Printing Profits in the Third Year, Youtap Prepares to Dominate SaaS Solutions for All Business Scales

Youtap's three product pillars (cashless payment, POS, and supply chain) balance each other to contribute to a sustainable business

Thanks to the pandemic and other global factors, startup founders are now required to refocus on business fundamentals. Just like companies in general that are oriented towards sustainability by making profits. The later they fix it, the heavier their responsibility, especially to investors.

Even though it is a startup, Youtap Indonesia (PT Mitra Digital Sukses) is luckier than most startups. Because they are under the parent conglomerate Salim Group, they have been directed from the start to build the right fundamentals to become a sustainable company.

This intense monitoring means Youtap can make a profit in September 2023, almost three years after it was first founded in February 2020.

"Our shareholders are quite experienced in the retail world and in profile, each company [under them] is for the long term and must be sustain. From the start it was calculated between cost and revenue that will be obtained. This approach "which is good because valuation will follow in the end," said Youtap Indonesia CEO Herman Susanto in a joint interview DailySocial.id.

He continued, “Although shareholders use the old method, but we implement in the new world [of startups]. It was tough in the beginning so it forced us to go in a better direction. More wise in using money, every spending must really bring something [margin] to the company.”

Herman was not willing to go into further detail with detailed figures. According to him, the contribution of the three products above is balanced because they are integrated with each other.

"Margin of supply chain leaders it's thin, so we play with volume [transactions]. Then [margin] iscover by POS subscription fees, MDR income (merchant discount rate) from non-cash payments, from enterprises there are also service fees that we wear. That all helps us catch up revenue what is needed for running company this."

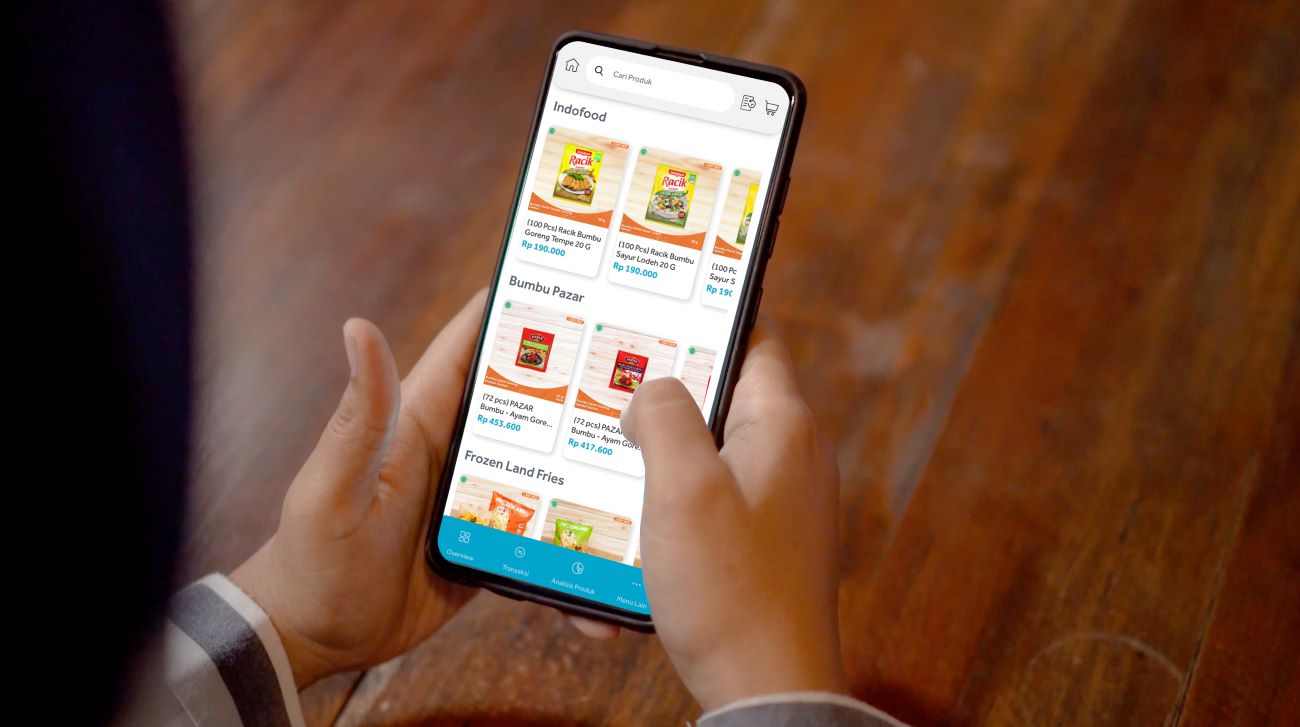

As a SaaS startup, Youtap has three solutions that can accommodate all scales of go digital business, from enterprise to MSME, including:

- Non-cash payment aggregator;

- POS application (Youtap POS): record bookkeeping, sales analysis, inventory management;

- Supply chain (Youtap BOS): B2B marketplace platform that connects suppliers with entrepreneurs for wholesale shopping.

