Momentum Works: Coffee-Chain GDP in Southeast Asia Estimated to Reach IDR 52,6 Trillion

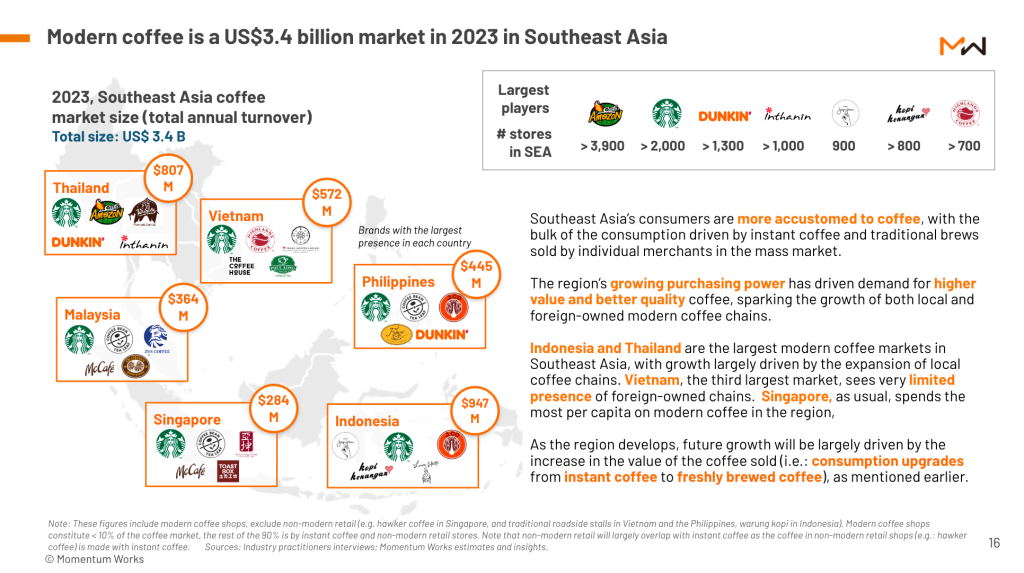

The annual turnover of modern coffee shops in Indonesia ($947 million) and Thailand ($807 million) is the largest market in the region

It is estimated that Southeast Asia will spend $3,4 billion or around 52,6 trillion Rupiah this year to buy a cup of modern coffee, according to a new study released Momentum Works.

The research results were published in the report "Coffee in Southeast Asia 2023," which summarizes in depth the business dynamics behind the modernization of daily beverage retail which is widely consumed by the majority of Southeast Asian people.

It was explained that Indonesia and Thailand are markets coffee shop the largest modern ones, with estimated annual turnover of $947 million and $807 million respectively. This huge growth was largely driven by the expansion of the player network coffee shop local. Then followed by Vietnam, which only has a few foreign-owned network players.

Based on the number of outlets, there are two coffee shop from Thailand, Café Amazon and Inthanin are the players with the most outlets in Southeast Asia with more than 3.900 outlets and 1.000 outlets respectively.

From Indonesia, there are Soul Promise and Memories Coffee with a total of 900 outlets and 800 outlets respectively. Then from Vietnam there is Highland Coffee with 700 outlets. Starbucks and Dunkin are the two players coffee shop foreigners with the most outlets, each with 2.000 outlets and 1.300 outlets.

“Consumers in Southeast Asia are more accustomed to coffee, with much of their consumption driven by instant and hand-brewed coffee sold by individual traders in markets. "Increasing purchasing power in the region has driven demand for higher value and better quality coffee, thereby fueling the growth of modern local and foreign-owned coffee chains," wrote Momentum Works.

Why is it still busy?

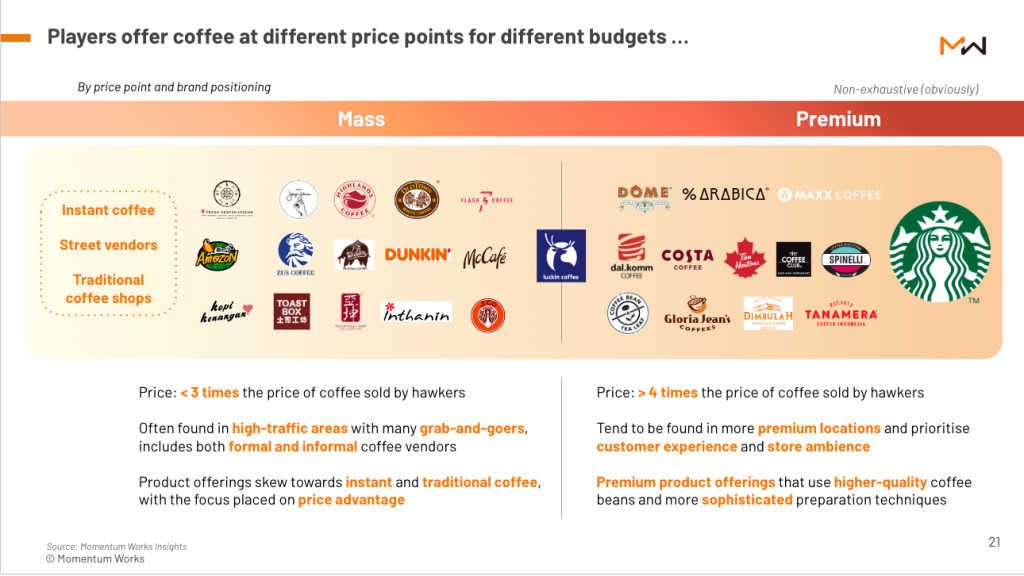

Momentum Works looks at the industry coffee shop This modern region is very competitive, but why are there still so many players in the market? The reason is because this industry is divided into two different target consumers. Namely, mass and premium.

