Indonesian Startup Funding Value Drops 74 Percent in Odd Semester 2023

Compared to the same period the previous year (H1 2022). The high "cost of capital" is the main cause

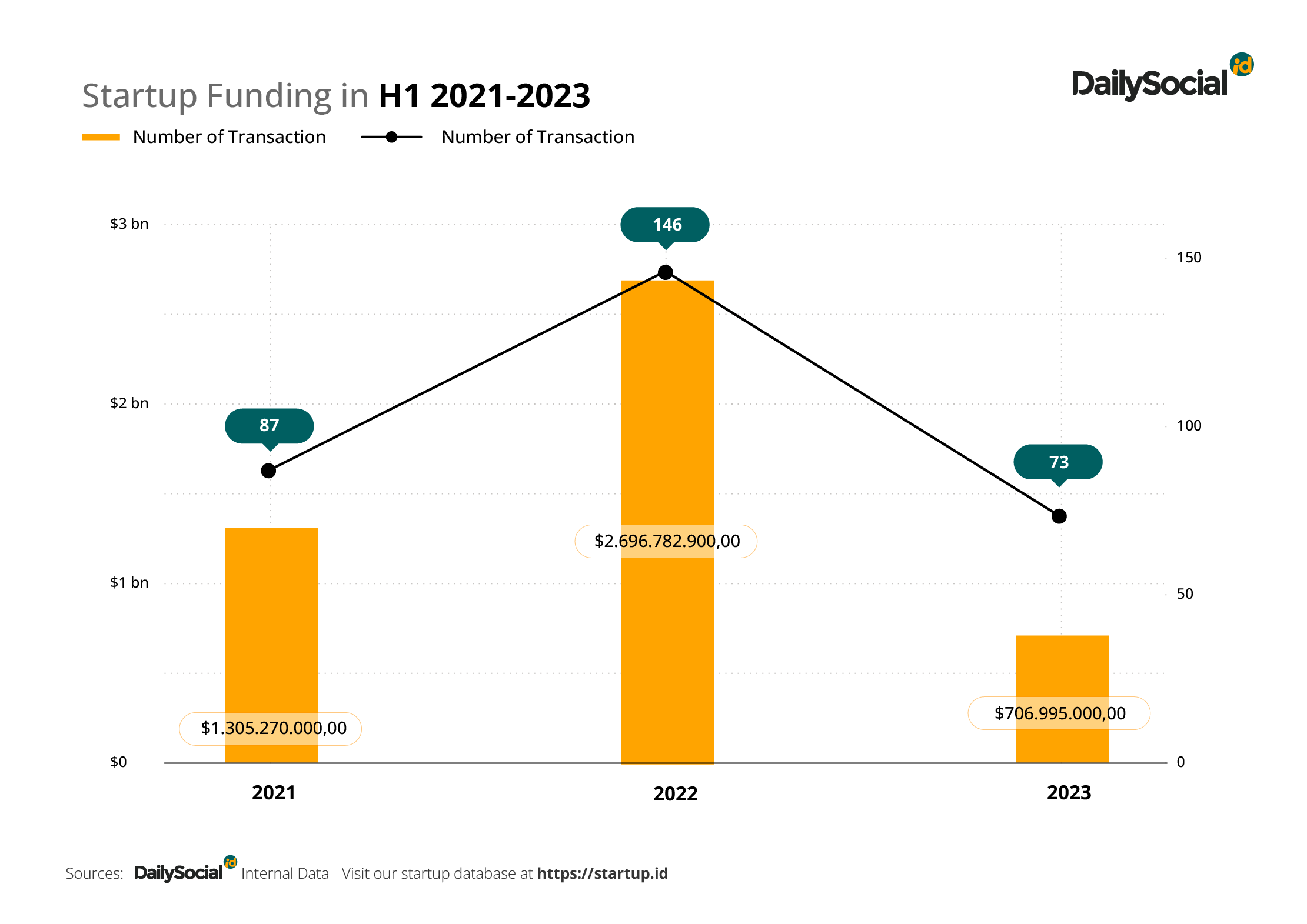

Indonesia's startup investment climate in the odd semester (H1) 2023 shows a significant slowdown. Based on publicly recorded data DailySocial.id, there was a decrease of 74% compared to the same period last year (H1 2022).

In the odd semester of the year at least 73 startup funding publicly announced (34 transactions cited) valued at $707 million.

In comparison, in H1 2022, 149 funding transactions (99 transactions declared value) accounted for $2,69 billion. Meanwhile in H1 2021 there were 87 startup funding transactions (46 transactions announced value) which posted $1,3 billion.

