Amount of Indonesian Startup Funding Doubles in Q2 1 [UPDATED]

Trends in Q1 2022 startup funding data based on the type of round, industry segment, to the list of the most active investors and the largest investments

*There is additional data regarding the funding received by DANA worth $25 million from PT Bank Sinarmas Tbk

The first quarter (Q1) 2022 has just closed. A number of business achievements of the startup ecosystem in Indonesia have begun to be recorded, one of which is related to funding. Data DSInnovate noted, in this quarter there were 76 startup funding announced to the public. Of the 50 funding that stated the nominal, the total announced investment amounted to $1,22 billion.

This number is doubled (2x) if compared to Q1 2021. There were 40 funding transactions worth $554,7 million out of 24 announced nominal transactions. Consistently, the amount of funding obtained in the first quarter always increased 2x from 2020. This indicates that the pandemic has not discouraged investors from supporting startups in Indonesia.

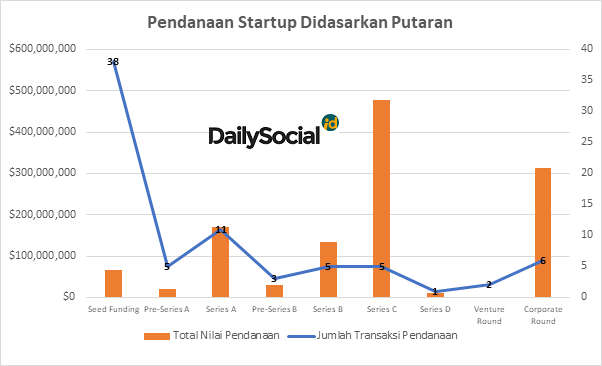

Funding round trend

Judging from the type of funding round obtained, seed funding aka initial funding still dominates in terms of numbers. This is suspected to be the presence of several new business models that are stealing the attention of investors.

Among them are solutions quick commerce to revolutionize service Grocery, then there are a number of agrotech and aquatech New products are starting to be validated on several platforms cryptocurrency, to startup direct-to-consumer.

Some startups also get significant value in their initial funding. As obtained by Tip Tip from Albert Lucius, former founder of Kudo. From East Ventures, Vertex, EMTEK, and SMDV they closed $10 million in funding to support their business debut.

Aquatech startup DELOS also received additional support from its previous investors, including Alpha JWC Ventures, MDI Ventures (via Cenaturi and Arise), and a number of other investors. They managed to raise $8 million in initial funding. A total of 13 rounds of seed funding valued at more than $2,5 million.

In the recap data funding throughout 2021, we see a trend of increasing the number of advanced stage funding (series A or above). At the beginning of this year, this trend did not appear significant, although several follow-on funding rounds resulted in significant gains (above $20 million).

What can be noted is that several relatively new startups have gained the trust of their investors to record investments again. For example, Astro, with its series A acquisition not long ago with its initial funding, closed with a nominal value of $27 million. Also other startups such as Brick (series A), Bukukas (series C), Sayurbox (series C), and a number of others which are less than one year removed from the previous funding round.

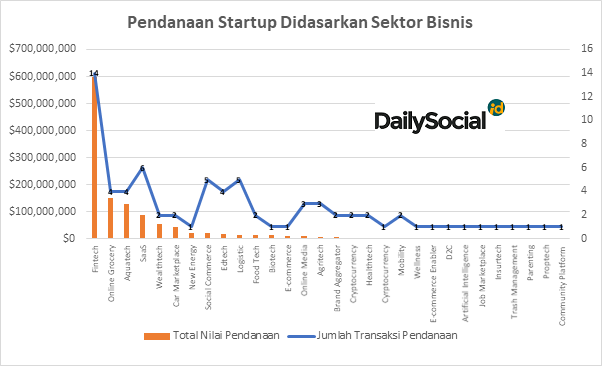

Fintech is still the favorite

Based on the type of business investors are interested in, as in previous years, fintech still firmly at the top. In fact, if you look deeper, the business model in it is also developing, for example, this year, many startups are starting to work on solutions. Earned Wage Access for early disbursement of employee salaries -- Wagely and Gajiku are two players that have secured funding in this segment.

DANA becomes a startup fintech which received the largest total funding this year. Past corporateround which was obtained from PT Dian Swastika Sentosa Tbk (part of the Sinar Mas Group conglomerate), this startup led by Vincent Iswara managed to obtain additional capital funding of $225 million to win the tight application competition e-money. Akulaku also raised $100 million in additional funding from Siam Commercial Bank, lifting its valuation above $1 billion. Now on to the list unicorn next.

