An Overview of the Cleantech Startup Ecosystem in Indonesia

Summary of New Energy Nexus Indonesia's survey report on 50 cleantech startups in Indonesia

New Energy Nexus Indonesia review the development of the clean technology ecosystem (cleantech) in Indonesia through its latest report entitled "Clean energy technology startups in Indonesia: How the government can help the ecosystem".

This report explores a number of challenges faced by startups related to the development of clean technology, operations, to funding sources based on the results of a survey of 50 startups cleantech in Indonesia. It should be noted, of the 50 respondents surveyed, only 42 startups are still alive, the rest are no longer operating until this report is released. In addition, most of the respondents occupy C-level positions (84%) and operate in the Java region.

Currently, the government and other stakeholders are pushing for energy transition efforts to achieve this target. However, the transition is not going fast where the renewable energy mix (EBT) nationally has only reached 12,3% of the target of 23% in 2025.

Therefore, clean technology developers are said to be able to help accelerate target achievement net-zero emissions (NZE) set by the Indonesian government in 2060. In addition, the emergence of startups cleantech can also unlock economic potential. As an illustration, the green technology sector in the US has created 3,2 million new jobs in 2021.

Ecosystem cleantech

In Indonesia, the rise of green startups is starting to be seen with investment growth as one of the indicators. Based on the data collected, this report states that there are 300 startups cleantech in the homeland, incl Xurya and Energy Swap which has reached the series A funding stage.

New Energy Nexus Indonesia as an accelerator program for startups in this segment, has supported 85 startups (incl non-cleantech) since 2019.

According to the survey results, 52% of the total respondents are based in cities tier 1. However, the survey shows that the startup cleantech is out of town tier 1 with a growth rate of 48% in the 2017-2022 period, indicating that business actors in this field are starting to grow.

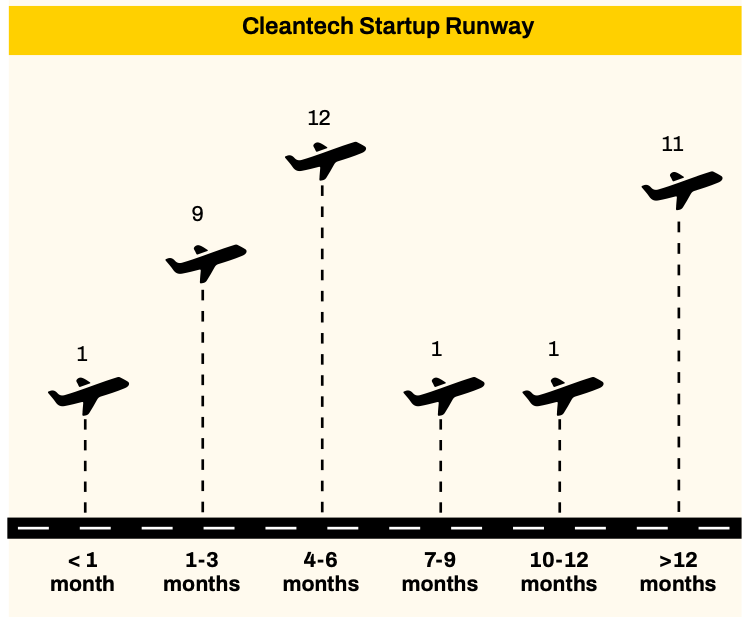

Meanwhile, 42 startups cleantech which are still operating relatively have runway short one. As many as 22 of them were only able to survive operations for 1-6 months before running out of capital, while 11 startups claimed to have runway more than 1 year. This finding is an important issue considering that ideally a startup should have one runway minimum 18 months.

Then, 64% of respondents who are still operating admit to being in a phase idea/prototyping or pilots (testing partners/users). Meanwhile, most of the respondents who stopped operating failed at the initial stage.

