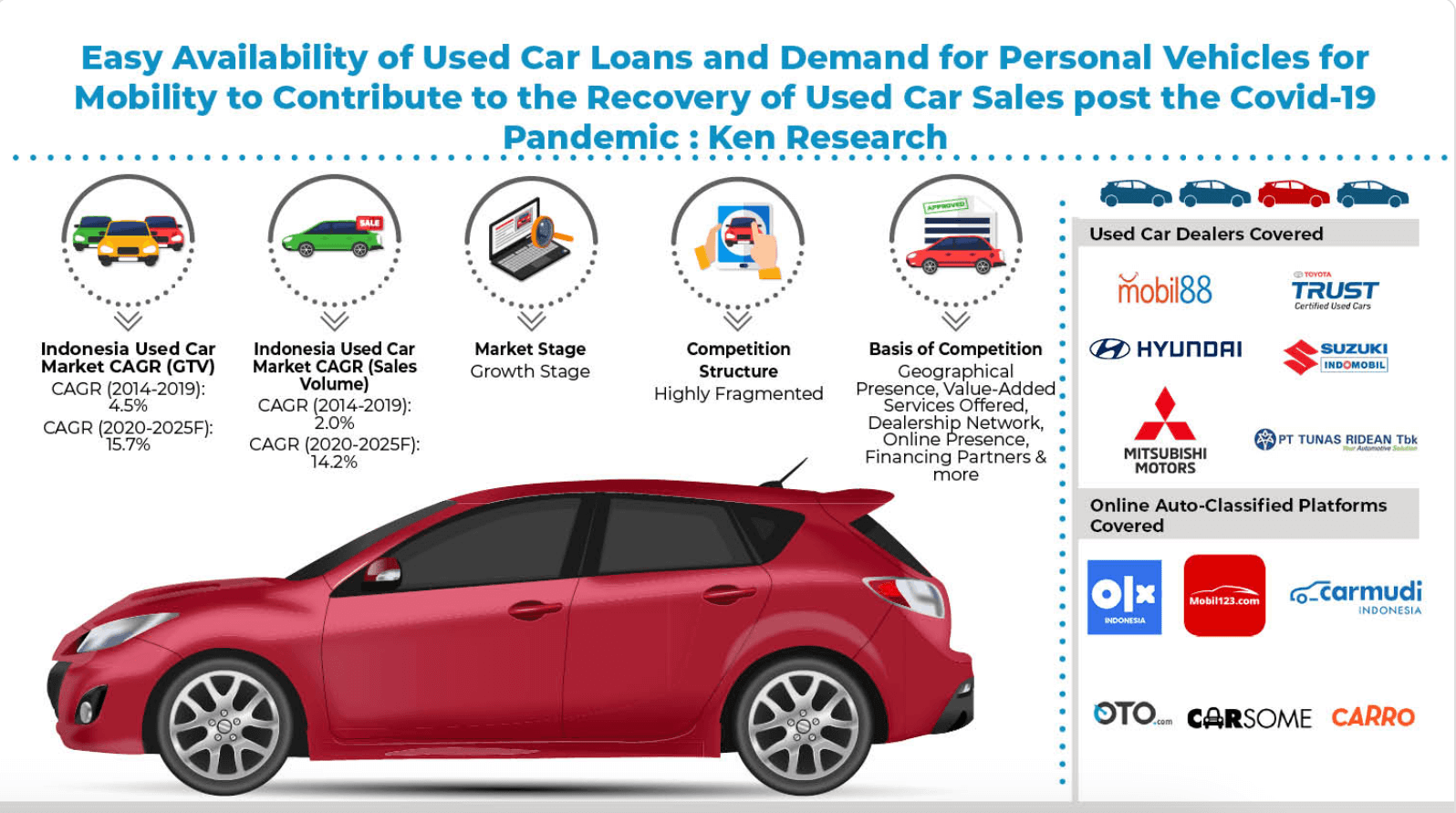

Referring to the report Ken Research, used car sales volume in the country is projected to grow at 14,2% CAGR (2020-2025F). One of the driving factors is the availability of credit or financing facility options.

