AMVESINDO: The Role of Regional Venture Capital Companies is Not Optimal

One of the challenges is that business actors in the regions are not familiar with the financing models offered by venture capitalists

The Venture Capital Association for Indonesian Startups (AMVESINDO) has just released a report regarding the performance of the venture capital industry in 2022. It notes growth in assets in Venture Capital Companies (PMV) which is followed by a decreasing trend in the number of PMV throughout the year.

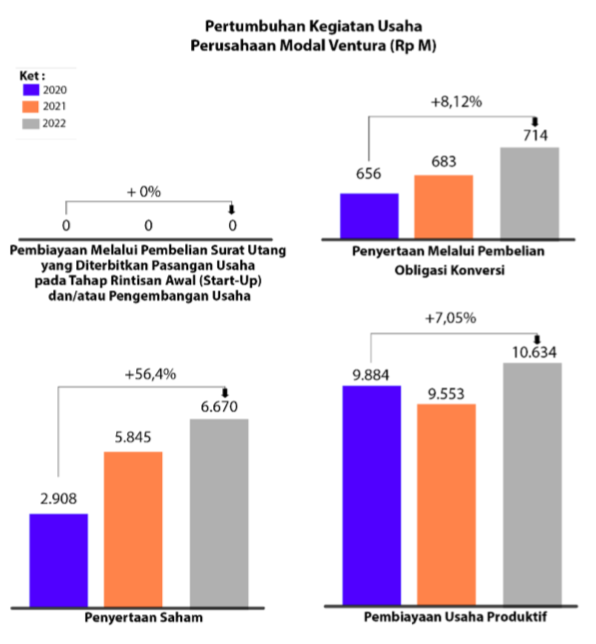

In the report, PMV's combined assets, both conventional and sharia, increased to IDR 25 trillion. This increase was driven by an increase in current assets, namely equity participation which grew 56,4% to IDR 6,67 trillion in the 2020-2022 period.

AMVESINDO assessing asset growth to be a positive indicator in the midst of a storm in the technology industry in Indonesia. Meanwhile, PMVs outside DKI Jakarta are said to channel more productive business financing compared to equity participation with a growth of 7% to IDR 10,6 trillion (2020-2022).

On the other hand, this report reveals that the number of PMV fell throughout 2022 from 55 companies (Q1) to 49 (Q4). This decline was caused by the reform of the Financial Services Authority (OJK) as the supervisory body for the venture capital industry. One of the focuses in 2023 is to rearrange venture capital business activities according to their competence or field.

According to the general chairman of AMVESINDO, Eddi Danusaputro, this asset growth indicates that the venture capital industry is getting better. "OJK reform aims to encourage PMV to carry out business activities in the form of equity participation, purchase of convertible bonds, financing through the purchase of bonds issued by Business Partners at the initial pilot stage and/or business development and productive business financing in accordance with POJK 35 Article 2," he added.

In addition, the decline in venture capitalists outside Jakarta is likely due to the not yet optimal role of Regional Venture Capital Companies (PMVD) in channeling financing/capital to MSMEs. PMVD's business scale is also relatively small considering that the community is not familiar with it financing models offered by ventures and tend to take financing options to banks.

AMVESINDO proposal

AMVESINDO seeks to encourage the role of PMVD in various regions to develop the potential of MSMEs. According to him, PMVD offers a number of added values that can be considered strongly by business actors, including the flexibility to formulate financing schemes, the foresight to take business opportunities, and the ability to provide assistance.

In its report, AMVESINDO also submitted a number of suggestions to the government to encourage the growth of the venture capital industry in the regions. This proposal is expected to boost the growth of the national venture capital industry and the economy in Indonesia:

- AMVESINDO and OJK socialization about the OJK License PMV scheme as an alternative startup funding

- Reducing the amount of start-up capital and compliance requirements for PMV stewardship

- Encouraging the formulation and implementation of tax incentives for the OJK License PMV

- Advocate for no morotarium for the current OJK Licensed PMB and encourage interested parties to the PMV registration process

- Formation of a team of experts from the OJK Licensed PMV ecosystem to study and formulate policies related to venture capital company regulations

- Expedite the venture fund application process while remaining prudent

- Continuing the Microfinance Company RPOJK process for PMV which focuses on providing MSME financing which has been running since 2021.

Deputy Chairman I of AMVESINDO Dennis Pratistha hopes that the various suggestions above can encourage the growth of the startup ecosystem and carry out its mission to play an active role in developing the venture capital industry in a professional manner.

More Coverage:

"In line with the acceleration of digital adoption, accompanied by a large population in Indonesia which has proven to be resilient in facing free market competition in 2023, AMVESINDO invites venture capital companies outside Indonesia to join AMVESINDO and together create a stronger ecosystem." Close it.

The 2022 SEA e-Conomy report by Google, Temasek, and Bain & Company projects that Indonesia's digital economy will reach a GMV of $130 billion by 2025 with a CAGR of 19%, and grow threefold in the range of $220 billion-$360 billion in 2030. Last year, three services were recorded. top digital in Indonesia is E-commerce, transportation, and food delivery.

Sign up for our

newsletter