Southeast Asia's Total Startup Funding Drops 51% in 2023, Indonesia and Singapore Contribute 90%

Summary of the Southeast Asia Deal Review 2023 report compiled by DealStreetAsia and Rigel Capital

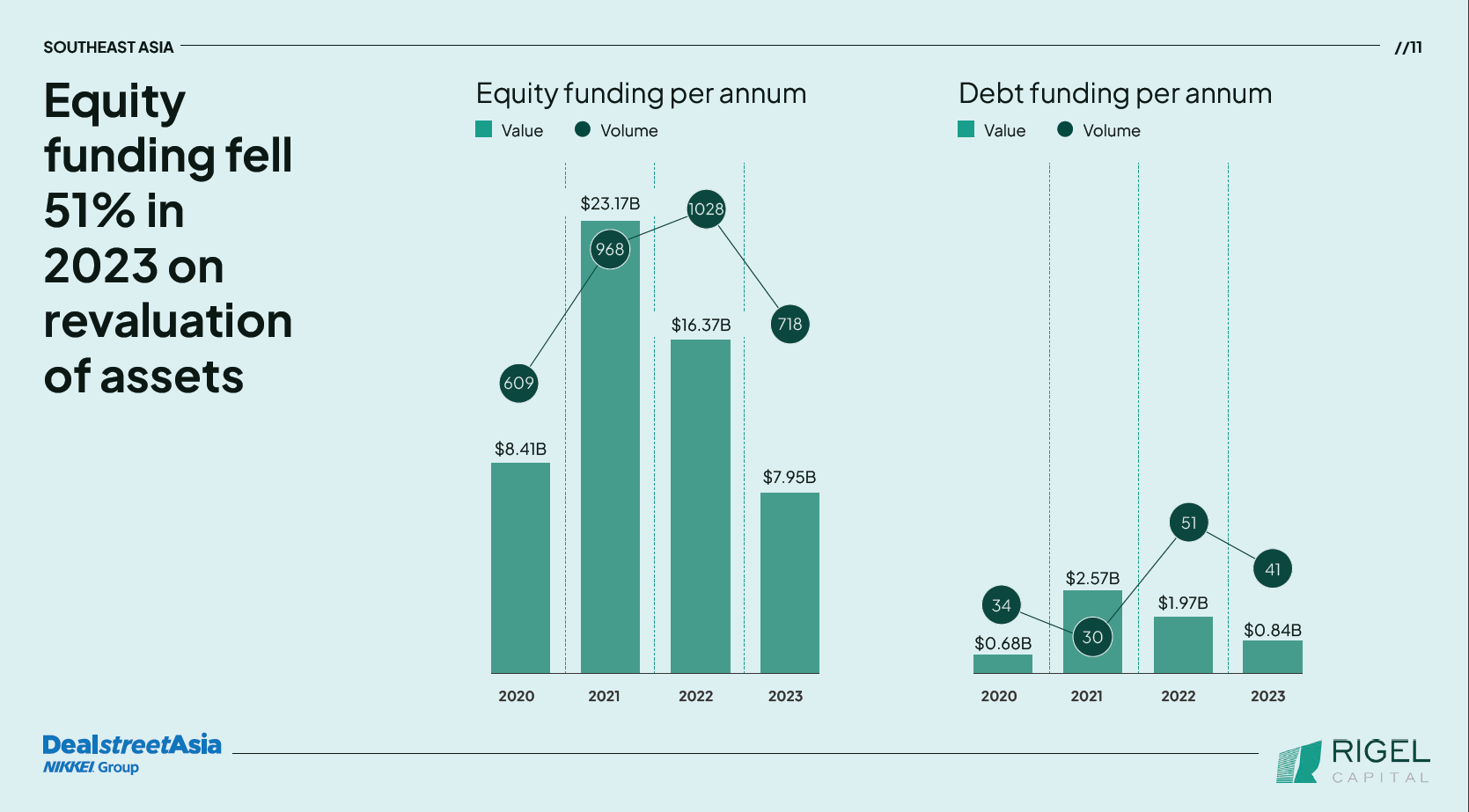

The total funding raised by the startup (equity and debt) in the Southeast Asia region fell by 51% (yoy) throughout 2023. This decline was motivated by macroeconomic factors which weighed on investor sentiment.