Platform presence marketplace Automotive has long provided new ways for consumers to seek more choices. Digital platforms are widely used to place advertisements for selling used cars, which makes it easier for consumers to check first before visiting showroom.

Other published surveys DSResearch in 2018 said that 96% of consumers use digital platforms to search for information, sell or buy cars.

Astra boosts O2O

On a regional scale, Indonesia still dominates the largest vehicle sales in Southeast Asia with a total of 3,35 million units throughout 2023 according to the ASEAN Automotice Federation (AAF) report.

Several key players in the domestic industry are taking a number of strategic steps to strengthen their service ecosystem and compete with foreign companies that acquire domestic automotive platforms.

This step was also taken by the conglomerate company Astra by annexing OLX in 2023. Last month, Astra officially announced the merger of Mobil88, mobbi and OLX Autos to become OLXmobbi. Now, OLXmobbi is under the auspices of PT Astra Digital Mobil.

"The merger of three big players in the Indonesian used car market, namely mobil88, mobbi, and OLX Autos, is expected to make the used car market in Indonesia even more enthusiastic, and the Astra Group used car buying and selling business increasingly solid," said the President Director of Astra Digital Mobil. Naga Sujady in a separate statement to DailySocial.id some time ago.

Moreover, this is also the company's strategy amidst the declining trend in new car sales. It is known that sales of Astra four-wheelers fell 23% (YoY) to 40.438 units in March 2024. Nationally, Astra controls 54% of the new car market share in Indonesia.

Naga revealed that OLXmobbi will bring the experience omnichannel by combining offline and online (O2O) channels. With the B2C model, OLXmobbi connects showroom belonging to the Astra Group ecosystem to used car buyers.

Before the presence of OLX and mobbi, Astra's offline car sales were carried out by its subsidiary, Mobil88. Joining the OLX ecosystem is considered to increase OLXmobbi's credibility, especially the performance of buying and selling used cars in the future.

"We are considering various options for expansion, including looking at markets and locations that can provide significant benefits to our business. However, we have not yet decided on the exact time for this expansion," he explained.

OLXmobbi has more than 30 stores and inspection centers in 10 major cities in Indonesia, including Jabodebaek, Bandung, Surabaya and Denpasar.

They are reluctant to elaborate further, but this merger allows them to synergize with other Astra digital initiatives, such as Astra Otoshop, a platform E-commerce B2B and B2C for two-wheeled and four-wheeled vehicle spare parts and Auto2000 Digiroom which serves after-sales, workshops and home service.

So far, the Astra Group has digital lines that are targeted to generate new sources of income, such as Motorku X, AstraPay, Moxa, Maucash, Seva.id, Movic, Mobbi.

Player consolidation

In recent years, the automotive sector has seen many consolidation actions. Mergers and acquisitions were pursued in line with difficulties in accessing capital and efforts to increase efficiency amidst macroeconomic difficulties. Cars 24 left Indonesia last year.

More Coverage:

In its competitive map, OLXmobbi will compete with a number of platforms, such as Mobil123, Carsome, Carro, and Carsome. As an illustration, Carsome now houses Mobil 123 and Carmudi. Carsome plays in C2B2C, which not only sells directly to consumers, but also buys from consumers and sells to dealer networks.

| Company | acquirer | Year |

| Carmudi Indonesia | iCar Asia | 2019 |

| iCarAsia | Carsome | 2022 |

| MPRent | Car | 2023 |

Interestingly, several other players have entered the financing business (multi-finance) to accommodate vehicle financing needs while strengthening their used car ecosystem.

Carro acquired 50% of MPMRent shares, which is a car rental provider. Carro also has its own financing business through PT Sembrani Finance Indonesia. Meanwhile, Moladin recently entered the multi-finance business which has OJK permission.

Another strong competitor, OTO.com not only plays in used cars, but also motorbikes, trucks and electric vehicles. OTO.com is a subsidiary of Girnar Software Pvt. Ltd which also operates CarDekho and Zigwheels, India's largest car portal.

Sign up for our

newsletter