Mandiri Capital Starts Managing Investment Funds from LPs Outside the Company Group

There are three active funds currently managed by MCI: Balance Sheet Fund from Mandiri Group, Global Climate Tech Fund, and BTN Fund

Mandiri Capital Indonesia (MCI), CVC of Bank Mandiri, is starting to target a position as fund managers, like most VC business models, so that it can manage fund from LPs outside the Mandiri Group. There are two ambitions that have been launched since the end of last year fund which will soon be active this year, namely the BTN Fund and Merah Putih Fund.

Mandiri Capital Indonesia CEO Ronald Simorangkir said that by managing investor money outside Bank Mandiri, it is hoped that MCI can be more independent (self-sustaining) to fulfill its own operations. "We are starting to build it step by step, so that in the next 1-2 years it will be ready fund managers independent ones can self-sustaining," he said during Media Outlook 2024 in Jakarta, Wednesday (17/1).

BTN Fund with a target of managed funds of $20 million (around IDR 312 billion) is targeted to be operational soon after it was first announced in early December 2023. MCI will earn a commission from managing these funds. Meanwhile, Red and White Fund has raised $300 million in funding. This fund is managed jointly by other state-owned CVCs, namely BRI Ventures, MDI Ventures, Telkomsel Ventures, and BNI Ventures.

Currently MCI manages two fund which have been actively used for investing: balance sheet funds from Mandiri Group for $250 million and Global Climate Tech Fund which is currently still in the process of raising funds with a target of $150 million.

Of the two, there are 23 active startups that have been funded from 14 business verticals, starting from lending, B2B value chain, and fintech & payment enablers. MCI has too exit in seven startups (three full exit and four partial exit), such as: MOKA, Cashlez, and DamCorp.

If separated by each managed fund, even though the Global Climate Tech Fund is still fundraising, there are already a number of startups that have been funded, namely: Greenhope, Cakap, Delos, and FishLog. This is because the managed funds are a continuation of the mandate of the Indonesia Impact Fund (IIF) which was launched in 2021.

This year's investment strategy

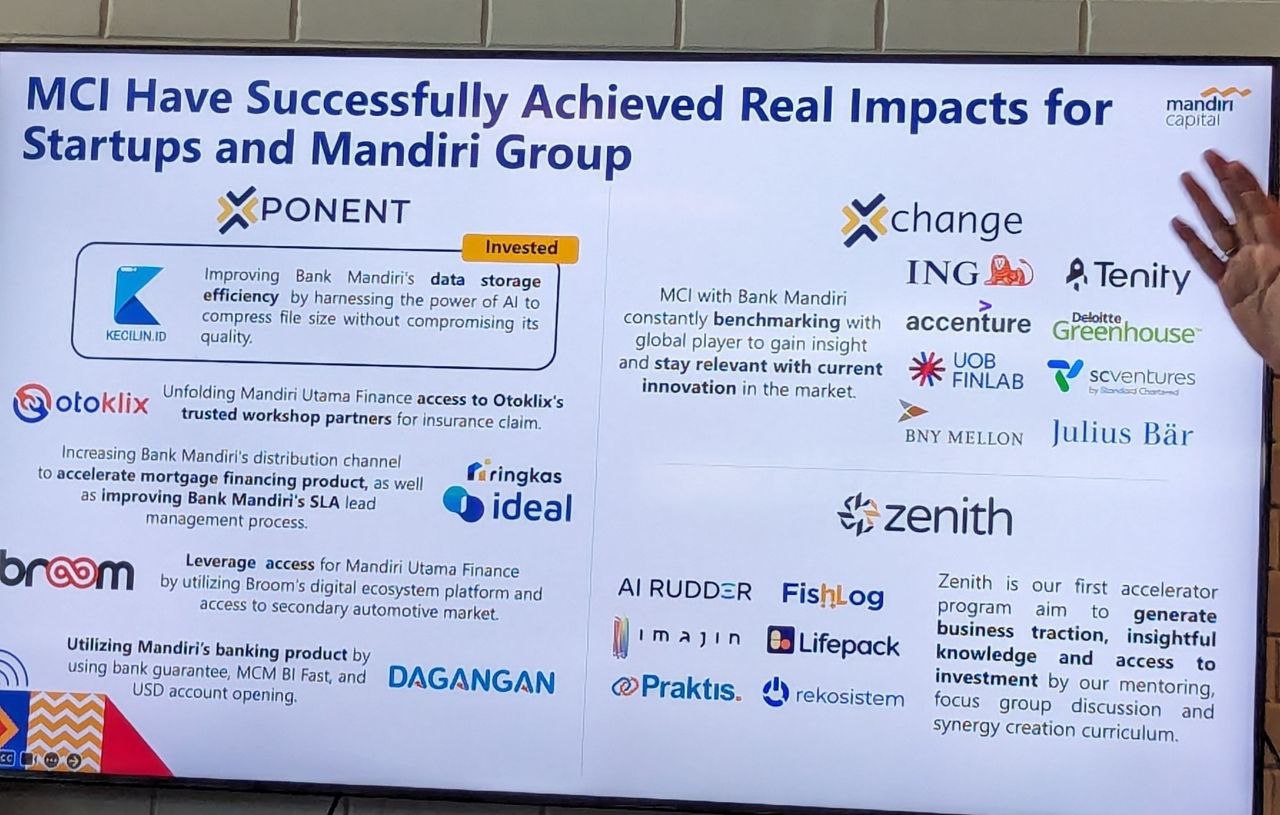

Ronald continued, MCI as CVC has a mandate to continue to support Bank Mandiri's strategy by creating value creation in order to achieve an innovative and sustainable business. This is done through the implementation of the XYZ program, including:

- Xponent program for business matchmaking startup with Mandiri Group;

- Xchange program by conducting innovation benchmarks against several innovation labs in Singapore;

- Y-Axis, which accommodates startups to expand their network with the tech community, investors and corporations;

- Zenith Accelerator program aimed at business development and collaboration with the Mandiri Group ecosystem.

“We foster various startups before finally being invested. Something is already underway. So we actually give them work, in the form of an MoU or piloting, no workshop", so there are products that are ready to be used by the Mandiri Group," added Ronald.

Mandiri Capital Indonesia Investment Director Dennis Pratistha added that balancing short-term profits with long-term sustainability and exploiting synergies is the goal value. This strategic alignment not only improves the financial health of each business unit, but also positions the entire portfolio to adapt and thrive in a dynamic market environment, thereby driving lasting success.

“We look at things in the long term, so we help startups grow their business. That's why we also don't indulge in FOMO (fear of missing out), didn't join Web3 or wealthtech like during the previous pandemic," said Dennis.

Mandiri Capital Indonesia CFO Wisnu Setiadi said that because MCI focuses on building its own startup business fundamentals, when liquidity in the market is dry, startup valuations will be assessed based on the fundamentals they already have. So the numbers are more real and logically measurable.

"When liquidity returns to normal, with inflation under control and global tension cooling. There we can realized-right gain-gain "by actively divesting and looking at new potential for investment," he added.

More Coverage:

This year, the sector that MCI considers interesting to look at is the supply chain, which still has many conventional aspects in its business processes. Then, sustainable green business is also being looked at, in line with the initiative of the Global Climate Tech Fund. MCI will target global startups to bring their technology to Indonesia.

"climate tech still very new in Indonesia. So to start, you have to build an ecosystem here, invite people from outside to bring it in Knowledge"which is useful for Indonesia," concluded Dennis.

Sign up for our

newsletter