Indonesian Startups Q3 2022: 62 Funding Announcements with a Total Value of $983 Million

Comparable to Q3 2021 year-on-year funding, but there is a downward trend when compared to Q1 and Q2 this year

Throughout Q3 2022, investment in startups in Indonesia, based on publicly announced data, was arguably still stable compared to the same period in the previous year. However, when compared to the previous two quarters, there was a decrease in the number of transactions and the value of funding.

Market conditions

2022 is arguably a challenging year for digital startups. A number of startups have had to change their strategy, focusing their full strength on sustainability and the direction of profitability. The previous metrics were glued to the highest growth and traction. This is due to a shift in the startup investment paradigm. Investors are becoming "conservative" and want numbers that make more sense, rather than a lot of "playing around in valuations".

Several startups in Indonesia were directly affected. They have to put the brakes on expenses that result in a reduction in the number of employees, business efficiency (by turning off sub-units that have no significant traction), to choice pivot. On the other hand, an ecosystem that is already classified as "resilient" makes the circulation of money in the digital sector still fast, especially for funding at the stage of early stage.

Startup funding

In Q1 2022, the startup ecosystem in Indonesia recorded 76 funding transactions. Of the 50 rounds mentioned in value, $1,22 billion was raised. This number has doubled compared to the same period in 2.

Meanwhile, throughout Q2 2022 there were 71 transactions that generated more than $1,4 billion in funds. It's not nearly as much as Q1 2022 gains, but on the face side there's an increase of almost $300 million.

In Q3 2022 this happens a decrease in the number of transactions and the nominal recorded. There were 62 funding transactions with an announced value of $983 million. This number is actually no different when compared to Q3 2021, which was 68 transactions worth $974 million.

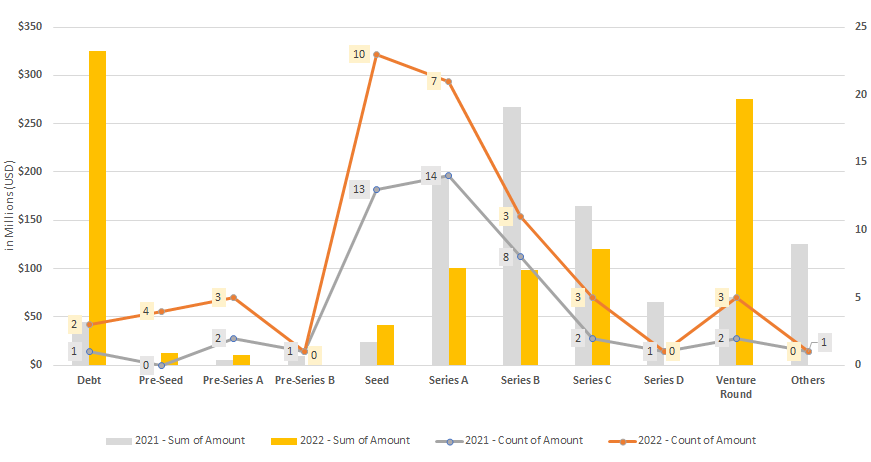

Looking deeper, the trend in funding stages is still relatively the same. In terms of initial funding amount (pre seed up to series A) saw the highest number of transactions.

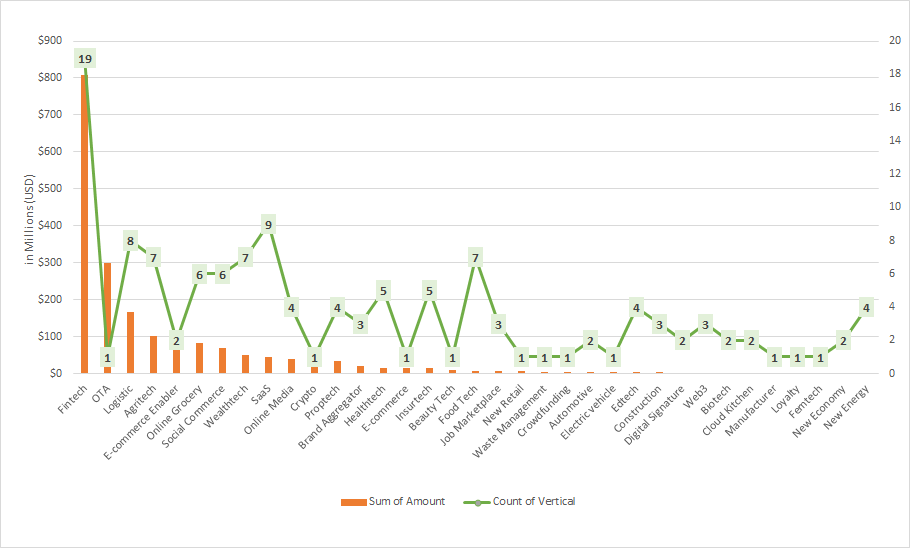

Then, if we look at the types of businesses that receive funding, the trend is still relatively the same. Fintech leading acquisitions related to the number and value of transactions. The next sector that can behighlight is logistics and agritech. Both saw increased interest compared to the previous period.

The most active investor

More Coverage:

From the funding above, 128 institutional investors contributed, as well as involving dozens of individual investors in 12 funding transactions. The following is a list of the most active venture capitalists during the Q3 2022 period:

| Venture Capital | Funding Amount |

| East Ventures | 15 |

| AC Ventures | 9 |

| Alpha JWC Ventures | 3 |

| Go-Ventures | 3 |

| Teja Ventures | 3 |

| BRI Ventures | 3 |

During this period, East Ventures invested in various sectors, starting from startups wellness, SaaS, web3, beauty-tech, wealthtech, D2C, F&B, and several other sectors. One interesting thing, last September East Ventures led Gokomodo's series A funding worth a record-breaking $26 million largest series A funding in Indonesian startups to date.

Sign up for our

newsletter

Premium

Premium