"Cloud Kitchen" Industry in Indonesia, Between Solution and Competition

DailySocial noted that there are 15 cloud kitchen operators operating in Indonesia with a total of hundreds of outlets, the dominance is still in Jabodetabek

Concept cloud kitchen perhaps as monumental in the food industry as the discovery of fire. We are witnessing a drastic change in the way we eat food, leading to a boom in the food service industry. From cooking in the kitchen, eating to restaurants, to finally ordering food three times a week through an application. Comfort continues to improve at every level.

According to the compiled analysis Deloitte, comfort is an important consideration for millennials because of their hectic lifestyle. Lack of time is one of the main reasons for the rapid growth of online shopping and online ordering from restaurants.

Millennials eat out or order food more often than previous generations. More than 60% of millennials order food or eat out at least once or more than once a month. Taking advantage of increasing purchasing power and high demand, the online food delivery market in Indonesia has great potential for growth.

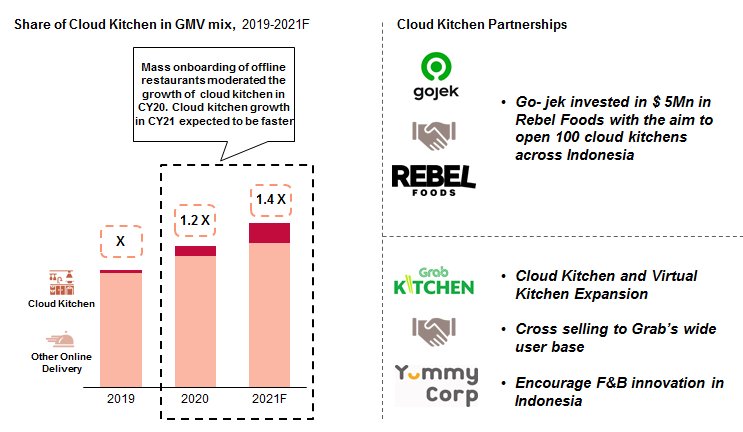

As e-Conomy 2020 reveals, the food transportation and delivery industry will be worth $16 billion (GMV-wise) by 2025, from $5 billion in 2020. The main engine of the digital economy in the country is still dominated by trade via e-commerce platforms which is projected to worth $83 billion.

This report does not specify how large a percentage of the potential provided by the food delivery industry includes cloud kitchens. At least in general, this figure is able to illustrate how delicious the food delivery business is.

Take for example, in India alone the food delivery market share is projected to grow at a CAGR of 16% to reach $17 billion by 2023, according to DataLabs by Inc42. Meanwhile, industry cloud kitchen projected to reach $1,05 billion in 2023. Supporting factors come from increasing disposable income and changes in consumer mindset.

Rebel Foods one of the operators cloud kitchen with the largest network in India, more than 350 locations spread across 35 cities. They operate 12 F&B brands, Faasos, Behrouz Biryani, and Oven Story, are the top 3 most recognized brands. The company is also collaborating with other F&B players to expand to new locations. Wendy's is one of them, through its Rebel Launcher program.

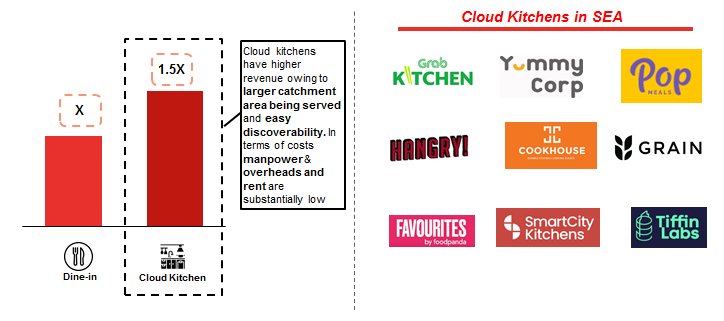

Gojek is one of the shareholders of Rebel Foods. They expanded to Indonesia by forming PT. Rebel GoFood Indonesia to operate cloud kitchen GoFood Shared Kitchen. There are 27 Dapur Bersama outlets spread across Jabodetabek, Surabaya, Bandung and Medan.

Here, they adopted the rental concept, partnered with other F&B players to utilize kitchens, and launched their own brands, just like in India. They brought the Faasos brand to Indonesia. Not only Indonesia, Rebel Foods has expanded to the UAE and UK.

