OVO Group Expands Service Ecosystem, Establishes Joint Venture Company in Insurtech

In partnership with ZA Tech, an insurance technology company based in Hong Kong

PT Bumi Cakrawala Perkasa, hereinafter referred to as OVO Group, is the parent company of OVO digital wallet services (PT Visionet Internasional) and Taralite p2p lending (PT Indonusa Bara Sejahtera). They have just announced a strategic partnership with ZA Tech to form a joint venture company in the insurtech.

It is known that ZA Tech is a subsidiary of ZhongAn Online P&C Insurance, formed from a partnership between SoftBank Vision Fund 1 and ZA International.

Presence insurtech at OVO Group certainly expand the scope of their financial products. In addition to digital wallets and p2p loans, they also have strong attachment to Bareksa as service fintech which focuses on mutual fund investment. The potential for penetration of various financial services that continues to strengthen is the basis for the company to take corporate actions.

"Through this partnership, we believe that we can together drive digital transformation in Indonesia for insurance companies, thereby accelerating insurance adoption in Indonesia," said OVO Group President Director Jason Thompson.

It was also conveyed that insurance penetration in Indonesia is still very low, which is only 1,7% of the more than 265 million Indonesians currently covered by private insurance. On the other hand, Indonesia is also the fastest growing market in Southeast Asia, with strong economic growth averaging above 5% in the last three years.

Services that will be presented by insurtech This will help insurance companies to digitize their products. Process backend which was manual will be automated; including simplifying the premium calculation process that was previously very complicated. The hope is to create an ecosystem of products that are affordable and attractive to the wider community.

"By using the platform insurtech built by BCP and ZA Tech, insurance companies will be able to digitize their conventional offerings, so they can more effectively deliver products and services to the public in order to accelerate digital transformation in Indonesia's huge insurance market," concluded Thompson.

ZhongAn himself had previously also formed joint venture with Grab to create a service insurtech based marketplace. It will offer various categories of insurance products that can be accessed directly through the application Grab and paid through features GrabPay. In Indonesia, Grab is also affiliated with OVO as a digital wallet that supports the payment system in its application.

Ecosystem insurtech in Indonesia

DSResearch in a report entitled "Insurtech Strategic Innovation 2020“map multiple players insurtech which is currently operating in Indonesia. Through partnerships they have with various insurance companies, each service tries to present a variety of insurance products – mostly aimed at the consumer segment.

Some also do integration with digital services in other segments, for example what is done PasarPolis by presenting GoSure services on Gojek for travel insurance; Qoala also did the same thing together Grab in Indonesia; then there is also Premiro who enters the Tanamduit service ecosystem.

Citing the results of the Munich Re Economic Research study, Indonesia will lead the growth of health and life insurance premiums from 2019-2030, with a CAGR of 9,1%. Throughout 2019, the premiums that have been recorded have reached 185,3 trillion Rupiah for life insurance and 80,1 trillion Rupiah for health insurance.

More Coverage:

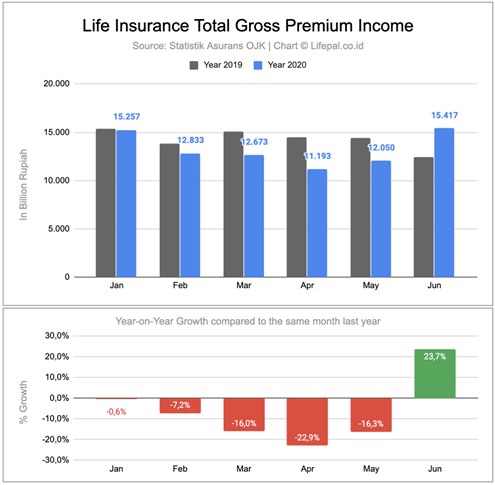

The pandemic did not dampen the growth of the insurance business in Indonesia. Data shows recovery relatively fast related to gross premium income for life insurance throughout 2020.

Move fast fintech enter insurtech also continues to be seen, not only by legacy players who continue to expand their business. One of them is Fazz Financial Group, the unit in charge of Payfazz and Modal Rakyat services in collaboration with Adira Insurance to support one of their service units. Because it is believed, awareness of the adoption of insurance services will be formed along with the increase in the financial literacy of the Indonesian people which continues to be boosted, including the assistance of the players. fintech The.

Sign up for our

newsletter