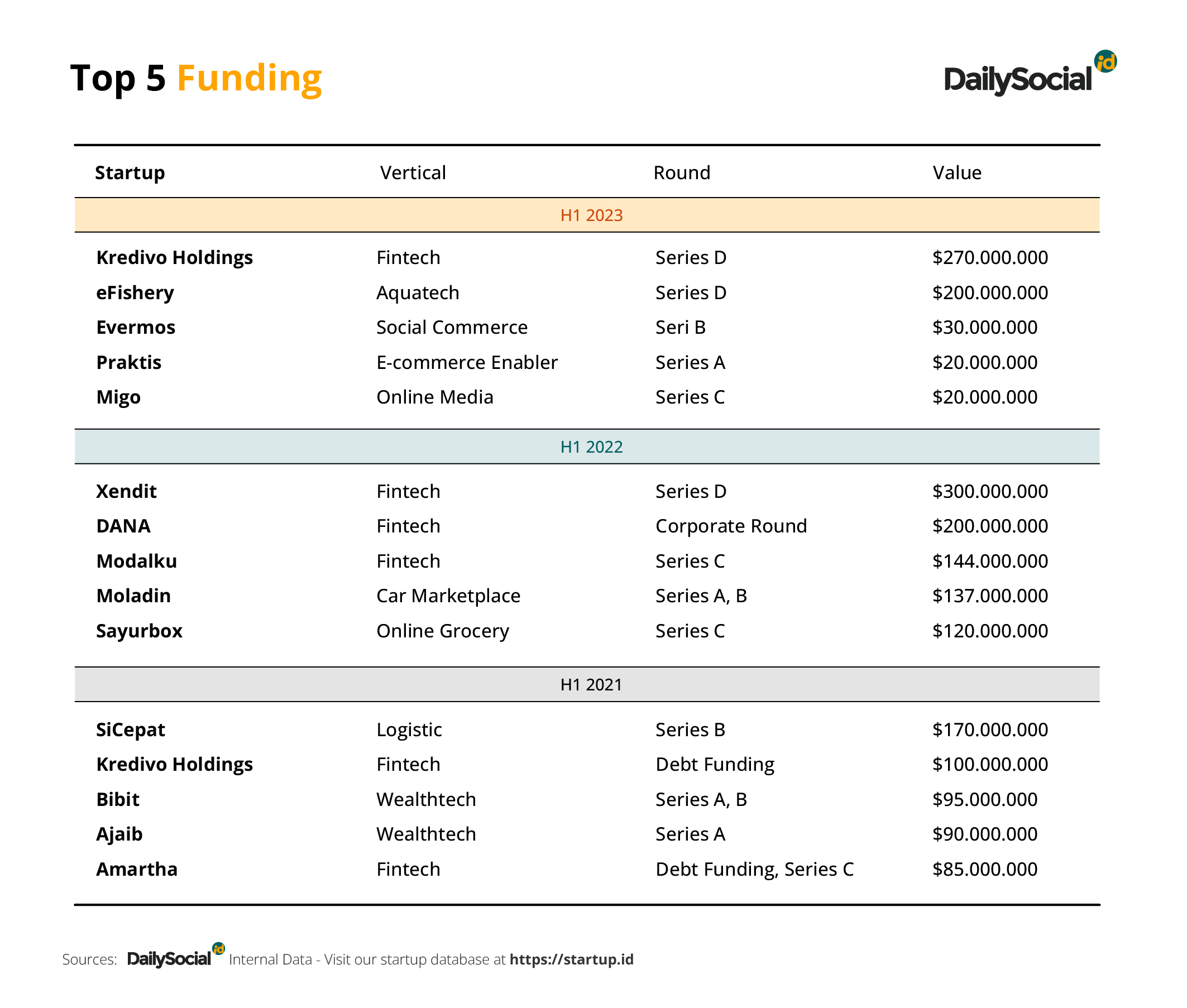

The majority of funding in H1 2023 is supported by follow-up funding eFisheries and Kredivo Holdings. Both of them contributed 66,4% of the total investment acquisition in that period.

According to the CEO of BNI Ventures Eddie Danusaputro, which affected the downward trend in funding was not far from macro factors, related to increases cost of capital.

"This certainly makes investors more selective because they have to search return on investment which is certain and/or better. Investors are also becoming more selective because now many startups have been lulled by high valuations and avoid corrections, so they are rethinking fundraising -- or delay. On the other hand I've also seen a lot of startups that aren't agile for pivot ke path to profitability," said Eddie.

Founding Partner DS/X Ventures Rama Mamuaya added, "With his height cost of capital, so many investors are focused on fashion portfolio management, ensuring their portfolio can survive, so that the priority to add new portfolios decreased. Coupled with the still startup liquidity underperform in Southeast Asia, including Indonesia. All still wait and see macroeconomic situation and global inflation."

This condition does not only occur in Indonesia. India has also seen a slowdown in the growth momentum of digital startups. The SaaS sector, which is the spearhead of the industry there, experienced a decline in investment value of up to 79% compared to the same period the previous year.

