Green Startup Momentum Takes the Stage

"Effective business" begins to attract "mainstream" investors

Blue skies, fresher air, returning to cooking in the kitchen, returning to exercise are some of the signs that many people have experienced since the pandemic. Although now this condition is not fully valid because there have been easing in many sectors, there is an indication that there is awareness to start living a healthy life.

There is an opportunity for businesses that care about the environment to be recognized by many people. Although the number of startups that use a green approach or environmental, social, and governance (ESG) is still limited, according to Managing Director of Angel Investor Network Indonesia (ANGIN) David Soukhasing, currently there is a positive trend in the presence of impactful businesses in the ecosystem. Impact investment (impact investing) emerged, as also discussed in DSInnovate report on agritech in Indonesia.

The majority of them are here to support entrepreneurship, providing more specific support for certain groups of social entrepreneurs, for example energy-focused accelerator programs, accelerator-focused waste management programs, or entrepreneurial support focused on specific geographic areas.

For Soukhasing, this factor is able to measure Indonesia's readiness for impact investment. Indonesia needs a comprehensive ecosystem to be ready to welcome impact investors. Not only capital, basically it is needed pipeline strong company/startup.

“One measure of maturity is the overall value of capital diversity, investor diversity, different stages, different types of money, and all supporting functions. In terms of supporting functions, such as incubators, accelerators, co-working spaces, Indonesia is actually quite developed. There are quite a lot of networks pipeline and investors are here," explained Soukhasing to DailySocial.

He continued, “But we need more action, diversity of capital is needed to really talk about a mature ecosystem. "Another aspect of maturity is the policy aspect, how regulations are developed to impact investment and entrepreneurship, and this is still lacking in Indonesia."

According to the ANGIN report entitledInvesting in Impact in Indonesia, in 2013 the concept of impact investment was still very rare in Indonesia. But now it is becoming more familiar because there are VCs starting to make it fund specifically for investment in impact sectors.

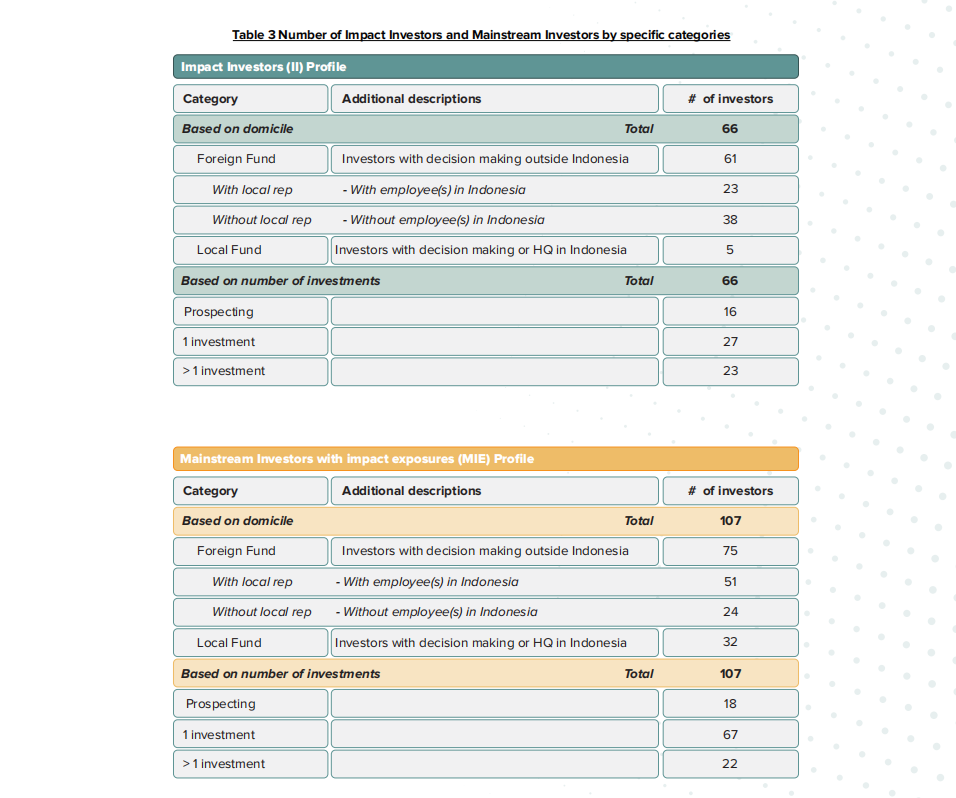

There are a number of impactful investors who have invested in Indonesia, both local and foreign players. Some already have a representative team in Indonesia. The total reached 66 investors, with details of 61 of fund abroad and the remaining five from Indonesia.

Meanwhile, investors mainstream The number of people who have disbursed funds for the impact sector is much greater, almost double the number of 107 investors. With details of 32 local investors and 75 investors from abroad.

