Interpreting the Joining of Several Local Conglomerates in the Pre-IPO Grab

Indirectly, each is strategically connected, both through portfolios and investments

Grab it's official announce the plan for go public on the US stock exchange using SPAC in collaboration with Altimeter Growth Corp ($AGC). Although there is no certainty when the preparation process will be completed, so far the market has welcomed this initiative quite well.

One of them is evidenced by the interest of several conglomerates in Indonesia to participate in the pre-IPO offering. There are three parties from Indonesia who are interested in participating through PIPE (Private Investment in Public Equity), that is Djarum Group, Sariaatmadja Family (EMTEK Group), and Sinar Mas Group. In total there are 14 investors involved in PIPE.

Grab targeting a valuation of $39,6 billion (around Rp580 trillion) and raising $500 million of fresh funds from $AGC and through PIPE worth $4 billion. $750 million of which is the Altimeter commitment.

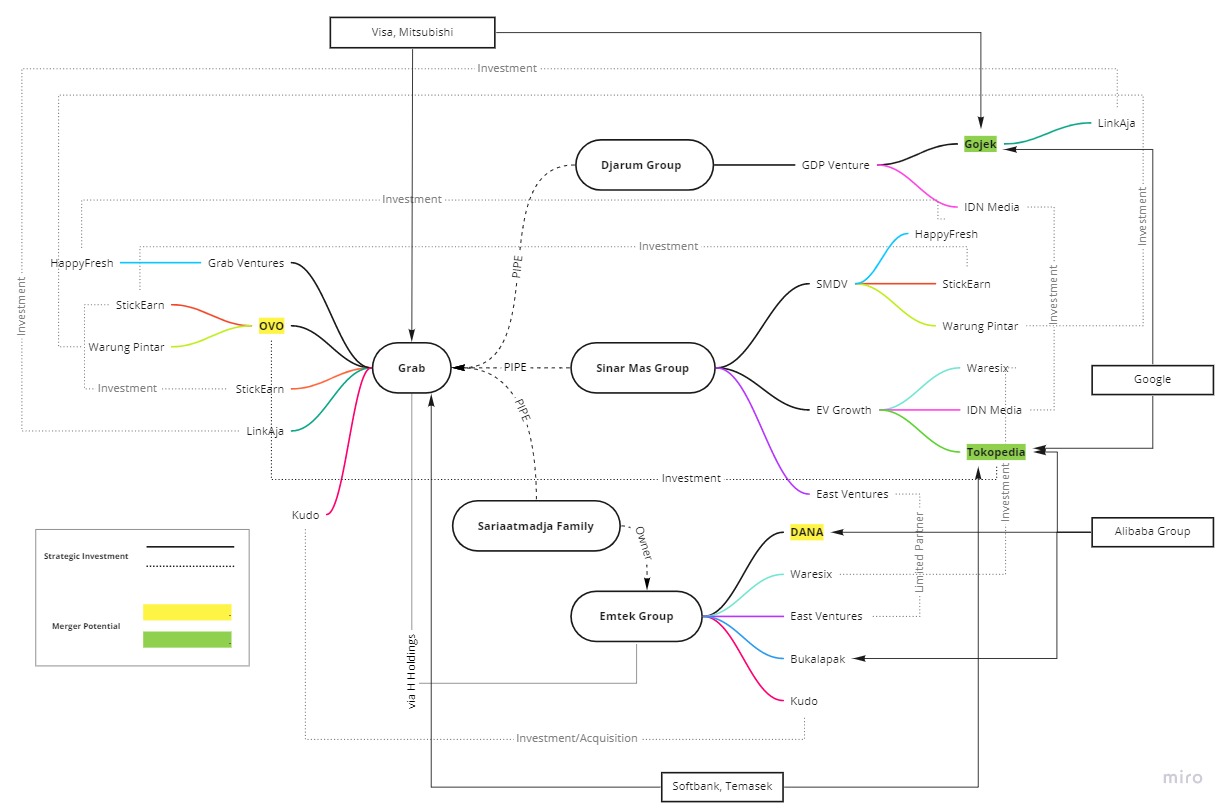

The entry of these three local conglomerates deserves attention, because they are also affiliated with various digital businesses in the ecosystem. We try to map it through mind map the following:

The map above shows an interesting (indirect) relationship. Each of them can be said to be affiliated with the current digital business leaders in Indonesia – even though they also compete in the same market share.

In addition to operating its own services, Grab in Indonesia is affiliated with Ovo (backed by the Lippo Group conglomerate) – unicorn Local Tokopedia also has shares in the payment platform. Regarding payment, Grab also involved in funding LinkAja, which Gojek also do the same thing. The implication is in both super app Now there is a payment option from the service formerly known as TCash.

Recently Grab (via H Holdings) also reportedly entered into Emtek share ownership through PMTHMETD, together with Naver. Making rumors of plans for a merger between Ovo and Dana even louder - especially based on current disclosures Emtek is no longer the controller parent Fund. Since 2019 Grab indeed be one of the parties encouraging business mergers both payment platforms.

Together with three Indonesian conglomerates who entered PIPE, Grab has several strategic engagements in supporting startups operating in Indonesia. On the other hand, with its competitors [including joint plans Gojek-Tokopedia] actually there are still the same slices in the ranks of investors.

Entry of Djarum, Emtek, and Sinar Mas in the IPO Grab So far it can be viewed from two sides. First, there is a movement by corporations to take a deeper role in developing the digital economy in Southeast Asia. Then secondly, it is not impossible that even greater consolidation between players will occur in the future - there has already been news circulating before Grab-Gojek akan to merge before the IPO.

More Coverage:

Market enthusiasm for the IPO Grab can also set a good precedent for initiatives exit similar for unicorn others and bringing the digital ecosystem – especially in Indonesia – to the next level. Success exit they [unicorns] can be interpreted as business maturity and the opening of opportunities for candidate regeneration unicorn next.

- Header Image: Depositphotos.com

Sign up for our

newsletter

Premium

Premium