Leo Koesmanto: Transformation of Bank Saqu and Its Efforts to Attract Solopreneurs

Exclusive chat with President Director of Bank Jasa Jakarta Leo Koesmanto

The euphoria of digital banks may be starting to slow down, but the industry is believed to still have potential. The last three years have been used to introduce digital banks with savings products as a way of entry.

At the beginning, digital banks were enlivened by players supported by technology groups or large banks, for example Bank Jago (GoTo), Bank Neo Commerce (Akulaku), or blu (BCA). On average, they take advantage of small bank acquisition schemes to easily develop their ecosystem rather than starting from scratch.

The Astra conglomerate group will become the final participant in 2023 by introducing Saqu Bank application. One year was used to complete it acquisition transaction with WeLab, and transforming Bank Jasa Jakarta (BJJ).

Acquisition and transition of Bank Jasa Jakarta

For almost 40 years, BJJ operated as a conventional bank. If you want to transition to digital, companies need large IT investments. "We believe going digital itu inevitable, but the investment is big. And this is not talking about investment corporate banking, but consumer. Need Capex in front of. "Meanwhile, we are a relatively small bank," said President Director of Bank Jasa Jakarta Leo Koesmanto when chatting with DailySocial.id.

For your information, Leo Koesmanto is a banker with a long career in banking digitalization. He served as Managing Director Head of Digital Banking at PT Bank DBS Indonesia.

At the same time, WeLab, which had already established a virtual bank in 2020, was considering expanding to Indonesia. Then, Astra Financial with the Astra Pay portfolio and maucash, is also intensively developing digital-based financial products.

He assessed that the digital banking industry will still grow positively this year, especially in Indonesia. Even though the euphoria is not as big as a few years ago, Leo said that banking is a long-term business, and is not based on aspects digital banking.

"Our [digital] market is currently attractive, but this transformation can no longer be done the old way. Finally, WeLab and Astra entered Bank Jasa Jakarta. In this agreement, WeLab brings the technology, Astra brings the ecosystem for market access. The transition process is quite fast. In "7-8 months, we will be ready," he explained.

Leo has not been able to share Saqu Bank's development plans this year, citing a focus on technology transition and development Branding the product. Likewise with its integration into Astra's ecosystem. During the transition period, BJJ uses WeLab's technology in Hong Kong, but it is currently in the process of building its technology in Indonesia.

Meanwhile, several Saqu Bank products that have been launched include Tabungmatic (Savings), Busposito (deposits), and Saqu Booster which allows users to get boost with interest of up to 10% of the transaction return.

"Ecosystems are one of the important aspects in digital banks because acquisition costs are expensive. Of course we will embed function into the Astra ecosystem so that users don't just use their savings. However, we haven't done much in-depth research because it's still early days, and we're still focused on savings products. "In the future, we will expand to loan products," said Leo.

The claim is that the Saqu Bank application has received positive traction in the market with 300.000 customers in two months. His party will also not add branch offices and rely on branches Existing Bank Jasa Jakarta in 13 locations.

Products in mindset solopreneur

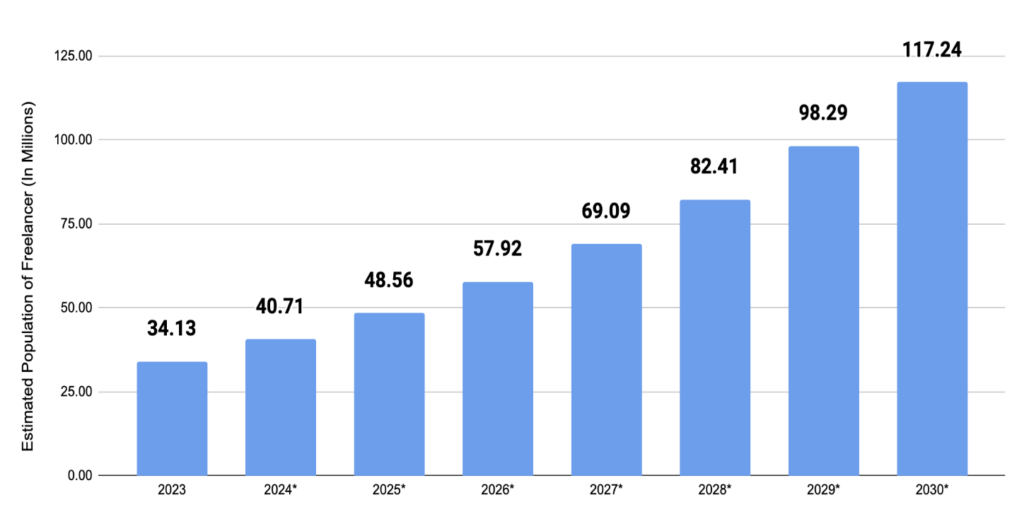

Bank Jasa Jakarta is said to want to bring different added value by entering a more specific segment, namely solopreneur. According to the definition, a solopreneur is an individual business owner, or an office worker who has a side project. The number of solopreneurs in Indonesia is estimated to reach 117 million by 2030.

"For a long time, there have been many people who have had side jobs, but this is a solopreneur. This means that individuals are different from SMEs which have employees. Solopreneurs have a productive mindset," said Leo.

In translating the needs of solopreneurs, the team saw that solopreneurs tend to have a mindset of working hard, but can still have fun enjoying the results. Savings is the main product at the moment, with loan products likely to follow.

"Digital banking is synonymous with personal banking. However, Bank Jasa Jakarta's DNA is SMEs. Indeed, the sector is retail, but our consumers are not in the segment mass market, but rather those who have a business and need working capital. Of course personal banking "It makes it easier to open an account, but there are things in the business sector that can't be that fast," he said.

Digital banks tend to target the millennial and Gen Z segments who are considered to be fluent in digital activities. Bank Jago is one of them. Meanwhile, other digital banks have entered with different positions in the market, such as Royal Bank which targets informal workers or Aladdin Bank attracting the Alfamart retail network so that it is closely related to the daily aspects of users.

According to a report from the Ministry of Cooperatives and SMEs, the pandemic has sparked new habits for Indonesian people in digital transactions. This new habit has helped encourage the adoption of e-commerce services and digital payments, which has also given rise to the emergence of new business actors.

Sign up for our

newsletter