Important sectors

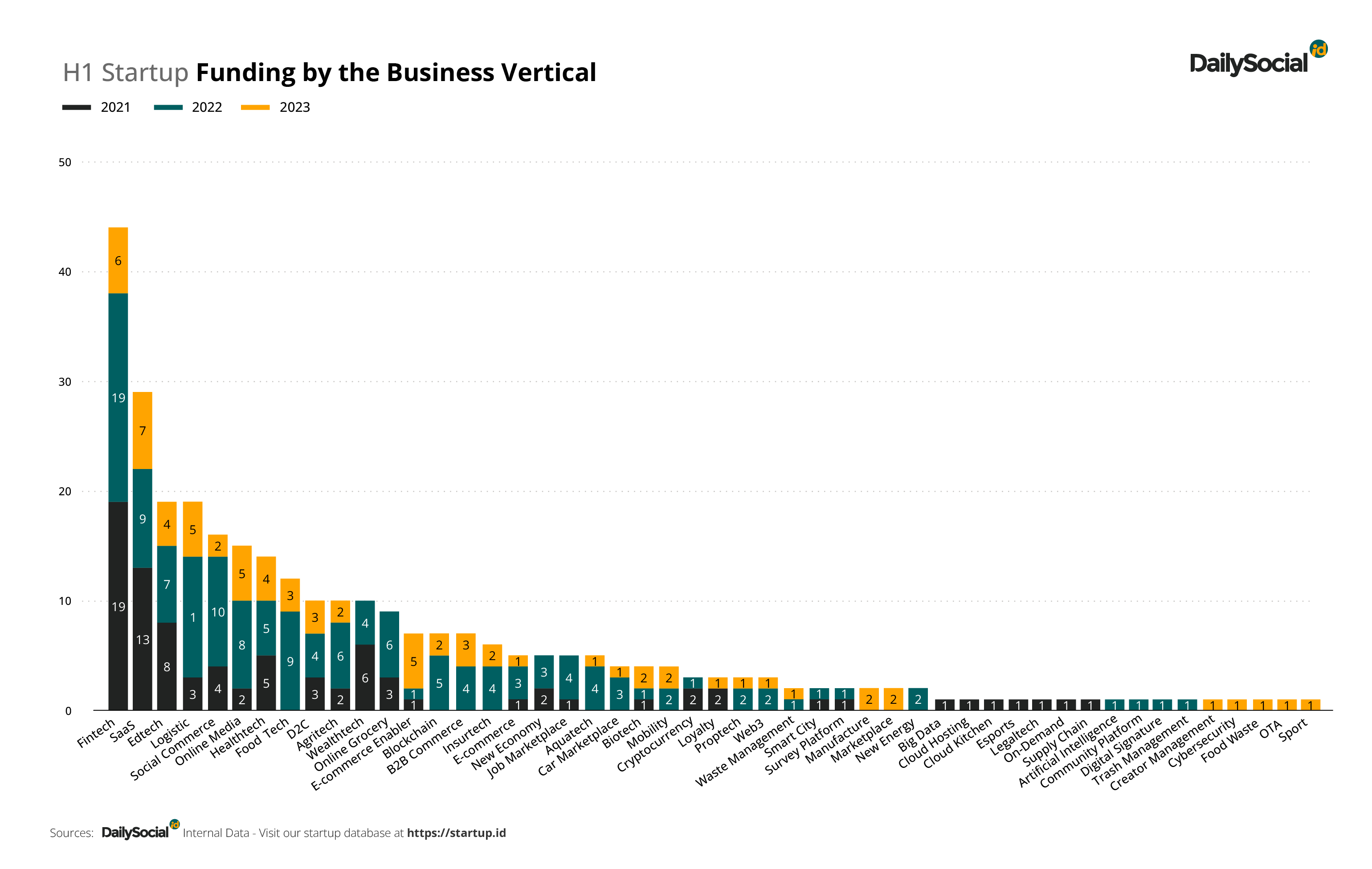

Based on the data, the popular business sector tends to remain the same for the last 3 years. Fintech, SaaS, Edtech, and Logistics are receiving high interest from investors, both in the pre-start/early stages and advanced stages.

Interest in funding for B2B business models has also increased. A number of startups fintech funded are payment infrastructure service providers.

Funds are still available

More Coverage:

Investors agree and feel the trend of decreasing interest in funding, incl East Ventures. Spokesperson for Pheseline Felim said the macro factors did present uncertainties and various challenges. Companies need to make efficiencies as money becomes "smarter" or "hard to come by". From the investor side, they are increasingly careful in providing funding.

"However, keep in mind that money is still available. East Ventures remains active in investing in technology companies in Southeast Asia. As of the first half of 2023, we have made at least 17 deals and we will continue to invest in the future," he said.

A number new managed fund was also born this year to enliven the startup investment climate in the country, including DS/X Ventures, First Move, Creative Gorilla Capital, and the Merah Putih Fund.

On the other hand, many VCs have announced a large number of new managed funds in the past year. Below are some of the managed funds announced this year for Southeast Asian and Indian startups, including Indonesia:

| Venture Capital | New Managed Fund Value |

| Argor (Go-Ventures) | $240 million |

| Peak XV Partners (Sequoia SEA) | $2,5 billion |

| East Ventures | $250 million |

| B Capital | $2,1 billion |

| Northstar Group | $90 million |

Sign up for our

newsletter

Premium

Premium