Menurut report Southeast Asia Deal Review 2023 arranged Deal Street Asia and Rigel Capital, there was a 30% decline in deals to 718 deals with a total value of $7,96 billion (Rp. 126,2 trillion).

The biggest deal came from Lazada, which was injected by its parent, Alibaba, for $1,89 billion. This figure accounts for approximately 24% of total equity funding in the region. “The large role Lazada plays in propping up overall transaction value makes the decline in startup funding even more pronounced,” the report said.

The next sequence was contributed by Kredivo which closed a $270 million series D round, the startup insurtech Bolttech raises $246 million in series B funding, investree raised $231 million in series D funding (despite reports that DailySocial.id accept that funding is not realized), and startup aquatech eFishery completes $200 million series D round.

“This deal is one of the rare deals worth more than $100 million, as skeptical investors are reluctant to write large checks amid geopolitical uncertainty, high interest rates and persistent inflation.”

It was further explained that last year was the most difficult year to create new unicorns with a valuation above $1 billion. Only two startups, namely eFishery and Silicon Box (based in Singapore) have achieved this status

This trend continues to show a decline. In the previous year, there were eight startups that received unicorn status. Then in 2021, there were 23 startups recorded in this region whose valuation exceeded $1 billion.

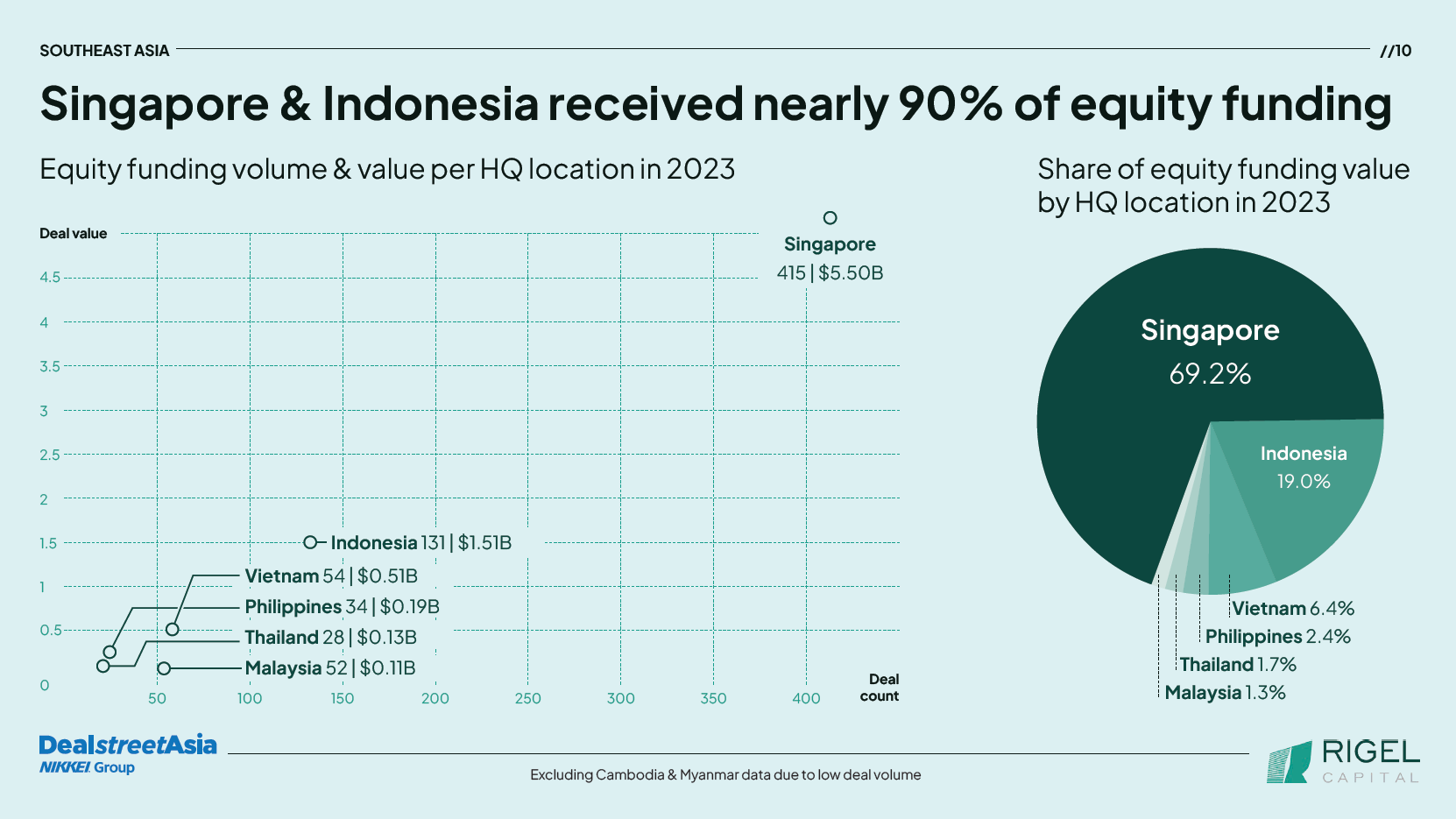

Singapore and Indonesia reach 90% agreement

Another interesting data revealed was that Singapore and Indonesia received almost 90% of the total equity funding. Singapore earned $5,5 billion from 415 transactions, while Indonesia earned $1,51 billion from 131 transactions.

