Guessing the Prospects of AI Startups in Indonesia

Discuss with On Lee (CTO GDP Venture, CEO & CTO GDP Labs), Meidy Fitranto (Co-founder & CEO Nodeflux), and Agung Bezharie (Antler Indonesia Partner)

The sophistication of ChatGPT has succeeded in making the narrative about AI discussed throughout the world, that generative artificial intelligence (genAI) technology is designed to revolutionize the way organizations run business.

Menurut research released by Bain in August 2023, it was reported that genAI accelerated work by 41%. Respondents said that 81% of users said they were more productive thanks to GenAI. Research shows that AI helps them automate email and communications (50%), data analysis and reporting (45%), and research (42%).

Global investment data revealed by CB Insights reveals that in 2023, AI startups raised $42,5 billion in 2.500 equity rounds. GenAI startups dominate up to 48% of all AI funding. In the previous year, genAI startups only received 8% of total funding.

This surge was driven by massive rounds to developers large language model (LLM), such as OpenAI, Anthropic, and Inflection. Startups from the United States took up the largest share, up to 73% (up 14%), followed by Asia (25%) and Europe (24%).

“We expect genAI startups to maintain or even scale this up in 2024, as the genAI boom is far from over,” wrote CB Insights.

However, not all AI startups are created equal. Before discussing AI in more depth, this article will first discuss the differences between horizontal and vertical AI startups.

Horizontal AI startups:

- Definition: The solution is designed to be versatile and widely applicable, while serving as a foundation for a variety of industries. It is broad in scope and can be integrated into a variety of domains, including customer service, content creation, and general information retrieval, to generate human-like responses, engage in natural language conversations, and provide valuable insights. Its flexibility makes it available to businesses looking for an AI solution that can be quickly tailored to their specific needs.

- Example: ChatGPT (OpenAI), Gemini (Google), Claude (Anthropic), Cohere, Tongyi Qianwen (Alibaba). In ASEAN there are SEA-LION (AI Singapore) and WIZ LLM (WIZ.AI).

Vertical AI startup:

- Definition: vertical AI solutions tailored to specific industries, to address their unique needs and challenges. The solutions offered have advanced functionality and specialized capabilities, providing industry-specific insights, optimizing processes, and improving decision-making, thereby revolutionizing operations in sectors such as services, legal, marketing, and others.

