Overview of Digital Business Competition in the Four Most Popular Sectors in Indonesia

Indonesia is the largest digital market share in the region

Judging from the business activity – including market share value and investment rounds – there are several digital sectors that are growing significantly in Indonesia. One of them refers to the results of research Google and Temasek this year, the four main sectors that dominate are e-commerce, online travel, online media, and ride hailing. In addition to the four above, other sectors are also growing, one that is squirming is fintech.

In this paper, we try to present an overview of the latest competition in the digital industry which is heating up and is in the spotlight in Indonesia. Consists of business ride hailing, fintech, e-commerce, and online travel. Each has been populated by big players with huge user bases and funding support as well.

Ride-hailing still about Go-Jek vs Grab

Talking about competition ride hailing in Indonesia, it is still narrowed to two unicorn Go-Jek and Grab. Both continue to dominate market share with different portions. So far in terms of completeness, the Go-Jek application is far superior because it offers more variants.

However, from the total download statistics on the Play Store, numbers Grab more –because it only uses one application in all operational areas, while Go-Jek separates them; like in Vietnam use Go-Viet or even a secondary service with Go-Life.

On the other hand, features e-wallet into a service business model. Go-Jek is maneuvering itself through Go-Pay, meanwhile Grab still depend on other parties, in this case Ovo from Lippo Group. For business expansion, both of them also have investment units, embracing other players to strengthen the service ecosystem – there are Go-Ventures and Grab Ventures.

Mapan, Promogo, Findaya, Dana Cita etc. are digital startups that are now strategic partner with Go-Jek, through funding and/or acquisitions. Kudo, HappyFresh, StickEarn, Karta and several other players are in the corner Grab. From the actions that exist, both seem to lead to the same point in relation to business goals.

This year's market share value ride hailing in Indonesia is estimated at $3,7 billion. This figure is projected to continue to increase to reach a minimum of $14 billion in 2025. So that round after round of competition will still be very interesting to watch from the two big startups.

Fintech growing fast, e-money have the greatest potential

In Indonesia there are two sub-sectors fintech which seems to be thriving, that is lending and e-money. In terms of the number of players, far more, even those that have been approved by the regulator. Temporary e-money tend to be fewer and dominated by big players.

There is a very basic reason why e-money will be a sub-sector fintech the most potential. Like money in a wallet, balance e-money designed to help users transact their daily needs.

No doubt now players e-money more aggressively conducting user acquisition by expanding the service ecosystem. In Indonesia there are several popular services for e-money, starting from Dana, Go-Pay, Paytren, Tcash and others. However, the most dominating news lately are three services, namely Dana, Go-Pay, and OVO.

The domination of the news is none other than efforts to expand the integration of services. Now these three popular services have been integrated with a platform with a large user population. From a survey conducted by DailySocial involving 825 service users, Go-Pay users ranked first, followed by OVO, Tcash, and Dana.

After this year's massive integration, it means that the competition drum has just begun. Some players are already looking dimmed – for example PayPro who ended up trying their luck at traditional small retail.

Several new players have also appeared marked with license release organizer e-money by Bank Indonesia. Call it BluePay, Duwit, to E2Pay which soon solidified its debut.

Sector travel quiet but promising

According to Google and Temasek data, currently the online travel has the largest market share in Southeast Asia, at $30 billion. In Indonesia alone this year is estimated to contribute to the circulation of money to reach $ 8,6 billion, and is projected to reach $ 25 billion in 2025. Player in online travel actually there are also many, namely Airy, Pegipegi, Tiket.com, Traveloka, and others.

If the player with the top rank is drawn, it refers to the two big players – coincidentally both were founded by local developers – namely Tiket.com and Traveloka. Post exit, Tiket.com is currently under the auspices of the Djarum Group through the Blibli business unit. While Traveloka is included in the ranks unicorn in Indonesia with valuation is currently estimated to exceed $2 billion.

It seems that the large capital has made Traveloka's user acquisition quite successful – balanced with service innovations that continue to be intensified. Statistically, Traveloka still outperforms Tiket.com, although in terms of service variants, the two almost have similarities. In the innovation corner, Traveloka has also launched many breakthroughs, for example the PayLater through TravelokaPay in partnership with the Danamas loan service.

In particular DailySocial also ever release report entitled "Online Travel Agencies Survey 2018". The survey results put the order of the most popular services as Traveloka, Tiket.com, Pegipegi, Airy, Blibli, Jd.id, Nusatrip, etc. The size of the market share online travel make E-commerce also flocking to provide services ticket sales planes and hotels. A number of E-commerce work closely with OTA developers, the rest design the system independently.

E-commerce in Indonesia is moving dynamically

The most crowded digital sector in recent years, even with its growth looks the most impressive. If packaged in anecdotes, travel digital society in Indonesia starting from the use of social media, then E-commerce, new to other services.

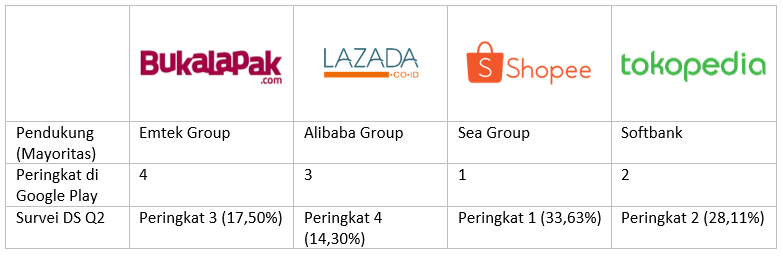

Currently landscape E-commerce Indonesia is dominated by four big players, namely Bukalapak, Lazada, Shopee and Tokopedia. The difference between E-commerce and online marketplace even more melting.

Meanwhile, apart from the four players, there are many other platforms that also continue to strengthen their existence, namely Blibli, Bhinneka, Mataharimall etc. Players with special segments such as Sale Stock, Hijub, Berrybenka etc. also still have market share. Not to mention those in the B2B special segment, there are Bizzy, Mbiz etc.

Several studies have stated that E-commerce will become the most influential digital business in the next few years. As of 2018, market share value E-commerce in Indonesia has reached $18 billion, the largest in the region.

Towards the end of the year, in the middle of a grand celebration E-commerce several survey agencies released reports regarding the popularity of the service E-commerce. One of them MarkPlus, they said that currently Shopee is in first place, competing with Tokopedia. Earlier in the second quarter DailySocial have also done popularity survey service E-commerce, placing Shopee, Tokopedia, and Bukalapak at the top of the list.

The competition doesn't end here. Each platform developer continues to maximize various strategies to strengthen its presence in the market share. The strategy also has a different approach between players.

For example, Bukalapak chooses to maximize advertising costs – as of the third quarter of 2018, Bukalapak is the most popular startup advertise a lot. It's different again with Shopee who is trying to strengthen Branding by attracting famous Asian figures and holding big performances.

Sign up for our

newsletter