Both Thailand and Malaysia experienced the largest corrections in total private capital gains, falling by 86% and 83% respectively. Thailand earned a total of $0,13 billion from 28 deals. Malaysia recorded 52 transactions generating a total of $0,11 billion.

Vietnam looked relatively resilient with a 9,55% decline in deal value, pocketing $0,51 billion from 54 deals. The Philippines earned $0,19 billion from 34 deals.

Healthtech most funded

If you look at the startup vertical, fintech remains the most injected by investors, even though the number and value of recorded transactions has decreased. Total deals in the sector fell 39% to 142 transactions and transaction value fell 67% to $1,82 billion.

Pursed in more detail, startup lending raised the most funding at $734 million with 35 deals. Followed in sequence, insurtech ($361 million with 15 deals), digital payments ($287 million with 37 deals), wealthtech ($148 million with 37 deals), and solutions fintech ($73 million with 10 deals).

Based on transaction value, the first position is occupied by the sector E-commerce which raised the most funding, namely $2,32 billion, thanks to Lazada. Then followed fintech and healthtech with 60 investment deals, up 20% compared to last year. However, its value fell 34% to $582 million due to the smaller deal amount.

Startups healthtech those from Singapore contribute the largest cake in this sector with a share of 72,1%. Then followed by Indonesia with 21,7%. Telemedicine services were the most funded business venture at $191 million with 17 deals. More than half of this nominal funding came from rounds the embraced D series Halodoc.

