Traveloka Presents PayLater Loan Feature

Collaborating with p2p lending startup Danamas as a loan partner

Traveloka further complementing the payment features in Traveloka Pay with the loan feature for traveling "PayLater." This feature complements the existing payment ecosystem, payments by e-money (in collaboration with Uangku), credit cards, and debit cards.

"So to give best product and service"We believe that the payment department must make it easier for consumers, so that they have more choices [to transact on Traveloka]," said Traveloka CMO Dannis Muhammad to DailySocial.

Dannis said that there will be official information regarding PayLater in the coming weeks. The latest version of the application update regarding PayLater is also still being gradually distributed to some Traveloka customers.

PayLater is the result of Traveloka's collaboration with a p2p lending startup Danamas as a lending partner. Interestingly, before collaborating with Danamas, Traveloka also collaborated with Uangku for partners from e-money providers. Both are part of the Sinar Mas Group.

The Danamas party who fully carries out the risk management process in managing PayLater. Starting from verifying consumers, the amount of interest, to paying the installments.

"Actually, there is no special reason. We as a technology provider marketplace are open to all partners. The considerations [when choosing a partner] must be there, but nothing special. Incidentally, at that time, Danamas had the commitment and capability compared to other players."

According to Dannis, the most popular payment methods by users are ATM transfers and credit cards. In total, both of them occupy the majority position compared to other methods. Unfortunately, Dannis is reluctant to provide detailed information about this.

PayLater submission flow

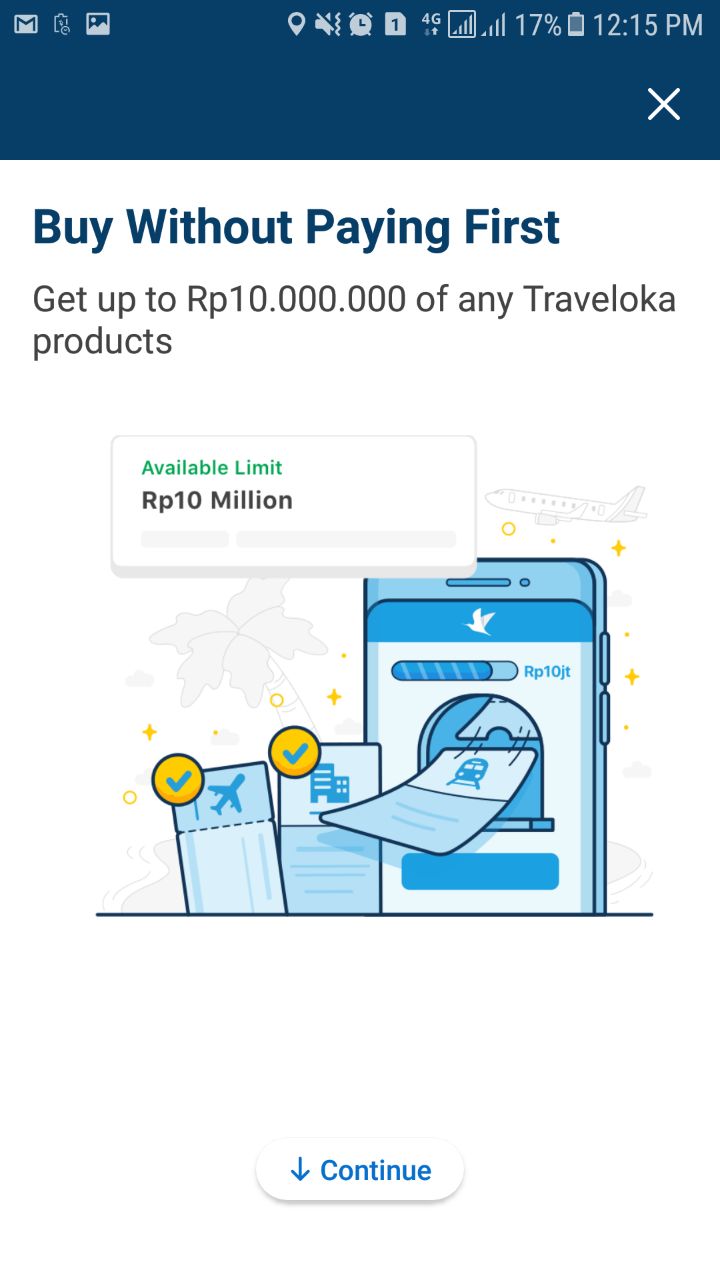

To apply for a loan facility from PayLater, the process must be carried out through the latest version of the application. The nominal funds that users can get are between Rp. 2 million and Rp. 10 million to buy products on Traveloka, such as plane tickets, hotel rooms, trains, and attraction tickets.

