AMVESINDO: Total Venture Capital Assets Reaches IDR 28 Trillion in the First Quarter of 2023

Shows growth in total assets of 17,26% compared to the first quarter of 2022

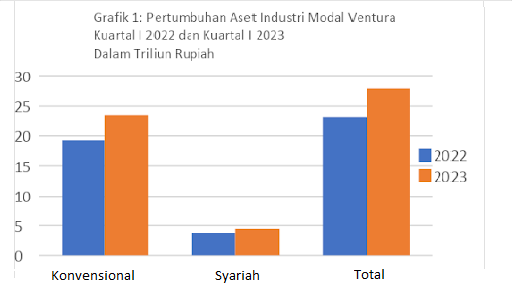

The Venture Capital Association for Indonesian Startups (AMVESINDO) said that the total assets of the venture capital industry reached IDR 27,9 trillion in the first quarter of 2023. Presented at the General Meeting of Members (RUA), this achievement grew 17,26% compared to the first quarter of 2022 which amounted to IDR 23,09 trillion.

For your information, the General Meeting of Members discussed the development of the venture capital industry. In this meeting, AMVESINDO expressed optimism that they could get through 2023 with guerrillas.

Chairman of AMVESINDO, Eddie Danusaputro assess the industry is going through a different and challenging period when the new AMVESINDO management was formed in 2022. These include post-pandemic changes, the war in Europe which affected world supply chains and prices, global finance, decreased investment in Asia, and layoffs in a technology company.

"However, the venture capital industry continues to record positive things, where there is an increase in assets of 17,26% in the first quarter of 2023 compared to the first quarter of 2022," explained Eddi.

In the graph above, total conventional and sharia venture capital assets recorded an increase of IDR 23,42 trillion and IDR 4,49 trillion respectively, compared to the same period the previous year which amounted to IDR 19,31 trillion (conventional) and IDR 3,78 trillion (sharia). ).

AMVESINDO believes the growth of the venture capital industry is due to hard work and consistency in running the business Corporate Governance and comply with regulations made by conventional Venture Capital Companies (PMV), Regional Venture Capital Companies (PMVD), and Sharia Venture Capital Companies (PMVS).

In the regional realm, investment trends have also recorded an increase in recent years. Quoting from the latest report Momentum Works and Cento Ventures in "Southeast Asia Tech Investment 2022", Southeast Asian startups raised $10,4 billion in funding in 2022, the third strongest year on record, and at par with pre-pandemic investment levels.

The report said the total funds raised in 2021 were $14,5 billion. Then in 2022, the region closed a total of 929 agreements, slightly down from 991 agreements in 2021. It was stated in the report, "Southeast Asia did not see an abnormal investment capital deficit until the end of 2022 despite the bad mood of the capital market."

Amvesindo Institute

Since it was founded in 2016, AMVESINDO aims to create a stronger venture capital industry so that it is better beneficial for the startup ecosystem. In its 7th year, AMVESINDO Institute was established to strengthen the association's strategy to improve the venture capital and startup ecosystem. Another goal is to strengthen synergy with the Financial Services Authority (OJK) as a regulator and PMVD.

More Coverage:

The AMVESINDO Institute program focuses on increasing the competence of PMV and PMVS management so that they remain relevant to market needs and developments, as well as development to hone skills and build experience which can be considered as competency certification qualifications for venture capital businesses in each company.

The AMVESINDO Institute, which was established with the entity PT Lembaga Karya AMVESINDO, acts as an income and profit-oriented business, and is run under the leadership of the management of the venture capital company as well as AMVESINDO, including Jefri Rudyanto Sirait, Sandhy Widyasthana, Edward Ismawan Chamdani, Rimawan Yasin MM, and Rachmat Faizal Nasution.

"Through our initiatives and proposals above, AMVESINDO will further strengthen its role in continuing to increase the role of the venture capital industry for a better startup ecosystem, which can be beneficial for the Indonesian economy as part of the Southeast Asian, Asian and global economies. We also invite companies non-venture capital both corporations and startups to join AMVESINDO," concluded Dennis Pratistha, Deputy Chairman I of AMVESINDO.

Sign up for our

newsletter