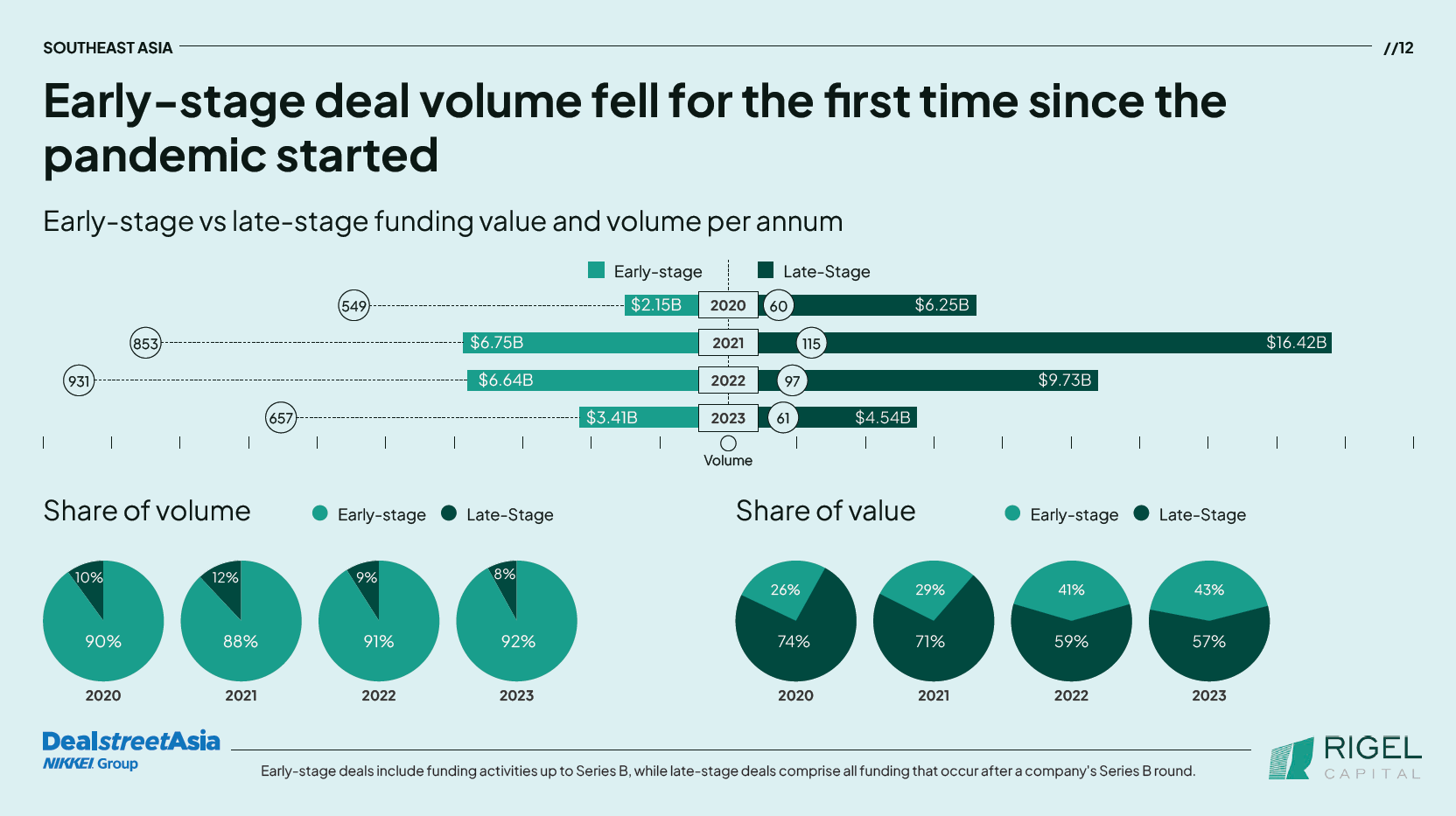

Times are tough for early stage startups

Other highlights from the report, citing company announcements, regulatory filings, media reports, and research Deal Street Asia, revealed that funding-raising difficulties in 2023 extended beyond late-stage startups as early-stage deals fell 29% to 659 deals while total capital raised fell 49% to $3,42 billion.

“Early-stage funding, considered a trend-setter in early-stage investing, has shown a downward trend since the second quarter of 2022, signaling a pullback from the peak exuberance that characterized the market in 2021,” the report said.

