AMVESINDO: "Exit" Strategy and High Startup Interest for IPO

The IDX said eight technology companies will conduct an IPO in 2023

Recently, PT GoTo's IPO journey Gojek Tokopedia Tbk (IDX: GOTO) is in the public spotlight. The reason is, after being crowned as one initial public offering this year, GoTo's stock price continues to decline.

As of today (15/2), GoTo's share price was recorded at IDR 96 per share, much lower than during the IPO at around IDR 338 per share.

Apart from GoTo, another technology company PT Bukalapak.com Tbk (BUKA) also suffered a similar fate. The IPO share price was IDR 850 per share in August 2021 and has now fallen to IDR 280 per share (``15/12). This begs the question whether IPOs are a strategy exit ideal for a technology company?

In early December, the Indonesian Venture Capital Association for Startups (AMVESINDO) held a seminar entitled "Exit Mechanism for Investors & Startup Companies (IPO vs Acquisition)". In this event, there were several representatives stakeholder to discuss strategy exit which is ideal for startup investors in Indonesia.

Strategy exit is one of the significant decisions in runway a technology company, especially after the company has received funding from investors. As you know, strategy exit This can be done through an IPO, merger or acquisition. This is done in order to end the investment in a way that will maximize profits and/or minimize losses.

Regarding strategy exit through IPOs, technology companies still often face challenges. Bono Daru Adji as Senior Partner of Assegaf Hamzah & Partners revealed that regulations in Indonesia were considered inadequate for startups to carry out IPOs. In addition, the internal structure of startups in the pre-IPO stage is often considered insufficient to be listed on the stock exchange.

However, recent OJK and IDX regulations have begun to be adapted to the needs of startups intending to go for an IPO. Apart from the related POJK 22/2021 Multiple voting shares (MVS), IDX regulation No. IA regarding the listing of shares no longer requires obligations profit for issuers intending to list their shares on the Main Board.

This opens up opportunities for startups. Strategy exit through an IPO is one way to raise funds from public investors in the hope of developing the company's business, not just for exit. Even so, some investors consider the acquisition mechanism (M&A) to be more profitable than an IPO.

This was acknowledged by Managing partner of MDI Ventures Kenneth Li. According to him, the acquisition allows for a quick liquidation process. While IPO has a waiting period of at least 8 months. "That's if the share price goes up," he added. However, he emphasized that the strategy cannot be generalized to all companies.

BNI Ventures CEO Eddi Danusaputro who also serves as chairman of AMVESINDO said, "that we as venture capital need funds to be rolled back through investment. M&A allows for compact liquidity. While the IPO has a waiting period. As investors' fund managers, we also have a responsibility to be able to turn over the money immediately."

Alternative fundraising

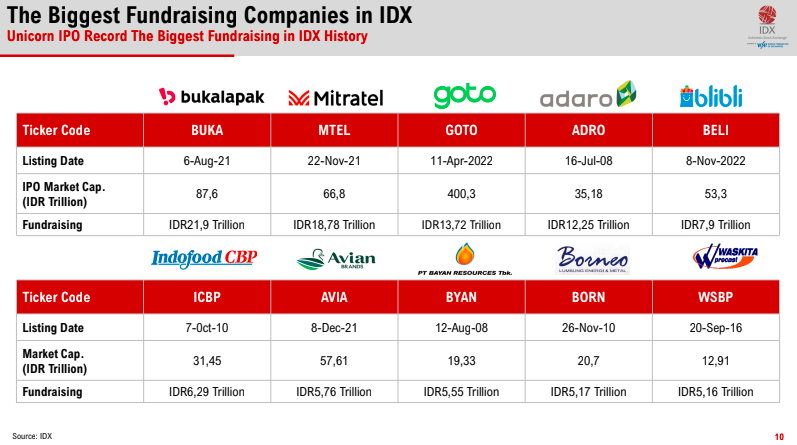

The Indonesia Stock Exchange (IDX) noted that throughout 2022 there were 59 issuers that did initial public offering (IPO), Venteny became the last company to be officially listed on the IDX. This figure is the highest record in the history of the Indonesian capital market. In addition, the acquisition of IPO funds in 2022 is said to have reached IDR 32,68 trillion.

Head of IDX Incubator Aditya Nugraha said, "As for IPO interest, it feels like next year will still be high. pipeline us, we have 48 in progress for next year, this is not counting December. We are sure that next year will be more crowded. The hope is that the companies that enter will Sizeable and better prepared for go public, including from the aspect compliance. Not just IPO and create market So unhealthy," he said.

He also revealed, in the exchange itself there is no definition start-up company but rather the Register of Technology Stocks (IDXTECHNO). Of the 48 entities applying for an IPO in 2023, eight are technology companies. This sector is still very interesting to go public, many companies are still looking for alternative funding through IPOs.

Aditya, who is familiarly called Anug, also provided input for the students founder those who intend to go IPO on the IDX, namely by forming a legal entity in Indonesia to make it easier to carry out each process. Then, founder You have to clean up early on, you can't just focus on business but more detail in managing administrative aspects, including legality, finance, taxation, etc.

Next, the company must have The roadmap clear. When IPO, details of the use of funds must be complete. To be able to go public, the company must be able to attract investors. Starting from expansion plans, research development, talent, etc. "They must have path which is clear, can not be inflated. If everything is complete and clear, the IPO process can go smoother," he concluded.

Sign up for our

newsletter