Grab Wandering the IPO and Things You Need to Know

Still not making a profit with a net loss of $988 million in Q3 2021; GMV has consistently increased especially in the Intermediary line

Thursday (2/12), Grab performs ceremoniously for its inaugural record debut on the US stock exchange. The stock price trend is still very volatile, even one day after the Nasdaq bell was rung, it fell 21% to $8,75 -- previously when it opened the stock rose 19% at $13,06. Of course this is natural, it also happens to similar players who have just made an IPO.

“Stocks will go up and then they will go down,” said the Co-founder Grab Anthony Tan shortly after the ceremonial event as quoted Bloomberg.

Grab officially announced its plans to go public on April 13, 2021, through a Special Purpose Acquisition Company (SPAC) vehicle, they partnered with a blank check company Altimeter Growth Corp ($AGC) which has been listed on the local exchange since October 2020. This success also made them the first company in Southeast Asia to successfully take the floor. on the Nasdaq with SPAC.

Other companies might follow suit, the obvious one is Kredivo through an agreement with white shell company VPC Impact Acquisition Holdings II ($VPCB).

Business Performance Grab

Financially Grab have not recorded a profit. But it can be said that it is normal, because such a digital company is indeed in the phase of maximizing growth potential (growth). This also reflects the condition of Bukalapak which only announced its achievements in Q3 2021 -- and the possibility of other unicorns (unfortunately there is no public data that we can check because they are not yet a public company).

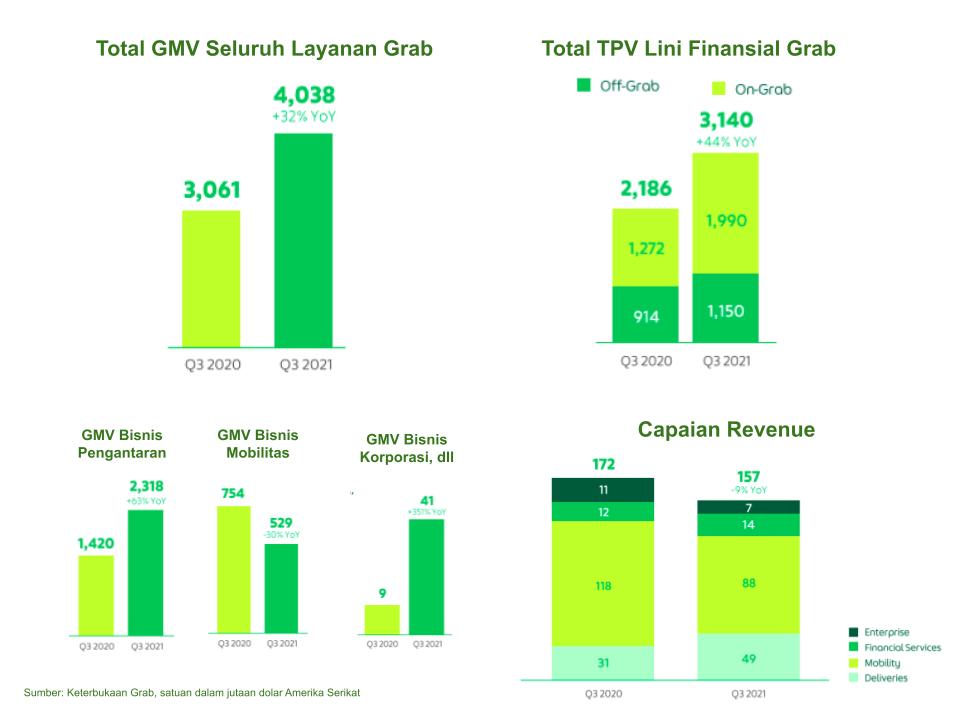

According to the data submitted, in Q3 2021 Grab posted a net loss of $988 million, an increase over the same period last year of $621 million. Meanwhile for revenue stood at $157 million, down 9% from the same period in 2020 of $172 million.

The metric they use is gross merchandise value (GMV) for services and total payments volume (TPV)in the financial line. GMV calculates the total value of transactions in the service ecosystem. In addition to fees, this includes taxes, tips, etc. -- basically all the money that flows through the company. Whereas TPV is the total value of the payment after deducting the returns successfully completed through their financial platform.

It was reported that in Q3 2021 the total GMV that was successfully booked reached $4,03 billion, an increase of 32% YoY from the previous period of $3,06 billion. Meanwhile, the TPV that was successfully booked reached $3,1 billion, up 44% from the same period in the previous year which was around $2,1 billion. This achievement was supported by transactions within ($1,9 billion) and outside ($1,1 billion) of applications Grab.

Delivery service businesses (incl Grabfood, GrabMart, and GrabSupermarket), in this period recorded the strongest GMV with a growth of 63% compared to last year. While the mobility business (incl GrabLaughs, GrabCar, etc.) is actually minus 30% compared to last year's period. GrabMart itself received special attention, because it managed to record an increase in GMV of 380% YoY and 78% QoQ.

