Pertamina NRE CEO Dannif Danusaputro Explains the Energy Fund

The Energy Fund was formed to explore innovations in renewable energy sources, including low-carbon solutions to solar panels

Energy Fund, a managed fund formed by PT Pertamina (Persero) through Subholding Power & New Renewable Energy (NRE), is ready to be invested in advanced startups in 2024. The company is currently finalizing the establishment of the managed fund, including the investment value commitment.

For your information, Energy Fund is one of three managed funds which was launched by the Ministry of BUMN in September 2022, and agreed through the signing of the Head of Agreement (HoA). The Energy Fund will later be managed by MDI Ventures.

In an interview with DailySocial.id, Pertamina NRE CEO Dannif Danusaputro revealed that the Energy Fund is in the establishment stage to ensure that the administrative and governance processes are appropriate. He also ensured that Pertamina had not made any investment into startups until now.

"We are waiting for the process fund establishment completed with commitment and planned investment thesis. Pertamina NRE estimates deployment [Energy Fund] realized in 2024. At the time initial closing, Pertamina NRE still acts as the main Limited Partner (LP). However, we also open access to other LPs to invest through this Energy Fund," said Dannif.

His party has not been able to reveal the prepared and estimated investment value ticket size. However, Energy Fund targets growth-stage startups (growth stages) and continuation (later stages). This shows that Pertamina NRE prioritizes startups that already have a source of income, and does not target startups with ideas/products that are still being incubated.

It is known that Pertamina NRE is currently exploring and producing renewable energy sources (EBT) with business scope including geothermal work areas, geothermal power plants, gas power plants, and EBT development.

Dannif added, regardless of the situation Bubble which has hit the technology industry for the last few years, now is the right moment for companies to look again at the startup ecosystem. He believes there is still growth in the technology sector.

"Energy transition efforts cannot be carried out by the government and corporations alone, an ecosystem is also needed. We believe investment in technology startups and innovation in the EBT sector will support the formation of an ecosystem and accelerate the energy transition in Indonesia," he added.

Low carbon solutions to solar panels

There are three main criteria that Pertamina NRE is targeting—also aligned with its business pillars—including low carbon solutions, renewable energy, and new businesses (new and future business). The priority is startups in Indonesia and the Southeast Asia region with expansion into the Asian, European, United States and Australian markets.

Regarding innovation, the Energy Fund will invest in startups working on solutions/products related to the electric vehicle (EV) and battery ecosystem, technology clean hydrogen, energy conservation, solar panels, waste and EBT, up to energy audit platform.

In fact, said Dannif, currently Pertamina is developing new products to speed up the energy transition. Some of these are carbon credit trading, clean hydrogen, and battery and EV ecosystems. Meanwhile, EBT-based businesses currently operating are geothermal energy (Pertamina Geothermal Energy) and Solar Power Plants (PLTS).

Through this managed fund, the party hopes to be able to synergize with startup players cleantech in order to achieve operational cost efficiency (cost efficiency), new sources of income, to collaboration to market . This synergy can complement each other's capabilities, both new markets within Pertamina and the BUMN ecosystem.

"The development of innovation and the EBT ecosystem in Indonesia can be said to be quite rapid even though startups involved in the field are still in the incubation and early stages. Therefore, synergy with startups cleantech necessary to access their technology and innovation," he said.

The potential for renewable energy (EBT) in Indonesia is recorded at more than 3.000 GW. In the context of the energy transition, Indonesia needs new technology and innovation to develop and utilize this potential.

However, energy transition efforts are hampered by a number of factors, including access to competitive financing and technology, funding for early stage development, and human resource capabilities.

Based on Ministry of Energy and Mineral Resources data, the new EBT mix will reach 14,11% in 2022, up slightly from the mix level in the previous year which was around 13,65%. The majority of the primary energy mix for electricity generation still comes from coal with a percentage of 67,21%.

Ecosystem cleantech

Environmental issues, the need for sustainable business practices, and market demand are driving the rise of the cleantech startup ecosystem (cleantech) in Indonesia who want to be involved in energy transition efforts, waste management, and decarbonization.

Based on New Energy Nexus Indonesia's latest report title "Clean energy technology startups in Indonesia: How the government can help the ecosystem", there are around 300 cleantech startups in the country. From a survey of 50 startups cleantech Indonesia, the report wants to summarize a number of obstacles related to product and business development in this sector.

More Coverage:

Financial constraints are one of the big stumbling blocks that is quite highlighted. This report states that state-owned investment vehicles, both Corporate Venture Capital (CVC) and managed funds, are still focused on investing in large sectors, such as fintech, e-commerce and logistics.

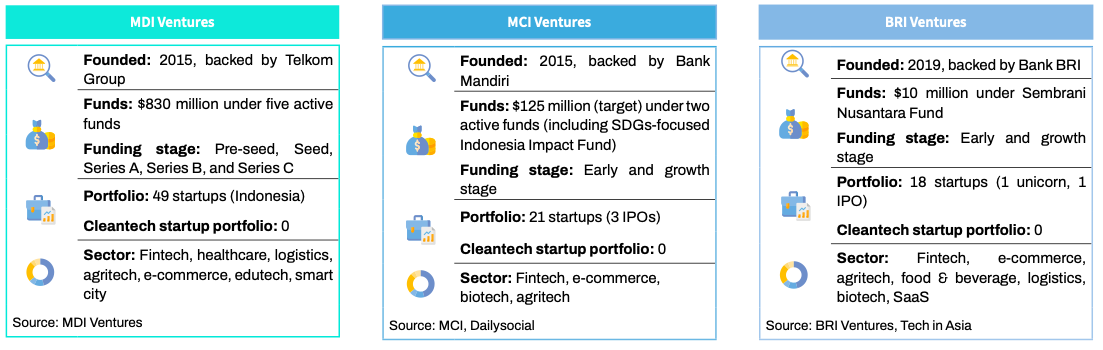

In his findings, the three large CVCs currently operating, namely MDI Ventures, MCI Ventures, and BRI Ventures, do not yet have a portfolio track record in the sector. cleantech. Apart from that, the special managed fund in the energy sector that will be launched is also considered to not have a clear investment and implementation commitment.

This report recommends that relevant stakeholders can bridge bank loan facilities through schemes debut venture or soft loans for startups cleantech advanced stage (later stages). Financial support from local governments is also needed.

Sign up for our

newsletter

Premium

Premium