Cento Ventures: The Recent Investment Climate Could Influence Startup Valuations Back to the Pre-Unicorn Era

The fintech sector contributes 40% of all investment; all fintech derivative verticals are getting investment

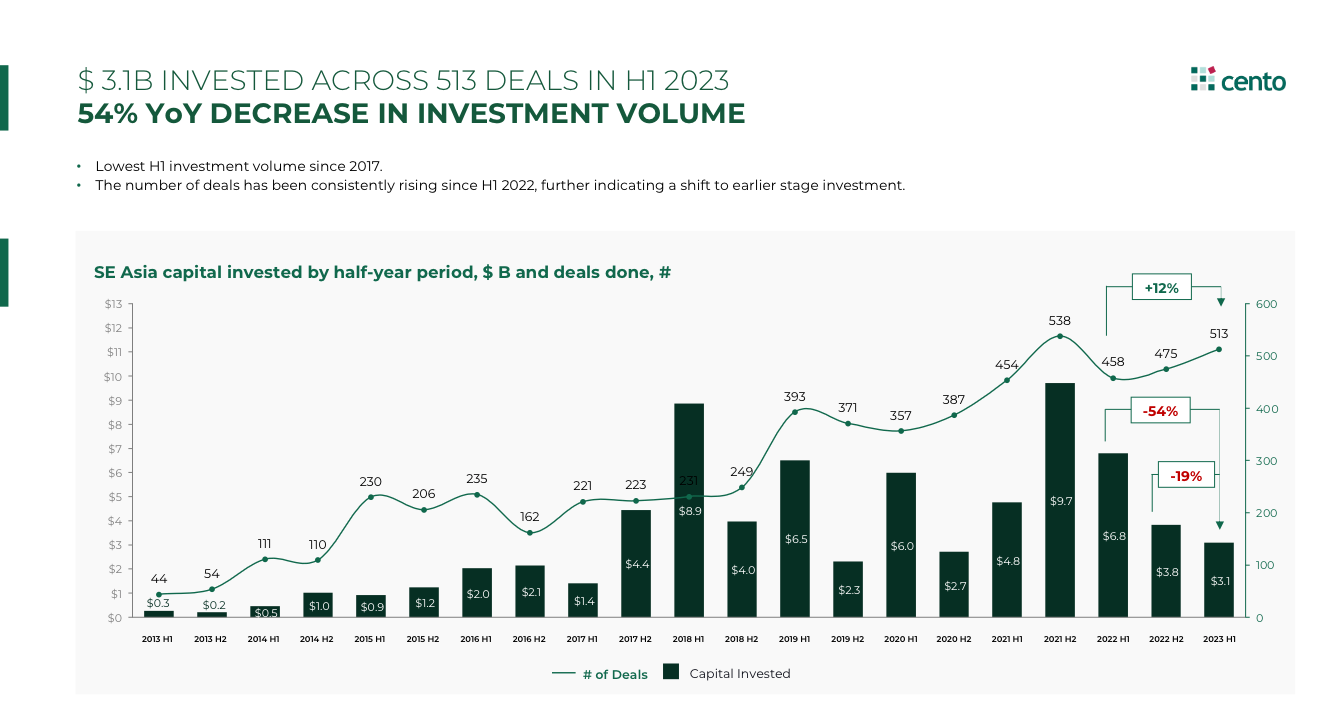

On first half of 2023, Southeast Asia saw investment volume fall by 54% to $3,1 billion. This decline is the lowest first-half investment since 2017, according to the report announced Cento Ventures.

The report states that although investment in the region is falling, the trend will end as investor interest in new funding slowly increases.

“The investment deal landscape appears to be reversing to pre-Covid-19 levels – and quite possibly to pre-era standards unicorn. The return of valuation bubbles and deal sizes follows the decline in investment volumes, but with a significant lag. "Interestingly, this market correction only occurred a full year after the market downturn was first felt in the US — the region did not experience a sharp decline in capital intake until the end of 2022," wrote Cento Ventures.

Despite the loss of half of its capital, the region is still below the baseline figure for capital receipts in 2017-2020 – the only global market besides China that was able to adjust quickly, as the 2021-2022 achievement has not increased investment levels in Southeast Asia that much, such as in India or Latin America.

“This, coupled with volume mega-deal "which is a historical minimum, leads us to believe that Southeast Asia will probably experience a slightly smaller decline in investment activity year-on-year compared to similar regions," the report said.

This hypothesis is strengthened by reports “Southeast Asia Deal Review 2023” quoted separately, compiled by Deal Street Asia and Rigel Capital. It was stated that throughout last year total funding in the region fell by 51% to $7,96 billion. Investment deals fell 30% to 718 deals.

As further explained by Cento Ventures, when this region entered an era of correction, investors continued to shift their attention to early stage funding. Even though negative sentiment is increasing towards the second half of 2023, the core business in Southeast Asia is apparently able to survive well.