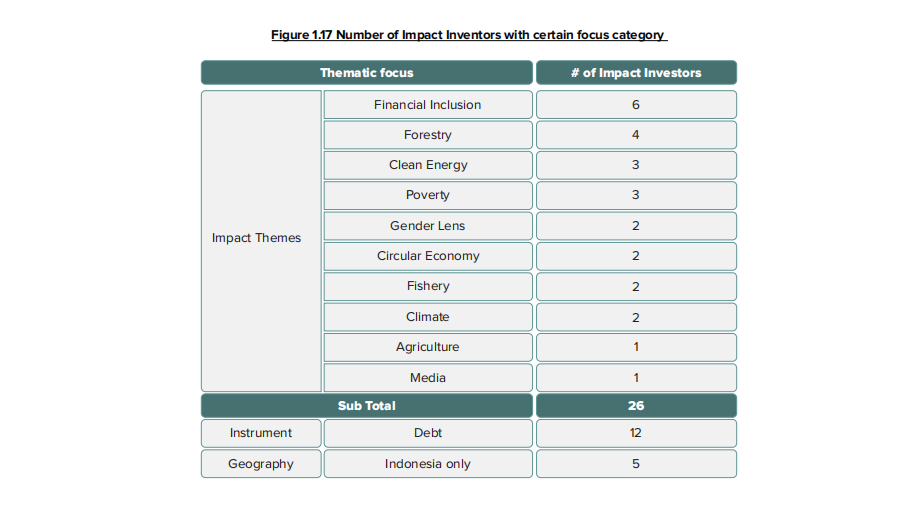

The focus of each impact investor is also different. ANGIN noted thematically, there are 10 types of impact businesses that are the focus of each, divided into financial inclusion, forestry, clean energy, poverty, gender lens, circular economy, fisheries, climate, agriculture, and media. Each of these themes reflects opportunities and challenges in Indonesia.

What the global non-profit organization New Energy Nexus is doing might be a concrete example in the field. They know that the potential for renewable energy has not been fully explored in Indonesia, encouraging them to be present in Indonesia since 2018 through incubation and acceleration programs and regularly held hackhatons.

To date, New Energy Nexus has completed seven classes of incubation and acceleration programs, and guided more than 40 renewable startups in honing their business and innovation strategies. “We don't just provide support capacity building "but there is also funding to provide comprehensive support," said New Energy Nexus Indonesia Program Director Diyanto Imam.

The total grant that has been given reaches IDR 650 million until March 2021, while the funding is in the form of convertible notes reached IDR 3,5 billion. One of its portfolios is PT Bina Usaha Lintas Ekonomi (BLUE), a renewable energy startup that provides marketplace Warung Energi and B2B solar energy solutions for commercial, industrial and centralized.

Different from philanthropy

Soukhasing explained that the fundamental similarity between philanthropy and impact investing is that both have "impact intentions (impact intention)” and “impact measurement (impact measurements)”. However, we can differentiate them based on two factors, namely priorities and expectations of financial benefits.

Philanthropy clearly has social and environmental goals, placing investments given as grants so there is no expectation of returns. Unlike philanthropy, impact investors prioritize impact and profit.

Thus, impact investors expect financial returns. However, there are investors who adopt the so-called second approach venture philanthropy.

This hybrid approach takes the best of both worlds. The benefits obtained are the creation of social impact and the expectation of financial profits. Impact investors assess opportunities differently than philanthropists. “It is important to note that not every impact (often discussed by philanthropists) is always suitable for impact investing and vice versa.”

How to monetize and impact business challenges

Interestingly, currently many impact businesses are positioning themselves as startups, aka utilizing technological approaches to reach their target users, carry out monetization, and receive investment from third parties.

One of the example is Cycle which focuses on reducing plastic waste. Cycle providing mobile refill stations for shampoo, detergent and floor cleaning fluid. It is claimed that one jerry can of shampoo brought by the officers can save the cost of making 2.500 sachets. Consumers can buy few or many refills at lower prices.

The business model used by Cycling is B2C because they carry out capital expenditure and require a number of orders per station which is difficult to do using B2B2C.

“Our selling point is that we are cheaper and deliver to consumers' homes, perfect for those who are price sensitive. However, we also see that there is a growing segment of consumers who care about sustainability," explained Cycle Founder and CEO Jane von Rabenau.

The same focus, but with a different approach, was taken by Rekosistem. They focus on recycling inorganic waste by creating collection points or approaching consumers with the logistics fleet provided ordered via the application.

Any inorganic waste received will be reprocessed into recycled materials, energy and environmentally friendly building materials. Meanwhile, organic waste is processed using biodigesters into liquid fertilizer and biogas which will be given to consumers.

In other sectors there are breath which focuses on providing air quality data via applications. Indonesian people's awareness of the good and bad of air quality has not become a common topic in many people's daily lives. Now apart from playing in the application sector, Breath is expanding into products air purifier based smart home named Aria. Natas Co-Founder & CEO Nathan Roestandy explained that the biggest challenge for startups like Breath, apart from increasing awareness in the market, is access to good quality factories for ease of manufacturing processes.

“Manufacturing in Indonesia is still dominated brand big capable electronics setup big factory. Resources [that big] is not accessible for startups. However, we have experience to build on supply chain leaders to overcome this," said Nathan.

Aria products are in fact no different from products produced by other brands. Nathan claims, Aria has a sensor connected to the breath for the most up-to-date indoor air quality monitoring. These advantages are offered to the market.

Soukhasing added that business challenges have quite diverse impacts and cannot be compared apple-to-apple with other types of business. He gave the example of sector green energy has its own characteristics and stakeholder profile that cannot be compared with other types of startups.

Talking about “traction” also has a different meaning, as green energy startups also consist of various verticals -- whether they work with urban households/settlements, rural residents, or B2B companies.

“So, we would say that we can't measure green energy startups with the same success metrics that we typically have for regular startups. Because this will bring another context to the problems faced by green energy startups, namely finding the right investors and a support system that understands their sector well.”

Most investors who are unfamiliar with green energy startups may assume the business model is capital heavy (high capex), requires a longer time horizon, and requires more effort to penetrate and educate markets that are more familiar with existing solutions (e.g. energy-based fossil). Therefore, startups have the homework of "educating" customers and investors, with the support of programs or other ecosystem actors.

-Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium