Explore How Pinhome Digitizes the Overall Property Ecosystem

Support the supply and demand side with technology; has handled transactions worth trillions of Rupiah since operating

Currently, the ecosystem proptech Indonesia is not yet fully digital. The existing players are still only a property search portal, even though it is only one of the long processes in finding the ideal residence. In practice, buying a house in Indonesia is generally difficult because it is closely related to the issue of growth inequality between young people's income and the desired house price.

However, according to published survey results, Goodwater, as many as 28% of Indonesians are planning to buy property in the next 1-2 years. The next highest position is held by those who answered in the next five years by 25% of respondents and will then buy over the next five years by 14%.

It is projected that 150 million young people are in their productive age and they are property consumers for the first time who have not been touched by players. proptech at the moment. Pinhome is trying to answer this need by releasing a consumer application on Facebook early October as part of the company's efforts to digitize the property ecosystem.

“This app has features that nobody in the property industry doesn't have. This is a form of our support in providing property access to 150 million millennials because we believe they will be the driving force for the property industry in the future," said Pinhome Co-founder and CEO Dayu Dara Permata in a press conference held yesterday (25/11) .

Rely on innovative features

The features embedded in the application cover all the problems experienced by property seekers in Indonesia. Dara explained, from an internal survey conducted by the company, respondents answered that when they wanted to look for property, there were three complaints that were generally felt. Namely, it is difficult to find the right and reliable information, do not know a fair price in the market, and hesitate to choose the most suitable payment method.

Then, when they have found a home option, again find three issues. Namely, property information is not complete, accurate, and representative; it is often difficult to contact property sellers; and the selection options still don't match the preferences. Issues arise again when they decide to buy property. Namely, lack of knowledge about mortgages, many unknown costs, and sometimes not getting information on the development of pivot projects.