Business Structure Grab

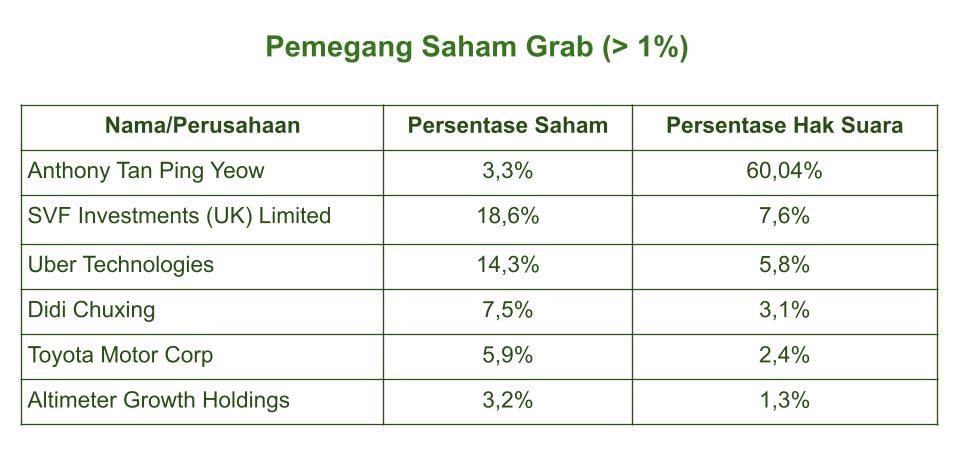

In the opening of the IPO yesterday, the valuation (market capitalization) Grab was briefly boosted to $51,6 billion, bringing Tan's total wealth to more than $1 billion. In the ranks of shareholders (shareholders), there are at least 7 important names with a portion above 1%. Interestingly, it was agreed that Anthony as CEO has the most voting power -- indicates trust shareholders to founder to determine the future direction of the business.

Apart from that, they still have several other supporting investors. Including the recent one joined in the PIPE round (private investment in public equity) worth $4 billion, namely BlackRock, Fidelity International, Temasek, Djarum Group, Sariaatmadja Family (EMTEK Group), Sinar Mas Group, and others.

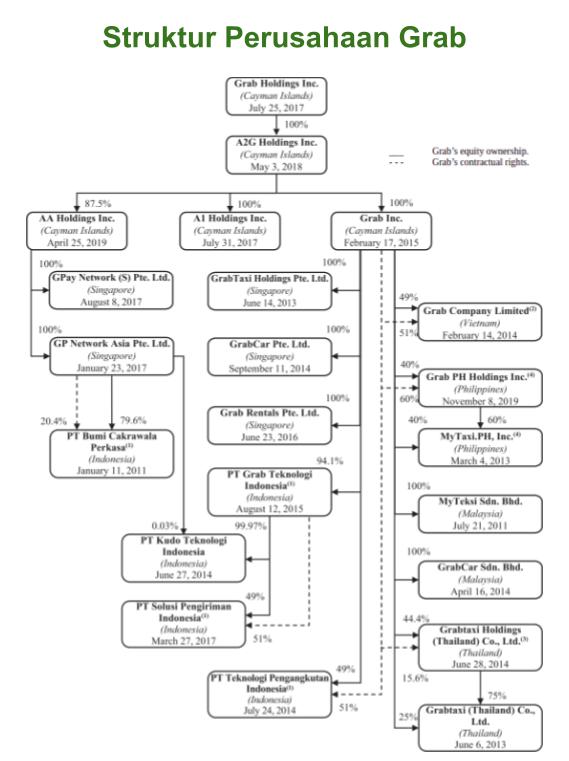

To support its business operations, Grab (holding) also controls a number of companies to run its service units. Even in Indonesia there are several limited liability companies that stand under holding companies, including:

- PT Grab Indonesian Platforms: GrabTaxi

- PT Grab Indonesian Technology: GrabBecause, Grabbicycle, Grabfood, GrabMarts, Wholesalers, Grabfresh, Grab for Business, GrabHello, GrabGifts, Bus Marketplace

- PT Bike For Indonesia: GrabWheels

- PT Solusi Shipping Indonesia: GrabExpress

- PT Solusi Culinary Indonesia: GrabKitchen

- PT Grab Advertising Technology: Grabads

- PT Kudo Indonesia: GrabBuy Together

- PT Kudo Indonesia: GrabStall, GrabMartDaily

- PT Bumi Cakrawala Perkasa: OVO

In detail, the following is the structure of the company that is shaded in holding Grab:

Business strategy

More Coverage:

Seeing the existing business achievements, there are several strategies that will be encouraged Grab for some time to come. They plan more reinforcement for Delivery and Finance line.

For the Delivery business, they want to create a complete ecosystem for the business GrabFood, Cloud Kitchen, to the dine-in experience. It does not stop there, Online Grocery services are also planned to be boosted by increasing the percentage of penetration.

Research from Momentum Works says, in Indonesia the GMV of food delivery services has reached 52 trillion Rupiah in 2020. This acquisition was dominated by Grab and Gojek, holding 53% and 47% of the total market share, respectively. Interestingly, this year the market competition is getting busier with the presence of ShopeeFood and TravelokaEats -- both of which have broad market coverage and large capital support.

As for Financial services, a number of important actions were taken this year, including increasing its ownership of the OVO payment platform. In addition, they are also partnering with Mastercard for strategic partnerships to increase the diversification and reach of their financial products.

Sign up for our

newsletter