Redseer Reveals Guidelines for Successful Agritech and Aquatech Business Models in Indonesia

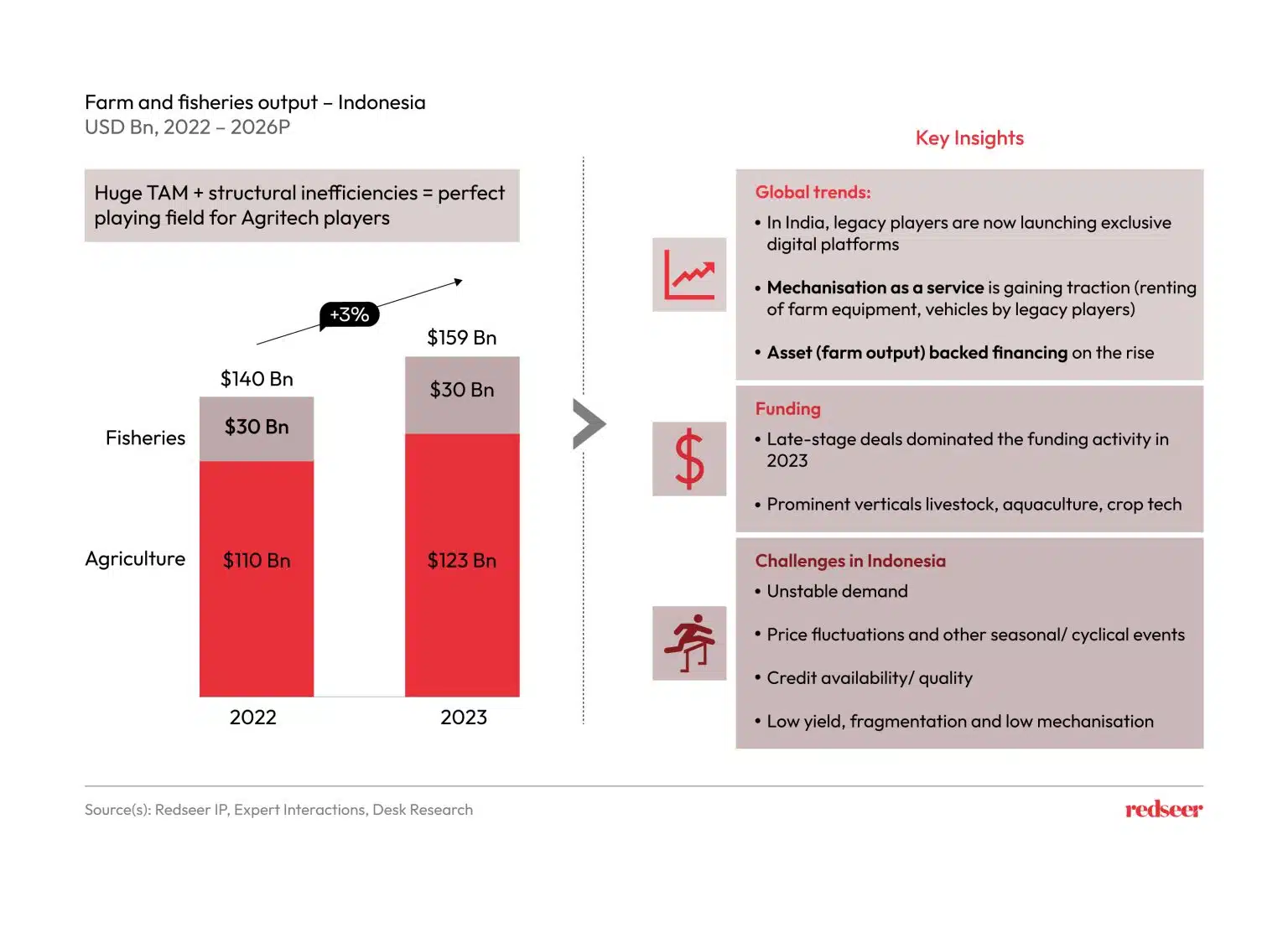

By 2022 the agricultural and aquaculture market value in Indonesia will reach $140 billion, a huge potential for digital innovators to exploit

Agricultural industry or the sleeping giant from Indonesia has increasingly shown its strength since the pandemic. Growth trend agritech (including aquatech) is actually getting stronger, one of which is marked by funding to this sector which increases every year.

Quoting from the report Startup Report 2023 published DSInnovate, sector aquatech ranked third for total funding of $213 million. Agritech came in at No. 8 with total funding of $26 million across eight deals. Compared to the previous year, agritech (including aquatech) found 15 total deals worth $229 million and was the third largest by deal amount.

Deep Redseer research institute latest report said that by 2022, agriculture and aquaculture will be worth $140 billion in Indonesia offering great opportunities for technology players to intervene and innovate.