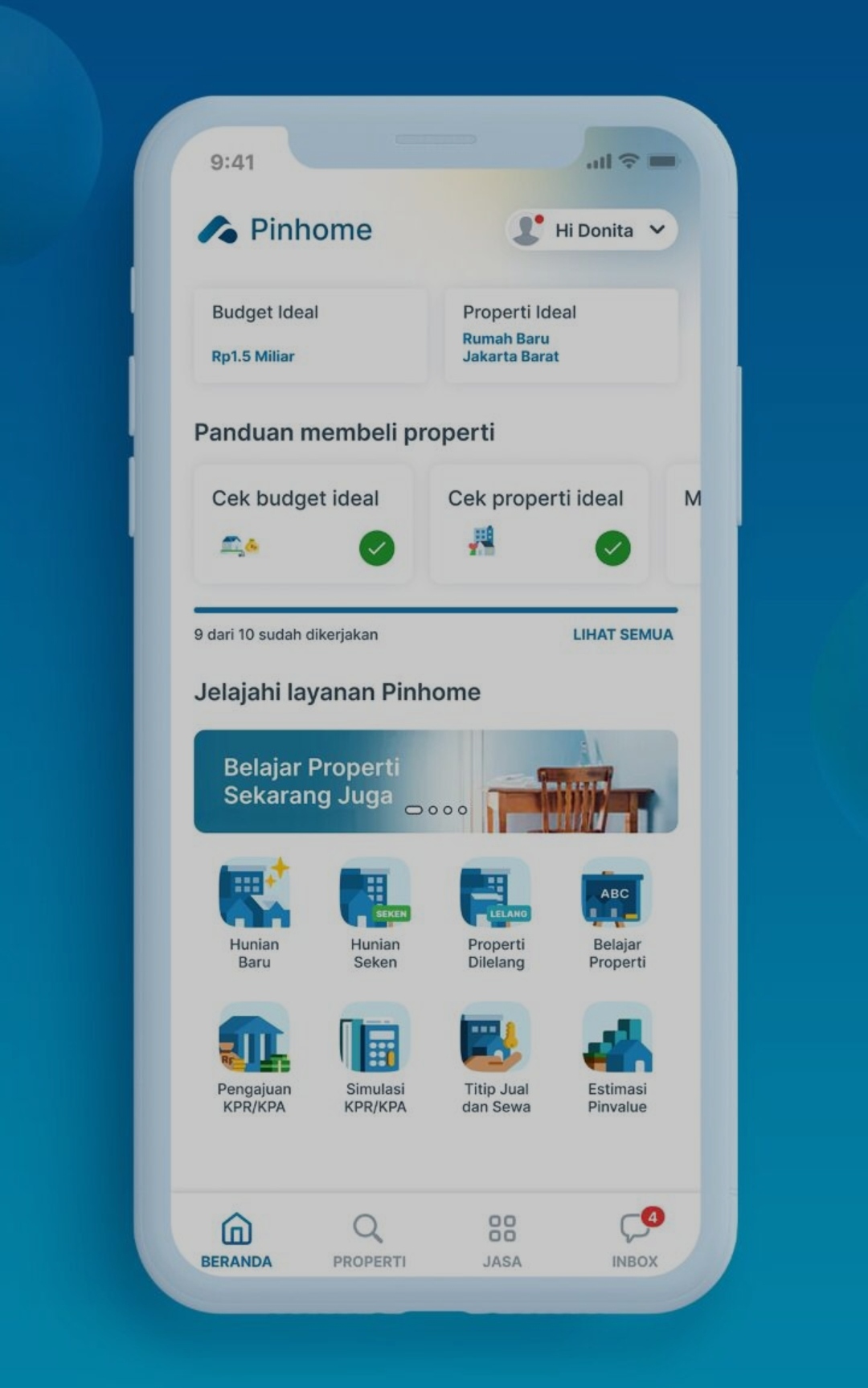

The Pinhome application is equipped with a series of advantages, one of which is a guide to buying property. Users will be guided in determining budget and ideal properties, payment options, contacting agents, making property visits, determining price estimates, mortgage guidance, starting transactions, preparing important documents, to the handover process all in one application.

There is also a PIN value which is the range of values / prices of a house, apartment or other residential property on the market according to Pinhome. Thus, consumers can get an idea of the price when they want to buy or sell a house.

“From all experiences of buying a house by 100%, now Pinhome has digitized about 80% of it. We will continue to improve the consumer experience, so we can frictionless and seamless pattern. "

Dara gave an example, applying for a mortgage usually takes a long time because consumers usually have limitations in finding the best mortgage offer recommendations from financial institutions. Even when they get it, banks usually require consumers to pass the pre-qualification stage to determine whether they are eligible for a mortgage.

However, in the Pinhome application, at least consumers can get to know range properties they can afford and what they look like range installments, as well as recommendations for one or two Pinhome partner banks in less than 1 minute. The recommendation is taken from the algorithm of the consumer profile. "Even though this bank recommendation is ultimately a consumer decision, at least with a recommendation it can make consumers make the best decisions."

After that, when applying for a mortgage, agents are usually assisted. The Pinhome application allows consumers to monitor until it is approved. "Currently not all the process" paperless, but at least the submission can betracking progress online. ApprovalIt can also be known through the application.”

According to an internal Pinhome survey, mortgages are still the belle of the younger generation in buying their dream home. As many as 78% have a bank mortgage method, 12% choose the cash method (cash hard, cash gradually), and 9% use KPR finance. Because of the importance of the mortgage program for homeowners, Pinhome also opens up opportunities for mortgage refinancing.

Currently, Pinhome has partnered with 50 financial institutions, ranging from banks and finance that consumers can choose from.

Not only supporting the need to buy or sell a house, the Pinhome application is also embedded with household and lifestyle services, Pinhome Home Service (PHS). This solution is to target Pinhome users who want to take care of their homes, even though they don't plan to buy/sell a house in the near future.

This PHS includes house cleaning services, car washing, AC washing, massage services, and other services fogging disinfectant. PHS partners have spread across 27 areas throughout Indonesia.

Digital solutions for the supply side

From the supply side, pinhome also actively develops various digital solutions for property agents and property offices, developers, banks and finance, to service partners. They are all part of a property ecosystem that is no less important in need of digital solutions to simplify their activities.

Pinhome co-founder and CTO Ahmed Aljuneid details the solution for real estate agents that the company has released in the form of an app. This application is also packed with features that make their work easier, ranging from comprehensive guides (hundreds of thousands of listing, referral mortgage, install listing free, and property education); instant commissions for primary property projects; Co-Broke with property agents (Wants to Buy/WTB, Wants to Sell/WTS, and Wants to Rent/WTR with control in the hands of agents); and online transactions (simplifies client management, SPR details, commission tracking from various projects in one place.

"Although anyone can become an agent at Pinhome, we carry out special verification to ensure that they are not rogue agents," he said.

More Coverage:

Furthermore, property developers are provided with a platform that facilitates their overall operational activities. Finally, for the property office, a special CRM platform is provided that fully supports brokerage partners, starting from agent management, listings, and transactions in one dashboard. According to Aljuneid, this solution will be available in the near future.

Not only digital platforms, Pinhome also inaugurated a collaboration space called PINArena. This is a means for all members of the Pinhome community to carry out various activities with the support of facilities that can be tailored to their needs. Property agent partners, property office members, and Pinhome partners can use PINArena for free for seminars, gatherings, meetings, workshops, or as a workspace facility.

PINArena has a maximum capacity of 75 people, includes four rooms plus several meeting pods, mini studio, seminar room, breakout area, private room, and snack bar. One PINArena location that has been inaugurated is located at Pinhome HQ, 18 Parc Palace, South Jakarta.

Regarding the achievements of Pinhome, so far the company has more than 500 thousand listing properties on its site spread across 10 cities, the site has been visited by more than two million unique visitors each month, and a network of 25 thousand agents, realtors, property & developer offices, and service partners.

Dara only mentioned that the company had handled property transactions amounting to trillions of Rupiah. With details, 33,5% of property transactions are under Rp. 300 million, 24% of transactions are between Rp. 301 million-Rp. 700 million, West Java is the area with the most sales. Then, the property worth IDR 51,2 billion is unit primary most expensive ever transacted, while for units secondary for Rp. 14,5 billion.

Sign up for our

newsletter