Indonesia Startup Funding Data H1 2022, Still Shows an Increasing Trend

On a year-on-year basis, funding for the first half of this year has doubled in value compared to the previous period

DailySocial.id re-captured digital startup funding transactions during the first half (H1) of 2022. There are several interesting trends that can be observed, in the midst of oblique issues that are currently in the spotlight in the ecosystem --- one of them regarding the market correction due to the global economic crisis, which has a direct impact on the how investors value a startup.

Reminiscing, the year 2022 begins with optimism for the revival of the digital business ecosystem after previously being hampered by many restrictions in the midst of a pandemic. Many people think that Indonesia's digital economy will skyrocket along with very fast technology adoption during the self-quarantine period.

Sure enough, throughout Q1 2022 we recordedstartup funding more than doubled compared to the same period the previous year.

However, entering Q2 2022 a number of upheavals, also has a direct impact on the startup investment climate. On the surface, news like startups do layoffs, business pivots, up to business closures are widely heard about. However, will these shaking conditions have a direct impact on the disbursement of funding to Indonesian startups?

This article will present data that answers this question.

Quarter-on-quarter improvement

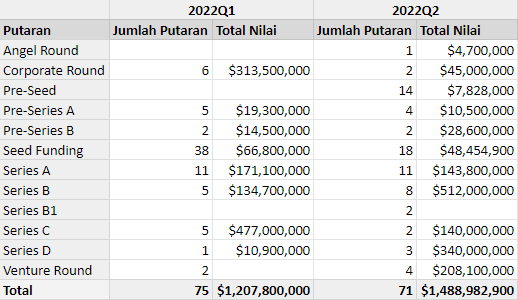

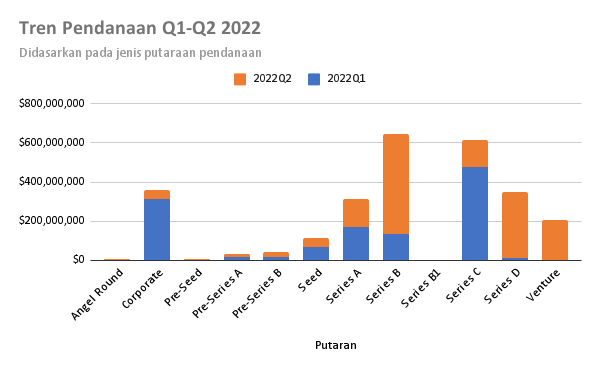

Based on startup funding announced to the public, Throughout Q2 2022 there were 71 transactions recording funds of more than $1,4 billion. In terms of number of transactions, minus 4 points compared to Q1 2022, however on the nominal side there was an increase of almost $300 million.

Looking deeper, there are several interesting trends to note. First, there is growth in the value of continued funding throughout Q2, especially in series B and above. Although the number of initial and pre-initial funding transactions still dominates --- reflecting the special attention of investors in this generation founder new.

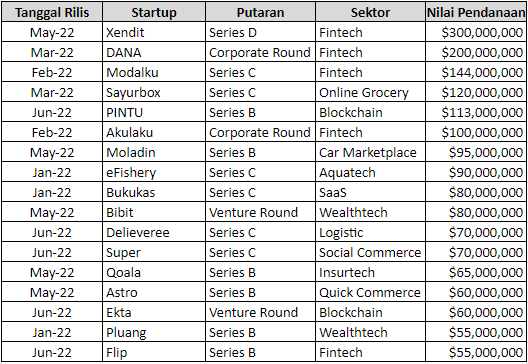

Regarding further funding, as many as 17 startups managed to record funding with a nominal value of more than $50 million in their latest round. The biggest one was obtained unicorn Xendit in series D follow-on funding.

