In Q4 2022, Indonesian Startups Book More than $580 Million in Funding

On a "year-on-year" basis, the nominal funding for Indonesian startups in 2022 fell by 38% compared to 2021

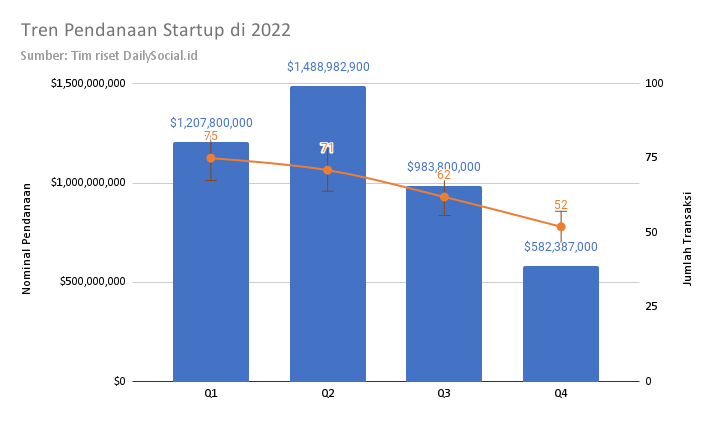

2022 is not an easy year for global startups, including the Indonesian ecosystem. Nonetheless, a number of interesting records were made throughout Q4 2022. In this period, Indonesian startups managed to record 52 funding transactions with a value of more than $580 million (more than 9 trillion Rupiah).

This achievement makes gains total funding for 2022 is $4,2 billion based on 260 publicly announced transactions. When compared to last year, there is a downward trend of -38% compared to the total funding of $6,8 billion in 2021.

Even though funding was still strong in Q1 2022, the trend throughout the year up to Q4 did show a slowdown, both in terms of the number of transactions and the total nominal, in line with changes in the global technology business constellation.

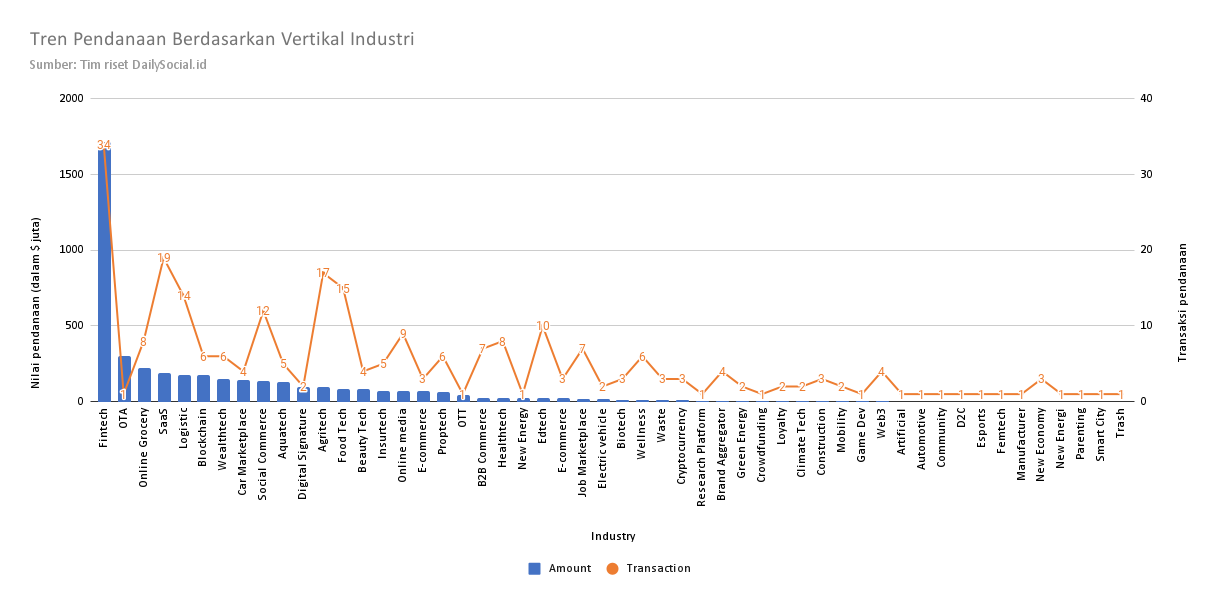

In total, fintech is still the most favorite sector with the highest number of transactions (27 transactions) and nominal ($1,7 billion). While SaaS (19 transactions), agritech (17), food tech (15), and logistics (14) are also investors' favorite sectors in 2022.

In total, fintech is still the most favorite sector with the highest number of transactions (27 transactions) and nominal ($1,7 billion). While SaaS (19 transactions), agritech (17), food tech (15), and logistics (14) are also investors' favorite sectors in 2022.

Looking at earnings, these 10 companies received at least $100 million in funding – some of that combined equity and debt funding.

| Startups | Acquisition of Funds |

| DANA | $450,000,000 |

| Akulaku | $310,000,000 |

| Traveloka | $300,000,000 |

| Xendit | $300,000,000 |

| my capital | $144,000,000 |

| Kredivo | $140,000,000 |

| Moladin | $137,000,000 |

| Vegetablebox | $120,000,000 |

| PINTU | $113,000,000 |

| Fazz | $100,000,000 |

This follow-up funding cements the status Akulaku and DANA as the next unicorn in Indonesia.

Funding trends

When viewed from the funding portion, the initial stage still dominates the number of funding transactions. This is a strong signal that investors still have high confidence in aspiring founder local and positioned to help validate ideas and discover product-market fit.

| Round | amount |

| Seed Funding | 90 |

| Pre-Seeds | 42 |

| Series A | 36 |

| Pre-Series A | 20 |

| Series B | 22 |

| Venture Rounds | 13 |

| Series C | 11 |

| Corporate Rounds | 10 |

| Pre-Series B | 7 |

| Series EASY | 6 |

| Debt | 3 |

What does seem difficult is the developing stage startups that want to raise funds at an advanced stage.

A number of investors consider global economic shocks the cause of the funding slowdown. This is based on world economic factors that anticipate a recession with rising interest rates and high inflation.

Including the factors that make the condition more complex is the influence of the Russian-Ukrainian war which resulted in disturbances supply chain leaders, the tightening of startup regulations in China, and the massive sale of tech stocks in the United States. As a result, the valuation of startups is towards the "normalization" level, for a healthier startup ecosystem.

Sign up for our

newsletter