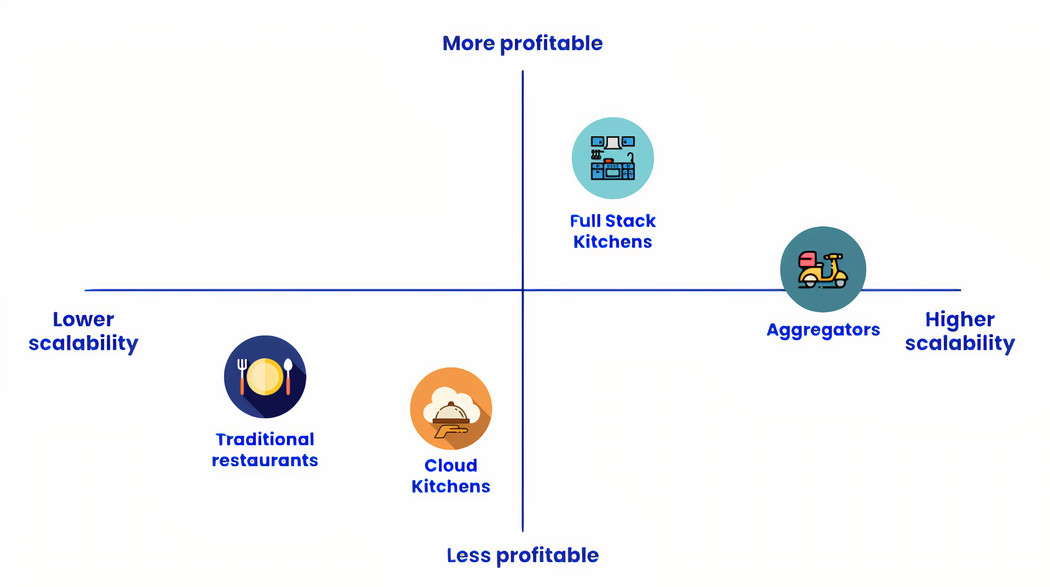

Rebel Foods is not the only player in this segment. The company has strong competition from food aggregators such as Zomato and Swiggy, which also have chains cloud kitchen Alone. At the same time, players like Rebel Foods, including Ola Foods, FreshMenu, Box8, and QSR Foods.

This condition gives a serious picture that with a solid business foothold in the food delivery business, food aggregator players are aggressively moving towards cloud kitchens to run the business.

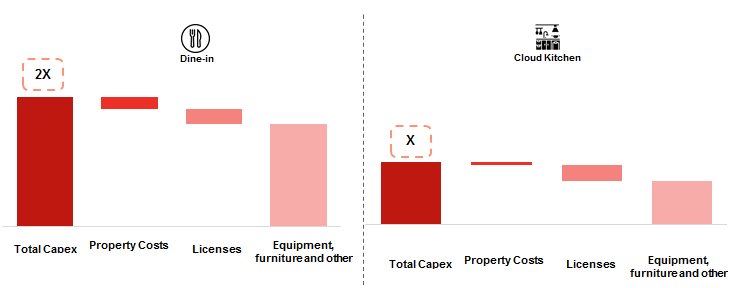

In Indonesia, citing reports Rise of Virtual Kitchens 2021 published by Savills Research & Consultancy, model cloud kitchen currently operating targets a different consumer target than restaurants in malls.

It is estimated that there are 70 outlets cloud kitchen which is operated by seven players in Jakarta.

The majority of operators cloud kitchen This targets F&B business people who are still on an SME scale. Meanwhile, restaurant chains tend to choose traditional outlets because many of them not only sell food, but also the atmosphere and dining experience to their customers.

“However, we are seeing those who are more reputable starting to use it cloud kitchen as 'satellite kitchens' – complementary outlets outside malls to capture consumers in more remote areas. "Typically, delivery from malls appears to be less effective because it takes too much time for drivers to park, enter the mall, order food, and deliver," the report said.

It was further explained, "The satellite kitchen is only responsible for accepting delivery orders in order to reduce delivery time from restaurants to consumers. In the future, we may see more collaboration between traditional retail and malls cloud kitchen in a hybrid business model, thereby creating great opportunities for both sectors to continue to grow."

DailySocial noted at least there is 15 operators cloud kitchen operating in Indonesia so far. Here are the details:

| No | Operator Name | Since | Venues | Minimum contract | Kitchen size | Rental price (starting from) | Brand partners |

| 1 | GrabKitchen | 2018 | 45 outlets | 1 tahun | 10 20-m2 | Profit sharing | Geprek Bensu, Reddog, The Good Habit Express |

| 2 | GoFood Shared Kitchen | 2019 | 27 outlets | 1 tahun | 14 25-m2 | Profit sharing | FamilyMart, Banzai, I am Geprek Bensu |

| 3 | Everplate | 2019 | 9 outlets | 1 tahun | 6 17-m2 | Fixed costs, 6 million/month | 2080 Burger, The Moo, Grumpy Meatballs |