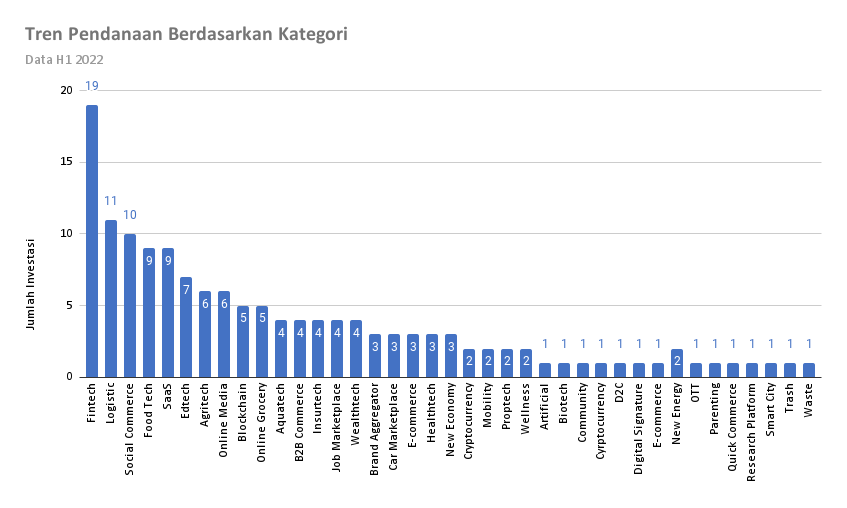

Judging from the business category, fintech is still the most hunted throughout H1 2022. Followed by other models, namely logistics and social commerce. The second one is interesting, social commerce attract investors' attention because the business model is able to catch on gap which so far the service has not been able to complete E-commerce existing ones --- for example in streamlining product distribution for users in tier 2/3/4 cities.

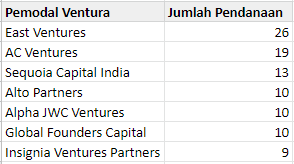

On the investor side, East Ventures and AC Ventures still occupy the top rankings as the most active venture capitalist --- in terms of the number of transactions participated in. As for angel investors participated in 44 existing funding transactions.

If armed with existing funding trend data, issues bubble brust which is currently being widely discussed in Q2 2022, does not seem to have a significant impact, because regarding funding the trend still tends to increase. However, it could be that this impact actually occurs in funding calculations --- for example regarding calculating company valuation when a startup enters the advanced funding phase.

Comparison with 2021

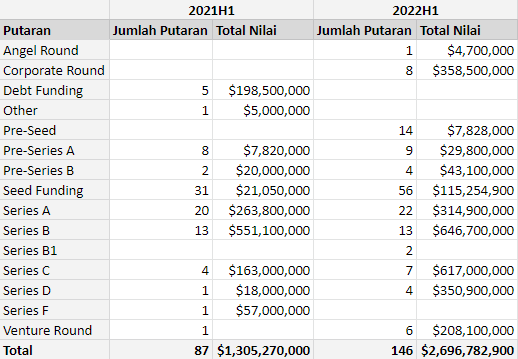

If in the first quarter the increase 2x fold year-on-year, it seems that in the first half of this year the trend is still consistent. Throughout H1 2021, there were around 87 funding rounds with a total announced value of $1,3 billion. Meanwhile in H1 2022, the number and value increased, reaching 146 transactions and recording a value of $2,6 billion.

More Coverage:

There was an increase in quantity in almost all funding rounds, from the initial stage to the final stage. Even for initial stage funding, the number of transactions increases 2x. This is an interesting thing, when there is economic uncertainty, many investors still believe in putting their money to help founder validating its business model --- in which case it carries much greater risk.

Funding disbursement which tends to increase drastically can also be seen from the readiness on the part of investors. Since the second half of 2022, many VCs who focus on the Indonesian market have announced new managed funds. Including local venture capitalists such as Arise Fund (MDI & Finch Capital), Intudo Ventures, Alpha JWC Ventures, East Ventures, AC Ventures, Sembari Kiqani (BRI Ventures), and others.

A number of new managed funds were also announced in the first half of this year, such as Indonesia Impact Fund (Mandiri Capital), Cydonia Fund (Indogen & Finch Capital), Teja Ventures, and others.

Sign up for our

newsletter

Premium

Premium