SYNC Southeast Asia: Consumer Satisfaction with Online Shopping Experience Decreases

For Southeast Asia as a whole, the average NPS score this year is 35%, down from 53% last year

In annual report released by SYNC Southeast Asia, Meta, and Bain & Company revealed a decrease in the level of shopping satisfaction online from the community in Southeast Asia, especially Indonesia in recent times.

Especially during the post-pandemic, when the situation has gradually recovered and activities offline re-done. Indonesia is also listed as the country that has the most consumers who make digital purchases in Southeast Asia.

Digital consumer growth

The last two years have seen a significant growth of digital consumers in Southeast Asia. The pandemic has accelerated shopping activities online. It's no longer just buying products like gadgets and fashion only, but also groceries such as vegetables, meat and fish.

Indonesia is recorded as a country in Southeast Asia which has around 168 million people who have been shopping online online. This number is quite an increase from last year's around 154 million. Age range that does a lot of shopping online are 15 years and over.

"Digital adoption in the city tier 3 give tier 4 continues to grow. This, along with increased access to various payment options and the development of logistics infrastructure, has helped to further facilitate trading activities," said Group Chief Economist Sea Limited Dr. Santitarn Sathirathai.

In the report also mentioned, the average contribution of services E-commerce to the retail industry continued to grow over the past year, rising from 9% in 2021 to 11% in 2022 (representing 16% growth).

Retail penetration growth online for each category is also projected to increase from last year, with groceries showed the strongest growth in Southeast Asia at 29%. Over the next five years, retail contribution growth online for each category in Southeast Asia is expected to continue to increase with a compound annual growth rate of at least 16%.

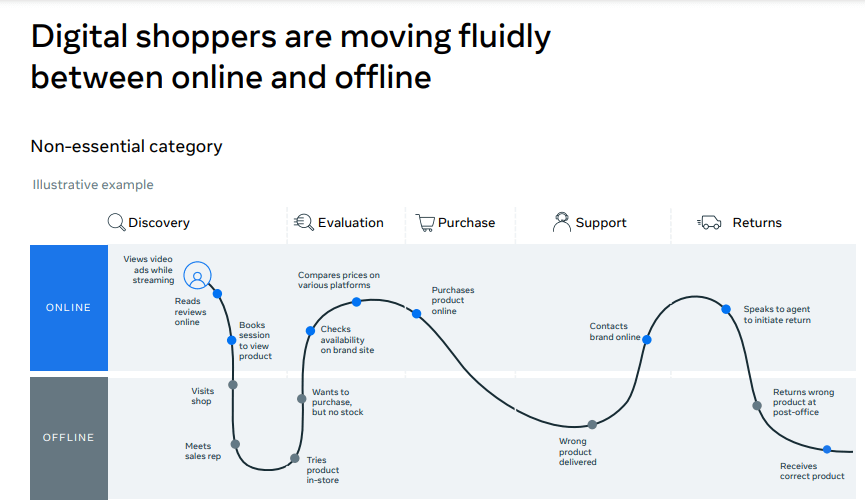

At the evaluation stage, online still survives with 81% of consumers citing it as their primary channel for comparing products, viewing reviews, and doing research. However, at the buying stage, the separator between online and offline almost evenly, because offline still plays a more relevant role even for digital shoppers. 80% of consumers choose to shop online online.

Another interesting thing that is also noted in this report is the level of consumer satisfaction with the shopping experience online has decreased compared to the previous year, with the Net Promoter Score (NPS) of the service E-commerce top.

For Southeast Asia as a whole, the average NPS score this year was 35%, down from 53% last year. On a country-by-country breakdown, each market experienced the highest NPS declines—especially in Indonesia (from 74% in 2021 to 50% in 2022), Vietnam (from 65% to 41%), and the Philippines (from 64% to 43%). 24

