GMV Food Delivery in Southeast Asia will only increase by 5% throughout 2023

According to the Momentum Works report, Indonesia remains the largest food delivery market with a value of $4,6 billion

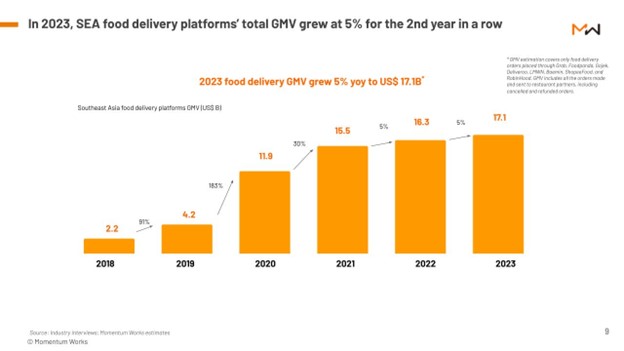

The annual report "Food Delivery Platforms in Southeast Asia" published by Momentum Works reveals that the total GMV of food delivery services in Southeast Asia is estimated at $17,1 billion---only growing 5% (yoy) throughout 2023. This growth figure is exactly as stated. happening in 2022.

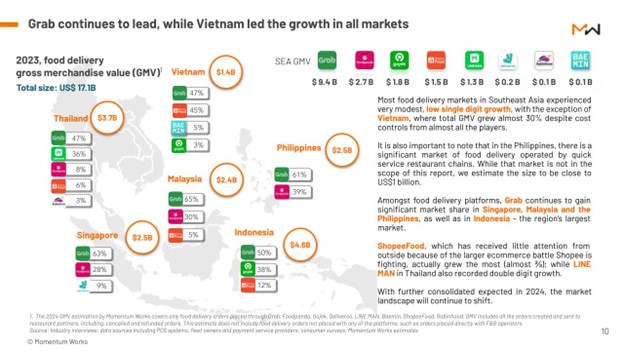

The biggest growth came from Vietnam ($1,4 billion or 27%) and followed by Malaysia ($2,4 billion or 9%). Thailand and Indonesia recorded single-digit growth, GMV of 2,7% ($3,7 billion) and 2,2% ($4,6 billion), respectively. Meanwhile, Singapore remained at the same GMV of $2,5 billion.

If you look at volume, Indonesia remains the largest market, followed by Thailand. Singapore and the Philippines are in the same order, followed by Malaysia and Vietnam.

“High food and beverage consumption, low food delivery penetration, and ongoing consolidation, leave a lot of room for growth for food delivery platforms in the region. "While focusing on their core capabilities, leading players also need to pay attention to potential market changes and emerging challenges," said Momentum Works Founder & CEO Jianggan Li in an official statement, Monday (29/1).

Even though some countries in this region only recorded single-digit growth, there is a small interesting note that occurred in the Philippines. There, most of the food delivery market is operated by fast food restaurant chains.

“While the market is not within the scope of this report, we estimate its size to be close to ⅓ of the total platform GMV in the country,” the report states.

Furthermore, based on the contribution of each player, Grab is still named the largest contributor in the region, at 55% or $9,4 billion of total GMV. Foodpanda and Gojek estimated to contribute 15,8% ($2,7 billion) and 10,5% ($1,8 billion), or declines of 12,9% and 10,0% YoY respectively.

Next, Shopee and LINE MAN showed significant growth. The two are estimated to contribute 8,8% ($1,5 billion) and 8,1% ($1,4 billion), respectively.

More Coverage:

Market share Grab dominates significantly in Singapore, Malaysia, the Philippines and Indonesia. ShopeeFood, which has received little outside attention due to competition E-commerce the bigger one that Shopee is fighting for, actually experienced the biggest growth (almost ⅔); while LINE MAN in Thailand also recorded double-digit growth.

Main highlights

This report also highlights industry trends in 2023. Here's a summary:

- Premium F&B brands face challenges even as regional spending on F&B begins to recover: F&B spending in Southeast Asia has finally recovered to exceed pre-pandemic levels ($125,2 billion in 2023 vs $115,7 billion in 2019). However, many premium brands (especially in Singapore) are finding this year more difficult than 2022, and many are taking cost-cutting measures amid macro uncertainty and inflation, which may increase price sensitivity among middle-class diners.

- The mass entry of Chinese F&B brands increases competition: In 2023 there will be an accelerated entry and expansion of Chinese F&B brands into Southeast Asia. This trend can be seen from 30 Luckin Coffee outlets in Singapore and nearly 4.000 Mixue outlets throughout Southeast Asia. However, brands in various categories and sizes have also established a presence in the region. They leverage their knowledge in store operations, marketing, user operations, and franchise management. Expect more in 2024.

- Main cast food delivery have achieved profitability: Most platforms have reached or are on track to reach adjusted EBITDA breakeven (adjusted EBITDA), with some targeting to achieve positive free cash flow by 2024. However, as the experiences of Meituan and Uber show, profitability may not last long - platforms must continue to balance growth with sustainable profitability.

“After one to two years of cost reductions, operational optimization, and sometimes layoffs, most platforms have, by their own definition, reached a certain level of profitability. "The consolidation that is already occurring in this sector is expected to continue in 2024," wrote the report.

- Food delivery players continue to differentiate strategies, leveraging advertising to increase revenue: Major food delivery players continue to leverage advertising products to lock in more investment from merchants. Then, it expanded its advertising product portfolio to meet the various needs of all brands, including large F&B chains, SME F&B merchants, and FMCG.

- Room for user base growth and operational optimization in the region: Grab only has 5% of the region's 600 million population as monthly transaction customers. Amid flat sector topline trends, underserved populations in big cities, expansion into smaller cities, and catering to tourists provide further growth opportunities for food delivery platforms. Players are encouraged to continuously optimize operations to reduce costs and increase their profits.

Sign up for our

newsletter