"Point of Sales" As Pintu MSME Digitalization Gateway

There are no dominant players yet, competing to strengthen the "go digital" initiative for MSMEs

Who is driving the pace of digital transformation in Indonesia? COVID-19.

Sounds like a joke, but in reality that is what has been happening for the past year after the COVID-19 pandemic arrived in Indonesia. All sectors are encouraged to move towards digital, especially Indonesian MSMEs which are greatly affected by various limitations in this pandemic era.

According to data from the Central Statistics Agency (BPS), the number of MSMEs reaches 64 million or 99,9 percent of all businesses operating in Indonesia. More than 60% of GDP comes from MSMEs and more than 90% of the workforce is absorbed by MSMEs. This makes the stretch of MSMEs very influential on the national economy.

Through his speech, (16/8), the President of the Republic of Indonesia said that the government continues to encourage the development of the digital economic ecosystem to increase people's productivity. The number of digitalized MSMEs entering electronic commerce applications and marketplaces continues to increase. As of August this year, more than 14 million MSMEs or 22% of the total MSMEs had joined electronic trading applications.

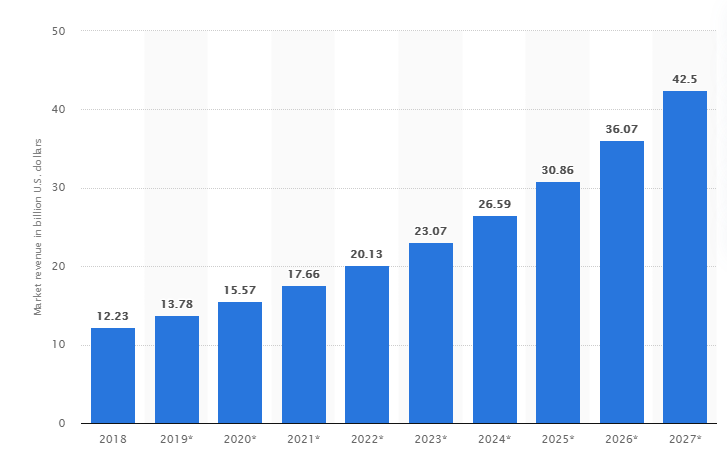

According to Kominfo data, the digital economy's gross domestic product (GDP) in 2020 reached $44 billion or grew 11% from 2019. The Mckinsey Global Institute (MGI) predicts that the digital economy will be able to contribute $130-150 billion to Indonesia's GDP growth in 2025. Next , in the long term, the size of the contribution will reach 3%.

From a technological perspective, various initiatives have been launched to help MSME activists go digital, one of them is a solution point of sale or also known as online cashier. Basically, the point of sales (POS) application functions as a cash register that records every transaction in a retail business. As technology advances, its functions develop, covering the ins and outs of retail management, from sales, customer data storage, bookkeeping, to e-commerce.

More than just a cash register

Looking back at the history of the development of POS technology, around 1800, there was no special system for recording every sales transaction in stores. Most businesses still use the traditional method where money is stored in a box and then sales transactions are recorded on paper manually.

As time passed and times progressed, a trader named James Ritty initiated its creation cash registers or cash register in 1879. In 1906, Charles F. Kettering, who at that time worked for NCR, developed the first cash register powered by an electric motor.

Entering the 21st century, cash registers have experienced many changes. The latest technology now allows web-based cash registers or applications connected to the internet which we know as Point of Sale (POS). You could say, POS is a more sophisticated version of a cash register with a computer-based system, using applications or software that allows entrepreneurs to store sales records, buyer information, inventory lists and other business data.

Don't stop there, take advantage of technology cloud, mobile point of sale or mPOS comes with a POS system that uses a tablet or other mobile device. It can be operated with iOS, Android, and Windows. Not only does it have a wider variety of devices, its small size also makes mPOS easier to adapt to layout shop.

In addition to more detailed and accurate recording, POS technology also reads purchasing behavior buyers, which can then be used if entrepreneurs want to offer relevant special promotions. From the beginning, POS was only intended as a cash register, this solution now doubles as a cash register retail management who can manage the business as a whole.

| Cash register | point of sales |

|

|

In Indonesia, several players already provide POS solutions, including Qasir, MokaPOS, Pawoon, or those that have recently launched their newest services, Majoo.

POS industry in the midst of a pandemic

In Indonesia, the COVID-19 pandemic has radically changed consumer behavior. The pattern of consumption of goods and services from offline to online is increasing, this forces business actors to adapt to conditions and transform digitally.

One of the challenges that many MSME activists encounter is that the bookkeeping process is still manual, some even don't feel it is important. The presence of POS services provides a number of conveniences for business activists. They just need a system to manage all their activities.

Mandiri Capital Indonesia CEO Eddi Danusaputro said, "We see that merchants (both online and offline) need a platform to help their business, not just POS but also payment, inventory management, accounting, and others. We feel POS is the starting point for this need."

Of course, there are still a number of MSMEs who are still not familiar with this solution. However, both the government and industry players are also aggressively providing education go-digital towards MSMEs in Indonesia.

Tim DailySocial had a short discussion with Michael Liem, CEO of Qasir, regarding the growth of the POS industry in Indonesia. He admitted that more and more people are starting to realize the importance of POS services in running a business, which can be seen from the addition of 500 thousand merchant from 250 thousand merchants before the pandemic.

Reporting from Statista, for 2020, the total value of mobile POS transactions was $1.017.982 million and is projected to reach $2.489.471 million in 2021.

Player domination

In terms of services offered, actually every POS application has core product which is not much different. With features basic POS such as accessing sales data and transaction history, financial recording, cash flow management, as well as inventory management, these services have the same aim, namely making it easier for business people to manage their business.

However, each player also tries to differentiate their business in various ways. One of them YouTube which labels itself as a trading friend application. The platform that positioned itself from the start sebagai merchant-centric It has a team that is divided specifically to serve merchant which comes from large to micro scale.

On the other hand, Qasir, whose mission is for stall entrepreneurs to level up, offers a concept pay as you grow or paid as the business grows, meaning the features provided can be obtained modularly. That way, it is hoped that businesses can better adapt the processes needed, because everything comes back to the needs and scale of the business.

At the beginning of this year, one of the entrepreneurial applications (mini ERP for SMEs) Majoo was present with features that were said to be the most complete, not only cashier applications or point of sale, but also includes inventory management, customers, accounting, employees, business analysis and orders online.

| Application | Start operating | Number of users (merchants) | Total downloads (Google Play) |

| Qasir | 2015 | 700.000+ | 500.000+ |

| MokaPOS | 2014 | 40.000+ | 500.000+ |

| Pawoon | 2014 | 25.000+ | 100.000+ |

| Smart Cashier | 2018 | 30.000+ | 500.000+ |

| Majoo | 2019 | 15.000+ | 50.000+ |

| OlseraPOS | 2015 | 10.000+ | 50.000+ |

| YouTube | 2018 | 150.000+ | 100.000+ |

| iSeller | 2016 | thousand | 10.000+ |

Among the several names currently enlivening the POS industry in Indonesia, there is no player who truly dominates. Michael Liem said that in an increasingly crowded market, POS offers products that are not much different. Therefore, each player must have innovation in terms of business model.

"In this industry, no winner takes it all. "There are so many businesses in Indonesia and they will still grow, no one player can dominate them all," he added.

Sign up for our

newsletter

Premium

Premium