Examining the reasons why Quick Commerce is less developed in Indonesia

According to Redseer, Indonesian quick commerce players are faced with the challenges of thin margins, low commissions and high operational costs

Indonesia is a market E-commerce the largest with a GMV contribution of 52% in Southeast Asia. Rapid growth E-commerce in this region creates demand for purchasing goods online expressly with instant delivery options or same days.

Quick commerce generally often associated with services e-grocery which offers food and fresh grocery purchasing services. However, the provider's platform quick commerce also offers daily necessities products and other product categories so that Average Order Value (AOV) can be superior to services Grocery.

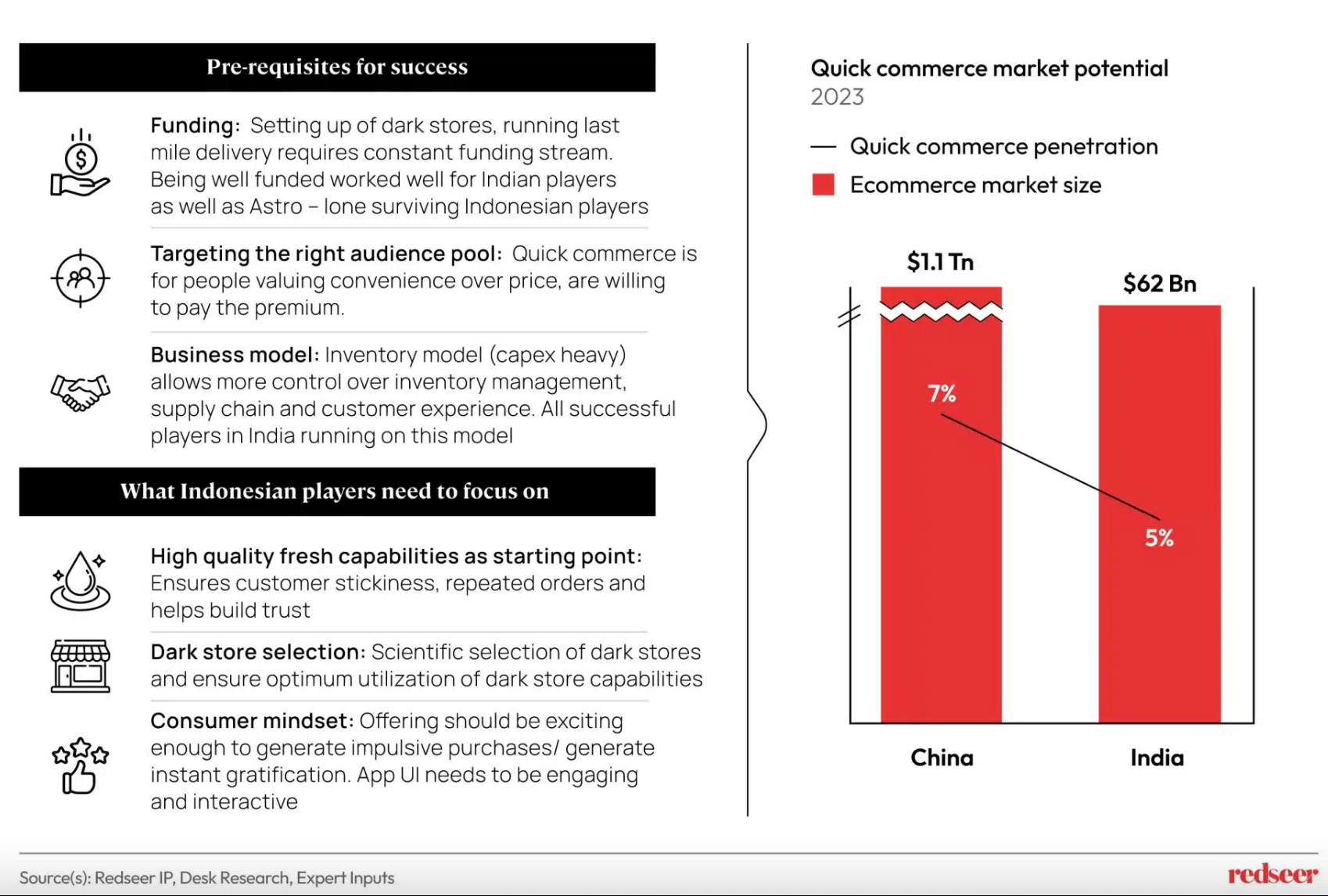

Regardless of its market potential, quick commerce In Indonesia, in reality, we still haven't found the right formula to win the market. In an analysis revealed by consulting firm Redseer, provider quick commerce in Indonesia are faced with thin margins, low product commissions, and management costs dark store and shipping expensive goods.

To increase margins, consumable products (FMCG) are also difficult to sell at a premium cost. The products available are less varied, not to mention that users generally only aim for discounts.

Most players quick commerce play in mass market instead of focusing on the upper class segment, professional workers, or the GenZ and millennial segments who tend to target convenience and speed of transactions. However, Redseer also underlined that the pandemic actually became reality check for players considering that people are starting to return to shopping in physical stores.

"The players quick commerce in the world failed for various reasons, namely focusing too much on grocery delivery. "High supply chain costs lead to very thin margins, and a lack of the right customer target market," wrote Redseer Partner Roshan Behera as quoted by Redseer.com.

As an illustration, currently the ecosystem quick commerce and e-grocery In Indonesia, there are only a few surviving players, including Astro, AlloFresh, Titipku, Segari, and Sayurbox. Several other platforms, such as Bananas has stopped its business due to the difficulty of competing in the B2C realm.

However, there are also those who pivot to other business verticals, such as Dropezy (now Sekilo) which switched to downstream poultry and Onion (now Brambang Elektronik) which is a smartphone marketplace.

Recipe for success quick commerce in India

On the contrary, said Roshan, quick commerce In fact, it is in great demand and has proven successful in India. Build supply side The right one is the key to winning the market quick commerce in India. This includes three main strategies.

First, operational dark store must run quickly to be able to make a profit. dark store must process at least 1000+ orders every day, or the equivalent of the number of transactions obtained by a traditional shop. In order to be successful, players quick e-commerce need to have turnaround times (TAT) for 1-2 months to evaluate storage in dark store.

Second, inventory management needs to be paid attention to to ensure there is a daily stock replenishment cycle to reduce working capital. Third, taking goods directly from suppliers/manufacturers/principals to avoid potential reduced profits and allow brand owners to directly negotiate the price of their products.

Furthermore, Roshan also highlighted the strategy used by TikTok to dominate E-commerce in India, that's what Zepto and Blinkit also do; two platforms that dominate the market quick commerce there. A predictive AI-powered interface is their strategy to attract engagement users, especially impulse purchase transactions.

More Coverage:

Thanks to that and a larger product portfolio--especially those with a high Average Selling Price (ASP) such as cellphones--both were able to achieve significant GMV growth. This strategy is said to be able to boost their margins. Blinkit is currently listed as master quick commerce in India with 38% market share, while Zepto took 30% share.

"By looking at the example of the case in India, one of the markets is precisely that quick commerceits growing rapidly, we can draw a hypothesis that operates quick commerce "it will be difficult to succeed separately, especially if we only focus on foodstuffs and FMCG products," he added.

Redseer added several strategy recommendations to win the market quick commerce, among them are (1) expanding product categories, similar to horizontal e-commerce and (2) targeting segments mass market and the premium one is willing to pay for convenience.

Sign up for our

newsletter