VC Ecosystem Awaits Government's Further Steps to Encourage Venture Capital

AMVESINDO has established key strategies to encourage venture capital development in Indonesia

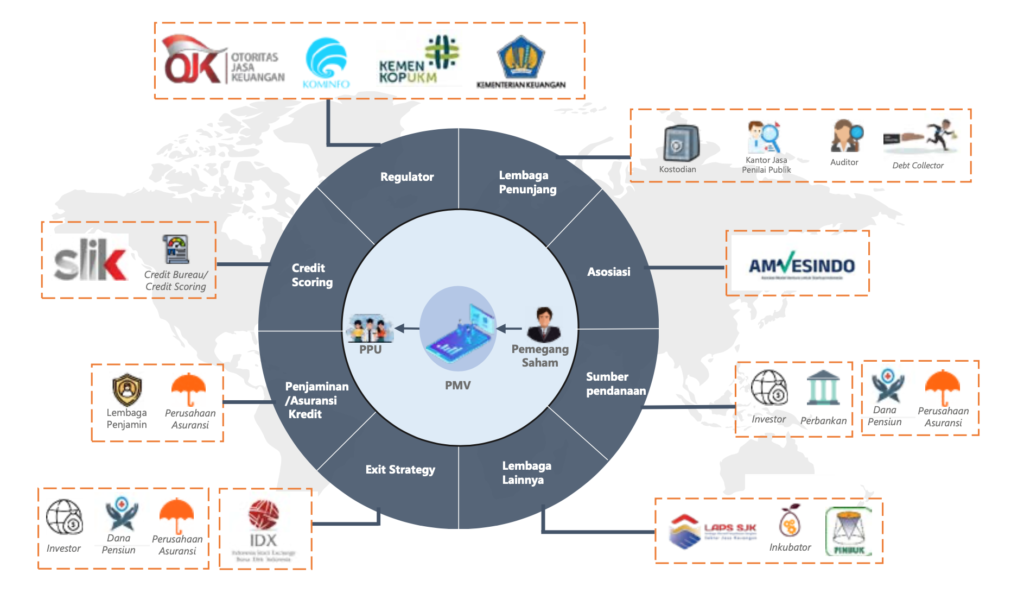

Following its publication POJK No. 25 of 2023, The Indonesian Venture Capital Association for Startups (AMVESINDO) released a roadmap for developing venture capital companies (PMV) in Indonesia. Regulations regarding capital and licensing are known to be in conflict venture capital (VC) in Indonesia is a key strategy that will be encouraged by the association.

This road map seeks to provide an overview of the current development of PMV and its challenges, as a reference for policy makers. For example, challenges regarding funding sources for venture capitalists, especially those carrying out capital investment business activities.

Currently, the majority of PMV funding sources come from loans. About 32% of venture capital assets are funded from loans. Meanwhile, venture funds can be an option for expanding PMV funding sources.

Apart from that, AMVESINDO found that not many venture capitalists focused on capital investment. Of the total 54 PMVs, around 74% of PMVs had capital participation of less than 51% of the total funding disbursed. This is because most of the business activities are financing to business partners. Only 12 PMVs had a share of capital participation of more than 85%.

So The roadmap This will be completed in 2028, AMVESINDO targets 67% of VCC distribution to be focused on capital participation and 67% of VDC assets for financing business partners. In addition, as of November 2023, total PMV assets were recorded at IDR 26,56 trillion or grew 80% (YoY), consisting of conventional PMV (IDR 25,59 trillion) and PMVS assets (IDR 0,96 trillion).

Meanwhile, POJK 25/2023 has only raised the main provisions regarding the categorization of venture capital companies (PMV) and sharia venture capital companies (PMVS) only. A number of VCs we asked were reluctant to comment much regarding this new rule. However, they admitted that they were waiting for the government's next steps to accommodate the needs of VC industry players in Indonesia.

"In my opinion, this POJK is approaching best practice in countries that already have a standard (standardized) venture capital ecosystem. The problem is, is this POJK attractive to VC? "In Singapore, for example, the rules and ecosystem are clear," said Ideosource Managing Partner Edward Chamdani when contacted DailySocial.id.

He also considered that the provisions on the paid-up model were quite burdensome for venture capitalists. The reason is, in the provisions of POJK 25/2023, the minimum capital requirements required depend on the type of PMV. For category venture capital corporation (VCC), the minimum equity is IDR 50 billion. Then, venture debt corporation (VDC) is required to have a minimum equity of IDR 25 billion, while Sharia Business Units (UUS) have a minimum of IDR 10 billion.

According to the AMVESINDO report, 12 PMVs out of a total of 54 new PMVs have equity below IDR 25 billion, while only 28 PMVs have equity below IDR 50 billion. This low equity is considered to be able to affect PMV's ability to expand its business scale, including absorbing risks that could potentially result in business failure.

Even so, AMVESINDO is known to have had many discussions with the OJK to accommodate issues related to capital to taxation as has been widely voiced by PMVs who actively invest in Indonesia, but the legality of their businesses is registered overseas. Currently, the number of PMVs in Indonesia is 54 with the majority headquartered in DKI Jakarta, of which five are Sharia PMVs.

AMVESINDO Chairman Eddi Danusaputro stated plans for further discussions with the OJK and related agencies to discuss tax matters at the end of this month. "Tax matters are in the realm of the Ministry of Finance, so this just requires coordination between ministries," said Eddi some time ago.

Edward, who also serves at AMVESINDO, added that discussions regarding capital, taxes and derivatives with the OJK were no longer preliminary discussions, but were already discussing observations with models in other countries. According to him, by having a complete ecosystem, this can influence the future growth of venture capital businesses.

Sign up for our

newsletter