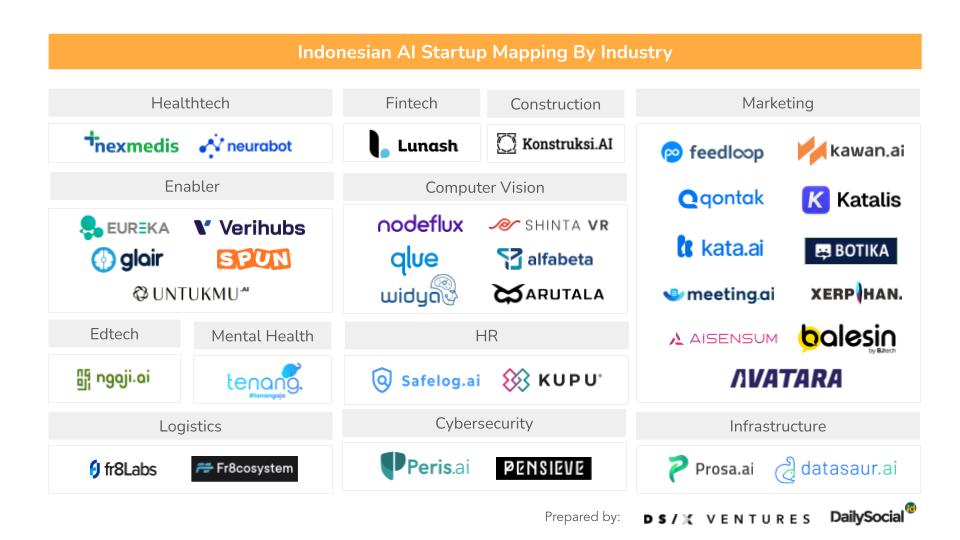

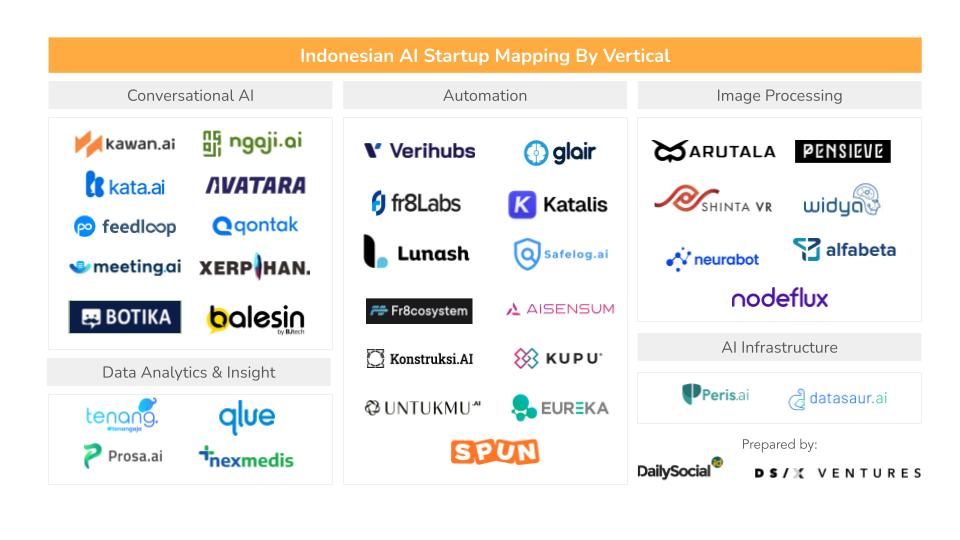

- Example: in Indonesia there is Nodeflux (image processing), Verihubs (automation), Kata.ai (conversational AI), and Prose.ai (data analytics & insights).

Conditions in Indonesia

DailySocial.id summarizes the results of interviews with three sources. They agreed that the prospects for AI startups in Indonesia are very bright because the journey has just begun. One of the supporting factors is the emergence of ChatGPT.

“Mapping of local AI startups shows that almost half of AI startups in Indonesia are new players less than one year old. "The majority of them have received funding from VC," said Antler Indonesia Partner Agung Bezharie.

Of the total registrations received at Antler Indonesia, AI startups registered for batch I and II in 2022 to early 2023 the number will only be 1-2 startups. Meanwhile, now the number continues to increase.

CTO GDP Venture, CEO & CTO GDP Labs On Lee added, before ChatGPT boomingIn general, companies that have adopted AI are still very limited. One of the biggest reasons is because it is expensive. "But because ChatGPT isconsumerize, everyone knows," he said.

He also gave an example, BCA is one of the companies mature has been at the forefront of adopting this technology for a long time. The initial process of adoption was not instant, the banks tried one by one usecase. Once you feel the increase in productivity, it increases even more usecase assisted by AI.

Loving ChatGPT, On hopes to create it awareness At the multi-industry company level, more and more people are encouraged to start adopting it.

“Indonesia is new aware with AI since last year, before that there weren't many aware. [..] I expect in five years a lot of things will have changed. Yesterday [ChatGPT] got it hyping make marketing "[AI adoption], then it was felt that productivity increased [after AI adoption], many companies finally started to dare to invest," he said.

“As time goes by, technology becomes more sophisticated, so there will be more and more applications. AI is the same, the more people use it, the more people want to invest in it, the more solutions will be produced from AI. Finally created positive feedback loop," continued On.

GDP Venture is a VC that is considered active in funding AI startups in Indonesia. Some of its portfolios are Balesin, Datasaur.ai, Glair.ai, Prosa.ai, and Qlue.

Co-founder & CEO of Nodeflux Meidy Fitranto highlighted that the presence of genAI makes the difficulty level much lighter because the solution is built on a foundation model that has already been created. However, it could backfire because the level of competition becomes fierce because there is no meaningful differentiation.

"Ambience Even globally, there seems to be an equilibrium (looking for a balance point) because value propositionnot yet clear. "Even globally [horizontal AI startups] are not that strong, there are still many that have emerged recently," he explained.