According to the latest data, more than 300 local and national suppliers have joined Youtap BOS. Some names are: Sosro, Indomarco Adi Prima, Campina, BreadLife, Sari Roti, Dima, Diamond Fair - Bintaro, and Best Meat. The number of Youtap merchants is said to be more than 500 thousand users spread across 510 cities in Indonesia, consisting of MSME and enterprise merchants. One of Youtap's enterprise merchants is McDonald's Indonesia.

Youtap Indonesia is a technology company j between PT Graha Kencana Maju, PT Kreasi Sentosa Makmur, and Youtap Mobile Money Asia Private Limited from Auckland, New Zealand.

Herman said that apart from intense monitoring, Youtap was able to make a profit in a short time thanks to the support of Youtap Global's core technology. Companies do not need to build technology from scratch and can enter the market more quickly. This is a little different from most startups.

However, as technology continues to develop, companies must be adaptive. Currently there is a technology team specifically recruited to develop solutions according to the needs of merchants here. “By core system [Youtap Global] there is the same, but the service is around core system "There are many different ones and we have adapted many of them to suit the needs in Indonesia."

Organic growing

According to Herman, from the start Youtap was driven by the Salim Group as an independent company that did not rely on the market captive to run his business. It can be seen from the majority of business users coming from non-captive, instead it only strengthened with the group in the middle of last year for supply chain solutions with PT Indomarco Adi Prima, distributor of basic food products produced by Indofood.

Mindset which is instilled in the ranks of Youtap management is they must be able to generate income even if it is small. This translates directly into all organizational and operational aspects.

The first solution, a non-cash payment aggregator, already set MDR fees until finally Bank Indonesia implemented a standardization of the MDR amount that could be quoted by issue, amounting to 0,7% for regular transactions consisting of small, medium and large businesses.

"Indeed, from the start it wasamplify [by shareholder] to print revenue streams. All line of traction we already have a margin. Even though it is small, there must be a commitment that it must be there revenue streams so that the business remains healthy."

Organic strategies are also fully implemented in every marketing campaign. The company always invites partners, both from financial companies (banks/e-wallets) and suppliers to create joint programs.

“It's difficult to be a company tech it becomes the middleman, not the owner of the entire business. For example, if we succeed in selling Indomie to merchants, we get a small margin, but the margin is large for those who own the product. That's why we have to be careful about creating [marketing] programs that are not burn money, play on level of margins what we got."

Even though it is oriented towards business sustainability, Youtap is mandated to help MSMEs. Therefore, the Youtap POS application can be used free of charge for all business groups. They can use features such as: cashier, QRIS, smart analysis, transaction history, e-menu, and so on. However, for features that are more complex and require personalization, you must subscribe first.

“User ratio free and it pays quite well. Of the total users, about 20% are paid. We charge competitive, there are monthly and yearly. [..] Once satisfied with POS subscription, we fulfil fulfill their needs stock. "This is the strength that we sell to suppliers, they can sell relevant products to merchants more precisely."

Advantages of embedding mindset This was especially felt when the pandemic occurred. At a time when many companies finally had to give up their employees, Herman admitted that Youtap did not need to take such extreme steps. "We are extra careful, stream down some investments costit can't be measured."

Youtap's organizational structure is relatively lean compared to most other startups. The core team is almost 80 people with head office in Central Jakarta. Meanwhile, the field team is recruited randomly outsourced, the number is around 200 people.

To encourage business, Youtap is now collaborating with companies sales force which has hundreds of salespeople and individuals who have a large network, joining the partnership program. “This partnership is a partner Sales Youtap sells all our products. There are incentives provided for them.”

Strengthen supply chains

Throughout this year, Youtap will launch new initiatives in order to increase the contribution of its supply chain lines. Some of what will be announced are business packages to make it easier for people to become new entrepreneurs. The goods will be supplied directly by suppliers who have collaborated with Youtap.

More Coverage:

For example, the business package for selling ready-to-eat bread and making toast is supplied by Sari Roti, a subsidiary of the Salim Group. There are also non-group suppliers, such as fried chicken business packages, tegal stalls, ice cream, and so on.

“We can sell supplier products that are relevant to the merchant's needs. Our expectations are high here, but it takes time to build them. Supply Chain this also happens pricing war controlled by trader. We have to face this. But because half of our merchants are F&B, price sensitiveless than the grocery store.”

Regarding this, Youtap will immediately release a financing product paylater collaborate with banks. Later, merchants can use the approved credit limit to purchase stock from suppliers. So far, because there is no neat record keeping, small businesses cannot take loans from banks to support their businesses.

"Later, merchants who can use this will only be those we know [historical records] through the POS application they use."

So far, Youtap is still supported by its main shareholders. Herman admitted that a number of external investors had started to approach Youtap, but had not received their blessing. The reason is that there is no urgency that requires Youtap to raise funding.

"There are no plans yet [external funding] but it's been discussed and shareholders too already aware about this. Might be looking for more strategic values, not just the capital," he concluded.

Sign up for our

newsletter

Premium

Premium