Their technology solutions can solve some of the most basic yet important challenges farmers face. Regional/continental funding and expansion activities are proof of the large role of startups, providing a positive signal for the wider startup ecosystem.

Meanwhile, on the one hand, there are challenges faced by various startups agritech in various domains, starting from B2C, marketplace, and financing. On the other hand there are incumbent players who have catapulted themselves by leveraging learnings and creating strong business offerings.

Here are the startup guidelines agritech compiled by Redseer:

Map the players' potential for success agritech in Indonesia

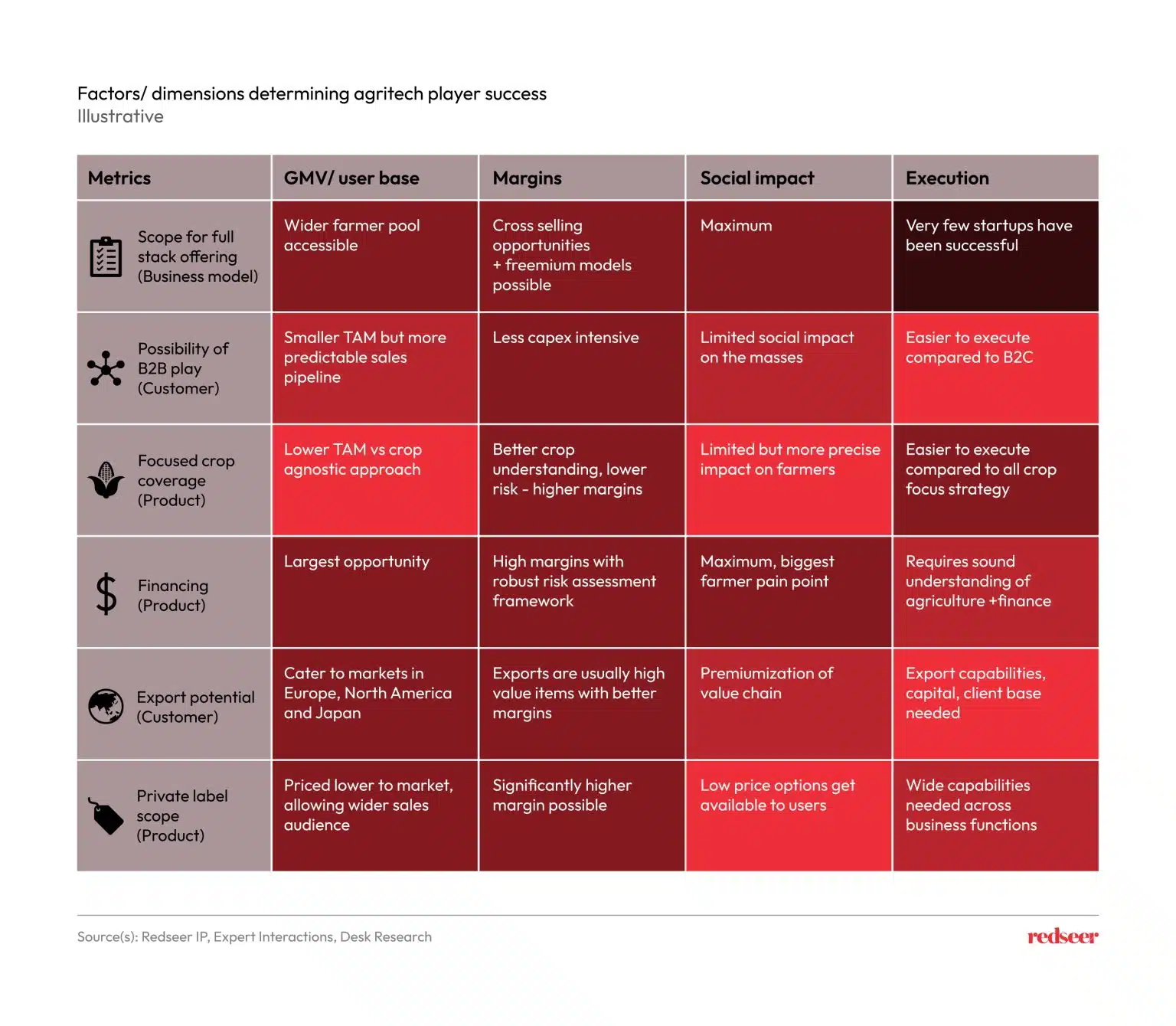

Factors and dimensions that play a role in agritech as well as the general approaches adopted by successful players:

- Target solutions full stack as a long-term goal with financing as part of it.

- Focus on a particular crop and develop skills in that area before moving on to other crops.

- B2B (supplying output products to Horeca, export houses and processing centers) is more profitable compared to the simple farm-to-fork B2C model.