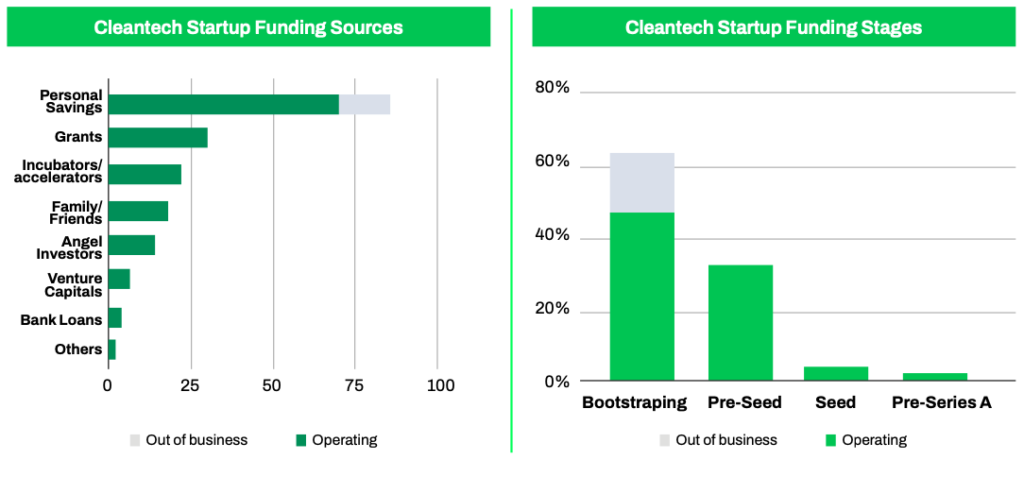

"Most of the respondents stated that their source of funding mostly came from their personal pockets founder-his. This finding is consistent with the results of interviews with cleantech startups who admit to experiencing problems in seeking external funding and eventually turning to bootstrapped. They also depend on grants and incubators to support their operations," the report states.

Investment and regulatory support

Venture capitalists (VCs) tend to invest in fintech, but other sectors— SaaS, F&B, and transportation—are also seeing significant investment. From the results of an interview with the Indonesian Venture Capital and Startup Association (AMVESINDO), regulations are the main factor hindering investment in cleantech.

AMVESINDO said that the current policy or regulatory framework does not support the adoption of EBT, technology for energy efficiency, to electric vehicles. As a result, investors are less interested in investing because of market interest in products/solutions cleantech in Indonesia is still relatively low.

Some examples of domestic VC investments in this sector are East Ventures and Saratoga to solar panel developer Xurya. In addition, Kejora Capital has also injected funding into Swap Energi, a developer of exchangeable batteries (battery swap) for electric vehicles.

"Not only is it a matter of market interest, investors are also looking at the startup ecosystem cleantech don't have much founder and a capable team so this holds them back from investing in the sector."

Asked about government incentives for startups cleantech, respondents highlighted the need for funding. Meanwhile, for incubators, accelerators, and venture builder, incentives such as a supportive regulatory framework cleantech, access to funding for R&D, ease of obtaining business licenses and certification, will provide more motivational boost.

Likewise tax reduction incentives for companies that support the adoption of clean energy, access to markets, to public procurement opportunities for products and services made by startups cleantech.

Even so, this report finds most of the startups cleantech Those surveyed have not taken advantage of the incentives provided by the government. This is due to a lack awareness and the echo of information related to incentives for startup actors, as well as the complexity of the submission process and administrative requirements that must be met.

The findings from this survey indicate a lack engagement between startups cleantech and government. This could be due to the government's limited knowledge and understanding of the startup ecosystem cleantech.

Recommendation

More Coverage:

In its final summary, this report provides several recommendations to address various challenges in the sector cleantech. DailySocial.id summarizes some of them:

Funding constraints

- Funding in the form of grants often has to go through ceremonial events and does not support startup efforts to scale their business.

- State-owned VCs do not yet have equity investment options for startups cleantech.

- Energy funds the newly formed ones do not have a clear funding commitment and implementation.

- Startups cleantech innovation is difficult due to limited access to government R&D funds.

- Low collaboration between startups cleantech and universities for R&D.

Recommendation

- The grant program is adjusted to the stages of startup development, and ensures that this grant contributes to startup growth by emphasizing intensive publication.

- Catalyzing investment from the private sector to startups cleantech through government funds and state-owned VCs.

- Bridging bank loan facilities through schemes debut venture or soft loans for startups cleantech advanced stage (later stages)

- Local governments need to provide financial support to startups cleantech.

Policy constraints

- The quality of regulation is low and law enforcement in the energy sector is still weak

- The minimum capital requirements are high for setting up a VC with an inflexible venture fund structure.

Recommendation

- Strengthen energy policy and enforcement to support demand for solutions cleantech.

- Reducing minimum capital requirements, for example adopting a model corporate venture capital (CVC) which allows for a more flexible investment structure.

Sign up for our

newsletter