“We see capital in the pre-A to series C stages (all ranges of $0,5-50 million per deal) still being deployed at the same pace as the previous three years. However, categories mega-deals (above $100 million) has almost reached the historical minimum with only a few companies in this space (eFishery, bolttech, Kredivo, and Moladin) who raised or announced a $100M+ round in H2023 XNUMX.”

Regarding changes in the valuation landscape, Cento said that this has only just begun. Things like runway which is getting shorter in 2021-2022 and the number of company closures that are known to the public have a significant impact on investors' mindsets.

The true picture of valuation is still clouded by the existence of two “props” – namely structured internal rounds and private debt, which is applied liberally to delay pricing of digital companies across the ecosystem.

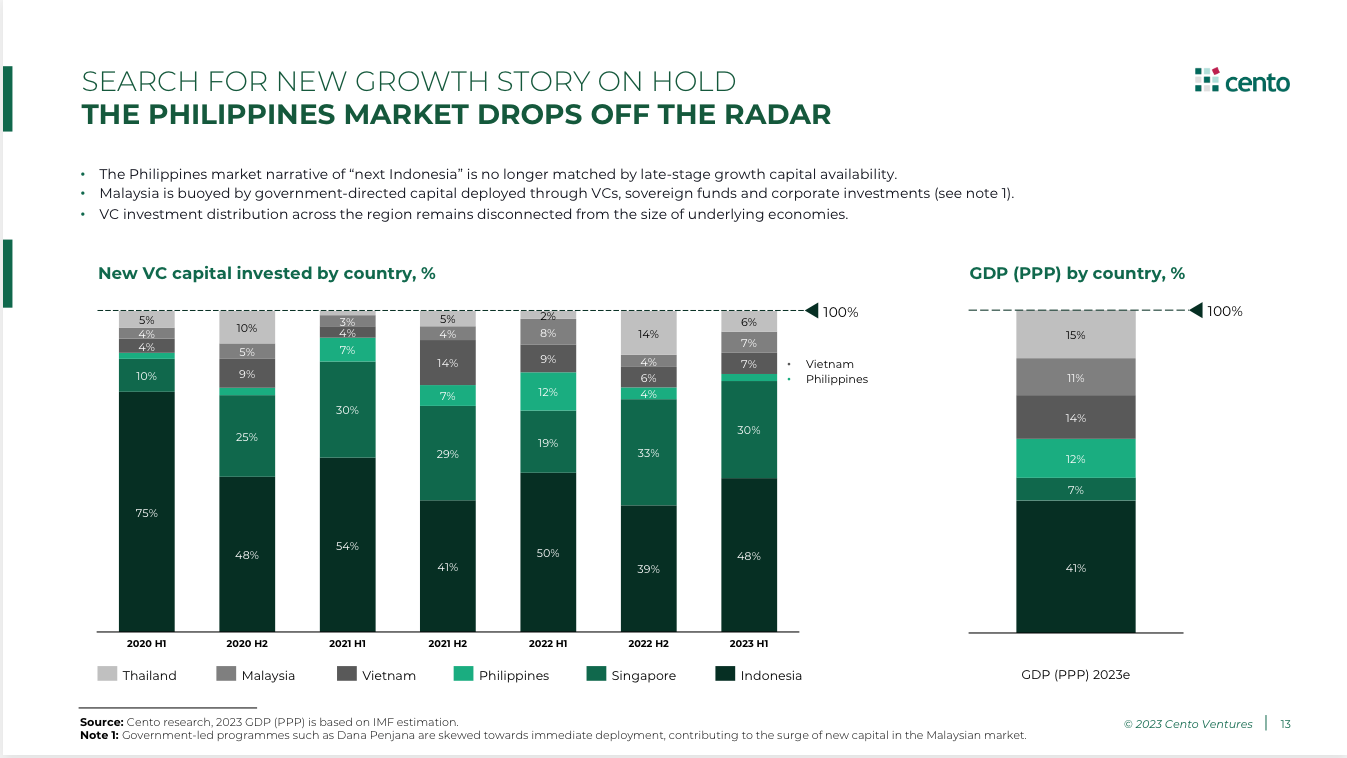

The Philippines is considered to have failed the next Indonesia

Startups in the Philippines were previously predicted to become the next Indonesia. However, in reality, according to Cento Ventures, it is considered to have failed to achieve this.

It was further stated that since early 2022, when valuations in Indonesia peaked and the search for the next regional growth story began, the narratives of “Next China” in Vietnam and “Next Indonesia” in the Philippines have been tested against each other. Nearly two years on, neither market has shown any clear progress.

Vietnam has launched many early-stage investment funds and maintained a large share of regional investment flows, although investment activity has weakened due to the economic downturn. Meanwhile, the Philippines experienced a surge in activity from various local conglomerates and the emergence of various capital-intensive business models, which mirrored Indonesia's development in 2017-2019.