- Exports and private labels are also better margin additions and great to have in a product portfolio.

Offer solutions full stack and create solutions agritech successful and tough

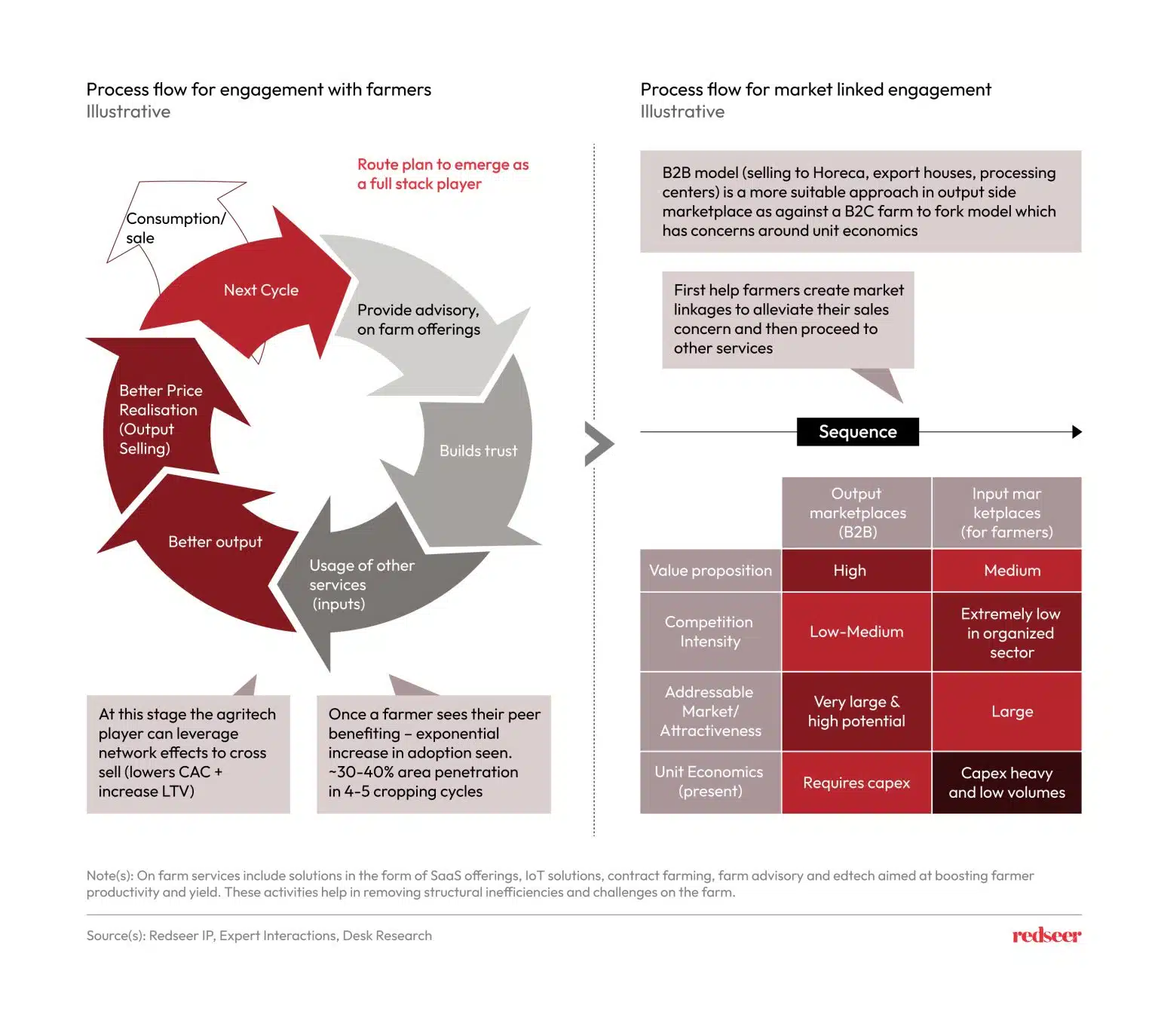

As shown in the graph, service on-farm can be a starting point for any agricultural technology player as it enables farmers to derive greater value from their product offerings and increase productivity.

This helps agritech build relationships with farmers. In agricultural services, knowledge solutions can be a starting point for educating farmers and followed by others in agricultural services. When the yield is higher and the realization is better, the perpetrator agritech got the chance to do it cross sell other offers to farmers.

Player full stack have a better chance of creating a sustainable business with stable revenues and healthy margins. To achieve the same, startup agritech need to work closely with farmers and establish market-linked relationships to provide a holistic end-to-end business offering.