Consumer mass it buys coffee from players mass (based on price and brand positioning) because the price is cheaper. They, formal and informal coffee sellers, are also easy to find at various points with high traffic. In terms of product offerings, they are more inclined towards instant and traditional coffee by focusing on price advantages.

Meanwhile consumers premium So, choose to buy at coffee shoppremium the price is more expensive, it can be up to 4x more than the brand mass. However, this product offering uses high-quality coffee beans and its preparation techniques are more sophisticated. Usually players premium these tend to be in more advanced locations premium and prioritizing customer experience and store atmosphere.

Apart from that, because the demand will definitely continue to exist because drinking coffee has become part of the need, it is an industrial market coffee shop This modern technology remains attractive for investors, entrepreneurs, coffee plantation owners and conglomerates that have F&B retail businesses. In Singapore alone, with the smallest market of the six other countries, there are more than 30 networks coffee shop which operates. ForeCoffee is the newest player from Indonesia who has just expanded to Singapore.

Although the players coffee shop often different in concept, atmosphere, coffee menu -even food pairings, basically they are more similar to each other than not.

Space growth slows down

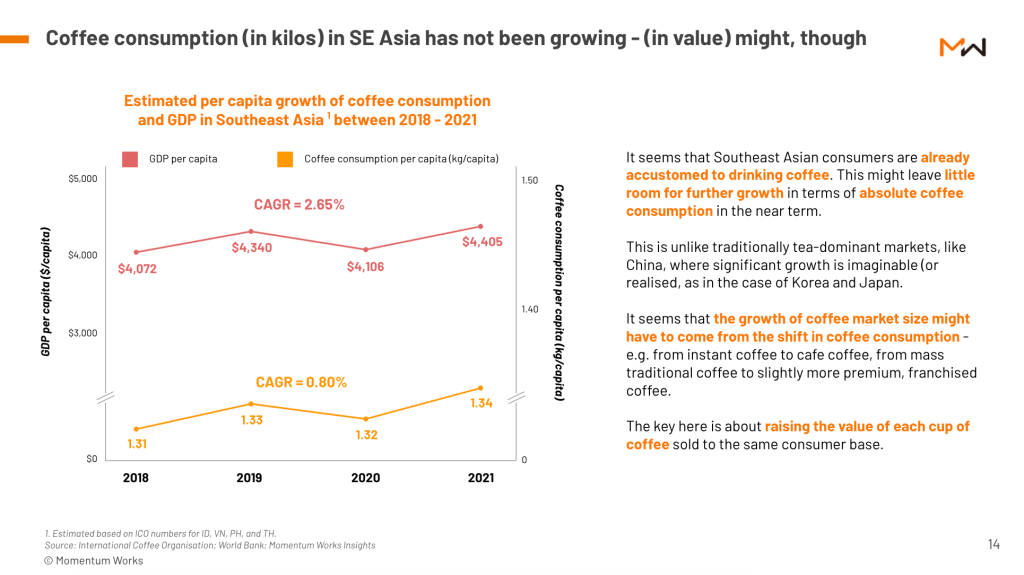

However, the big note from this report is that the estimated GDP for coffee consumption (CAGR: 0,8%) began to slow down throughout 2018-2021, compared to GDP growth per capita (CAGR 2.65%). This region is different from markets that are traditionally dominated by tea, such as China, with significant growth similar to Korea and Japan.

However, there will still be room for growth and is expected to occur due to shifts in coffee consumption, for example from instant coffee to cafe coffee, from traditional coffee to slightly more premium franchise coffee.

“The key here is to increase the value of each cup of coffee sold to the same consumer base.”

Player coffee shop required to develop its business, apart from adding food and other items to the menu, there are two other ways that can be done simultaneously:

- Taking market share from other players or forms of consumption;

- Convincing consumers to upgrade and spend more on each cup (also called premiumization);

“To achieve each (or both), players must have a clear and valid strategy, a good understanding of the evolving competitive dynamics, and of course good execution.”

Therefore, Momentum Works advises industry players to look beyond just improving products, to start looking for ways to improve their business models while leveraging technology and data to increase operational efficiency in various fields.

This increase must be supported by a strong leadership team, a solid organizational structure, and capable human resources. The ever-evolving market offers a wealth of case studies, with lessons not only for this industry, but also for all organizations across sectors looking to innovate.

Sign up for our

newsletter