Insurance Business Recovers Relatively Fast from the Pandemic, Insurtech's Growth Momentum

Research says, Indonesia will lead the growth of insurance premiums until 2030

Among the many business models that are developing in Indonesia's startup ecosystem, insurance technology (insurance technology - insurtech) has become one of the most sought after by local and foreign investors. The main principle insurtech trying to revolutionize consumer behavior, by presenting a simpler, transparent and cost-effective insurance process.

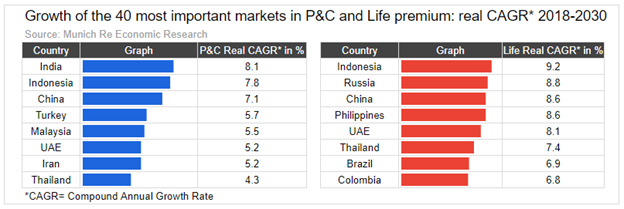

There are several basic reasons why insurtech projected to thrive here. As conveyed Lifepal on an occasion, citing the results of the study Munich Re Economic Research, Indonesia will lead the growth of health and life insurance premiums from 2019-2030, with a CAGR of 9,1%.

Throughout 2019, the premiums that have been recorded have reached 185,3 trillion Rupiah for life insurance and 80,1 trillion Rupiah for health insurance.

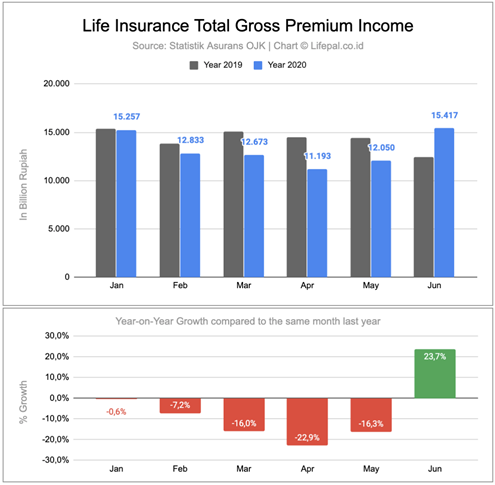

The Covid-19 pandemic is coming does not dampen growth insurance business in Indonesia. From the data summarized by Lifepal, it is shown that there is a relatively fast recovery in terms of gross premium income for life insurance throughout 2020. Moreover, in June 2020, compared to the same period last year, the value increased.

Momentum for insurtech

In the midst of the growth of the insurance business, it turns out that if you look deeper, there are still many pain points faced by potential customers. The process of finding information, buying, and claiming insurance products is sometimes not easy, it is also felt to be less transparent. The conventional business model uses an agency system, an agent will "fully encourage" prospective customers to subscribe to their insurance products, without providing holistic and comprehensive education.

In the end, in some cases, these agents actually create distrust among consumers. Moreover, in this digital era, consumers can also easily validate the information submitted. However, even when searching for it yourself, for example through Google, many complicated terminology and biased recommendations are encountered, in the end it does not lead consumers to products that provide optimal benefits.

Armed with this fact, then several startups appeared offering insurance processing that was easier, through the help of technology. Report DSResearch titled "Insurtech Strategic Innovation" has mapped several local startups already operating in the landscape.

Lifepal become one of the players insurtech which offers customers the convenience of finding and purchasing the right insurance for their specific needs. It presents content and reviews designed to make it easier for consumers to plan, by presenting lists and comparing insurance products. Currently there are around 50 insurance brands that have been embraced, with 200 product choices; managed to bring about 4 million website visits every month.

Development insurtech

2020, some startups insurtech strengthen business penetration, including being supported through new funding. latest, PasarPolis have announced recorded funds up to 796 billion Rupiah. This value was also supported by the latest round of series B from LeapFrog Investments, SBI Investment, Alpha JWC Ventures, Intudo Ventures, and Xiaomi. This acquisition is claimed to be the largest for a startup insurtech in the region.

Last May 2020, Igloo, previously known as Axinan, also announced series A+ funding worth 238,4 billion Rupiah. They are a startup from Singapore that already has an operational base in Indonesia through its partnership with Sompo Indonesia. There is also Qoala which recorded series A funding worth 209 billion Rupiah in April 2020.

Innovation continues to roll, several players have also created insurtech-based products this year. As is done by Modal Rakyat, in collaboration with Adira they provide vehicle insurance. This initiative was launched at the same time with the company's entry into business e-procuelogistics truck purchase rement.

More Coverage:

There are also artificial intelligence-based innovations that Prixa has launched. They integrate the system healthtech with insurtech, teamed up with several players in related landscapes. The service is presented in the form of chatbot, with the hope of making it easier for potential consumers to get an understanding while being chatting with an expert.

-

Header Image: Depositphotos.com

Sign up for our

newsletter