| 4 | YummyKitchen | 2019 | 40 outlets | 6 months | 5 10-m2 | Profit sharing, 7 million/month | Dailybox, KyoChon, Se'i Sapi Lamalera |

| 5 | We are Kitchen | 2020 | 3 outlets | 6 months | 6 17-m2 | Fixed costs, 5 million/month | Burgreens, Thai Alley, Yoshinoya, SaladStop |

| 6 | Telepot | 2020 | 1 outlets | 6 months | 7 19-m2 | Profit sharing, 6 million/month | Yuks Bowl, Kaka Bakes, CWIMS |

| 7 | hangry | 2020 | 40 outlets | N/A | N/A | N/A | own brand |

| 8 | Popitsnack | N/A | 1 outlets | N/A | N/A | N/A | Segara Market, Tehna |

| 9 | Table | 2020 | 53 outlets | N/A | N/A | N/A | Mujigae, Palava, Fondre |

| 10 | Eden Kitchen | 2020 | 1 outlets | N/A | N/A | Fixed costs, 5 million/month | Oppa Corn Dog, Unicorn Burger |

| 11 | Foodstory | 2021 | 2 outlets | N/A | N/A | N/A | Sunda Empire Chicken, TikTok Fried Rice, Chick Pok! |

| 12 | Lookalkitchen | 2021 | 50 outlets | N/A | N/A | N/A | Dapoer Bang Jali by Denny Cagur |

| 13 | DishServe | 2021 | 100 outlets | N/A | N/A | Commission | Phago, Daipan |

| 14 | Eatsii | 2021 | N/A | N/A | N/A | N/A | Endoy Fried Rice, Simply Fry |

| 15 | Food Kitchen | 2020 | 16 outlets | N/A | N/A | N/A | own brand |

Source: Savills Research, data processed

GrabKitchen

A year before Gojek debut with Dapur Bersama, its closest competitor Grab I've entered beforehand in September 2018. Branding cloud kitchen that Grab use at that time is Kitchen by GrabFood, located in Kedoya, West Jakarta. Then, change the name to now GrabKitchen

In a joint interview DailySocial, head of GrabKitchen Grab Indonesia Rio Aristo said that behind the increasing use of food delivery services in Indonesia, cloud kitchen This is a strong reason for merchants who want to expand their business without having to provide tables and chairs for eating on the premises.

"Grab remains confident in its strong ecosystem--supported by growing consumer numbers, application features, and mature delivery infrastructure--making it GrabKitchen is superior because it is supported by leadership GrabFood in the food delivery category. This has become the reason why brands, big or small, choose to join the network cloud kitchen us," he said.

GrabKitchen is now in more than 45 outlets, spread across Jakarta, Bandung, Bali, Medan, Surabaya, Makassar and Malang. Thanks to partnerships with players cloud kitchen other, Yummykitchen, partners can place kitchens in locations with the greatest consumer demand.

When combined with Yummykitchen's operational area, scope GrabKitchen now reaches more than 80 outlets. The presence of Yummykitchen provides a competitive bargaining power because merchants have the opportunity to gain expertise in brand development, digital marketing and business strategy.

“Each potential merchant partner can utilize this expertise to decide: what products consumers are most interested in, where their kitchen is located, how to market their brand to consumers, and evaluate their business strategy together. GrabKitchen and Yummy Corp.”

Facilities provided GrabThe kitchen consists of basic kitchen equipment. For partners who don't need a place to cook, there is an option to store their products at Chilling and ready to be sent after being ordered by the consumer. Consignment services like this are great for snacks like dessert boxes trending items, which are usually ready to be sold directly to consumers.

Jaringan cloud kitchen wide area automatically brings more value to local and national brands. Rio explained that local brands can operate in more locations, while national brands can launch their business in new cities. Consumers can order dishes from several merchants located in one location GrabKitchen. This is an attractive menu selection proposition for families and groups, as well as providing additional visibility and cross-promotional potential to each merchant.

Data and technology access is also provided to merchants who use it GrabKitchen Grab provide data that has been processed to be given to merchants to identify demand in certain regions.

“This innovation is a more efficient and effective solution. Our data-driven approach allows us to make recommendations to merchants on menu selection, presentation, promotions and branding to help them increase their sales and visibility online.”

Another advantage for merchants is not only getting access to food delivery, but also access to shopping for cooking ingredients at more competitive prices. Use GrabMerchant also allows merchants to manage menus, store operations, create digital advertising, and get access to comprehensive business reports that can be accessed via the web.

“We believe that the added value offered by this feature simplifies operations for our merchants. GrabKitchen will continue to develop features that are beneficial to both our merchant partners and consumers."

hangry

Different from Grab and Gojek, Hangry more or less took an approach like Rebel Foods when the company was founded. Hangry operates cloud kitchen for self-formed F&B brands (brand builder).