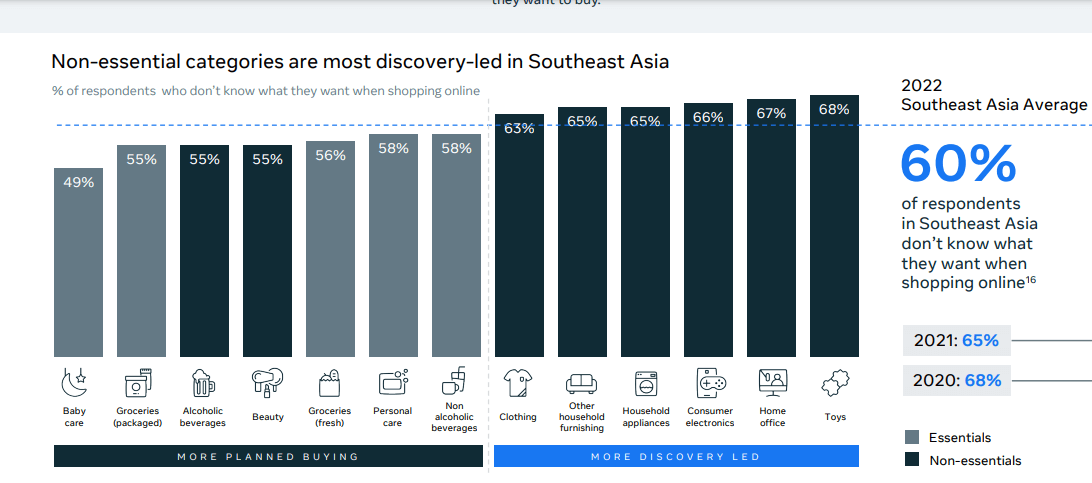

On the other hand, there are significant changes related to the habits of today's society. This year when many people start to return to activities offline on a regular basis, began to see a shift. And this affects the way people shop in Southeast Asia.

More and more consumers are demanding that shopping activities are integrated with seamless experiences seamless pattern on various channels online end-to-end. Social media and services E-commerce become an option for them to search and find products, while offline is still vital at the buying stage.

"Customers switch from online ke offline for two key reasons, they want to experience or see the product itself. They also want convenience, and don't want to pay shipping costs. Customers are shifting back online because they want promotions and specials to be offered," said Hanh Vu, Marketing Manager of Cỏ Mềm Homelab.

Keeping abreast of future technology trends

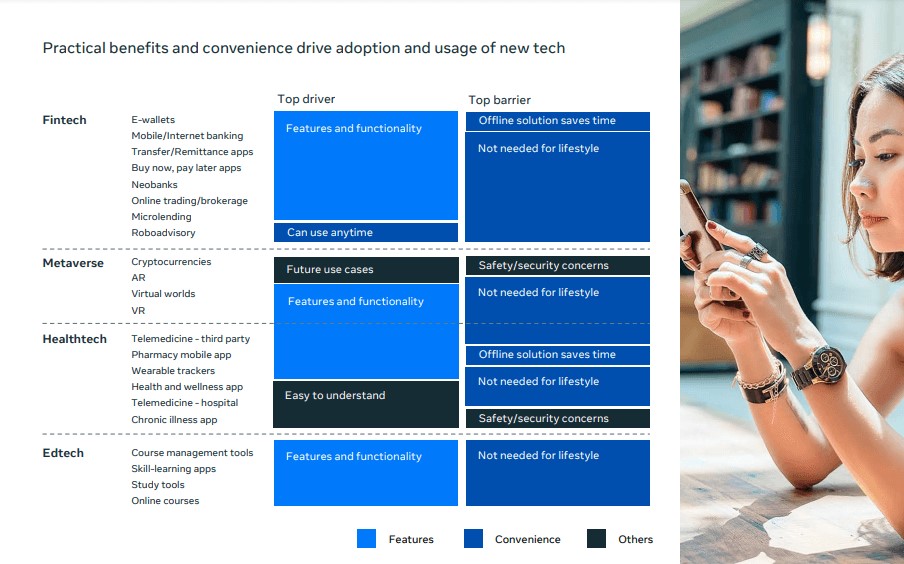

Another interesting thing that is also discussed in this report is, future technology at various levels of market maturity in Southeast Asia. Service fintech and metaverse is predicted to experience a significant increase. Followed by healthtech and EdTech.

For fintech products and services that will experience an increase in use, including digital wallets, internet banking, remittance services, Buy Now Pay Later (BNPL), digital bank and neobank. Meanwhile, the product metaverse technology that will be increasingly known by the public includes, cryptocurrencies, augmented reality (AR), NFT and Virtual Reality (VR).

While for service healthtech which will be increasingly in demand by users, including telemedicine, pharmacy or health stores, health & wellness, and chronic disease services. For EdTech There are several products or services that will become popular, including, course and management tools, skill-learning, study tools and online courses.

More Coverage:

Indonesia is also at the forefront of the regional curve in terms of new technology adoption. Although still in its early stages, the metaverse is a new chapter of technological innovation that gives a lot of hope in various countries including Indonesia.

Technology related to the metaverse is gaining traction where around 72% of Indonesian respondents have used the technology in the past year. Variations in the types of Metaverse-related technologies used in the country include cryptocurrency (46%), augmented reality (34%), virtual worlds (29%). This was followed by NFT and VR.

The study also found that Southeast Asia is seeing more foreign direct investment funneled into the region. Foreign direct investment accounts for a larger proportion of total investment in 2021, at 17% compared to 15% in 2015 and only 9% in 2009. This steady increase in foreign investment is a testament to investor confidence in Southeast Asia and driving technology growth new like fintech.

Singapore and Indonesia accounted for the bulk deal investment in Southeast Asia, accounting for almost 80% market share in H1 2022. Singapore represents a sizeable proportion, at 60% of the total deal this part of the year.

Sign up for our

newsletter