Peak XV Partners, The New Face of Sequoia for Southeast Asia and India

Peak XV will continue to expand its portfolio with $2,5 billion in uninvested funds under management

Last week, prominent investment firm Sequoia India & Southeast Asia (SEA) announced a change of name to Peak XV Partners. With this new face, Peak XV Partners will continue to expand its portfolio with $2,5 billion uninvested funds.

Through its official website, Shailendra Singh representing Peak XV Partners revealed that Sequioa's business development, scale, and leadership in various parts of the world over the years of operation have caused confusion about brand and conflicts in the portfolio.

This is because from the start Sequoia Capital (US/Europe), Sequoia China, and Sequoia India/SEA were built as separate businesses with independent investment decision making.

"This prompted leaders in each business to collectively decide to shift to a fully independent partnership with brand which is clearer for the sake of serving the founder and our LP in the best way possible," said Singh.

As such, Peak XV Partners will operate completely as an independent firm. The investment team at Peak XV Partners will be led by 11 Managing Directors with over 12 years of experience at Sequioa.

Continue investing

Singh stated that he will focus on investments across sectors, including SaaS, AI, cybersecurity, cloud, fintech, climate tech, healthtech, to consumer. Peak XV will also duplicate its flagship programs, such as Surge and Spark.

"Peak XV is the initial name given to Mount Everest. For us, it signifies the founders' relentless pursuit of a bold goal while overcoming challenges along the way. We firmly believe in the future of India and SEA, and the potential of the founders in this region," he said.

Operating 17 years in India and 10 years in Southeast Asia, the company has raised $9,2 billion through 13 managed funds, and has invested in over 400 startups in the region. It is recorded that more than 50 startups have exceeded more than $ 1 billion in valuation, including 19 of them taking the floor on the stock exchange and consolidating through M&A actions: generating exit $4,5 billion.

"Our company will continue to be managed by the current leadership team and will continue to invest through a new managed fund focused on India and Southeast Asia." Close it.

More Coverage:

In mid-2022, Sequoia SEA had announced an initial managed fund for the Southeast Asia region of IDR 12,5 trillion, in which Indonesia is a priority country the investment. Please note, the company has injected investment into 22 startups in Indonesia--including Gojek, Tokopedia, and Kopi Kenangan -- where 9 startups are involved in the accelerator program.

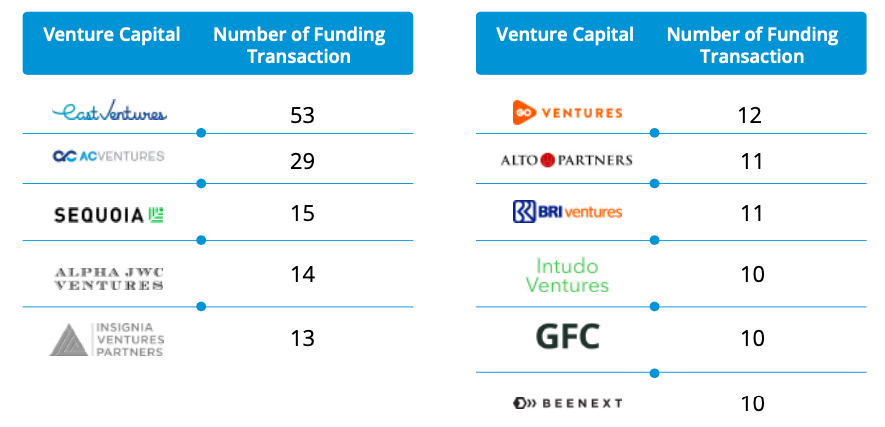

Based on reports Startup Report 2022, Sequoia Capital India is an investor that has been frequently involved in startup funding in Indonesia in the last three years. Throughout 2022, Sequoia Capital India is the third most active investor with 15 investment deals announced. Meanwhile, in 2021, Sequoia is in fourth place by investing in 17 portfolios.

Sign up for our

newsletter