Hangry CEO Abraham Viktor explained the reason why Hangry took draft cloud kitchen because of the added value offered, namely the flexibility and efficiency of kitchen infrastructure, and is always present wherever consumers are. “Moving from this concept, we are trying to provide a virtual experience dining. "

Because cloud kitchen It is operated independently, which is an advantage for Hangry because the company can prioritize product quality which is the core of its business, both in terms of deliciousness and cleanliness. There are SOPs and QC implemented to maintain product quality and hygiene.

“Now we have reached thousands order per day for a period of approximately seven months. Additionally, one of the metrics Another very important thing is our restaurant rating delivery channel which averaged 4,7/5. This is proof of our commitment to maintaining product quality."

Technology support is also embedded in the Hangry application. Apart from the convenience of ordering food, it's just like surfing on the application delivered In general, there is gamification in the form of points that can be exchanged for attractive prizes. These points are collected through any purchasing channel by scanning the QR code on the proof of purchase.

Don't forget, easy digital payments with various options are also provided. Transactions with e-wallet According to Hangry, it is still popular with consumers who make online transactions.

Abraham said that currently Hangry is spread throughout 40 locations in Jabodetabek and Bandung. The company's ambition this year is to be present in more than 120 outlets, including Bandung, Surabaya and Medan.

Regarding opening plans cloud kitchenFor brands outside of Hangry, Abraham still dismisses this possibility. "For kitchen facilities, currently only the Hangry brand can use them, no other brands can rent or use them."

Take a different segment

Despite the rapid development of cloud kitchens, there is still a lot of room for other players to take it seriously. DishServe positions itself as enabler ghost kitchen by utilizing the underutilized assets of home kitchen facilities. The kitchen will later be connected to the network cloud kitchen as a last-mile distribution point for F&B brands.

Sebagai enablers, DishServe makes it easier for brand businesses to develop without fixed costs through the company's infrastructure. The company will distribute the brand's food stock to selected outlets, based on the insights that have been recorded. Even for home kitchen owners, they can earn additional income. As a result, with this strategy, brands do not need to pay high costs for outlet expansion.

Currently, DishServe has a network of 100 kitchens in Jakarta.

Next there is Lookalkitchen which offers a kitchen/restaurant revitalization concept for restaurant owners so they don't get left behind by the online food delivery trend. Kitchens that have not been utilized optimally have been converted by the company into food and beverage delivery centers.

Restaurant owners continue to use the kitchen to increase the productivity and efficiency of existing staff, and become part of the cloud kitchen without having to be burdened by additional costs. Partners can serve up to 10 brands at once in their kitchen.

The company partners with online food and beverage (mamin) brands which generally only provide delivery services and have a strong presence on social media. This entrepreneur no longer needs to bother looking for a new location to be closer to his consumers. Lookalkitchen utilizes a profit sharing business model between food and beverage entrepreneurs and partner restaurants.

“We offer a hassle-free registration and partnership process in just two weeks. This includes the kitchen assessment stage, activation, until finally entering all platforms food delivery,” said Lookalkitchen Co-Founder and CFO Daniel Song.

Some of the brand names are Dapoer Bang Jali by Denny Cagur, Enakdibungkus, and Mandu Mami, which have a combined Instagram follower base of up to 100 thousand followers. The total Lookalkitchen outlets are currently spread across 50 points in Jakarta. The plan is to expand to other cities at the end of this year.

From the business side, of course the presence of players cloud kitchen is a diversification strategy for business owners to get closer to consumers without having to leave the house. Because it is more flexible in terms of rental and the investment is more pocket friendly. The majority of operators cloud kitchen This is targeting SME businesses that are relatively new to operating, so the business scheme is very suitable.

Not to mention the presentation insight Data for SMEs is very useful for determining the next strategy, especially if their status is still a startup so they need to minimize risks. Despite the positive side, there are challenges faced by operators cloud kitchen, such as lack of restaurant dining experience, food quality control problems because not all menusdelivery friendly”. Plus, more food deliveries mean more packaging waste is generated.

Hangry is aware of this weakness, that's why they created a special outlet dine-in which is used as flagship store to introduce the brand closer to consumers.

A culinary entrepreneur from India, Rachael Goenka, said, in running a business cloud kitchen To be profitable, operators must raise a sizable amount of capital or have a strong brand presence and delivery offering that can be leveraged across multiple locations.

“We have to rely on the latter by operating multiple brands from existing infrastructure. There is never any question of one option replacing another. Eating out is for celebration and experience. Eating there is comfortable. "

- *header photo: Depositphotos.com

Sign up for our

newsletter

Premium

Premium