The most active investor

From existing funding data, the names of investors who most actively participated in each existing funding round were also recorded. As of this quarter, East Ventures and AC Ventures topped the rankings in terms of quantity of funding participation. In fact, both are in several of the same funding rounds. Both EV and ACV have fund invested in early and advanced stage startups.

Apart from that, Sequoia Capital India is also quite active in investing - especially as a follow-up to their acceleration program Surge, a number of Indonesian startups are participating in the program.

| Investor | Number of Rounds |

| East Ventures | 13 |

| AC Ventures | 13 |

| Redwood Capital India | 9 |

| And Combinator | 5 |

| Alpha JWC Ventures | 5 |

| Alto Partners | 5 |

| Insignia Ventures | 5 |

A number of investors have the potential to increase the amount and value of their investments this year, following the successful closure of managed funds. ACV itself announced in December 2021 that it was closing its third managed fund of 3 trillion Rupiah. Alpha JWC Ventures also made an announcement last year managed funds of 6,1 trillion Rupiah which will be rolled out a lot this year.

Not to mention a number of new managed fund plans that will be launched this year, such as the Indonesia Impact Fund, Merah Putih Fund, and so on. This indicates that in the future the funding trend will be even greater - especially since a number of investors have experienced the success of this achievement exit which is impressive – via M&A and/or IPO.

More Coverage:

What is no less interesting, in this quarter angel investors participated in 28 rounds of funding. In one round, most of them are filled with more than 3 background angels founder startup (centaurs and unicorns). We see this becoming a trend life cycle interesting, moment founder in previous generations who succeeded in having significant businesses were willing to support the generation founder next.

And if it used to be angel investors the impression is only supportive in the round pre seed or angel round, now participation is starting to spread, from early stage funding to advanced stages.

The largest funding throughout Q1 2022

The following is a list of funding with the largest value throughout Q1 2022. The following data is for investment rounds that recorded at least $20 million:

| Startups | Sector | Round | Funding | Investor |

| DANA | Fintech | Corporate Rounds | $225,000,000 | PT Dian Swastika Sentosa Tbk (part of the Sinar Mas Group), PT Bank Sinarmas |

| my capital | Fintech | Series C | $144,000,000 | Softbank Vision Fund 2, VNG Corporation, Rapyd Ventures, EDBI, Indies Capital, Ascend Vietnam Ventures, Sequoia Capital India, BRI Ventures |

| Vegetablebox | Online Grocery | Series C | $120,000,000 | Northstar Group, Alpha JWC Ventures, Finance Corporation (IFC), Astra, Syngenta Group Ventures, Global Brain |

| Akulaku | Fintech | Corporate Rounds | $100,000,000 | Siam Commercial Bank |

| eFisheries | Aquatech | Series C | $90,000,000 | Temasek, SoftBank Vision Fund 2, Sequoia Capital India, Northstar Group, Go-Ventures, Aqua-Spark, Wavemaker Partners |

| Cash book | SaaS | Series C | $80,000,000 | Tiger Global, Sequoia Capital India, CapitalG, angel investors |

| Pluang | wealthtech | Series B | $55,000,000 | Accel, BRI Ventures, Gold House, Square Peg, Go-Ventures, UOB Venture Management, Openspace Ventures, Angel Investor |

| Coinworks | Fintech | Series C | $43,000,000 | MDI Ventures, Quona Capital, Triodos Investment Management, Saison Capital, AC Ventures, East Ventures |

| Moladin | Car Marketplace | Series A | $42,000,000 | Northstar Group, Sequoia India, East Ventures, GFC |

| JULO | Fintech | Series B | $35,300,000 | Credit Saison Asia Pacific, PT Surya Nuansa Berita, Quona Capital, AC Ventures, Gobi Partners, Central Capital Ventura |

| Aruna | Aquatech | Series A | $30,000,000 | Vertex Ventures, Prosus Ventures, AC Ventures, East Ventures, Indogen Capital, SMDV, SIG Venture Capital |

| Astro | Online Grocery | Series A | $27,000,000 | Accel, Sequoia Capital India, AC Ventures, Global Founders Capital, Lightspeed, Goodwater Capital, Angel Investors |

| Xurya | New Energy | Series A | $21,500,000 | East Ventures, Saratoga, Schneider Electric, New Energy Nexus Indonesia |

| safe | Fintech | Series B | $20,000,000 | Insignia Ventures Partners, BEENEXT, Integra Partners |

Sign up for our

newsletter

Premium

Premium