Choose to identify the type of crop and overcome these low odds before moving on to other crops

More Coverage:

By operating selectively in certain crops, agritech players can create a niche market for themselves. The ideal plant type will exhibit some or all of the following characteristics:

- Facing problems around low yields, seasonality, extreme price fluctuations, low agricultural mechanization.

- Simple agricultural activities carried out by farmers can drastically increase the value of their harvests.

- It does not receive strong government support so it is less competitive.

- Large domestic/export TAM.

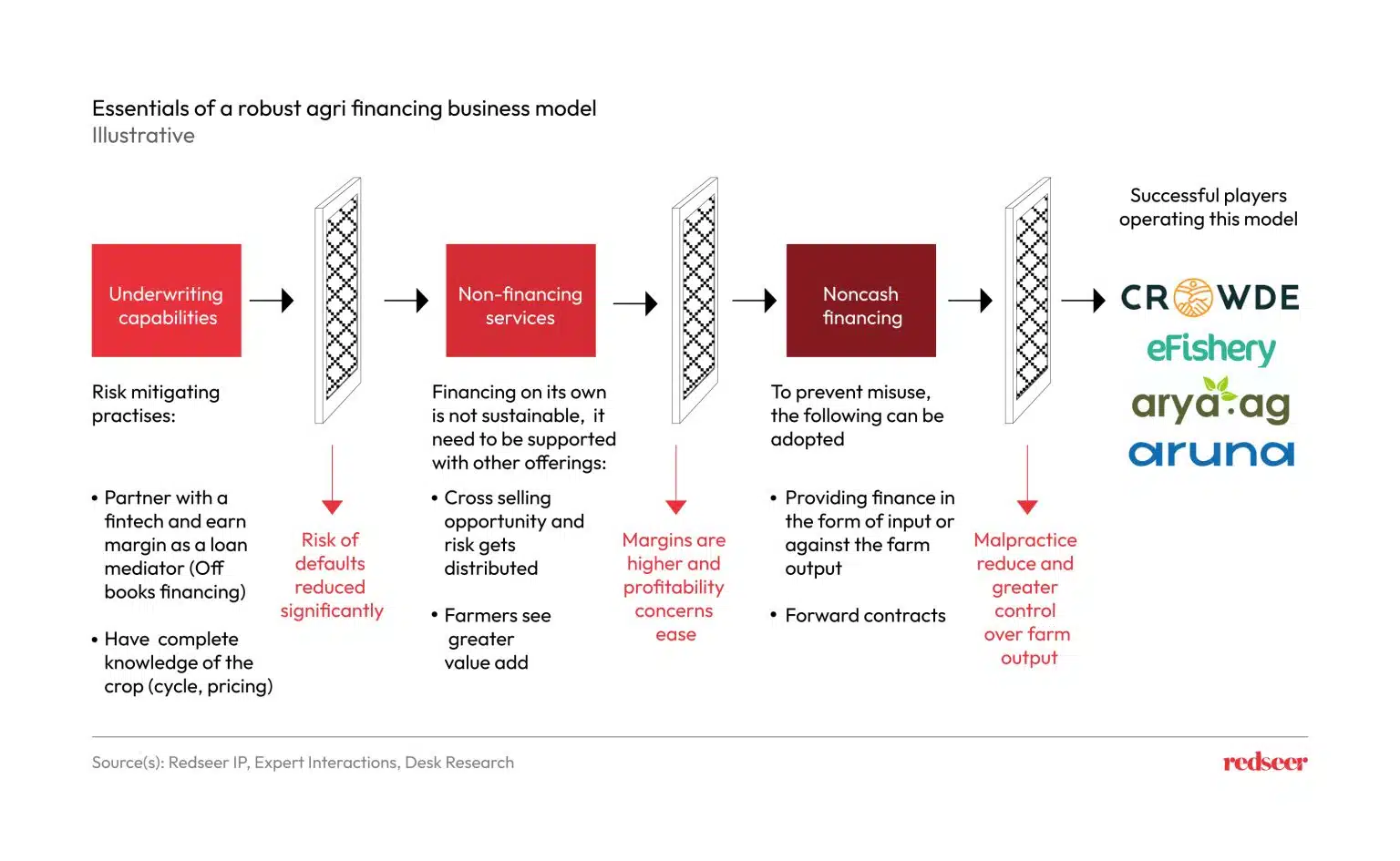

Risk-adjusted financing solutions can be created by agritech players by following a comprehensive 3-step model

Financing is the biggest opportunity in agritech. Some agritech players fail early because they cannot properly calculate risks or lack an understanding of the agricultural business model (cycles, agricultural processes). They just take it as an offer fintech. Several factors determining the success of agribusiness financing are:

- Presence across the value chain.

- Control over output to ensure ease of recovery.

- Offers financing in a non-cash format.

Sign up for our

newsletter