"However, this development is faced with a lack of capital at a later stage to support this development."

In another country, namely Malaysia, the government is trying to increase investment activity in the country through various programs led by government agencies. The result, giving the country a regional investment share equal to Vietnam and a significant increase in investment valuation in series A and B rounds.

Sector fintech funding vertical dominance

More Coverage:

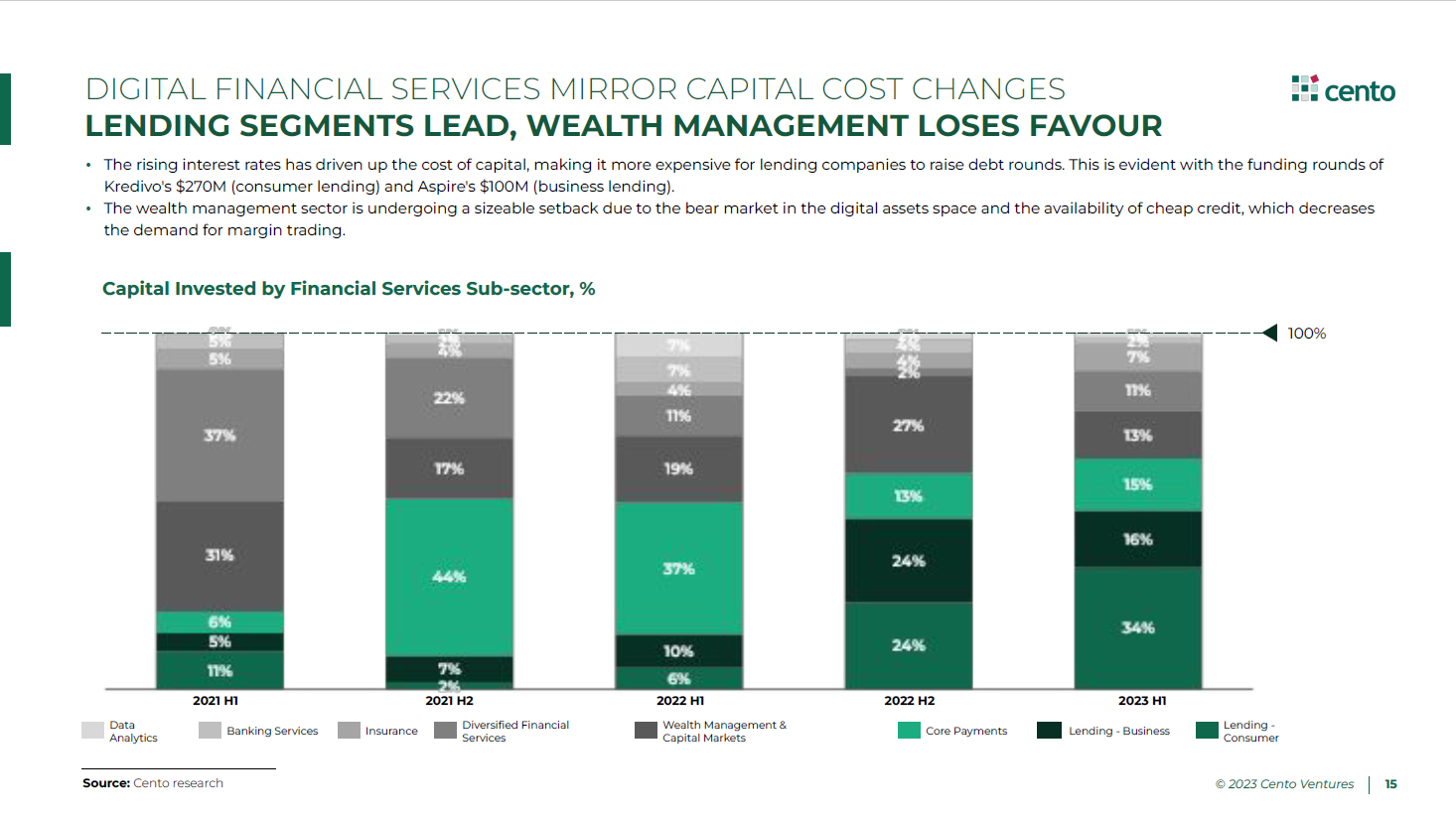

The fintech sector contributes 40% of all investment. All verticals derived from fintech generally receive investment, so the narrative of "fintech's death due to high interest rates" is outdated.

The vitality of the sector remains supported by rapid updates to regional payments infrastructure and regulations, various bank initiatives in collaboration with technology companies. Not only that, the shift in focus on digital platforms has left “super app” and turned to his talk as the financial sector and the distribution of financial services.

“The collapse in cryptocurrency trading volumes and its associated investment narrative has significantly impacted the amount of DFS investment flowing into the sub-sector wealth management and capital market infrastructure during the second semester of 2022. As a result, this sub-sector is back in line with its historical capital inflow volume.”

Sign up for our

newsletter