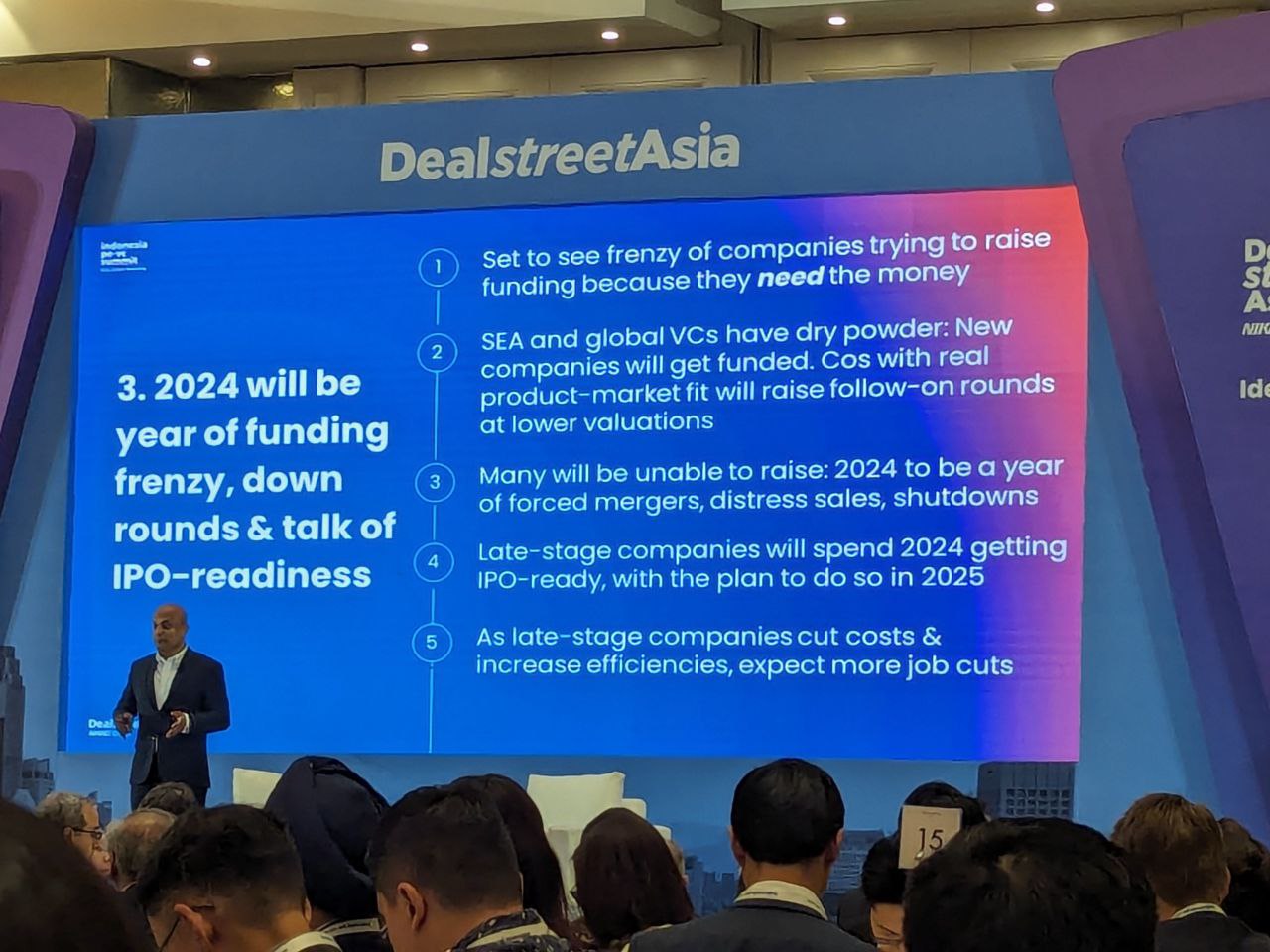

Outlook for 2024

For this year, several sectors are poised for growth despite current funding challenges and new themes are likely to attract venture capital investment. Sustainable sectors, including green technology, electric vehicles, climate technology and health technology are gaining traction. Clean mobility ecosystems, artificial intelligence and sustainability-related sectors are also expected to grow.

The report reveals a silver lining at the end of last year, that quarterly deal trends show signs of emerging stability in the startup investment landscape.

More Coverage:

In the fourth quarter of 2023 there were 167 transactions, up from 151 transactions in the previous quarter when transaction volume was at its lowest point in three years.

The fourth quarter was also stronger in terms of investment gains as regional startups raised $2,28 billion, up 9% from the previous quarter.

“However, towards the end of the year, private sector conditions in the region began to show signs of stability, with the fourth quarter recording a 12% increase in deal volume after reaching a three-year low in the third quarter,” the report concluded.

There are five other notes worth noting for the startup industry in this region. Here's the summary:

Sign up for our

newsletter