The opportunity to become a leader in your own country

However, Agung believes that the big opportunity for AI startups to develop rapidly in Indonesia is not from horizontal AI, such as OpenAI, but from vertical. Quoting from the opinion of Jussi Salovaara (Managing Partner, Co-founder of Antler), Antler's hypothesis for the Southeast Asia region is predicted to be pushed forward rapidly thanks to the presence of vertical AI startups. This is very different from the conditions in the US where horizontal AI is competing, for example co-pilot coding or language modelling.

"Verticalize AI focuses on specific solutions to industries, activities, and problems in region This. AI solutions are most effectively used to automate repetitive or repetitive activities. "In Southeast Asia and Indonesia in particular, there are many repetitive activities in daily life," he said.

There are three vertical AI startups entering the fray Antler Indonesia portfolio, namely SPUN, Kontak.AI, and Lunash. Globally, there are 11 AI startups that have received funding pre seed from Antler.

According to Agung, the opportunity to compete at the global level for vertical AI startups is much greater. Because there is only one strategy to survive, focus on the business vertical. For example, Nodeflux's activities have been able to survive and develop because it has unique technology and business.

“Leveraging this unique data produces solutions that no global startup could create. This uniqueness allows them to work with institutions that are usually difficult for startups to reach.”

Continuing this, On also agreed that local AI startups that play in developing Indonesian and combine it with interrelated local solutions, have the opportunity to become leaders in their own country.

“We can win because this is our [local] expertise. For example, Glair.ai paperless OCR for digitizing documents, such as NPWP, KTP, is unique, only Indonesia has it. "We should win with local goods like this," he said.

In support of LLM, two of its portfolios, Glair.ai & Datasaur.ai, participate in collaborative project together with BRIN, KORIKA, and AI Singapore (AISG) to develop LLM Indonesian under the SEA-LION foundation model. The expected target of this project is to encourage the creation of platforms such as ChatGPT with the aim of using them more specifically according to target consumers.

Serious challenge

Meidy continued, despite the opportunities offered, the AI ecosystem in Indonesia really needs support from all parties, especially for research and development (R&D) needs. The story experienced by Nodeflux can be a reference.

More Coverage:

Considering that the main target user is the government for monitoring system needs (surveillance system), it turns out that the tender process is still not considered valuable as a local product because it is equated with imported products. In fact, the product development process requires an R&D team that is not just random and takes a lot of time, at least having a doctoral degree and studying abroad, buying expensive equipment, and so on.

“So the competition is on marketIt makes more business sense if we trade as brokers/distributors because the calculations don't add up. Just bring the product white label from outside, which is thenbrand local itself. In the context of Nodeflux, state support for R&D for AI is not very meaningful.”

He also compared this situation with the support of the Chinese government. In 2017, the government announced an ambitious program for the development of AI technology domestically, with the aim of becoming the world's 'major AI innovation hub' by 2030. Then in 2019, it announced a “National AI Team” containing several selected companies in each vertical supported by the government central and regional to work on regional projects.

“That's why the movement there is extraordinary. If in Indonesia, fightIt's similar to selling clothes in Tanah Abang and imported Chinese clothes. So marketnot so much growing. "

This impact is what makes VisionAI players like Nodeflux, none of which can survive. In Indonesia, Nodeflux is available 'single fighter'. Whereas previously, there were around four players, including Nodeflux, who entered this area.

“Nodeflux is among the most heavy [deep tech-nya], so making it like us is not easy. On a scale of 10, you could say we are at 8,5, but our competitors are at 5. Gapit took a long time [to catch up].”

As a company, Nodeflux is no longer like a startup in general. The company has achieve profitability and has not relied on funding from investors since the last round in 2019.

Nodeflux has a number of AI-based solutions for its B2B and B2G clients, namely Visionaire (Surveillance-Analytics-as-a-Service), Identifai (e-KYC for the financial industry), and RetailMatix (SaaS Vision AI & Sales Force Automation for the retail industry). Each solves issues faced by clients who come from various industries.

Sign up for our

newsletter

Premium

Premium