Ula and a number of startups seek to disrupt the FMCG supply chain

Considered relevant in the midst of the onslaught of "direct-to-consumer" platforms

Early stage funding $10 million received by Ula It's been quite the talk recently. The value is arguably very large for a startup that has just been initiated since the beginning of this year and the product is in phase Minimum Viable Product (MVP). What is clear, capacity and background founder become one of the factors that make investors believe; but on the other hand, business prospects must also be one of the variables in their investment calculations and hypotheses.

The solution offered by Ula is to disrupt the FMCG (Fast-moving Consumer Goods) business supply chain. They developed an application that allows SMEs (especially shop owners) to efficiently get a variety of merchandise at a price that is claimed to be more affordable, because it allows them to be directly connected to their customers. brand. So they accommodate multiple processes at once: ordering, logistics, payments, and financing.

Not only Ula

Long before this, in 2014, Kudo (now named GrabKios by Kudo) debuts with a service that enables traditional warungs to do more things, such as making various payments, transferring funds, to bridging people to buy products on the service E-commerce. Acquired startups Grab the already embraced 2,8 million partners in 505 cities and regencies in Indonesia. Generate transaction value up to 2,7 trillion Rupiah.

Warungs are an important aspect of the economy in Indonesia. Kudo's success has become a legitimacy that validates that the "warung approach" is very relevant to reach market share on the national stage - especially in the lower middle class. This concept was finally replicated by several digital players, including Para unicorn in sector E-commerce, such as the Tokopedia Partner program, Bukalapak Partner, and most recently Shoppe Partner.

In 2018 GudangAda was launched, becoming marketplace B2B specifically for FMCG products. The focus is empowering the entire supply chain, making it easier for businesses to access various products efficiently. Earlier this year they get seed funding from a number of investors for business acceleration. Their target is traditional retail, including stalls or grocery stores in various areas.

The potential is there

The service solution solves a very fundamental issue. Based on the results of research entitled The Future of Southeast Asia's Digital Financial Services, at least 92 million adults in Indonesia have not been touched by banking financial services (unbankable) – making it difficult for them to access transactional digital services directly. This number is very large, even greater than the total population of countries in Southeast Asia except the Philippines.

Warung is the business system that reaches them the most – where the micro economy in various corners of Indonesia revolves. According to the 2016 Economic Census data released by BPS, of the 26,4 million units of Micro, Small Enterprises (UMK) & Large Medium Enterprises (UMB), 46,38% fall into the category "Wholesale and Retail Trade, Repair and Maintenance of Cars and Motorbikes " – the stall goes in there. This number is also the largest among other types of businesses in Indonesia.

In an interview with DailySocial, Co-Founder Ula Nipun Mehra explained his analysis of why his startup is steadily expanding into this sector. According to him, traditional retail such as warung is the main pillar of the Indonesian economy. "This is backbone of the consumption economy, while simultaneously employing millions of people. Traditional retailers belong to cost-effective and have in-depth knowledge of the local market. However, this sector is the most vulnerable part of value chain, because they usually work individually on a small scale."

The diversification that is trying to be presented is the efficiency of resources and capital by presenting a system doorstep (direct product delivery) which is cost-effective. Apart from connecting retailers with FMCG product stock providers, they will also expand product coverage in the fashion category. All efforts to improve the retail experience carried out by Ula fully prioritize the use of technology. "We keep the user experience as simple as possible and technology is brought in to remove any complexity."

Nipun added, "On-time delivery is one of the strongest reasons why partners choose to conduct transactions on Ula. We can do that because all processing is automated and data-driven."

In this initial stage, Ula did pilot project for the MVP in the East Java area.

Gudang Ada Stevensang Co-Founder & CEO to DailySocial revealed, in this digital era there are more and more challenges that traditional shop owners have to experience, such as increasingly difficult to get salesmen, increased business risks, threats from E-commerce big direct link principal with retailers, the next generation of shop owners who are reluctant to continue conventional family businesses, and others; which will cause a decline in business and profits in the future.

“GudangAda was founded because of concerns about the continuity of traditional shop businesses in the digital era. GudangAda's business concept is to empower all parties involved in the ecosystem so they can get optimal benefits from the platform. "By joining the GudangAda platform, shops can act as sellers and/or buyers."

business model

Discusses startups that are trying to present a platform “new retail” for traditional businesses, one question arises: instead of creating a service E-commerce To fulfill stall stock, why not choose the approach direct-to-consumer by selling the product directly to end consumers?

Responding to this, Nipun said, "Warungs are very cost effective. They are micro-entrepreneurs who run their shops around their homes. Mostly employ families and most of them are tax free. They serve cash-flow sensitive market. The average Indonesian still prefers shopping offline. They buy in small quantities and with high frequency."

"Model E-commerce B2C cannot accommodate orders with small basket values because shipping costs are very high. This allows only certain products to survive in the store offline. For example, shampoo sachet very hard to sell on B2C platforms but works great in stores offline. Therefore, it is not surprising, that after billions of dollars the product goes into E-commerce B2C, captured market share remains below 10%.”

More Coverage:

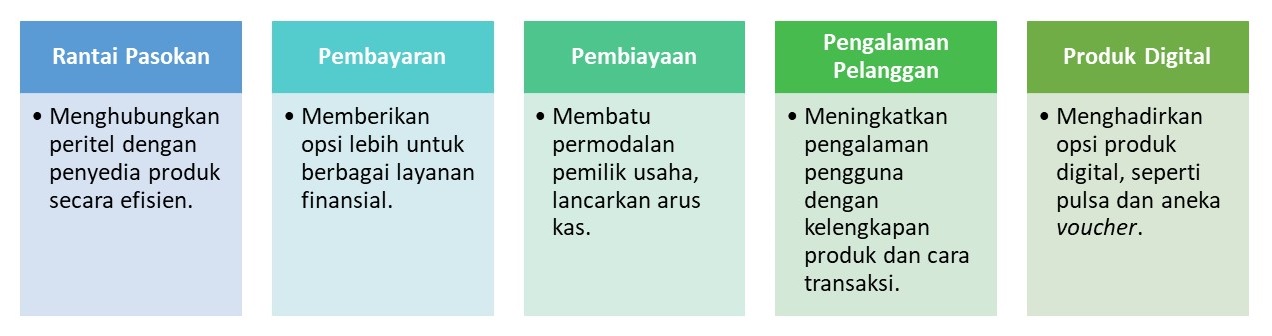

Many business aspects can be accommodated. Existing players can at least be mapped into the five components above. For example, Kudo, they present payment points, financing and digital products. This is different from GudangAda, which focuses a lot on the supply chain. Meanwhile, Ula debuts with a system that accommodates supply chains and financing. Each has a specific problem to be solved.

Take for example the question of financing. There is a culture of "debt" among shop customers. Because it is more personal, sometimes there is no specific billing model which results in the shop owner's cash flow being disrupted. The financing system allows stalls to get product stock first and pay for it later when the sales are sold.

"Yes, currently Ula is partnering with several loan providers. Our job is to ensure financing reaches shop owners. We are happy to play a role as partners for fintech companies that can utilize Ula's data and platform to disburse working capital credit," concluded Nipun.

Sign up for our

newsletter

Premium

Premium