Pinhome Presents Property Financing Services for People with Non-Fixed Income

Pinhome cooperates with PT Sarana Multigriya Finansial (Persero) which is a BUMN under the Ministry of Finance

The need for housing has always been an interesting topic to discuss. Many people already have an idea of their dream home in the future. However, house prices are increasing every year, making some people confused about whether to rent or start paying for a new house.

In 2020, BPS stated that more than 71 million low-income people in Indonesia, 15% of them or around 11 million people do not have a decent house to live in. One of the main obstacles that prospective buyers face is the down payment (down payment) which usually reach a minimum of 15-20% of the total price of the house.

Seeing the facts that happened to the community, platform marketplace sale-purchase-rent (proptech) pinhome introducing the latest solution, namely a special house installment program to facilitate low-income people and non-fixed income (NFI) people to own their dream home with the tagline #CicilDiPinhome.

"We hope that with this program, more and more people can get their dream home towards a better life." explained Founder & CEO of Pinhome Dayu Dara Permata.

How to get installment facilities at Pinhome

Armed with the main vision to provide easier access to the property industry to improve livelihoods and financial inclusion for the people of Indonesia, the #CicilDiPinhome program can be enjoyed in four easy steps.

First, consumers determine the dream house they want to own, and Pinhome will conduct an inspection of the legality of the house. The second step is for consumers to send required documents such as ID cards, NPWP, proof of income, and pay first payment which is refundable. Finally, consumers can now occupy the house of their choice and pay monthly installments until it is paid off.

Several value propositions are also offered including with no processing required checking from BI or the Financial Information Service System (SLIK), which makes this program open to those with irregular incomes. In addition, the #CicilDiPinhome Program does not require an income profile attachment and offers flexible installments of up to 50%.

Chief Commercial Officer pinhome Muhammad Hanif also revealed, "We also see that there are some consumers who actually already have sufficient income, but cannot enter the banking mortgage criteria because their income is not fixed. At #CicilDiPinhome we try to simplify the documents needed by potential buyers, while maintaining transaction security because all landed houses that enter this program can be monitored via website Pinhome."

Cooperation with SMF

In providing this service, Pinhome cooperates with PT Sarana Multigriya Finansial (Persero) which is a BUMN under the Ministry of Finance which was specifically established to support the housing sector. This collaboration is carried out in the context of synergizing the provision of home ownership facilities which will later realize the Rent-Buy Mortgage Program with the rent to own. This product is expected to increase access for low-income or low-income people non-fixed income to be able to own occupancy through a rental scheme and then proceed with the option to buy in the middle or at the end of the rental period.

Director of Securitization and Financing of SMF Heliantopo revealed that SMF's presence as a Pinhome partner is a manifestation of the state's presence to support the improvement of community welfare, especially low-income communities in order to fulfill housing needs.

"SMF as a Special Mission Vehicle (SMV) under the ministry of finance has a mission that is in line with Pinhome to be able to realize access and affordability for every community in Indonesia to be able to have decent housing. For this reason, the lease-purchase program is expected to reach segments of society that have been it has limited access (unbankable)," he said.

To date, Pinhome has offered more than 600 thousand property options with around 25 thousand service providers spread across 100 cities. In addition, the company has cooperated with more than 20 banks and finance throughout Indonesia to provide a variety of offers and financing for potential buyers. In a period of 2 years, Pinhome managed to score a transaction value of trillions of Rupiah, one third of these property transactions were at most under 300 million.

Financing potential in the property market

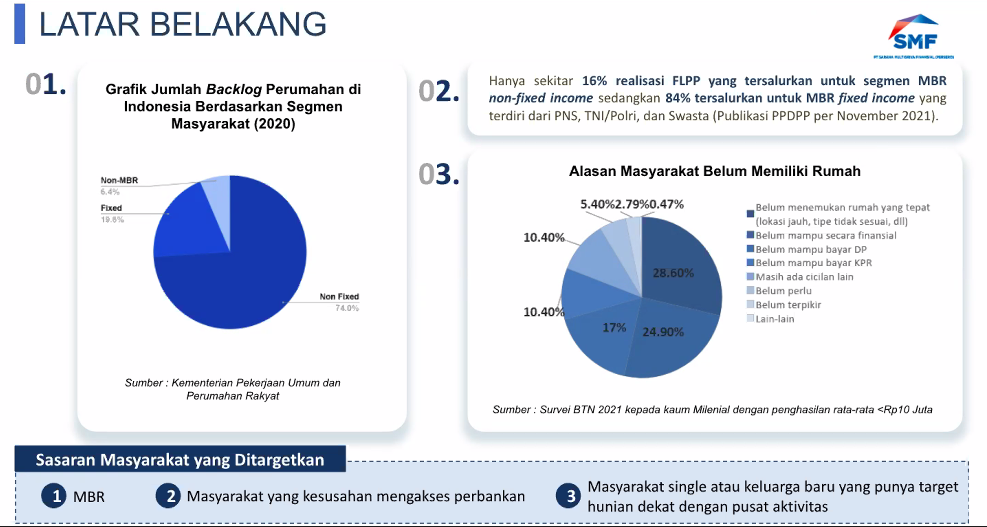

Based on Pinhome's internal data, financial institutions tend to serve property financing in the white necklace or people with fixed income (fixed income). This is what causes about 70 percent of rejection of Home Ownership Credit (KPR) applications due to eligibility or feasibility factors.

CEO of Indonesia Property Watch Ali Tranghanda who was also present at the online press conference (16/3) also revealed that the impact of the COVID-19 pandemic, consumer interest in buying houses in this segment was relatively small, because the pandemic had a significant impact on purchasing power. Therefore, there needs to be another scheme that can accommodate the needs of this segment, which can not only boost sales, but can also provide fresh air to low-income and precarious people.

In addition, the obstacles faced by the community are related to the strict Financial Information Service System (SLIK) to get a mortgage, even though they are financially capable. The stages of submitting a mortgage that are quite long and involve many parties are also one of the concerns of prospective buyers.

More Coverage:

Based on data from SMF, some of the reasons people don't own a house are because they haven't found the right house, are not financially able, can't afford a down payment, can't afford a mortgage, still have installments, feel they don't need or think about it, and so on.

There are more than 50% of the people who disclose financial reasons. This shows that financing options are really needed in the property sector so that not only people with fixed incomes, but also people with low and non-permanent incomes can own houses more easily.

In Indonesia itself, there are already several players who also offer solutions in the property industry. Call it 99.co and Rumah123 which are under the auspices REA Group, Rumah.com, also new players like PintuI had and Window360 who is planning a fundraiser. There are also fintech platforms that focus on property, one of which is Gradana.

Sign up for our

newsletter