HappyFresh Reworks Business Strategy

HappyFresh is reportedly in the middle of raising further funding; make efficiency by laying off some staff, a number of executives are also no longer on duty

HappyFresh is reportedly currently restructuring its business in order to develop a sustainable business strategy. As reported Bloomberg, the company recruited consulting firm Alvarez & Marsal to conduct a review of its financial condition [Manas Tamotia served as Managing Director of Alvarez & Marsal for; previously he was CSO at HappyFresh until July 2022].

On the other hand, HappyFresh is also struggling to raise the next stage of funding. Other sources from Deal Street Asia said the fundraising will focus on paying off payment obligations to its partners --- including supermarket owners, logistics partners, and others.

Along with this, sources say that a number of employees HappyFresh experienced layoffs – although the percentage is not stated. Even some senior executives are quitting to handle their day jobs [some have resigned] pending clarity on the future fate of the company. Service operations in a number of areas in Jakarta are also reported to have stopped --- customers cannot order delivery time slots and make payments via the application.

This clearly indicates that startup online groceries it's not okay. Unfortunately, this doesn't just happen to HappyFresh, in the regional arena a number of similar startups are rethinking their strategy to become a sustainable business. Startup food delivery & groceryFoodpanda one of them, they do layoffs to a large number of employees to adapt its master plan, Delivery Hero, to achieve positive EBITDA by reducing operating costs.

Foodpanda had a presence in Indonesia, then in 2016 decided to close its services in this region.

Primadona during a pandemic

At a media conference in 2021, HappyFresh Indonesia Managing Director Filippo Candrini said that changes in customer behavior during the pandemic have impacted their overall business growth 10-20x.

In order to support business acceleration, July 2021 HappyFresh announced the acquisition series D pendanaan funding $65 million by Naver Financial Corporation and Gafina BV, previously they had raised $20 million in funding. The investment had catapulted the company's valuation at $200 million.

In this vertical there are also a number of direct competitors, startups online groceries which focuses on the B2C model. These include HappyFresh, Sayurbox, KedaiSayur, PasarNow, Titipku, AlloFresh, Astro, Bananas, and others. Draft quick commerce also gaining popularity, promising delivery in minutes.

When asked whether HappyFresh will adapt to the model quick commerce, Filippo said, "Based on our experience in observing consumer behavior online groceries, we know that most consumers plan their purchases by selecting a variety of products from various categories and storing them in the shopping cart."

From this hypothesis, HappyFresh believes that the model that is carried out is the most relevant to the needs of the market. And in the end the focus on product quality will be the main key to service survival online groceries. In other words, HappyFresh won't take part in the frenzy quick commerce before.

Traditional retailers such as Indomaret have also transitioned to an O2O strategy. Utilizing its very wide network, people are now also given the convenience of placing orders and payments through the application.

Rearrange the concept online groceries

HappyFresh's business model is an intermediary between consumers and modern trade like supermarkets. In the midst of high demand, last year they also introduced "HappyFresh Supermarket", the goal is to expand access to daily necessities products by increasing the presence of virtual stores.

This step is also used as one of HappyFresh's strategies to strengthen collaboration with national and regional supermarket chains that have so far helped provide a variety of products.

“In just a few months after launch, we saw tremendous customer interest, through 300% monthly user growth,” said HappyFresh Co-founder & CEO Guillem Segarra.

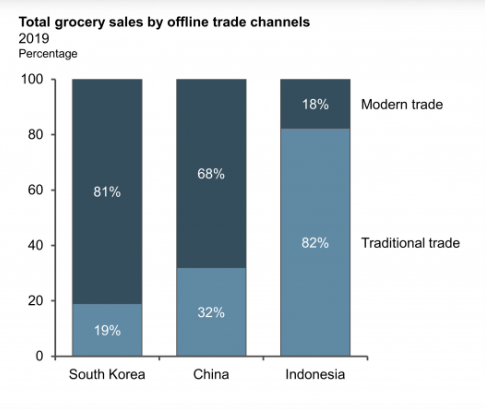

However, if you look at the data, actually the product sales channel Grocery The largest in Indonesia is still in traditional retail. Although modern stores also continue to expand its coverage area.

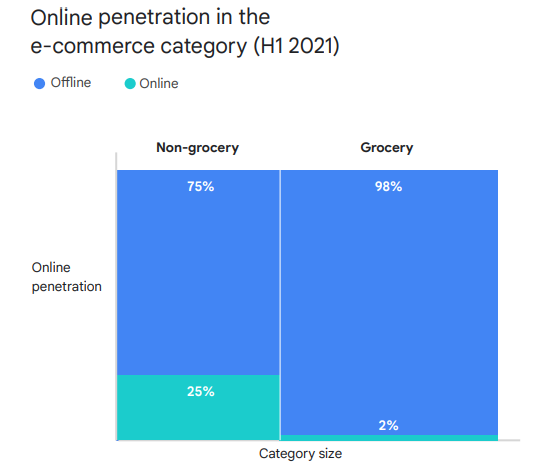

Meanwhile, the e-Conomy SEA 2021 report said that in the midst of penetration, E-commerce in Southeast Asia, sector digitization Grocery only reached 2%. Obviously this is a big homework for the related industry ecosystem to be able to increase its market coverage --- including through infrastructure improvements supply chain, market education, and business expansion on a national scale.

More Coverage:

The Covid-19 pandemic is relatively controllable, as vaccinations are evenly distributed throughout the archipelago. This has an impact on the recovery of activity offline, including in the retail sector. Shopping centers are starting to get crowded, along with travel rules that are getting looser.

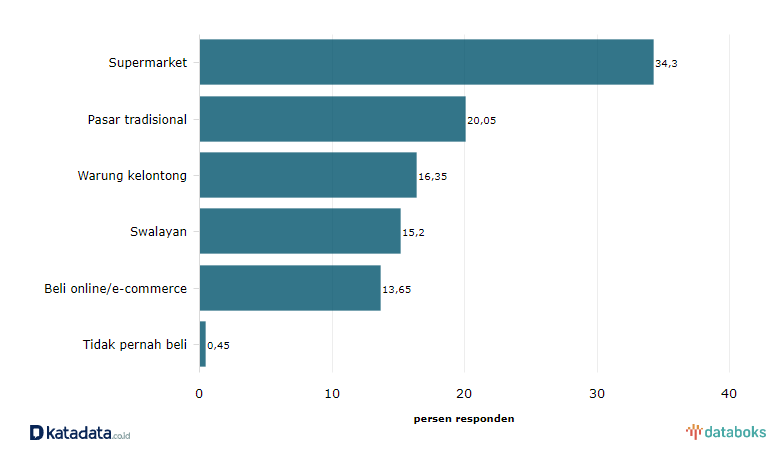

From a survey conducted by Katadata on 2022 respondents, it is stated that to fulfill their daily basic needs, the majority still rely on direct purchases at the nearest retailer, be it supermarkets, traditional markets, grocery stalls, or supermarkets. Platforms E-commerce find the lowest rank.

At this point, it can be concluded that the habits formed during the pandemic did not fully survive post-pandemic. Especially in terms of shopping, the experience of coming to the store remains a favorite choice --- although there are some aspects that can be streamlined by shopping online.

Player online groceries needs to reorganize its business model, providing a user experience that is more relevant to today's conditions. Including rearranging the product categories on the shopping shelf, so that they become relevant to be fulfilled individually on line -- at a time when speed alone is not yet fully a value proposition that makes everyone interested in being part of the consumer base.

Sign up for our

newsletter