Users only need to include their KTP, NPWP, KK, BPJS, or SIM and are 21-55 years old. There are four stages of the data filling process that must be taken, starting from self-identity, family, work, and uploading personal data. Danamas guarantees that the funds will be disbursed within one hour after the application is completed.

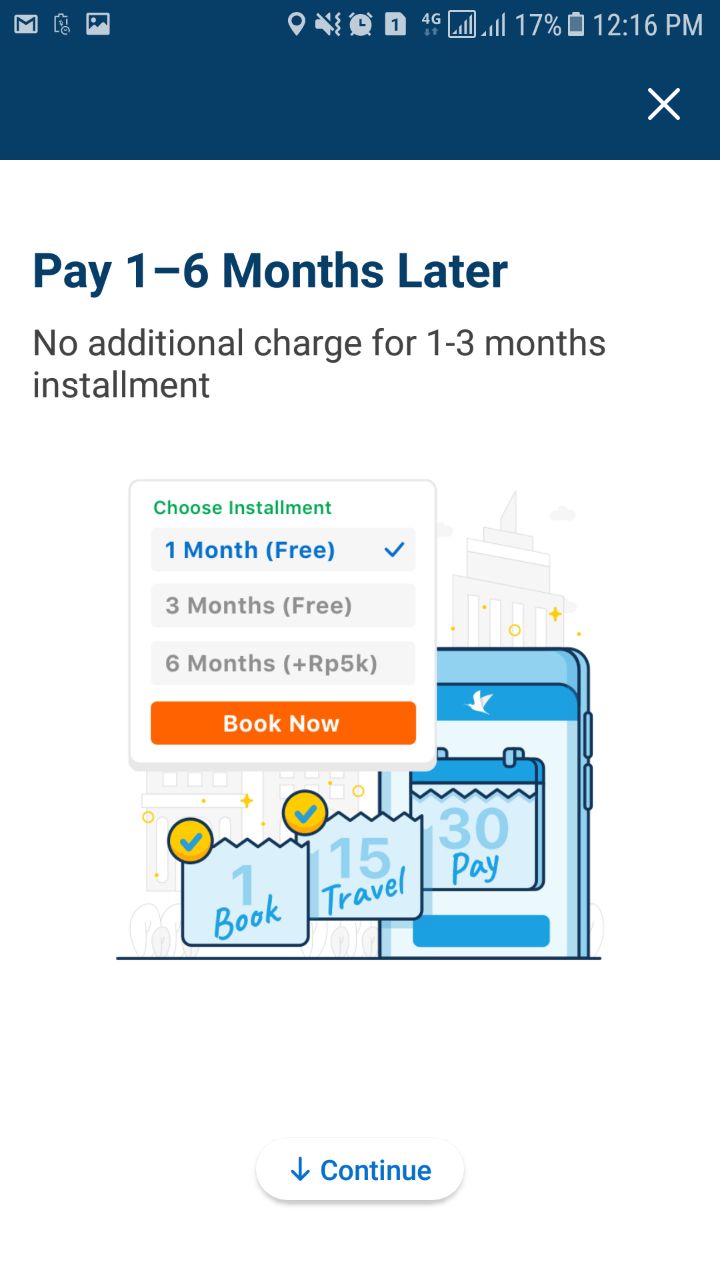

When the funds are successfully disbursed, users can immediately use them to transact at Traveloka. For the payment, Danamas guarantees that there will be no additional interest if the user pays it for a tenor of 1-3 months after the funds are disbursed a month later. More than that, there will be an additional interest of Rp. 5 thousand per month.

After the user has successfully paid off the installments, the PayLater limit can automatically be used again. Users can also request an increase in the PayLater limit. They can upload additional documents, such as payslips or bank statements for the last three months. For security, every transaction using PayLater will use OTP.

Sign up for our

newsletter